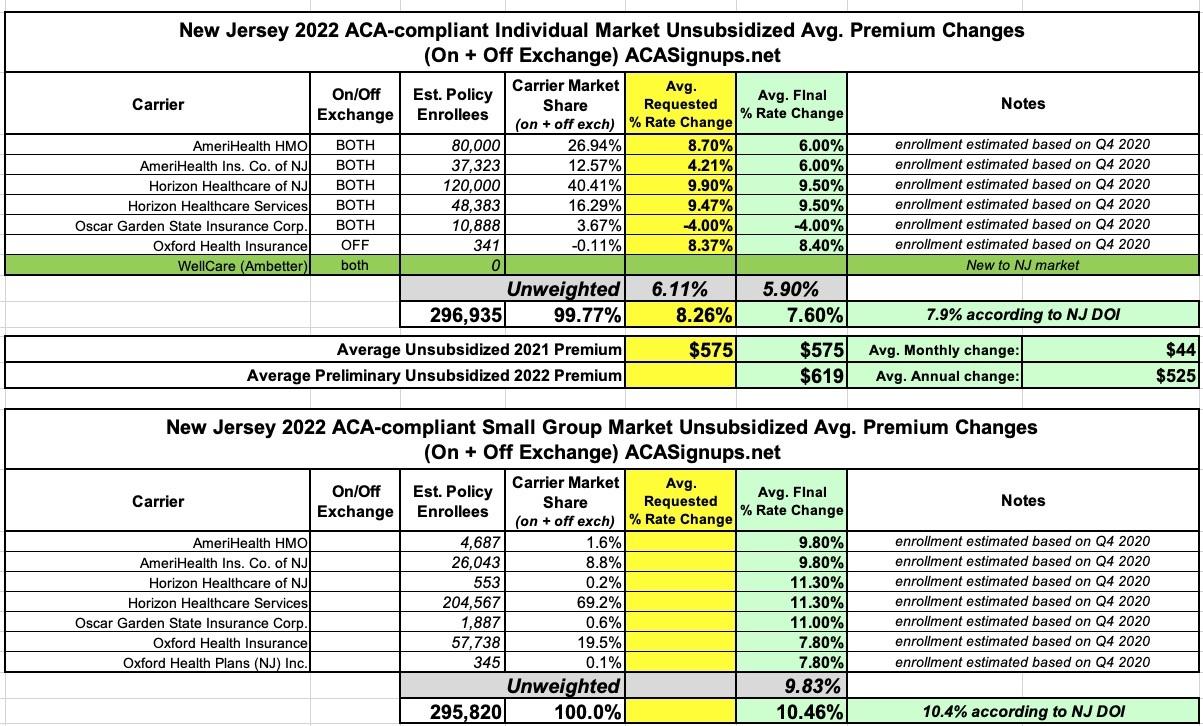

New Jersey: Approved avg. 2022 #ACA rate changes: +7.9% individual market; +10.4% sm. group; most can get a plan for $10/mo or less

via the New Jersey Dept. of Banking & Insurance:

NJ Department of Banking and Insurance Announces More Health Insurance Offerings in 2022, Record Levels of Financial Help Available for Another Year at Get Covered New Jersey

- 9 in 10 enrolling on the marketplace qualify for financial help; majority of consumers receiving assistance can find a plan for $10 a month or less

TRENTON — The New Jersey Department of Banking and Insurance today announced that consumers shopping for 2022 health coverage this fall at Get Covered New Jersey, the state’s official health insurance marketplace, will continue to benefit from record levels of financial help available from the federal American Rescue Plan and the State of New Jersey. Consumers will also have more choice, with the entry into the market of a new health insurance company, Ambetter from WellCare of New Jersey, increasing the number of carriers offering plans on the marketplace.

Open Enrollment begins November 1, 2021 at Get Covered New Jersey, which provides a one-stop shop for health insurance for residents who do not have coverage from an employer or other program, and is the only place residents can get financial help to purchase a plan. Nine out of 10 consumers will qualify for financial assistance and the majority of consumers receiving financial help will continue to have access to a health insurance plan with a monthly cost of $10 a month or less. Nearly half of consumers receiving financial help will qualify for a silver level health plan at no cost after federal premium tax credits and state subsidies.

“This year, we saw dramatic levels of financial help available to New Jersey residents shopping for health insurance at Get Covered New Jersey. Increased federal financial help remains in place, meaning that consumers will continue to benefit from lowered costs in 2022. Enhanced state subsidies will also continue for the upcoming year, making quality coverage more affordable for New Jerseyans,” said Commissioner Marlene Caride. “We know how important access to health care is for families, so we encourage residents to prepare to shop for coverage for next year as we approach the Open Enrollment Period. We also want residents who are without coverage to know that enrollment remains open at Get Covered New Jersey, and they can enroll now in a 2021 health plan.”

The state marketplace opened on November 1, 2020, offering state subsidies to consumers to help lower insurance costs in addition to the federal tax credits available to many residents. During its inaugural Open Enrollment Period, enrollment increased by nearly 10 percent compared to the previous year.

In March of 2021, President Joseph R. Biden, Jr. signed into law the American Rescue Plan Act, which made the most significant change to the Affordable Care Act since its passage. The law significantly increased the amount of financial help available to consumers and removed the income cap to receive assistance. The American Rescue Plan also provided special unemployment-related financial help for 2021, which will not be available for 2022.

The American Rescue Plan now ensures no one pays more than 8.5 percent of their income for health insurance (based on a benchmark plan). The additional savings allowed New Jersey to increase the amount of state subsidies available to eligible consumers and to extend the state savings to residents at higher income levels for the first time, allowing those earning an annual salary of up to 600 percent of the federal poverty level ($76,560 for an individual and $157,200 for a family of four) to receive state assistance. Both increased federal and state financial help will remain available, and 9 in 10 consumers enrolling will qualify for assistance.

For 2022, consumers will have more plan choices with the entry of a new health insurance company selling plans through Get Covered New Jersey, bringing to four the number of carriers offering plans on the marketplace. Ambetter from WellCare of New Jersey will enter the market in 2022, joining AmeriHealth, Horizon Blue Cross Blue Shield of New Jersey, and Oscar.

The addition of a new carrier follows the advancement of numerous measures to strengthen and stabilize the insurance market in New Jersey. They included launching a reinsurance program in 2019 to better manage high-cost health claims and reduce rates in the individual market, as well as implementing the shared responsibility requirement for health insurance coverage in 2019. Rates in the individual market are 22 percent lower than they would have been without those actions.

Along with the establishment of the state-based health insurance exchange, the state expanded the open enrollment window when it launched Get Covered New Jersey – doubling the previous six-week enrollment period on the federal exchange – and invested in outreach and awareness efforts to connect residents to available health coverage options. Enrollment on the marketplace reached record levels this year, with more than 283,000 residents signing up for coverage.

Based on plan rates for 2022 submitted by carriers, rates will increase on average by 7.9 percent over 2021 in the individual market, which includes on exchange and off exchange plans (sold directly by insurance companies). However, due to the availability of financial help, the majority of consumers shopping on the exchange and receiving financial assistance will continue to have access to a plan at a cost of $10 a month or less. Rates in the Small Employer Health Benefits Program will increase on average by 10.4 percent over last year.

Rate increases in the individual market are attributed largely to an increase in health care costs, also referred to as medical trend, according to information submitted by the carriers. During the COVID-19 public health emergency, insurers in 2020 saw a decrease in medical claim costs due to reduced utilization of services, such as postponement of elective surgeries and other medical services. Many of these deferred services appear to have been pushed into 2021, and possibly 2022. Rate filings for the individual market indicate an estimated annualized medical trend of 9.4 percent for 2021 and 2022, which is higher than previous years. Despite this trend being the primary driver of rate changes in the individual market year over year, on average, rates have been held below this trend. In addition, insurers are required under the Affordable Care Act to use 80 percent or more of premium for the payment of claims, and to return excess premiums to policyholders. Once the full 2021 experience is available, the department will conduct an analysis and determine if rebates are owed to consumers based on all claims paid in 2021.

Pursuant to Executive Order 217, the state is continuing its work to address health care cost growth in the state and to improve affordability. In addition to the actions taken to stabilize the insurance market and directly address insurance rates, the Governor created the Office of Health Care Affordability and Transparency in 2020. The Office is focused on a range of initiatives with the department, including examining the drivers of health care costs and establishing health care cost growth benchmarks and health insurance affordability standards that will apply to both insurers and providers operating in the state’s health care market. The work is being conducted to mitigate the unsustainable rate of health care cost growth as a means of improving more affordable access to quality health care for consumers, employers and the state.

Rate filings are submitted to the department by carriers. By law, rate filings in the individual and small employer markets are informational and not subject to prior approval; however, the Department may disapprove any informational filing if the Department finds that the filing is incomplete and not in compliance with relevant laws or that the rates are inadequate or unfairly discriminatory.

The Open Enrollment Period for 2022 coverage at Get Covered New Jersey (GetCovered.NJ.gov) will run from November 1, 2021 to January 31, 2022. Consumers must enroll by December 31, 2021 for coverage starting January 1, 2022; if they enroll by January 31, 2022, coverage will begin February 1, 2022.

Below is the average total rate action by carrier in the individual market, which includes both on-exchange and off-exchange offerings:

The table in the press release only lists the approved 2022 rate changes for each carrier and the weighted average, but doesn't include the per-carrier enrollment numbers; for those I'm using estimates from the 4th quarter of 2020. Interestingly, both the individual and small group market weighted averages still come out very close regardless--I get 7.6% for the indy market and 10.5% for small group plans, vs. 7.9% and 10.4% according to the NJ DOI: