Hawaii: *Final* avg. unsubsidized 2024 #ACA rate changes: +8.8% (updated)

Originally posted 8/07/23; updated 11/02/23

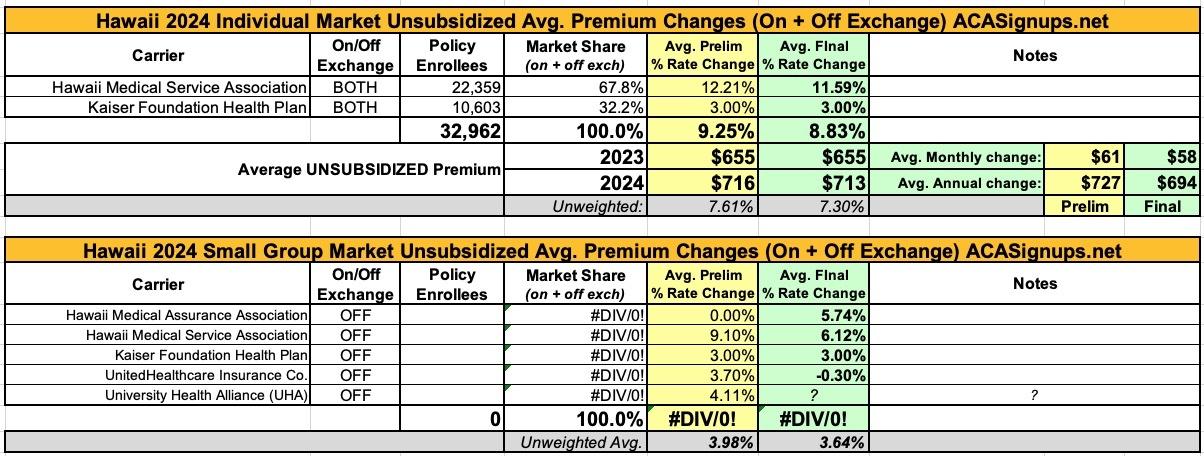

Hawaii only has two health insurance carriers serving the individual market, Hawaii Medical Service Assocation and Kaiser Foundation Health Plan. Both of them have submitted their proposed premium rate filings for 2024; HMSA is asking for a dramatic 12.2% rate hike while Kaiser Foundation is seeking a more modest 3% increase.

Our requested rates include only the amounts needed to cover the expected health care benefits of our members, the cost of administering their benefits, expected Affordable Care Act (ACA) fees, a small charge to help manage the risk of offering benefits to this population, and a small margin that will allow us to continue replenishing HMSA’s reserves.

We based our rate increase request on a review of past costs of benefits and other expenses. These historical costs are adjusted for trend, to account for expected changes in use of medical services, cost inflation, and other factors that affect the cost of care. We also adjusted costs for benefit changes, which were largely made to comply with government mandated plan designs. Administrative expenses have also been reduced over the past couple of years.

The overall requested rate increase for our plans is 12.2%. The increases range from a low of 11.5% for the Gold PPO I plan to a high of 20.1% for the Catastrophic plan. The Catastrophic plan is the only plan exceeding a 15% increase. There are 22,359 members, including 422 Catastrophic plan members, enrolled in our ACA Individual plans as of March 2023.

HMSA has minimized rate increases for ACA Individual plans for several consecutive years. We managed to decrease rates for three straight years, from 2019 to 2021, by -0.4%, -3.3%, and -3.1%. That was followed by minimal increases of 2.3% and 2% in 2022 and 2023, respectively. As a result, we experienced an underwriting gain of only 0.2% of premium in 2022 and expect to realize losses in this market in 2023.

We understand that any rate increase creates hardship for some members. However, the increase is necessary to keep up with the costs of covering this population and ensure the plan remains viable in the future. HMSA expects to offer plans in all metallic levels (Bronze, Silver, Gold, Platinum) as well as a Catastrophic Plan.

This document contains the Part III Rate Filing Documentation and Actuarial Memorandum for Kaiser Foundation Health Plan, Inc.– Hawaii Region’s (KFHP) ACA compliant Individual and Family (Individual) business in the state of Hawaii, supporting proposed premium rates (rates) with an effective date on or after January 1, 2024. These rates are guaranteed through December 31, 2024. This filing represents 41 renewals and modifications of plans effective during the 2023 plan year, with no new plans and 6 terminating plans. The products and plans are offered on and off the Federal Exchange marketplace (Exchange), and do not include grandfathered or transitional (“grandmothered”) plans. This Actuarial Memorandum is submitted in conjunction with the Part I Unified Rate Review Template (URRT).

This filing assumes that for the 2024 plan year the Individual Mandate will continue to be powerless with no replacement provision and the Cost Share Reduction Subsidies will continue to be unfunded by CMS. Additional plan paid claims costs associated with the CSR plans will be applied only to the On-Exchange Silver tier plans, while all other plan rates will remain unchanged.

Proposed Rates

The aggregate rate change for this population is 3.00%. The average rate change does not indicate that every member’s rate will change by this amount, as rates are affected by the ages of those covered, tobacco consideration, and plan chosen.

As for Hawaii's small group market, the unweighted average rate hike request is 5%.

UPDATE 11/02/23: The final/approved rates have now been posted at the federal Rate Review database; Kaiser was approved as is, but HMSA was shaved down a bit, so the weighted average is actually +8.8%.

The small group market rates are quite different, however...HMAA went from flat to +5.7%, HMSA dropped from +9.1% to +6.1%, and UnitedHealthcare wnet from a 3.7% increase to an 0.3% decrease...while UHA seems to be missing entirely. Huh. the unweighted average here ends up dropping slightly to +3.6%.