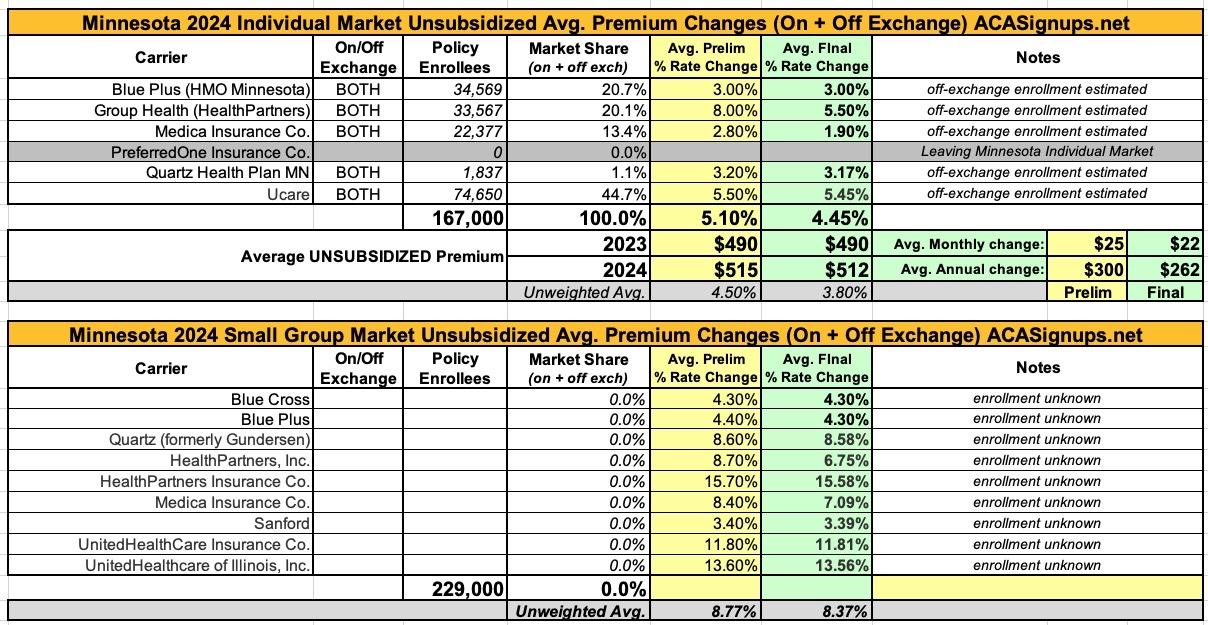

Minnesota: *Final* avg. unsubsidized 2024 #ACA rate change: +4.5%

Back in June I posted the preliminary avg. 2024 individual & small group market premium changes in Minnesota.

Last week the Minnesota Commerce Dept. has published the final/approved rate changes for each. Both markets have seen their rate increases shaved down slightly overall:

MN Dept of Commerce approves 2024 rates for individual and small group health insurance in Minnesota

- Commerce’s focus remains on consumer choice and reducing health care costs

The Minnesota Department of Commerce today announced its approval of 2024 rates for Minnesotans who buy small-group and individual health insurance, underscoring the breadth of choices available to consumers and the stability of the state’s insurance market. The rate approvals are part of Commerce’s focus on reducing consumers' health insurance costs.

“Our announcement about 2024 rates reflects Commerce’s continuous efforts to keep health insurance premiums relatively low in our state and ensure a strong marketplace,” said Commerce Deputy Commissioner of Insurance Julia Dreier. “We are focused on goals to give consumers choices, to reduce economic barriers to health care, and to improve access to care when people need it. We continue to explore innovative ways to deliver that kind of health care for all Minnesotans.”

Approved health insurance rates for 2024

Details of approved health insurance rates

- Individual market: Average increases range from 1.9 percent to 5.5 percent for the 167,000 Minnesotans who buy individual health plans.

- Small group market: Average increases range from 4.3 percent to 7.09 percent for the three largest carriers, covering roughly 185,000 of the 229,000 Minnesotans covered by small group plans.

Cost-saving measures

- In 2023, 66,000 Minnesotans received federal tax credits that lowered the cost of their monthly premiums. Those tax credits, only available to those who buy insurance through MNsure, are expected to save eligible households an average of $6,750 annually on their premiums in 2024.

- Governor Tim Walz signed bipartisan legislation in 2022 to extend Minnesota’s Premium Security Plan, also known as “reinsurance,” for consumers who buy health insurance individually. Reinsurance lowers the cost of premiums by an average of 20 percent from what they would otherwise be.

Scenarios of actual costs for consumers

Each year, Commerce receives, and reviews new rates proposed by health insurers for the coming year. The proposed rates do not reflect what the actual cost will be for consumers. Many Minnesotans who buy health insurance through MNsure, Minnesota’s health insurance marketplace, receive financial help through tax credits that help lower the cost of their monthly premium.

Two specific examples:

- A couple in their 60s in Minneapolis with an annual income of $80,000 can enroll in a gold plan and apply tax credits to cut their monthly premium nearly in half, saving almost $9,000 per year.

- A family of three in Mankato with an annual income of $97,000 can enroll in a silver plan and access tax credits that will lower their premiums by 46%, saving them over $6,500 per year.

Additional scenarios with examples of how tax credits through MNsure can lower health care costs can be found at MNsure.org.

“We encourage Minnesotans who buy individual insurance to use MNsure to shop and compare plans,” Dreier said. “The plans offered on MNsure all offer essential benefits that Minnesotans want, like preventive care, emergency services and outpatient care.”

In 2024, as in 2023, every Minnesota county will have at least two insurance carriers offering individual market plans, with most counties having three or four. Every county also will have at least 27 plan options for individual buyers.

The most noteworthy item in Minnesota for 2024 is that PreferredOne, which already dropped off the state's small group market in 2023, appears to be dropping out of the individual market as well. PreferredOne had only offered off-exchange plans for the past several years anyway.

Unfortunately, as usual, Minnesota's SERFF rate filing database doesn't seem to include any actual enrollment information, so I can't run a proper weighted average rate change for the small group market at all (the unweighted average increase is 8.4%). For the individual market, I'm basing the weighted 4.5% average increase on on-exchange enrollment only as of March 2023. The press release includes the total number of indy market enrollees, so I've bumped up each carrier by an equal percentage, assuming the off-exchange ratio is roughly the same: