UPDATE: Minnesota: *Approved* avg. 2017 rate hikes: 56.6%...and one other twist...

Back in June, BCBS of Minnesota announced that they were pulling all of their PPO plans out of the state. Aside from that, and some hefty proposed rate hikes for everyone else, there hasn't been a whole lot of news out of the Land of 10K Lakes.

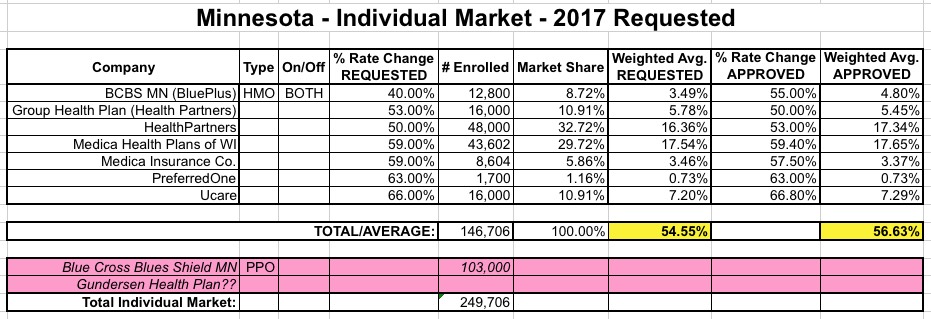

Today, however, they announced their approved rate increases, and the unsubsidized prices don't look pretty:

Health insurers are boosting individual market premiums by an average of 50 percent or more next year, increases that regulators say are necessary to save a market that otherwise was on the verge of collapse.

The increases were announced Friday by the state Commerce Department, and show premiums will jump even higher than proposed rates that were made public on Sept. 1.

At that point, carriers sought increases ranging from 36 percent to 67 percent. But the final average increases will range form 50 percent to 67 percent, depending on the insurer.

Here's how it actually plays out by the hard numbers:

Sure enough, the approved rates are slightly higher overall than requested, mainly due to higher bumps for both BluePlus and HealthPartners rates.

There's one other interesting twist here, however, which I was given a heads up on from Lynn Blewett earlier today:

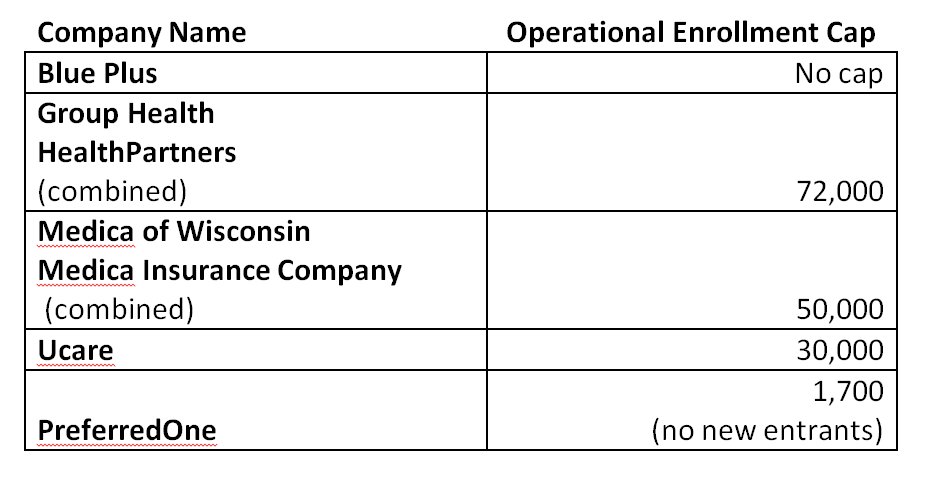

In addition, each insurer (except Blue Plus) will be limiting its total 2017 enrollment in order to manage its financial or provider network capacity to absorb the large number of consumers who will be shopping for new plans, especially current Blue Cross enrollees who must find a new insurer for 2017.

Yup, there's gonna be a cut-off for the other 6 carriers (well...4, if you group the 2 "Medica" and "HealthPartners" listings together, anyway). Neither the press release nor the official notice specify just how many enrollees that cut-off point will be; I assume it will vary by carrier and/or plan?

They further address this unique provision with an urgently-worded notice (their wording, not mine):

Rothman said that, following Blue Cross’s announcement, Minnesota’s individual market for 2017 was on the verge of collapse as all of the other insurers indicated that they were also prepared to exit this market.

“The Commerce Department pursued every option within its power to avert a collapse this year,” said Rothman. “We succeeded in saving the market for 2017, with only Blue Cross leaving. But the rates insurers are charging will increase significantly to address their expected costs and the loss of federal reinsurance support. In addition, each insurer except for Blue Plus will limit its total 2017 enrollment to manage its financial or provider network capacity to absorb the many current Blue Cross consumers who will be shopping for new plans.”

Rothman emphasized that, even with the discontinued policies and enrollment limits, every Minnesotan who needs it will be able to get insurance in the individual market, though not necessarily the specific insurer or provider network they might prefer.

Urgent Need for Reforms

”Last year at this time when rates were announced, I said there was a serious need for reform in Minnesota’s individual market,” said Rothman. “This year the need for reform is now without any doubt even more serious and urgent.”

He highlighted Governor Mark Dayton’s recent decision to reconvene his Task Force on Health Care Financing to make recommendations to ensure that Minnesota consumers have access to affordable, high-quality health insurance options in the individual market.

“While federal tax credits will help make monthly premiums more affordable for many Minnesotans, these rising insurance rates are both unsustainable and unfair,” said Rothman. “Middle-class Minnesotans in particular are being crushed by the heavy burden of these costs. There is a clear and urgent need for reform to protect Minnesota consumers who purchase their own health insurance."

In other words, as I keep reminding folks, around 40% of the individual market is off-exchange which, combined with the ~15% of exchange-based enrollees who don't receive APTC assistance, means that roughly half the individual market is gonna be hit with the full brunt of these rate hikes.

Rothman said the reconvened Task Force on Health Care Financing should consider any and all feasible reforms. Above all, he said, it should offer recommendations that can be implemented in the next year to improve market stability and rates for 2018.

“We received over 50 public comments from Minnesotans as part of our rate review,” said Rothman. “I personally read each one. They told heartbreaking stories about how hard-working families are struggling with very tough, painful choices because of these skyrocketing costs. They say that health insurance is unaffordable, and they’re right. This calls for immediate reforms as everyone's top priority.”

It's not so much the huge rate hike approvals which are eye-opening here; similar hikes are being seen in several other states, such as Tennessee, Arizona, Montana and Oklahoma. It's the other two points ("urgent need for reform" and the enrollment capping) which really stand out here.

UPDATE: OK, here's the actual enrollment cap numbers via Zach Tracer from Bloomberg News:

Assuming MN individual market enrollment stays right around 250,000 people, this effectively means that Blue Plus will end up with around 96,000 enrollees. Of course, there are still up to 17,000 or so uninsured people in Minnesota who are eligible for tax credits, plus another 193K uninsured who would have to pay full price either on or off the exchange.