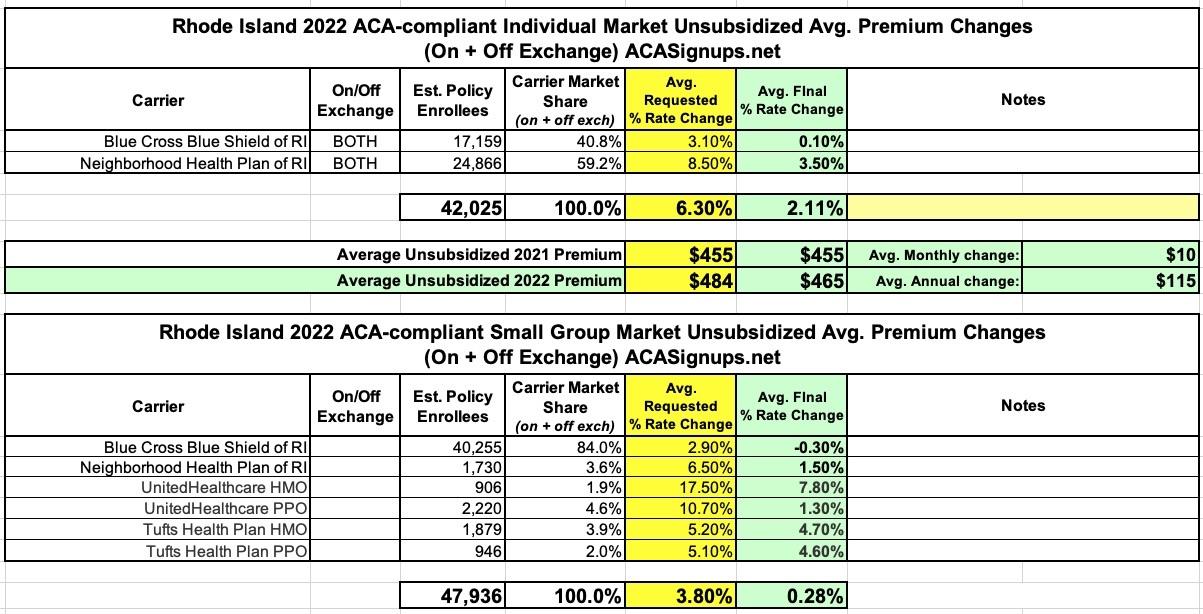

Rhode Island: Approved avg. 2022 #ACA rate changes: +2.1% indy market; +0.3% sm. group

Via the Rhode Island Insurance Dept:

State of Rhode Island Office of the Health Insurance Commissioner Requested and Approved Summary for 2022 Rates in the Individual, Small Group, and Large Group Markets

The Rhode Island Office of the Health Insurance Commissioner (OHIC) has completed its review of plan year 2022 rates for the individual, small group, and large group markets. This document is a summary of the requested and approved amounts for each insurer by market.

As required by the ACA, OHIC reviews premiums in the individual and small group markets by examining the following components:

- The CPAIR (Calibrated Plan Adjusted Index Rate) represents the weighted average base rate across all plan designs calibrated (or normalized) for rating factors.

- The Overall Weighted Average Rate Increase represents adjustments to reflect the benefits in plans, including modifications to prior year benefits and pricing and it includes terminated plans. This weighted average rate increase represents the average rate that consumers will experience. The range of rate changes represents variation by plan benefits. It does not include the effect of changes in age.

- In the small group market, OHIC also reviews the quarterly effective date projection factor which represents the expected annualized inflation rate for rates charged to small employers renewing at different points during a year. For example, a small employer renewing in January will pay a lower rate than a small employer renewing in December for the same plan because there are fewer months over which they will experience inflation, assuming that the two small employers have a workforce of the same age.

- In the large group market, OHIC reviews the average expected premium increase which represents the average expected percentage change in premiums from one year to the next, holding benefits constant, across all employers that are up for renewal within a given market. It is weighted by employer size. This average expected premium increase is comprised of rate factors that are applied to the employer’s existing experience. The resulting weighted average increase across an insurer’s large group market represents a maximum average increase that the insurers are committed not to exceed.

- The Medical Expense Trend Assumption is the annualized rate of increase due to increases in the unit cost of services and in the utilization of services. Because rates are generally based on the calendar year 2020 experience adjusted for trend, the expected experience underlying the 2022 rates is projected using two years of medical expense trend. Since COVID-19 had a significant impact on 2020 utilization levels, insurers have estimated how much utilization has been suppressed (COVID Suppression Assumption) and built that into their rate projections. The trends shown here do not reflect the impact of COVID-19 as this adjustment is elsewhere in the rate development process.

I don't track rates on the large group market, but the weighted average increases for unsubsidized enrollees in Rhode Island's individual market come in at +2.1%, while the small group market is just 0.3% overall.