New York: Final unsubsidized 2023 #ACA rate changes released: +9.7% (reduced from +18.7%)

I wasn't expecting New York to be the first state to publicly release their final/approved rate filings, but so be it (in fact, they're just the first state I'm aware of to do so).

Thanks to Michael Capaldo for the heads up on this press release from the NY Dept. of Financial Services:

DFS ANNOUNCES 2023 HEALTH INSURANCE PREMIUM RATES, SAVING NEW YORKERS $799.5 MILLION

- As Health Care Costs Return to Pre-Pandemic Levels, DFS Protects Consumers Against Significant Rate Increases and Approves Historically Low Insurer Profit Margins

- Individual Plan Rates Reduced by 48% from Insurers’ Requested Rates, Saving Consumers $167.1 Million

- Small Group Rates Reduced by 52% from Insurers’ Requested Rates, Saving Small Businesses $632.4 Million

Superintendent of Financial Services Adrienne A. Harris announced today that the New York State Department of Financial Services (DFS has approved health insurers’ premium rate increases for 2023, saving consumers and small businesses almost $800 million. In the individual market, DFS reduced insurers’ requested rates 48%. In the small group market, DFS reduced insurers’ requested rates 52%. Over 1.1 million New Yorkers are enrolled in individual and small group plans.

“Rising medical costs and inflation continue to put upward pressure on premiums,” said Superintendent Harris. “With our rate actions announced today, we continue to prioritize the financial wellbeing of consumers while ensuring that New Yorkers have access to a robust, stable health insurance market.”

The rising cost of medical care, including in-patient hospital stays and drug costs, continue to be the main driver of insurance premium rate increases, and medical claims have increased as New Yorkers catch up on medical appointments and services postponed due to the pandemic.

Also DFS, recognizing the continued uncertainty of the pandemic’s effect on consumer’s health care costs and the economy, held insurers’ profit provisions to a historically low 0.5%.

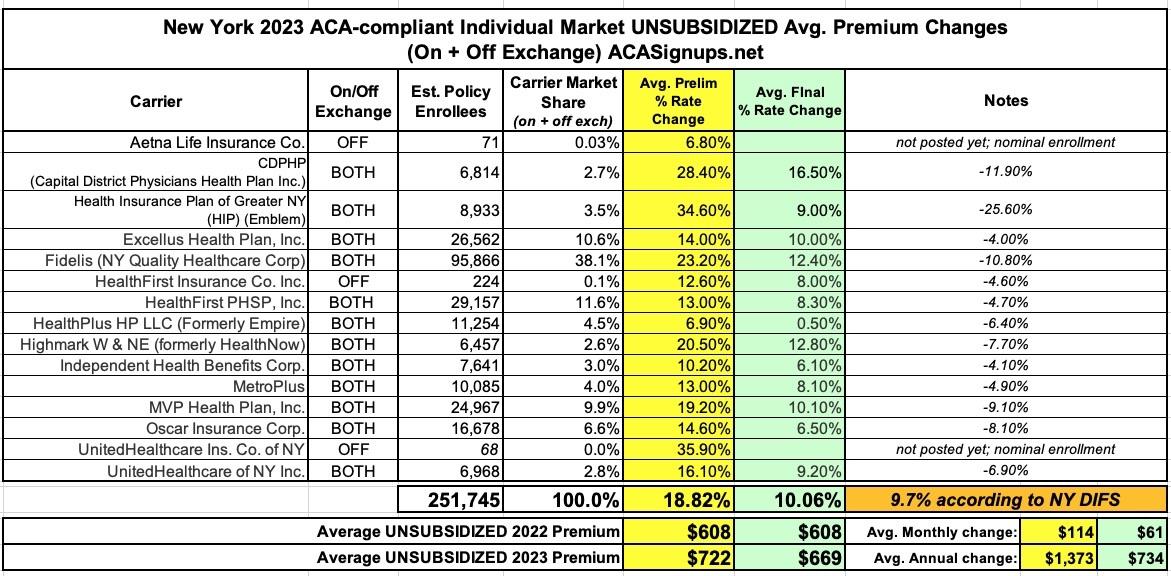

Individual Market

Insurers requested an average rate increase of 18.7% in the individual market, which DFS cut by 48% to 9.7% for 2023, saving consumers $167.1 million. These rates will be further reduced for many consumers who are eligible for federal tax credits. Last year, over 60% of individuals who enrolled in a Qualified Health Plan through New York State of Health received the federal premium tax credits to lower the costs of premiums. Approximately 262,000 New Yorkers are currently enrolled in individual commercial plans.

These rate decisions do not include the Essential Plan, available through NY State of Health, which as of June 1, 2021 charged no premium for lower-income New Yorkers who qualify. More than one million New Yorkers were enrolled in the Essential Plan.

Hmmm...NY DIFS claims the weighted overage average increase is down to 9.7%, which is slightly lower than the 10.1% I get, but there's generally some slight discrepancies since the number of effectuated enrollees can vary a bit depending on what month you're looking at.

Another other odd thing is that two off-exchange only carriers (Aetna Life Insurance and UnitedHealthcare Insurance Co. of New York...which isn't to be confused with UnitedHealthcare of New York Inc....don't have final/approved rates listed at all in the press release. I'm not too concerned about this, though, since neither of them have more than ~70 enrollees anyway out of over a quarter million total.

Speaking of which, there also seem to be around 10,000 enrollees "missing" from my table; there's several possible reasons for this, which also likely explain the 9.7% vs. 10.1% gap.

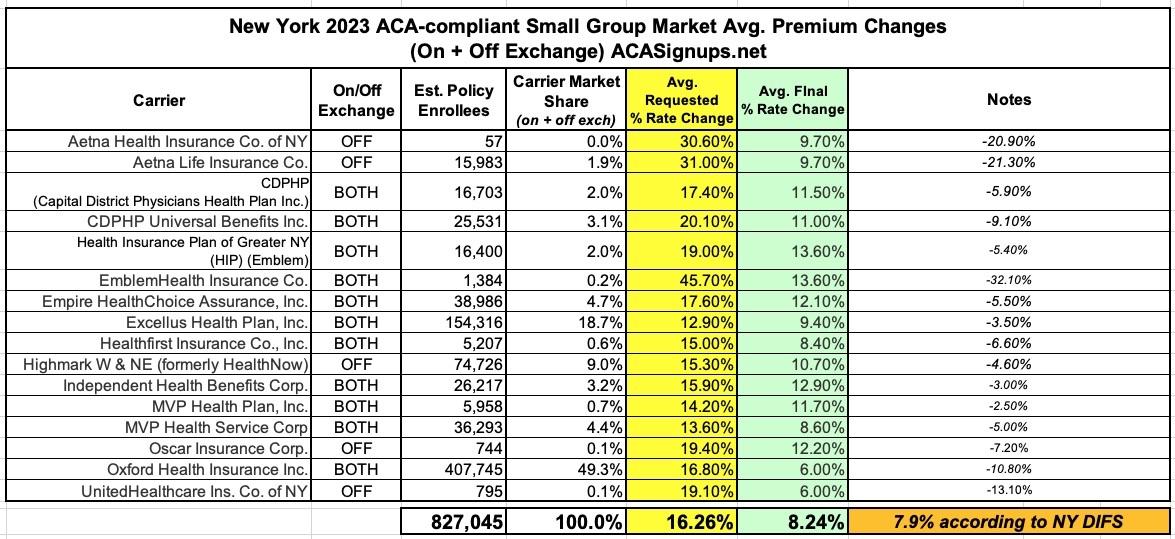

Small Group Market

Almost 850,000 New Yorkers are enrolled in small group plans, which cover employers with up to 100 employees. Insurers requested an average rate increase of 16.5% in the small group market, which DFS cut by 52% to 7.9% for 2023, saving small businesses $632.4 million. A number of small businesses also will be eligible for tax credits that may lower those premium costs even further, such as the Small Business Health Care Tax Credit.

Again, there's some "missing" enrollees here--nearly 23,000 total--and again, the DIFS average is slightly lower than what I come up with (7.9% vs. 8.2%), but otherwise nothing too weird.