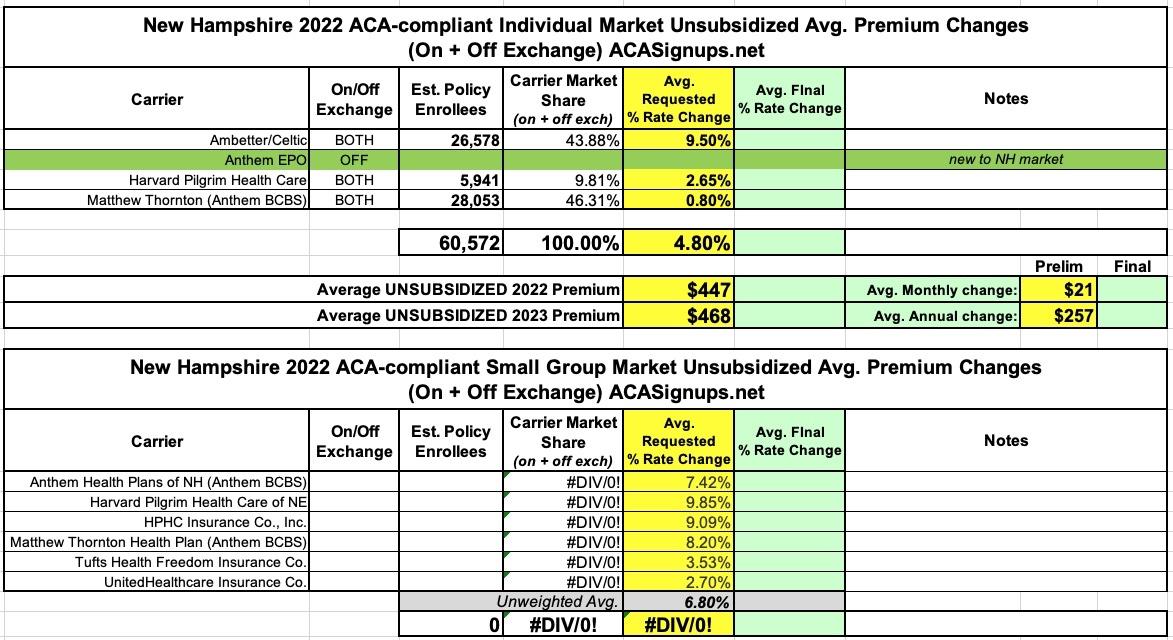

New Hampshire: Final avg. unsubsidized 2023 #ACA rate changes: +4.8% (w/caveat)

The good news about New Hampshire's health insurance market is that they're the only state without its own ACA exchange which produces publicly-accessible monthly reports on individual on-exchange market enrollment. The bad news is that they don't seem to publish the actual rate filings in an easy-to-read format, which means I'm left with the federal rate review website. The problem with that is the rate filings are mostly heavily redacted, making it impossible to get the total enrollment data.

via the New Hampshire Insurance Dept:

New Hampshire Insurance Department Kicks Off 2023 Open Enrollment Period And Releases Premium Rates

Despite difficult national economic headwinds, New Hampshire’s rates remain the lowest in New England.

CONCORD, NH (November 1, 2022) – Today, the New Hampshire Insurance Department (NHID) kicked off the Open Enrollment Period for Granite Staters who are seeking individual health coverage on the Affordable Care Act (ACA) Individual Marketplace. The Open Enrollment Period runs from Tuesday, November 1, 2022, through Sunday, January 15, 2023.

“This is a great opportunity for Granite Staters who do not have health insurance through their employer, Medicare, or Medicaid to enroll in the Individual Marketplace and comes at a critical time as the Medicaid redetermination process is likely to begin again next year,” said Christopher Nicolopoulos. “For the third year in a row, the 1332 Waiver has resulted in premiums for the individual market being the lowest in New England, helping more people get access to the healthcare they need.”

NHID references the age 40 nonsmoker second-lowest cost Silver plan (SLCSP) rates as the barometer for market premiums. For 2022, the SLCSP was $308.57. The 2023 SLCSP premium rate is $322.70, a 4.6 percent increase over 2022. The department worked with carriers to reduce their requested rate increase by 5 percent. Despite the increase, overall premiums remain the lowest among the New England states.

The premium rate can be attributed in part to overall market trends, and in part to the approval of the Department’s Section 1332 Waiver designed to lower rates in the individual market and to provide market stability in the future.

Hmmmm...unfortunately, that 4.6% figure only refers to benchmark Silver plan premiums statewide, not the overall weighted average of all the other plans offered on the individual market as well. The press release also doesn't mention anything at all about New Hampshire's small group market.

Fortunately, the SERFF database includes the raw rate filing data; as far as I can tell, the weighted average increase is around 4.8%, slightly higher than the benchmark Silver average. On the other hand, that "5% decrease" comment makes it sound like the benchmark average was originally more like 9.6%, so it's hard to say:

“Granite Staters will continue to enjoy the lowest health care costs in New England,” said Deputy Insurance Commissioner D.J. Bettencourt. “As a result of rising inflation, families across New Hampshire are trying to make their dollars stretch further. Without the 1332 Waiver in place, these rates would be 13 percent higher. New Hampshire’s rate changes remain relatively consistent from previous years, while factoring in the challenges currently facing our national economy.”

All three insurance companies currently in New Hampshire’s marketplace will return to offer individual plans: Anthem, Ambetter from NH Healthy Families, and Harvard Pilgrim Health Care. Premiums will vary by plan, based on the included benefit design. Premium subsidies remain in place, along with a three-year extension (2023-2025) of the ARPA eligibility enhancement by the passage of the Inflation Reduction Act.

“I strongly encourage those seeking health insurance to visit HealthCare.Gov to check out their coverage options and enroll in a plan that truly meets their needs,” said Jason Dexter, Life and Health Director at the NHID. “Plans can also be purchased through an insurance agent or directly from an insurance company, although those plans are not eligible for ACA price reductions based on income and other circumstances.”

Those seeking coverage can visit the federal insurance exchange at HealthCare.Gov, where consumers can compare and purchase various health and dental plans. Many consumers will be eligible for assistance covering premiums, out-of-pocket costs, and deductibles. The NHID recommends that consumers contact a licensed insurance agent for help evaluating the various plan options and eligibility for cost-savings.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.