Unintended Consequences: Some enrollees are profiting off of ACA plans whether they intended to or not

OK, OK, I know I said I was sick of writing about MLR rebates, but there's one more important point I need to mention...and while I'm at it, I also said "to hell with it" and recompiled the rebate tables for all 50 states into a single massive table listing every carrier offering rebates in every state.

While I applaud the ACA's Medical Loss Ratio Rebate provision overall, there's one important flaw in how it works. I've made allusions to this before, and last week David Anderson wrote a blog post specifically about it, but it bears repeating here: Due to an oversight in the wording of the section of the ACA devoted to laying out MLR rebates, some subsidized individual market enrollees are actually PROFITING off the program.

The reason why is pretty simple: The individual market MLR rebate payments are sent, in full, to the policyholder regardless of whether or not their premiums are being subsidized by the federal government or not.

Let's suppose you earn $60,000/year (too much to qualify for ACA subsidies) and enroll in the Silver benchmark policy which has full-price premiums of $600/month ($7,200/year). Your carrier came in with a 3-year rolling average MLR of 79%, so they have to pay 1% of the premiums back, which means you'd receive a check for $72. Fair enough. You're paying 12% of your income for your healthcare policy...getting a small fraction of that back isn't huge, but hey, $72 is $72.

Now let's say you enroll in the same policy, but you only earn $30,000 (240% FPL). You'd only have to pay around 8% of your income for the benchmark plan, or $200/month ($2,400/year), with the other $4,800 covered by federal APTC assistance. However, the MLR rebate check you receive would still be based on the total premium, not the unsubsidized portion. The insurance carrier doesn't care one way or the other--they have to pay back that 1% excessive charge either way.

In this case, it's not that big of a deal...$72/$2,400 is still just 3% of the total, big whoop, right? Until this year, this was probably about as far as it went for most people and wasn't that big of a deal.

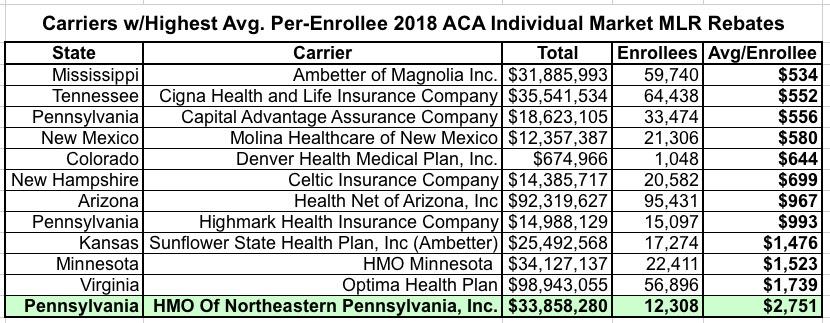

HOWEVER, as I've pointed out pretty clearly over the past few weeks, things have changed dramatically with the 2018 rebates. Of the 67 carriers which owe Individual Market MLR rebates this year, over 25 of them owe an average rebate of at least $200 per enrollee. Twelve owe at least $500 per enrollee on average...and four of them owe over $1,000 to 109,000 enrollees apiece. In fact, one carrier in particular, "HMO of Northeastern Pennsylvania, Inc." (operating as "First Priority Health HMO") owes an average of over $2,700 per enrollee to over 12,000 people:

In the above scenario, the enrollee earning $30,000/year would actually end up getting $350 more as a rebate than the $2,400 they paid out in premiums.

But wait, there's more! Remember, that $2,751 is just the average rebate amount. The ACA allows for a 3:1 age ratio when it comes to premiums, which means a 64-year old enrollee will likely be paying about 3x as much as a 21-year old. It's conceivable that some First Priority HMO enrollees could get rebate checks as high as $5,000 apiece this year.

Let's suppose you earn around $18,000...just 144% FPL). Under the ACA subsidy structure, you'd only have to pay perhaps 3.5% of your income in subsidies, or $630/year...but you could end up getting several thousand dollars back from your insurance carrier.

In case you think this is just theoretical, that's exactly what's happened. Here's an actual email I received last week (ID removed, of course):

I'm from Arizona. I just received an MLR rebate for $2,567 on a 2018 Ambetter subsidized plan for which I only paid $79/month in 2018. Am I really allowed to keep this money, or was there a mistake? Neither my accountant nor health insurance advisor knows the answer. The IRS website does not address who should be refunded when the plan is subsidized. It would be unbelievable stupidity if this law allows people to profit nearly 250% on a subsidized healthcare plan. I appreciate your help. Thanks!

Sure enough, this person paid just $948 in total premiums for their policy last year...but received a rebate check for $2,567. That's a net $1,619 profit.

Here's another forwarded by a broker friend of mine; the enrollee is also from Arizona (note: "Health Net of Arizona" is actually Ambetter):

I hope all is well with you and your family. This is nuts....I got a $1,648.60 check from Ambetter. Health Insurance Premium Rebate for Year 2018. Good Lord, I only paid maybe $75.00 in premiums for the whole year. I feel like I am participating in some forced scamming of the health care system. I think I asked you this last year, but is this for real? Will I be asked to repay this, somewhere down the line?

Again, that's a net $1,573 gain for this person.

The solution to this is obvious, as Dave Anderson noted last week:

I think there is a good policy argument that the US Treasury should be at least a beneficiary of MLR rebates that are earned to individuals who receive APTC subsidies. The Treasury paid too much in APTC on the original round of insurance choice. Rejiggering the rebate formula so that MLR rebates are distributed in proportion to total paid premium by source could generate several hundred million dollars in pay-fors for the US Treasury. A half billion dollar pay-for is a decent size downpayment for national reinsurance for catastrophic, multi-million dollar claims that are likely to become more common in the future.

In other words, if the APTC covers 90% of the premiums, 90% of the rebate check should be paid to the Treasury Dept. to reimburse them. The money could then be used instead to reduce premiums for unsubsidized enrollees via a reinsurance program or towards expanding direct subsidies beyond the 400% FPL cut-off. As Anderson notes, it's not a huge amount relatively speaking, but it's not chump change for such a program either.

If you're wondering where Anderson gets his "half billion dollar pay-for" quip, consider that over half of 2019 exchange enrollees earn 100-200% FPL, which means they're heavily subsidized; they only have to pay between 2 - 6.4% of their income for benchmark plans. If you go with a ballpark of 150% FPL, that's around 4.1%. For a single adult, that's $770/year, vs. avg. annual premiums of $7,200. That means the feds are paying about 89% of the total. Another third or so earn 200-400% FPL and are partly subsidized...let's call it 300%, with them paying around 9.8% of their income. Again, for a single adult that's around $3,700, which means the feds are covering 48%. So, crudely speaking, that's something like:

- ~50% x ~89% = ~45%

- ~33% x ~48% = ~16%

- Total = ~61%

All told, I'd imagine around 60% of the $769 million in MLR rebates would likely be reimbursed back to the federal government if it was paid out proportionately...call it $460 million this year. Not a lot, but something. For comparison, H.R. 1425 would provide $10 billion/year for reinsurance programs.

I should note that this is exactly how the MLR rebates work for the small and large group markets: In those cases, the carrier pays the full amount to the employer, who is then legally required to pay the portion of the rebate owed to each of their employees...but only the portion of the premiums actually paid by the employees. So if the employer covers 70% of their employees' premiums, the employer keeps 70% of the rebate and passes the other 30% on to the employee, which makes total sense.

I'm assuming the reason this same policy wasn't included for the individual market was simply because it never occurred to Congress in 2009-2010 that the carriers would ever end up miscalculating their pricing structure so badly as to end up with such high rebates.

Much of this, I should note, is one of the more unusual side effects of #SilverLoading and #SilverSwitching, which in turn was a direct response to Donald Trump cutting off CSR reimbursement payments, which in turn was due to a lawsuit filed by the House Republicans over CSR payments back in 2014.

Call this the law of unintended consequences.

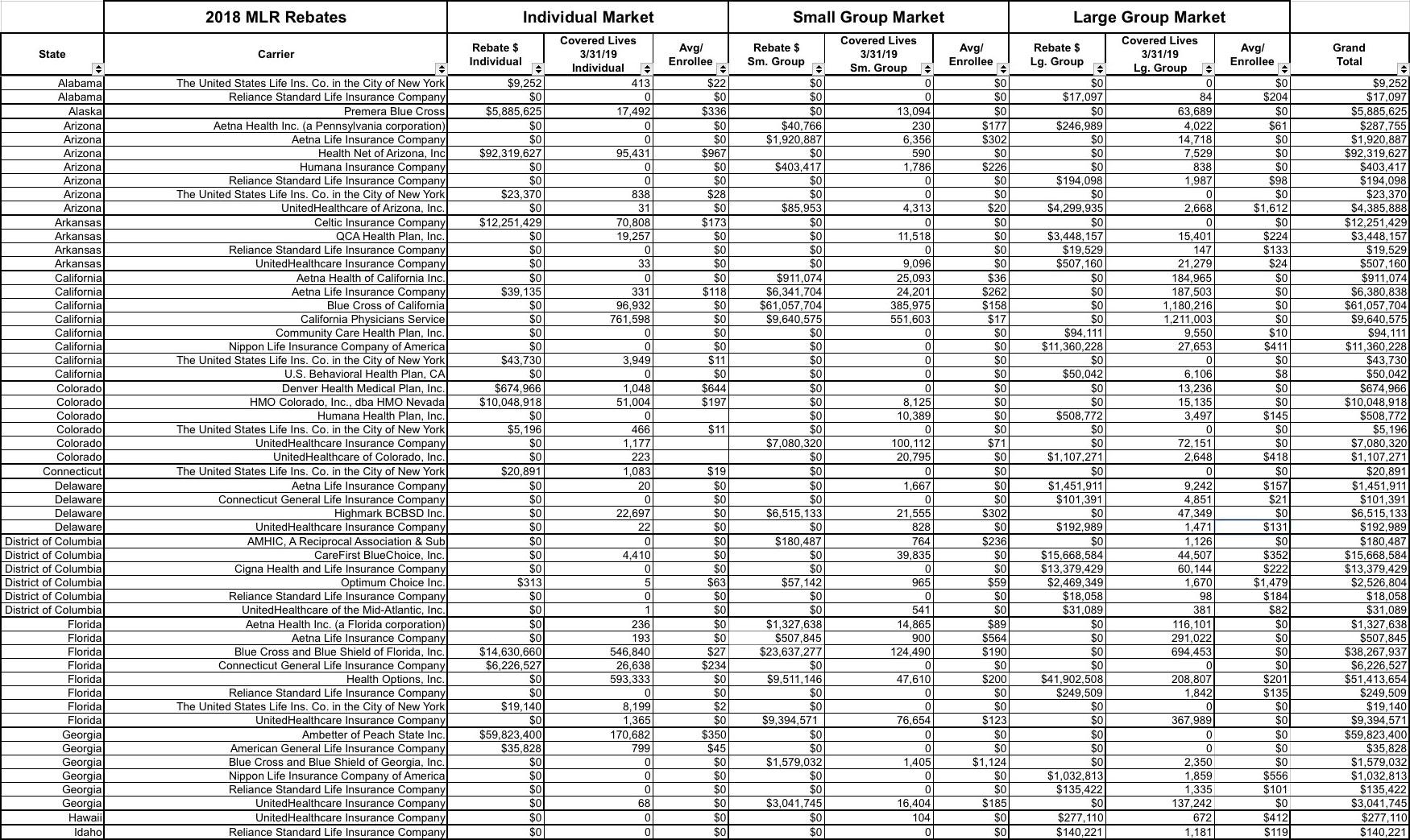

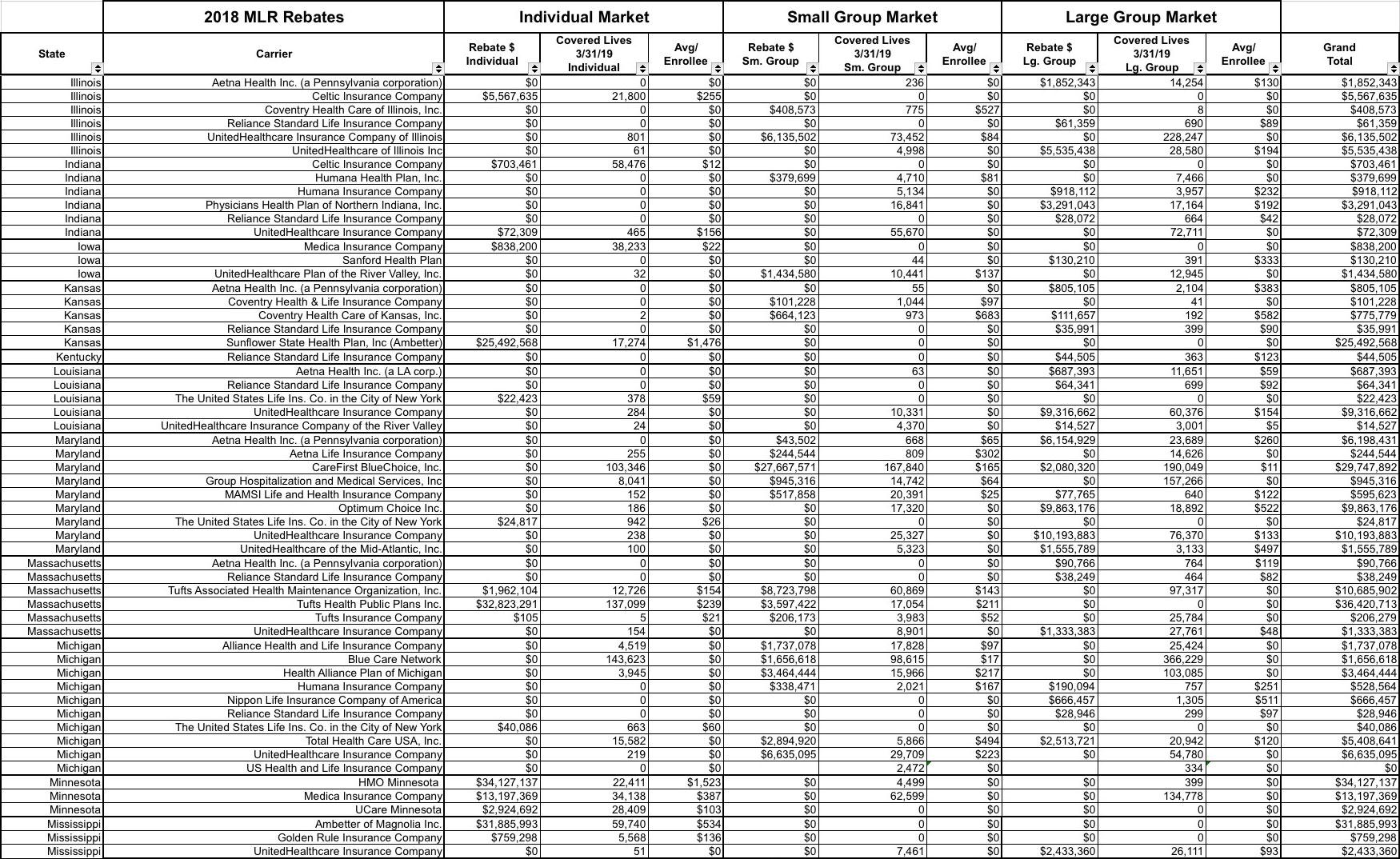

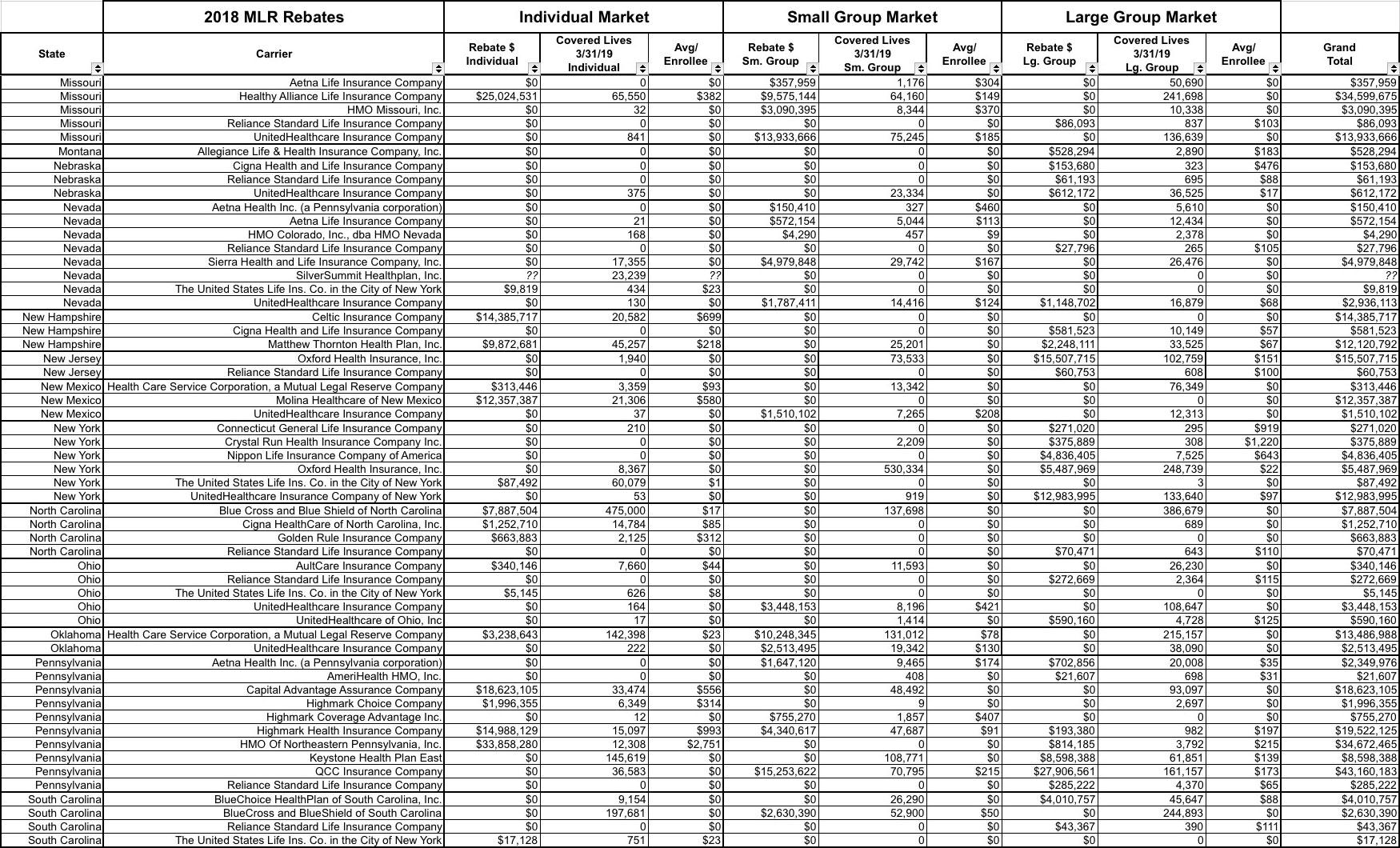

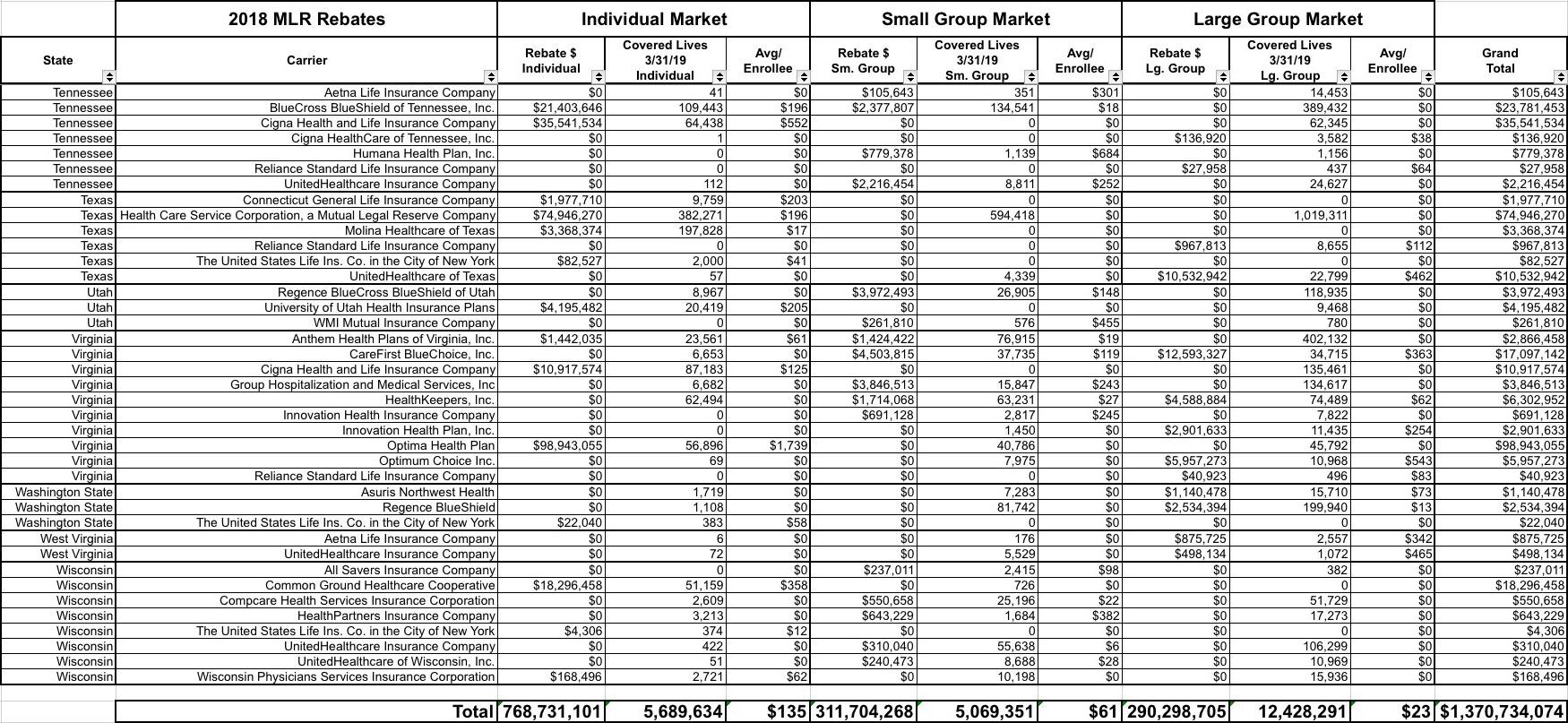

As for the state-by-state rebate table, see below...I've broken it into four image files. Click each one to load a higher-resolution version. Out of over 2,700 carriers nationally (carriers in multiple states count for each state, since that's how the MLR percentages are calculated), only 207 are actually subject to MLR rebates across any of the three markets this year, and of those, only 67 owe rebates on the individual market.