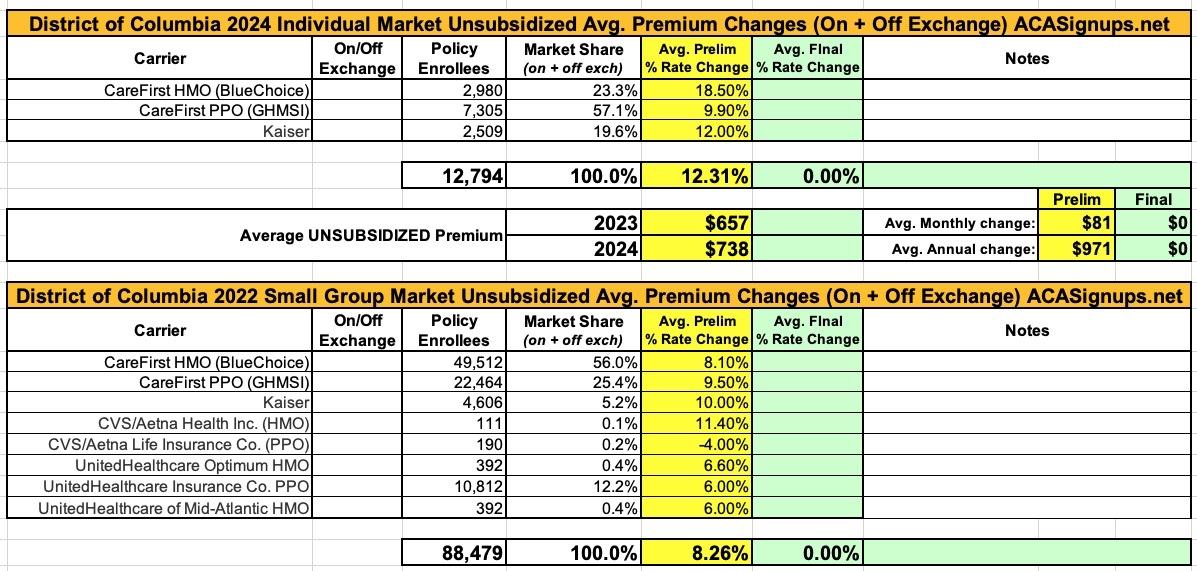

District of Columbia: *Final* Avg. Unsubsidized 2024 #ACA Rate Change: +7.8% (down from +12.3%)

(original post from 5/23/23; updated on 9/26/23)

via the District of Columbia Dept. of Insurance, Securities & Banking (DISB):

This page contains proposed health plan rate information for the District of Columbia’s health insurance marketplace, DC Health Link, for plan year 2024.

The District of Columbia Department of Insurance, Securities and Banking (DISB) received 215 proposed health insurance plan rates for review from Aetna, CareFirst BlueCross BlueShield, Kaiser and United Healthcare in advance of open enrollment for plan year 2024 on DC Health Link, the District of Columbia’s health insurance marketplace.

The four insurance companies filed proposed rates for individuals, families and small businesses for the 2024 plan year. Overall, 215 plans were filed, compared to 238 last year. The number of small group plans decreased from 211 to 188, while the number of individual plans remained at 27.

In the individual market, CareFirst proposed an average increase of 18.5 percent for HMO plans, and an average increase of 9.9 percent for insurance plans. Kaiser proposed an average increase of 12.0 percent. For small group plans, CareFirst filed average rate increases of 8.1 percent for HMO plans and 9.5 percent for insurance plans. Kaiser proposed an average increase of 10.0 percent. Aetna filed for an average increase of 11.4 percent for HMO plans and an average decrease of 3.8 percent for insurance plans. Finally, United proposed an average increase of 6.6 percent and 6.0 percent for its two HMOs and 6.0 percent for its insurance plans.

CareFirst BlueChoice & GHSM (HMO & PPO):

The main drivers supporting the rate change are 1) increase in the base period claims experience of the combined pool, 2) trend, 3) lower projected changes in pool morbidity, 4) higher projected risk adjustment payable, 5) higher projected cost for the Catastrophic plan, and 6) increases in assumed plan actuarial values.

For our initial submission, we have not adjusted 2024 rates to reflect potential impacts of Medicaid redeterminations. We reserve the right to update assumptions as appropriate during the review process

KAISER FOUNDATION HEALTH PLAN:

We are terminating the Silver HSA plan and adding a new Gold Plus plan for 2024.

Primary factors that affect the rate change for these plans are:

- Claims experience of the single risk pool different than projected in the previous year.

- Medical inflation.

- Changes in population morbidity and demographic make-up of the pool.

- Risk adjustment transfer payments into the district-wide risk adjustment pool.

- Benefit plan design adjustments, including those made to comply with Actuarial Value (“AV”) requirements which results in varying rate changes by plan.

- Federal and District taxes and fees.

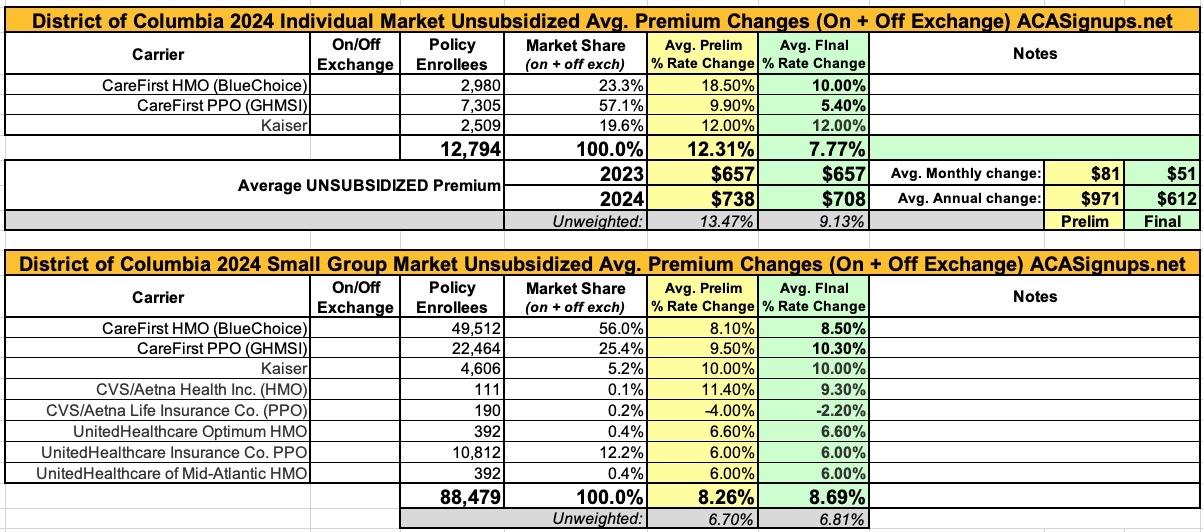

UPDATE 9/26/23: There hasn't been a formal press release yet, but the SERFF database has the final/approved 2024 filings for District of Columbia individual & small group market rates. Two of the three carriers in the former have had their original rate hikes shaved down significantly (CareFirst's HMO & PPO divisions), while the third was approved as is (Kaiser). Overall, the average rate increases in DC's indy market will be 7.8%.

On the small group market side, it's the other way around--while several carriers were kept at their original requested rate changes, several others will see higher final rates than requested by the carriers--CareFirst HMO & PPO, as well as CVS/Aetna's PPO plans. CVS/Aetna's HMOs are being shaved downwards a bit, however:

If you find my healthcare wonkery useful & would like to support it, you can do so in two ways:

1. Make a one-time or recurring donation.

2. Become a paid subscriber via Substack.