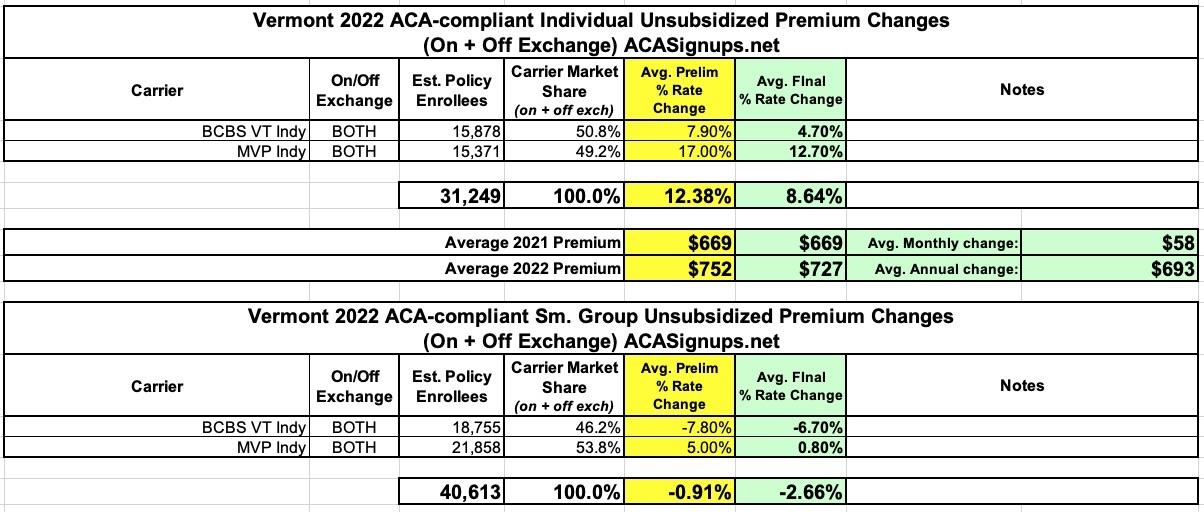

Vermont: Approved avg. 2022 #ACA rate changes: +8.6% indy; -2.7% sm. group; merged markets unmerging!

Vermont's 2022 rate filings are pretty straightforward: They only have two carriers in the state offering either individual or small group plans to begin with, and the insurance department clearly states not only the requested and approved rate changes, but the exact number of enrollees each carrier has.

There's one major change this year, however: After many years of having their individual & small group risk pools merged, Vermont has decided to unmerge the two (I believe Massachusetts is the only other state which has a combined indy/small group risk pool). The press releases for rate filings in each explains the rationale:

GREEN MOUNTAIN CARE BOARD REDUCES RATE REQUESTS FOR INDIVIDUAL AND FAMILY PLANS FOR 2022

Montpelier, VT – The Green Mountain Care Board (GMCB) issued decisions today requiring Blue Cross Blue Shield of Vermont (BCBSVT) and MVP Health Plan, Inc. (MVP) to lower the premiums they sought to charge individuals and families for health insurance in 2022. BCBSVT requested a 7.9% average annual rate increase for its plans, which it lowered to 5.0% based on the recommendations of the GMCB’s actuaries and then increased to 5.2% following the submission of Vermont hospitals’ 2022 budgets. MVP requested a 17.0% average annual rate increase for its plans. Based on the submitted filings, there are 15,878 BCBSVT members and 15,371 MVP members enrolled in the plans affected by these filings.

After a thorough review of the filings, the Board reduced BCBSVT’s proposed rates to 4.7% on average and reduced MVP's proposed rates to 12.7% on average. These rate increases represent averages across different benefit plans with varying levels of cost sharing. The planlevel increases approved by the Board range from -9.9% to 7.2% for BCBSVT and 6.4% to 16.3% for MVP. Despite the approved increases, individuals who receive premium tax credits are, on average, estimated to see a decrease in premiums.

Most Vermonters in the individual market will receive federal subsidies to cover or offset the cost of the plans offered by Blue Cross and MVP. The American Rescue Plan Act (ARPA) expands eligibility for federal premium tax credits through 2022, making them available for the first time to individuals with incomes above 400% of the federal poverty level. ARPA also increases the amount of federal premium tax credits available to individuals through 2022 at lower income levels. These changes do not impact how individuals and families purchase health insurance. Starting October 15, 2021, Vermonters can use the Vermont Health Connect (VHC) Plan Comparison Tool to compare health insurance plans for 2022. The Board strongly encourages Vermonters who purchase their own health insurance sign up through VHC to take advantage of the enhanced subsidies.

The filings reviewed by the Board this year were significantly impacted by the “unmerging” of the individual and small group health insurance markets for 2022, which was done to take advantage of the enhanced subsidies available to individuals under ARPA. Unmerging the markets had the effect of lowering small group premiums and increasing individual premiums compared to what they otherwise would have been, with the enhanced subsidies offsetting the increased premiums in the individual market.

The rate requests filed by the insurers on May 7, 2021 were subject to a 90-day analysis and review by the Board and its actuaries and by the Office of the Health Care Advocate (HCA) as an interested party to the filing. By law, the Board must consider whether a requested rate is affordable, promotes quality and access to care, and protects insurer solvency, taking into account the Vermont Department of Financial Regulation’s analysis and opinion regarding the impact the proposed rate will have on the insurer’s solvency and reserves. The GMCB held public hearings via Microsoft Teams on July 19, 2021 and July 21, 2021. The Board solicited public comment on the rates in writing, by phone, and virtually at the close of the hearings and in a separate public comment forum on July 22, 2021 from 4:00 to 6:00 pm. For questions about your health insurance or health care access, please contact Vermont Legal Aid’s Office of the Health Care Advocate at 1-800-917-7787.

GREEN MOUNTAIN CARE BOARD REDUCES RATE REQUESTS FOR SMALL GROUP PLANS FOR 2022

Montpelier, VT – The Green Mountain Care Board (GMCB) today issued decisions requiring Blue Cross Blue Shield of Vermont (BCBSVT) and MVP Health Plan, Inc. (MVP) to lower the premiums they sought to charge Vermont small businesses for health insurance in 2022. After a thorough review of the filings, the Board reduced BCBSVT’s rate request to -6.7% and reduced MVP’s rate request to 0.8%. BCBSVT requested a 7.8% average annual rate decrease (-7.8%), which it increased to -6.4% based on the recommendations of the GMCB’s actuaries and then increased to -6.2% following submission of Vermont hospitals’ FY 2022 budgets. MVP requested a 5.0% average annual rate increase (+5.0%).

Based on the submitted filings, there are 18,755 BCBSVT members and 21,858 MVP members enrolled in the plans affected by these filings. These rate changes represent averages across different benefit plans with varying levels of cost sharing. The plan-level increases range from -18.7% to -6.1% for BCBSVT and from -13.7% to 3.1% for MVP. Vermonters enrolled in a small group plan may see higher or lower increases in their premiums depending on the benefit plan they are enrolled in.

The American Rescue Plan Act (ARPA) signed into law in March 2021 expands eligibility for federal premium tax credits in 2022, making them available for the first time to individuals with incomes above 400% of the federal poverty level. ARPA also increases the amount of federal premium tax credits available through 2022 to individuals at lower income levels. Until recently, Vermont’s individual and small group health insurance markets were merged. To take advantage of the enhanced subsidies available to individuals under ARPA, the Vermont Legislature “unmerged” the individual and small group markets for 2022. Unmerging the markets lowered small group premiums and increased individual premiums from what they otherwise would have been, with the enhanced subsidies offsetting the increased premiums in the individual market. These changes do not impact how small businesses purchase health insurance plans.

The rate requests filed by the insurers on May 7, 2021 were subject to a 90-day analysis and review by the Board and its actuaries and by the Office of the Health Care Advocate (HCA) as an interested party to the filing. By law, the Board must consider whether a requested rate is affordable, promotes quality and access to care, and protects insurer solvency, taking into account the Vermont Department of Financial Regulation’s analysis and opinion regarding the impact the proposed rate will have on the insurer’s solvency and reserves. The GMCB held public hearings via Microsoft Teams on July 19, 2021 and July 21, 2021. The Board solicited public comment on the rates in writing, by phone, and virtually at the close of the hearings and in a separate public comment forum on July 22, 2021 from 4:00 to 6:00 pm. For questions about your health insurance or health care access, please contact Vermont Legal Aid’s Office of the Health Care Advocate at 1-800-917-7787.

I like how the GMCB isn't beating around the bush or using doublespeak to mask their strategy here: They saw an easy opportunity to leverage federal ACA subsidy dollars in a way which benefits small businesses without harming individual market enrollees, and they went for it.

In any event, the end result is that the official average premiums for individual market enrollees will go up 8.6% (to around $727/mo), while the average small group market plan will drop by 2.7%. As they note, however, the enhanced ACA subsidies will absorb pretty much all of the indy market increase anyway.