Happy 12th Birthday #ACA: CMS releases final 2022 OEP report (part 7)

As noted yesterday, it's the12th Anniversary of President Obama signing the ACA into law. To mark the occasion, the Centers for Medicare & Medicaid Services (CMS) has released the final, official 2022 Open Enrollment Period (OEP) report, which I've broken into multiple entries.

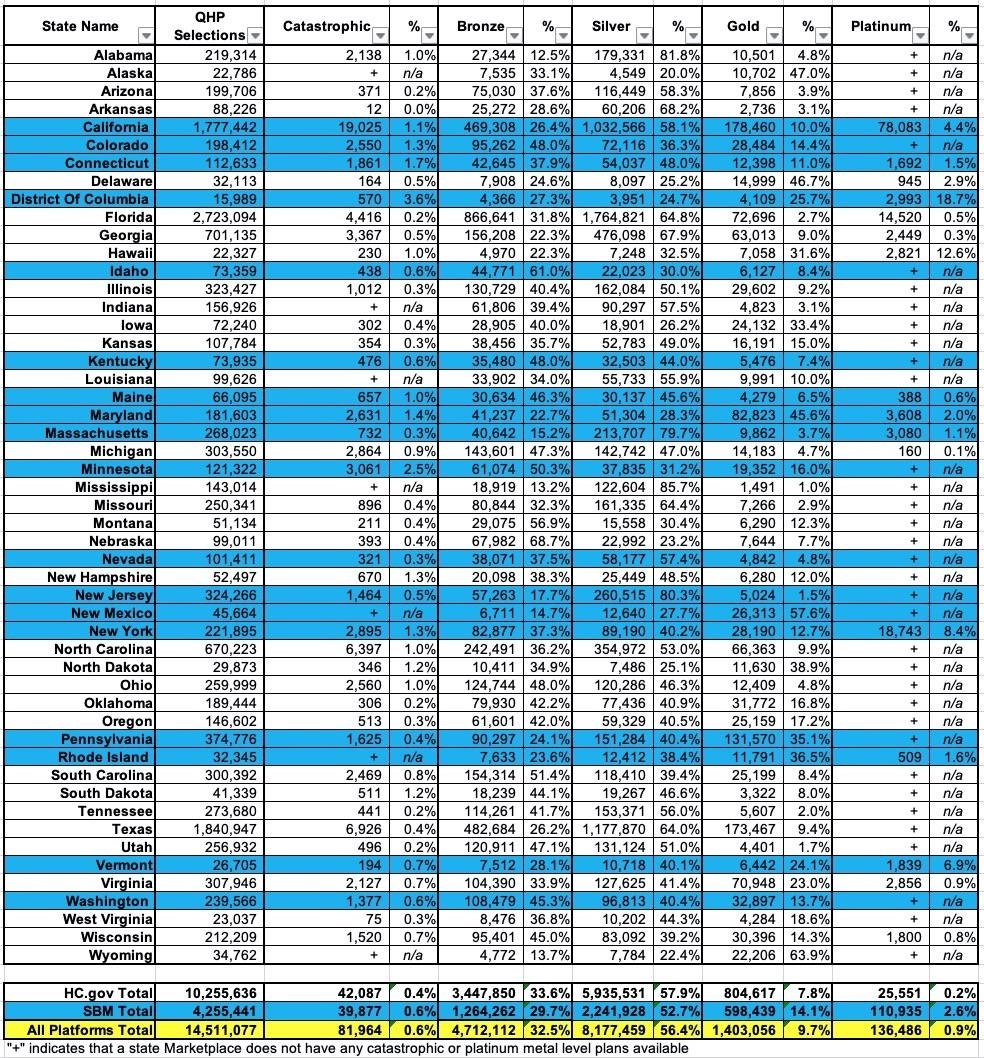

In this entry, I'm looking at the metal level breakout of the plans selected by ACA exchange enrollees. As a reminder, ACA policies fall into four categories: Bronze, Silver, Gold, Platinum, plus a special fifth "Catastrophic" category.

The 4 metal level categories represent policies which cover roughly 60%, 70%, 80% or 90% of the average enrollee's in-network healthcare expenses over the cours of the year. This doesn't mean that a Silver (70%) plan, for instance, will cover 70% of your specific medical expenses; it's an aggregate average.

Generally speaking, Bronze plans have the lowest premiums but the highest cost sharing (deductibles, co-pays, etc), while Platinum plans have the highest premiums but the lowest cost sharing. However, there are exceptions, and that rule of thumb relates to the official, unsubsidized premiums for each. Thanks to ACA tax credits, millions of lower-income enrollees can get Silver plans with $0 premiums...and thanks to the additional Cost Sharing Reduction (CSR) assistance of the ACA, many of them can effectively turn that Silver plan into the equivalent of a Platinum or even "Platinum-plus" plan:

It's worth noting that less than 1% of all ACA enrollees choose Platinum plans (the official Platinum, that is; not the "Platinum-equivalent Silver" I mention above). In fact, Platinum plans aren't even available in most states.

It's also worth noting that around 82,000 people selected Catastrophic plans this year (a mere 0.6% of total enrollment). Catastrophic plans have very special eligibility requirements:

Health plans that meet all of the requirements applicable to other Qualified Health Plans (QHPs) but that don't cover any benefits other than 3 primary care visits per year before the plan's deductible is met. The premium amount you pay each month for health care is generally lower than for other QHPs, but the out-of-pocket costs for deductibles, copayments, and coinsurance are generally higher. To qualify for a Catastrophic plan, you must be under 30 years old OR get a "hardship exemption" because the Marketplace determined that you’re unable to afford health coverage.

In other words, "Catastrophic" plans could be thought of as "Copper Plans" if you wanted to use the metal level branding. They're about as bare-bones as ACA-compliant coverage gets.

The thing is, thanks to the expanded/enhanced subsidies of the American Rescue Plan, there's almost no reason why anyone should choose a Catastropic plan, especially since they aren't eligible for ACA tax credits...either for premiums or cost sharing reductions. While 82,000 is a pretty tiny number, that's still way too many with the ARP subsidies in place. I'm sure there's a handful of exceptions with special circumstances, but I'm stunned that this number is more than a few thousand at most.

Only 9.7% of enrollees choose Gold plans, while a full third choose Bronze and over 56% choose Silver, which makes sense especially given the way CSR assistance works (CSR is only available on Silver plans in the first place).

Unfortunately, there's some disappointing news to report on this front as well. My friend & colleague Andrew Sprung of Xpostfactoid has already beaten me to the punch on this, so I'll let him explain:

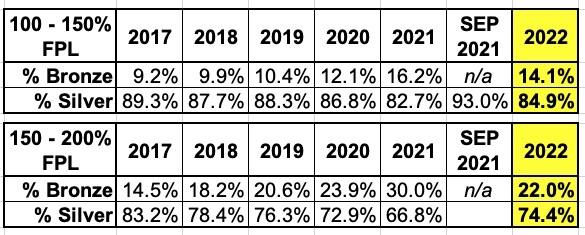

In the 33 HealthCare.gov states, for which CMS provides detailed plan selection breakouts, the ARPA subsidy boosts did not reduce underinsurance as much as might have been expected during the Open Enrollment Period (OEP) for 2022. That is, silver plan selection at low incomes (up to 200% FPL), where Cost Sharing Reduction (CSR) makes silver plans far and away the best value for almost all enrollees, modestly reversed a four-year slide, but not nearly as much as might have been expected.

In HealthCare.gov states this year, 60% of enrollees had incomes below 200% FPL, and 80% of them selected silver plans.

At the lowest income level at which subsidies are normally available, where the benchmark silver plan is now free, silver plan selection in 2022 was lower than in any year except 2021. At the next income level (150-200% FPL), CSR takeup was higher in 2020 and every year prior (including 2014-16, not shown) than in 2022, notwithstanding that benchmark silver cost about $130/month at 200% FPL in 2020, compared to $43/month this year.

This makes absolutely zero logical sense. While there are always exceptions (i.e., in some cases the enrollee may need a particular healthcare provider or prescription drug which isn't part of any of the networks/formularies included in any of the Silver plans available in their area), there's almost no reason why anyone earning less than 200% of the Federal Poverty Level (FPL) should have enrolled in anything other than a Silver plan this year...and especially if their income was less than 150% FPL.

Sprung is puzzled as well:

Why would a person to whom a free silver plan with a deductible in the $0-500 range is available choose a free bronze plan with a deductible usually in the $7,000-8,700 range (and a commensurate difference in out-of-pocket maximums)? In some cases, a desired insurer's silver plan (e.g., with a superior provider network) might be priced well above benchmark, while its bronze plan might be available free or at very low cost.

Cynthia Cox of the Kaiser Family Foundation chimed in to note that a lot of this could be due to simple momentum for existing enrollees who don't bother to actively check out their 2022 options and allow themselves to be passively auto-renewed into their existing Bronze plans. However, Sprung counters by noting that:

Only 23% of enrollees in Healthcare.gov states are new. On the other hand, more than half (55%) are "active re-enrollees" who updated their information and positively either chose to remain in the same plan or choose a new one.

In short: While 80% of ACA exchange enrollees earning less than 200% FPL did select Silver plans, this figure should have been closer to something like 95%, especially with the expanded American Rescue Plans subsidies making Silver plans cost virtually nothing while providing extremely comprehensive healthcare coverage.

There's a whole bunch of other important/interesting data buried in these reports but after 7 blog entries, I think I'll leave it at that for now.