Vermont: (Preliminary) avg. unsubsidized 2024 #ACA rate change: +14.5%

And here...we...go...

Every year, I spend months painstakingly tracking every insurance carrier rate filing for the following year to determine just how much average insurance policy premiums on the individual market are projected to increase or decrease.

Carriers tendency to jump in and out of the market, repeatedly revise their requests, and the confusing blizzard of actual filing forms sometimes make it next to impossible to find the specific data I need. The actual data I need to compile my estimates are actually fairly simple, however. I really only need three pieces of information for each carrier:

- How many effectuated enrollees they have in ACA-compliant individual market policies;

- The average projected premium rate change for those enrollees (assuming 100% of them renew their existing policies, of course); and

- Ideally, a breakout of the reasons behind those rate changes, since there's usually more than one.

Unfortunately, there are numerous states where due to the carriers and/or the state insurance departments heavily redacting the rate filing documentation, I've been unable to fill in the actual number of people enrolled by some or all of the insurance carriers within that state's individual market. In these cases, the average premium rate changes listed (shown in grey) are unweighted averages, not weighted.

This can make a big difference in some cases: Let's say you have 2 carriers in a state, one raising rates by 10% and the other raising them by 1%. The unweighted average increase would be 5.5%. However, what if it turns out that the first carrier has 90% of the market share while the second only has 10%? That would mean a weighted average increase 9.1%. The unweighted average is the best I can do for these states without knowing the market share breakout, however.

With that in mind...

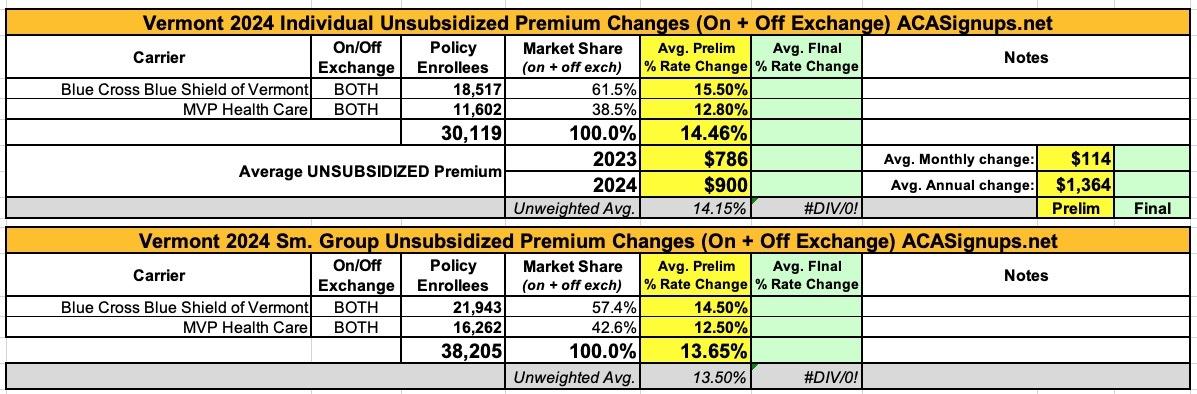

For 2024, the first state I have preliminary rate filings available for is VERMONT. Vermont's filings are pretty easy to average because a) they don't redact any of their filing data; b) they make the forms easy to access; and c) they only have two insurance carriers operating in the individual or small group markets anyway (in fact, it's the same two carriers in both markets).

Here's what VT's preliminary 2024 filings look like...and it's not pretty. This year they raised unsubsidized individual market rates by 14.7% on average, and next year it's almost an identical situation: On average, the two carriers (Blue Cross Blue Shield and MVP) are asking for 14.5% increases in individual market premiums and 13.7% for small group plans:

From the actual rate filings:

Blue Cross Blue Shield of Vermont:

Rate request summary. This filing includes our 2024 proposed rates and supporting calculations for individual plans. Overall we are requesting rates that are higher than last year by 15.5 percent.

- There are 18,517 members currently enrolled in the individual plans affected by this rate request.

- The increases for specific plans range from 12.4 percent to 15.2 percent for non-loaded silver plans and from 18.8 percent to 21.1 percent for On-Exchange silver plans, for an average of 15.5 percent.

Reasons for rate changes in the individual market. Our premiums must be adequately funded to ensure stability and to maintain access to quality care, while protecting Vermonters’ ability to pay. The factors that drive this rate increase are primarily the cost and utilization of care in hospitals and life-saving drugs.

- Medical care and retail pharmacy costs continue to rise. Hospital costs and prescription drugs are the two greatest pressures on the cost of health care in Vermont. This alone resulted in a 9.4 percent increase in our members’ premiums.

- Impact of required benefit changes. We changed the cost sharing aspect of our plans as required by the ACA to meet metal levels. Because of the relationship between cost sharing and premiums, those changes increased rates by 0.4 percent.

Regulatory requirements. The proposed rates reflect the federal and state requirements that Blue Cross VT must implement:

- Solvency. As a regulated insurer, Blue Cross VT must maintain financial reserves to be able to ensure our solvency, invest in cost-saving programs, and protect our members through a pandemic or similar crisis. These reserves have been crucial during these past two years, and must be sufficient at any given time to cover the health needs of our members and maintain programs that reduce costs and promote quality care. Our 2024 rate request includes a 3.0 percent contribution to policyholder reserves.

- Ongoing costs. The rate request includes other ongoing regulatory costs, such as regulatory bill backs and federal and state taxes and fees.

Our experience in this market. Blue Cross VT began selling Qualified Health Plans on the Vermont Exchange in January 2014. Blue Cross VT has cumulative losses of $9.4 million since inception for these plans for the combined Individual and Small Group ACA markets.

Why We Are Changing Our Premiums

MVP must obtain approval from the Green Mountain Care Board for the health insurance premium rates charged. MVP files annual premium rates for the Exchange which are guaranteed for 12 months. This rate filing seeks approval of MVP's 2024 Individual Exchange rates for effective dates of coverage between January 1, 2024 and December 31, 2024. The premium rates filed reflect MVP's current estimate of the cost to provide health insurance for that coverage period. The filed premium rates may be higher or lower than the previously filed premium rates, however, premium rates generally increase over time. Changes in the filed premium rates (relative to previously approved rates) are driven by many factors, including:

- Increases in base period experience. Premium rates are increasing by 3.4% because our estimate of 2023 claims are higher than expected compared to the previous year.

- Increases in cost and utilization of services. The cost and utilization of medical and pharmacy services generally increase over time. Premium rates are increasing by 7.5% because of this estimated trend in 2024.

- Impact of the Federal Risk Adjustment Program. The federal risk adjustment program seeks to “level the playing field” among insurers. MVP has enrolled a population of lower-risk members, so it is required to pay into the program. MVP’s individual payment has become less, decreasing premium rates by approximately 0.2%.

- Changes in the cost of doing business. As the cost of doing business rises over time, MVP must collect a portion of the premium revenue to protect consumers by ensuring its solvency. MVP aligned its administrative costs with the expected cost of the individual market. These changes are worth approximately 1.3% of a premium increase.

- Impact of the Leap Year. MVP is increasing rates by approximately 0.3% to account for 2024 being a leap year (and having an additional day).

Wow...that's a new one to me. They're increasing their rates by 0.3% because there's an extra day in the year?? Well...yeah, actually. 366/365 = 1.00274...or 0.274% more time for people to get sick or injured. Huh.

Conclusion

The proposed rates reflect an average rate adjustment to prior rates of 12.8%, ranging from 7.7% to 15.5%. There are 8,470 policyholders, 8,470 subscribers and 11,602 members impacted by this rate filing.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.