Hawaii: Preliminary avg. 2022 #ACA premiums: 3.1% indy, 7.3% sm. group

Every year, I spend months tracking every insurance carrier rate filing for the following year to determine just how much average insurance policy premiums on the individual market are projected to increase or decrease.

Carriers tendency to jump in and out of the market, repeatedly revise their requests, and the confusing blizzard of actual filing forms sometimes make it next to impossible to find the specific data I need. The actual data I need to compile my estimates are actually fairly simple, however. I really only need three pieces of information for each carrier:

- How many effectuated enrollees they have enrolled in ACA-compliant individual market policies;

- What their average projected premium rate change is for those enrollees (assuming 100% of them renew their existing policies, of course); and

- Ideally, a breakout of the reasons behind those rate changes, since there's usually more than one.

Usually I begin this process in late April or early May, but this year I've been swamped with other spring/summer projects: My state-by-state Medicaid Enrollment project and my state/county-level COVID-19 vaccination rate project.

I'm finally tackling the 2022 Rate Change project, and thankfully, my colleague Louise Norris has already gathered the data for several states. We rely on each others data quite a bit, so I'll be cribbing off of for some of my own posts until I catch up.

First on the list is...Hawaii. As Louise notes:

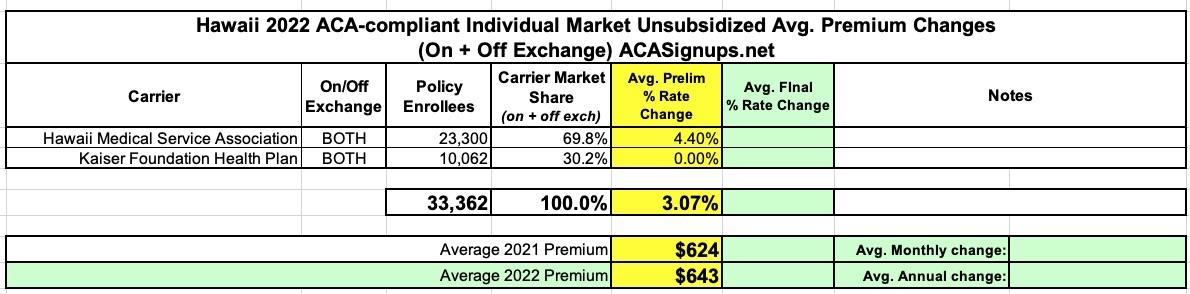

Hawaii’s exchange has two insurers that offer individual market coverage. They have proposed the following average rate changes for 2022:

- HMSA: Average proposed rate increase of 4.4%. HMSA has 23,300 members (SERFF filing number HMSA-132856831). HMSA’s filing notes that they plan to discontinue their individual market HMOs and replace them with PPOs. They clarify that the HMOs have low enrollment as of 2021. This is a noteworthy change, as we’ve seen the opposite trend in many states over the last several years, with insurers dropping PPOs and replacing them with HMOs or EPOs.

- Kaiser: Average proposed rate change of 0% (ie, no change overall, although some plans will experience a slight increase or decrease in premiums). Kaiser has 10,062 members (SERFF filing number KAHA-132856398).

Across both insurers, that amounts to an overall average proposed rate increase of about 3% for 2022. As is always the case when we talk about average rate changes, the rate changes refer to full-price premiums.

Again: If you enroll in an ACA plan off-exchange you'll have to pay full price regardless of your income level, which is why I always recommend people enroll on-exchange if at all possible, because you just never know. Thanks to the American Rescue Plan's vastly expanded/improved premium subsidies, far more people will qualify for ACA subsidies in 2022, so you should absolutely shop ON-EXCHANGE this fall!

As Louise notes, and as shown in the first table below, average unsubsidized premiums for the individual market will go up 3.1% next year if approved as is.

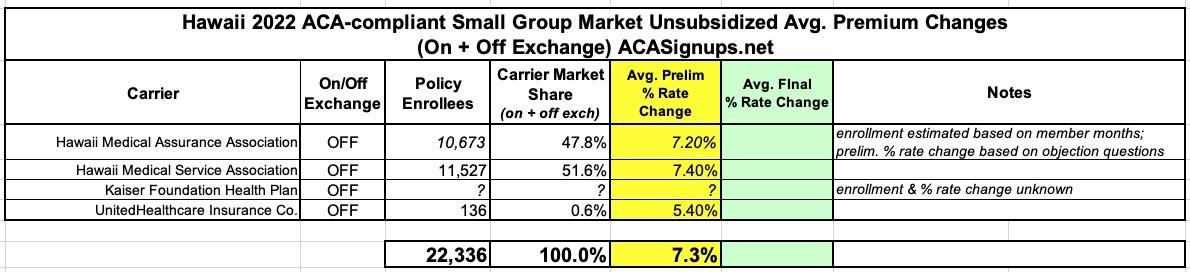

One thing I don't think Louise normally tracks is the small group market. The data there is spottier, with 2021 enrollment and proposed rate changes only available for three of the four carriers (and even then, I'm using an estimate for one of them based on some cryptic SERFF filings). Of the three I have data for, it looks like small group carriers want a 7.3% average rate increase next year.

As Louise notes above, any of these could change after the state completes their review later this summer.