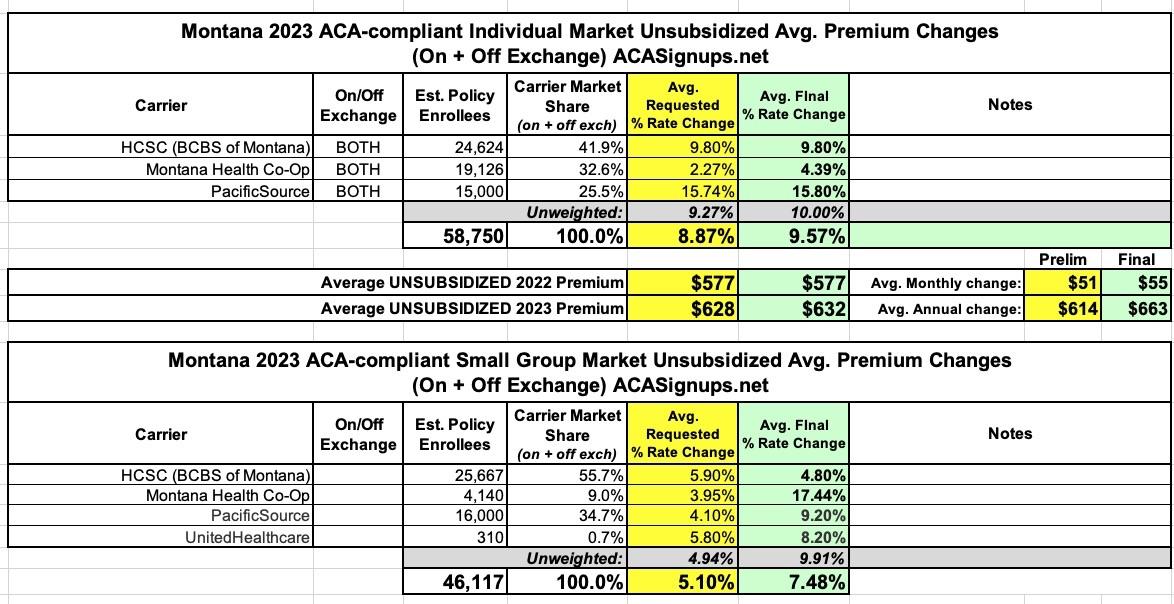

Montana: Final avg. unsubsidized 2023 #ACA rate change: +9.6% (up from +8.9%)

The Montana Insurance Dept. has published the final/approved (unsubsidized) premium rate changes for 2023 in both the individual and small group markets:

Insurance companies offering individual and small group health insurance plans are required to file proposed rates with the Montana State Auditor’s Department of Insurance for review and before plans can be sold to consumers.

What is a rate review?

The rate review process, established by the Montana Legislature in 2013, does not give the Commissioner the authority to disapprove rates or prevent them from taking effect. It does give the commissioner the chance to review the factors insurance companies use in setting rates.

If the commissioner finds a rate increase to be excessive or unjustified, the insurer can voluntarily lower the rate increase. If the insurer decides to use the rate anyway, the commissioner will issue a public finding announcing that the rate is unjustified.

What does the department consider?

Rates reflect estimates of future costs, including medical and prescription drug costs and administrative expenses, and are based on historical data and forecasts of trends in the upcoming year. In its review, the Department considers these factors, as well as factors such as the insurer’s revenues, actual and projected profits, past rate changes, and the effect the change will have on Montana consumers.

Below, you can review information on rate filings for individual and small-group products that comply with the Affordable Care Act (commonly known as Obamacare).

The weighted average increase for unsubsidized enrollees will be around 9.6% on the individual market and 7.5% for the small group market. Both of these are slightly higher than the preliminary filings, which is unusual (usually the final rate hikes are smaller than those requested):