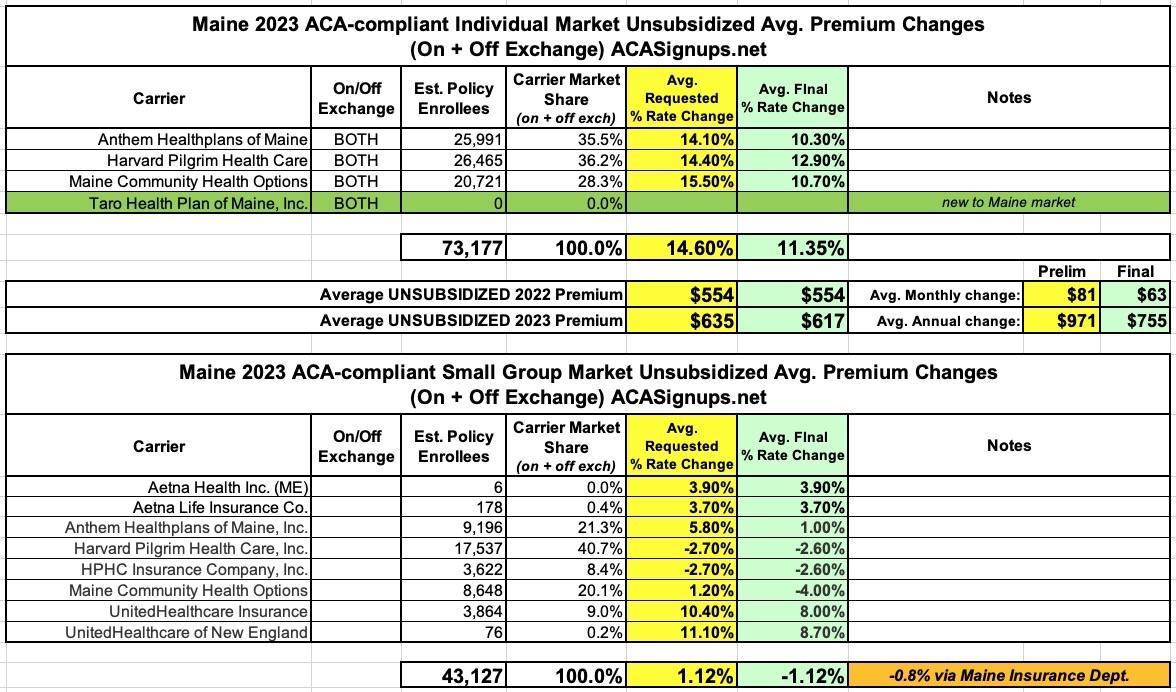

Maine: Final avg. unsubsidized 2023 #ACA rate changes: +11.4% (down from 14.7%)

Back in july, the Maine Dept. of Professional & Financial Regulation posted the preliminary 2023 rate filings for Maine's individual & small group markets:

Maine Health Insurers File Proposed Rates for 2023 Plan Year

Health insurance carriers in Maine's Individual and Small Group markets have filed proposed rates with the Maine Bureau of Insurance (the Bureau) for the 2023 plan year. June 27, 2022 was the deadline for the initial filing of plans and rates, but insurers may revise their filings through July 20, 2022.

- The proposed weighted average rate increase filed by the insurers in the Individual Market is 14.72%.

- The proposed weighted average rate increase filed by the insurers in the Small Group Market is 3.42%.

"The requested increases in the Individual Market appear to be the result of several factors, including increased health care utilization in the past year, since more people have resumed scheduled medical procedures," said Acting Superintendent Timothy Schott. The Bureau's actuarial staff will review the justifications for the rate changes and may object or request additional information from the insurers.

Many other states are also reviewing proposed rates, and a number of them are seeing larger rate increases this year compared to those filed in 2021 for the 2022 plan year. For example, for 2023, insurance carriers in Maryland have requested a weighted average increase in the Individual Market of 11%, and 10% in the Small Group Market. Insurance carriers in New York have proposed a weighted average increase of 18.7% in the Individual Market and 16.5% in the Small Group Market. Insurance carriers in Vermont proposed weighted average increases of 10.99% for the Individual Market and 14.62% for the Small Group Market.

The American Academy of Actuaries projects that premiums for 2023 will increase faster than they did in 2022 because of (1) a potential return of serious COVID-19 health problems, (2) the expiration of the American Rescue Plan Act (ARPA) tax credits that will likely reduce enrollment and worsen the risk pool, which will be partly but not fully offset by more enrollees when the Public Health Emergencys Medicaid maintenance of effort policy ends; and (3) inflation and health care workforce shortages. Governor Mills supports an extension of the ARPA premium tax credits which could lower 2023 premiums and the premiums individuals pay after the tax credit is applied.

Over 88% of individual market enrollees in Maine purchase coverage through CoverME.gov, Maines health insurance Marketplace. Over 80% of CoverME.gov consumers qualify for advance premium tax credits to make premiums more affordable. These tax credits, which are calculated based on the cost of plans available through the Marketplace, limit the maximum contribution that eligible consumers pay to a percentage of their income, helping to protect them against increases in premium.

Since 2019, rates in Maines Individual Market have benefited from the Maine Guaranteed Access Reinsurance Association (MGARA) program, which provides reinsurance to help cover claim costs for high-cost services. For 2023, Maine has requested approval from the federal Centers for Medicare and Medicaid Services to include the Small Group Market in the MGARA program. Maine has also dedicated an extra $8.6 million in federal reinsurance, that resulted from the ARPA increase in premium tax credits, to the reinsurance program in 2023.

The proposed rates for both the Small Group and Individual markets are likely to be revised before the July 20, 2022 deadline for revisions. The rate review process continues for several weeks after final rates are submitted in July. The Bureau plans to hold a Public Forum after July 20, 2022 to answer questions from the public about the rates and the rate review process.

Consumers with questions about insurance matters can obtain information and assistance from the Maine Bureau of Insurance by visiting www.maine.gov/insurance, calling 800-300-5000 (TTY call Maine Relay 711), or e-mailing Insurance.PFR@maine.gov. See more about how the Bureau can help.

However, more recently, the Maine Insurance Dept. posted their approved, final 2023 rate filings...and state regulators have cut down the increases pretty much across the board. Unfortunately they don't really delve into the reasoning so I don't know how much of the reduction is thanks to the Inflation Reduction Act being passed. In any event, the average individual market increase has dropped from 14.6% to 11.4%, while the average small group premium increase has gone from a 1.1% increase to a 1.1% decrease...although the state DOI claims the weighted average is -0.8%:

In addition to Maine's reinsurance program being extended to its small group market, there's another important change coming to their small group market this fall, which Louise Norris explained last year:

The creation of standardized plan designs (dubbed “clear choice designs”) that will make it easier for consumers to compare health plans from different insurers. The Clear Choice plans will be available by 2022 in the individual market, but delayed until 2023 in the small group market. Maine’s Bureau of Insurance has held several public meetings about the Clear Choice plans. In late 2020, the state published an outline of the regulatory specifics that apply to Clear Choice plans and the other alternative plans that insurers are allowed to offer.

...Maine’s new Clear Choice standardized plans (described above) will be available for purchase as of November 2021. Insurers have the option to keep existing plans as Alternative plan designs for 2022 if they choose to do so, but all insurers will also be offering the Clear Choice plans during the upcoming open enrollment period.