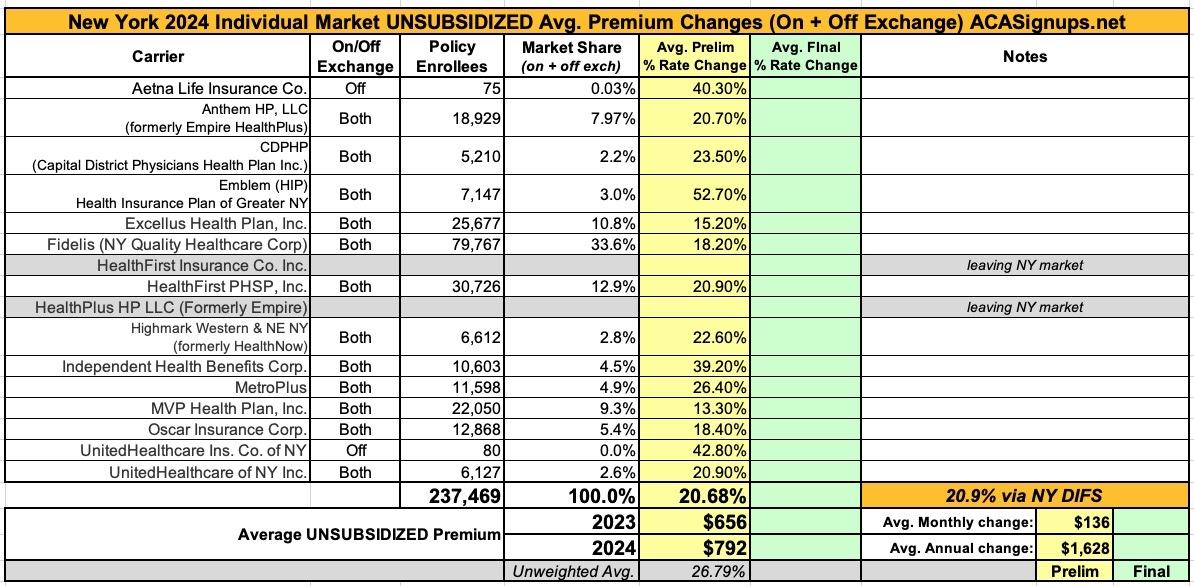

New York: (Preliminary) avg. unsubsidized 2024 #ACA rate change: +20.9%

Ouch. Via the New York Dept. of Financial Services, the preliminary, weighted average rate increases being requested for individual market health insurance policies for 2024 are looking pretty ugly indeed: 20.9% overall according to DIFS. I get a slightly lower weighted average of 20.7%, but it still ain't pretty.

Two of the highest increases are for carriers which are only offering policies off-exchange next year and which have fewer than 100 enrollees each anyway; I assume they're both winding down their operations in the state. There are also two carriers which appear to be leaving the NY individual market entirely this year.

As for the rest, they range from requested average increases of "only" 13.3% for MVP to a stunning 52.7% rate hike by Emblem (HIP). The justification summaries are below the table.

It's important to remember that these are not final rate increases--New York in particular has a tendency to slash the requested rate hikes down significantly before approving them:

From the individual carrier narrative summaries:

Aetna: The requested rate changes for Aetna's Small Group plans are directly related to two main drivers: the overall rising cost of health care services in New York, and an adjustment to reflect changes in the type and quantity of medical services used by our members which results in increased claim expenses.

Anthem/Empire: The cost of health care services and equipment continues to be the primary reason for rate increases. A report by Mercer projects accelerated health care cost growth moving forward as the impact of inflation begins to phase in with healthcare provider contract renewals.

Health care cost and spending trends reflect underlying changes in the demographics and health status of America’s population. The aging population is driving some of the increase – as people age, they typically utilize more health services. Between 2010 and 2050, the population aged 65 and older is expected to double, as the “baby boomer” population ages and life expectancy continues to rise. Indeed, the first baby boomers have now turned seventy and the percentage of workers over 65 is greater than at any period in history. As this population ages it will correspond to a further escalation of costs. Moreover, the country’s general declining health and the increase in obesity and other health concerns, even at younger ages, forces average costs upward.

Hospitals (inpatient and outpatient care) account for the largest share of the health care premium dollar in New York, a percentage that continues to grow. Factors driving this growth include increasing demand for care, rising costs to hospitals of the goods and services needed to provide care, and the growing intensity of care needs.

Specialty drugs account for one of the biggest health benefit cost drivers. Large employers reported that spending on specialty drugs rose by nearly 10% in 2022. Specialty drug trends are expected to increase as more breakthrough gene and cellular products enter the market. Additionally, 2022 shows continued increase in cost and utilization of diabetic and weight loss drugs. Claim cost for these drugs increased by about 110% in 2022.

CDPHP: ...we cannot ignore the fact that CDPHP and its competitors are facing difficult financial headwinds, due in large part to rising hospital consolidation and staffing shortages, rapidly rising drug prices, particularly in the specialty drug market, as well as lingering effects from the COVID-19 crisis and pent-up demand for medical services put on hold during the pandemic.

Excellus: Medical cost “trend” is a very important consideration in determining the need for a premium rate adjustment. This “trend” is the anticipated change in the cost to treat patients year over year. Upstate New York is not immune to national trends in health care costs given our state’s population and demographics. The trend forecast below takes into account projected increases in costs attributed to what Excellus Health Plan pays out in claims expenses for hospital inpatient and outpatient care, professional services, pharmacy benefits, and other goods and services. The health plan’s anticipated changes in annualized medical benefit spending are summarized as follows:

- Hospital inpatient, small group: 10.3% / individual: 9.4%

- Hospital outpatient, small group: 8.6% / individual: 8.5%

- Professional services, small group: 5.8% / individual: 4.3%

- Pharmacy, small group: 10.4% / individual: 7.9%, including:

- Specialty Rx, small group: 14.3% / individual: 14.7%

- Diabetic Rx, small group: 12.1% / individual: 7.8%

- Other medical goods and services, small group: 5.7% / individual: 8.5%

Rising drug prices are having the fastest growing impact on overall medical spending trends. This is a well-documented national phenomenon. Substantial savings have been achieved over the years with broad acceptance of competitively manufactured generic medicines. However, the savings trend associated with generics is being eclipsed by another trend around the rising cost and utilization of specialty medications including biologics. Every year more and more highly complex specialty medications are approved by the FDA to treat both rare and sometimes more common diseases. Specialty medications are used by approximately 2 percent of our members, but they account for more than 50 percent of total drug spend. Drug trend is a result of both increased utilization and increased unit cost.

Local hospital systems have been challenged financially due to both economic inflationary pressures as well as staffing shortages. Excellus Health Plan has responded to these provider challenges through additional contractual cost increases for our provider systems, resulting in more spending for hospital services.

Additionally, claims expenses are expected to remain higher due to some patients delaying healthcare needs during the pandemic. Those seeking care now have more severe health conditions requiring the use of more intensive treatments and higher drug costs.

Fidelis: Fidelis Care’s rate filing is driven by five primary considerations:

- Adjustment from actual experience to pricing

- Anticipated higher medical and pharmacy costs and greater use of services by our members utilization

- Legislative impacts contingent on a proposed Essential Plan (EP) expansion. If this expansion does not go into effect, the rate increase will be lower.

- Risk Adjustment transfer payment that considers the level of illness of our members

- Changes in the age and gender of those we cover as well as their level of health and wellness

Emblem (HIP): We increase premiums due to the rise in the cost of medical care, including the costs of hospital stays, prescription drugs, and other health services. Most of your premium goes toward paying for medical and pharmacy claims for members. In fact, New York State requires that at least 82% of the premium you pay directly covers member medical costs. As the cost and use of pharmacy drugs and medical services go up, so does the cost of medical care we must pay for.

HealthFirst: Healthfirst is requesting a higher rate for 2024 because several market forces continue to drive health care costs higher. These forces include:

- Cost and utilization increases for inpatient hospital, outpatient hospital, and physician services of approximately 6%.

- Cost and utilization increases for prescription drugs, including the increased use of expensive specialty prescriptions of approximately 8%.

Highmark Western & NE NY: Health insurance premiums must correspond with the cost of our members’ medical care, which continues to rise at an unparalleled rate year after year and is projected to increase significantly in 2024. Rising medical costs are the primary driver of our proposed individual rates and increase requested premiums by 19.1%. Additionally, regulatory mandates, taxes, and fees increase requested premiums by 3.5%.

With more than 90 cents of every dollar of revenue the company collects from premiums, which is well above to state-mandated medical loss ratio (MLR), going back out to pay for our members’ medical care, it’s becoming unsustainable to offer preferred individual products. Over the past five years, the company has experienced over $35.9 million in losses in individual products, demonstrating the critical need for sufficient premium rates.

IHBC: ...primarily due to increased costs due to inflation and changes in risk adjustment as well as the proposed 1332 waiver.

MetroPlus: The primary reason for the increase in costs is due to emerging experience and claim inflation of 8.3% (driven by higher utilization of health care services, higher payments to health care providers, and higher prescription drug costs). Other adjustments contributed to the proposed rate increase due to changes in the overall risk pool due to the Essential Plan 1332 Waiver and the unwinding of continuous enrollment in Medicaid programs established under the Families First Coronavirus Response Act.

MVP Health Plan: Premium rates are changing due to the following reasons:

- The rising cost and utilization of medical services and prescription drugs (+7.5%)

- The anticipated change in cost of COVID-19 services (+0.1%)

- The impact of 2024 being a leap year (+0.3%)

- A change in claim projection from the prior year which includes the impact of changes in anticipated payments/receipts in the Federal Risk Adjustment Program (+0.7%)

- A change in non-claim expense items including taxes and fees (+1.0%)

- A change in market morbidity due to the essential plan expansion (+3.2%)

Oscar: There are two main reasons for higher premiums: prices for drugs and health care services are on the rise, and members are projected to use more care.

UnitedHealthcare Insurance Co. of NY: ...Medical costs are the single largest part of the premium dollar and continue to rise significantly.

...The projected annual trend factor for 2024 is 8.8 percent. This breaks down into the following components: 4.3 percent unit cost, 3.7 percent utilization and 0.6 percent benefit leveraging.

In addition, aging of the New York Individual market is expected to increase costs by 1.1 percent per year. This is applied to the overall rate level because rating based upon member age is not permitted in the New York Individual market.

A part of the medical costs includes a pooling technique established under the Affordable Care Act (ACA) called Federal Risk Adjustment. This attempts to equalize risk within the New York Individual market and requires carriers to set rates at the statewide average risk level. The estimated risk adjustment value reduces the requested rates by 18.5 percent.

The requested rate change also reflects the impact of Medicaid redeterminations in 2024, which we expect to increase enrollment and increase the statewide average risk level. The estimated change in the statewide average risk level increases the requested rate by 0.4 percent.

Changes in state mandated benefits account for 1.4% percent of the requested rate change.

The requested rate changes also include the impacts of plan relativity changes due to pricing model updates (rate increases or decreases depending on the plan) and benefit changes (rate neutral, increases or decreases depending on the plan).

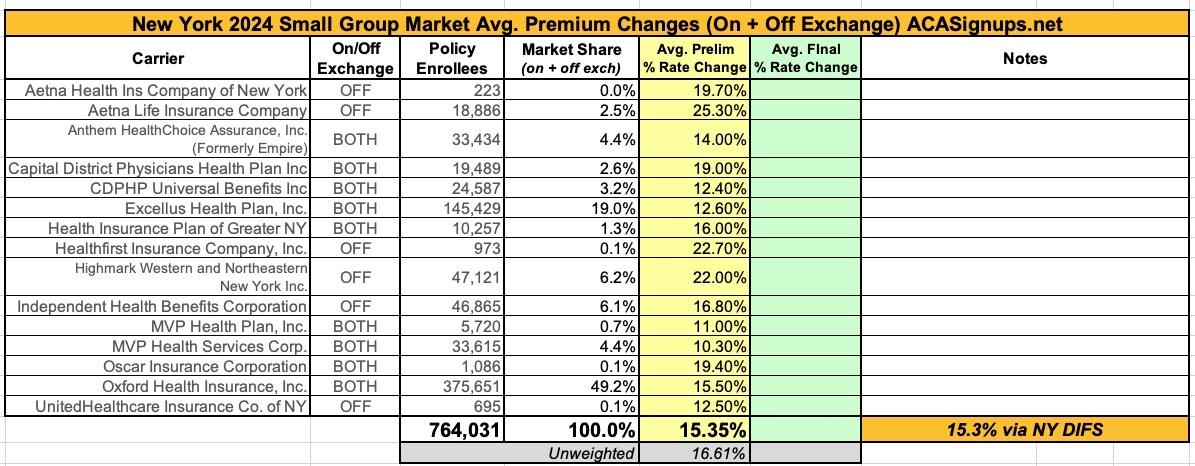

The NY Small Group market isn't looking much prettier, with average requested rate hikes of 15.3% overall: