Georgia just saved me the trouble of writing up a belated analysis of their "Cruz Amendment" proposal

Back in November, Georgia Governor Brian Kemp released a proposed ACA Section 1332 Waiver proposal which, if it were to be fully approved, would completely transform the ACA individual marketplace into something entirely different:

On November 4, 2019, Governor Brian Kemp of Georgia released a new draft waiver application under Section 1332 of the Affordable Care Act (ACA) that, if approved, would reshape the state’s insurance market. The application reflects a two-phase approach: a state-based reinsurance program to begin in plan year 2021, followed by a transition to the “Georgia Access” model beginning in plan year 2022. Both components of the waiver application would extend through plan year 2025.

The Georgia Access model would eliminate the use of HealthCare.gov, transitioning consumers to decentralized enrollment through private web-brokers and insurers. The state would establish its own subsidy structure to allow for 1) the subsidization of plans that do not comply with all the ACA’s requirements; and 2) enrollment caps if subsidy costs exceed federal and state funds.

The reinsurance proposal isn't anything unusual or concerning, beyond the normal question of where the state would find their portion of the funding; over a dozen other states have successfully implemented reinsurance programs to varying degrees of success.

The second portion, however, is a completely different story:

Georgia would be the first state to request a broader Section 1332 waiver, which the Trump administration has been encouraging since last fall. The “guardrail” analysis in Georgia’s application relies heavily on Trump-era guidance on Section 1332 waivers. Such a waiver would not have been possible under prior guidance and there are questions about whether the waiver application can be approved under Section 1332’s statutory terms.

Georgia expects the waiver to increase enrollment in the individual market by about 30,000 people for plan year 2022. This is a significant number of individuals, but the waiver could result in coverage disruption for the more than 450,000 individuals who are already enrolled in ACA coverage through HealthCare.gov. The 30,000 number also pales in comparison to the 1.4 million people who are uninsured in Georgia, more than half of whom are already eligible for ACA subsidies but not enrolled.

If approved, Georgia's individual insurance market would convert into a state-based version of a proposal from Republican Senators Ted Cruz & Mike Lee back in summer 2017 during the "Repeal/Replace" saga known as the Cruz Amendment:

His proposal, which he’s circulating to his colleagues on typed handouts, wouldn’t explicitly create and fund the special insurance markets, as the House bill did. Instead, insurance experts said, it would create a sort of de facto high risk pool, by encouraging customers with health problems to buy insurance in one market and those without illnesses to buy it in another.

...There is no public legislative language yet, but here’s how Mr. Cruz’s plan appears to work, based on his handout and statements: Any company that wanted to sell health insurance would be required to offer one plan that adhered to all the Obamacare rules, including its requirement that every customer be charged the same price. People would be eligible for government subsidies to help buy such plans, up to a certain level of income. But the companies would also be free to offer any other type of insurance they wanted, freed from Obamacare’s rules.

People who bought the Obamacare-compliant plans would be eligible for subsidies that limit their cost, as long as their income was less than about $42,000 per year for a single person. And those who earn more — or wish to buy skimpier, cheaper plans without all the rules — may also get a discount on those premiums, in the form of pretax health savings accounts, which the legislation would let them use to buy insurance.

As Mr. Cruz told Dylan Scott of Vox.com, “You would likely see some market segmentation,” meaning that healthy and sick customers would probably pick different kinds of insurance. Healthier, wealthier people would tend to gravitate toward the skimpy plans. Sicker people would opt for the compliant plans, which cover more benefits. Even though the compliant plans wouldn’t technically be more expensive for the sick, those choices would mean that mostly sick people would buy them, and the prices could get extremely high.

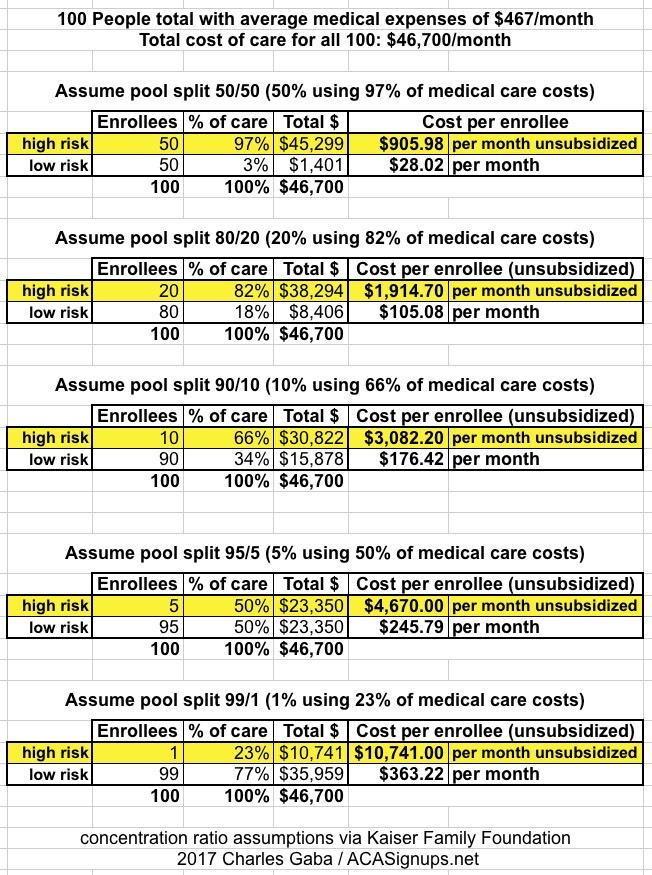

As I explained at the time, this deliberate bifurcation of the healthcare market goes completely against the whole principle of insurance, which is to pool risk. Encouraging healthy people to go towards dirt-cheap junk plans and sick people to go towards fully comprehensive ACA plans would inevitably result in the official pricing of the ACA plans skyrocketing to jaw-dropping heights:

My guess is that you'd end up with something resembling the 2nd to last scenario: Just 5% of Georgia's sickest individual market enrollees would be left in ACA-compliant plans with average premiums running $5,000/month, while the other 95% would be enrolled in junk plans costing less than $300/month.

Of course, with proper financial subsidies for those 5%, that wouldn't be too bad--if 90% of the premiums were subsidized by the government, that would bring the net premiums down to perhaps $400/month or so. This, indeed, would amount to Georgia reverting back to the pre-ACA High Risk Pool (HRP) structure.

The problem with that is the same problem those HRPs had in the first place: The funding levels were, for the most part, a complete joke...and it looks like Georgia's proposed subsidy formula would be as well:

Beginning with plan year 2020, Georgia would maintain a subsidy structure based on incomes from 100 to 400 percent of the federal poverty level (similar to the current federal subsidy structure).

...However, Georgia would cap its contribution towards the Section 1332 waiver on an annual basis. Unlike in the current individual market, this cap could result in waiting lists even for individuals who qualify for subsidies. Georgia notes that subsidies will be granted on a first-come, first-served basis until the state’s funding cap is reached. If there are a larger number of subsidy-eligible residents than expected, those individuals could still enroll in coverage but would be placed on a waiting list for subsidies (meaning they would pay full premiums even though their income would qualify them for subsidies under the ACA).

For plan year 2022, Georgia would cap its own contribution towards the reinsurance program and state-specific subsidies at $255 million. (The state’s anticipated contribution towards the reinsurance program for plan year 2022 is $111 million.)

For the record, assuming an average subsidy of, say, $4,000/month per enrollee, that's $48,000/year. $255 million would be enough to provide that level of subsidization for just 5,300 people. By contrast, over 450,000 people enrolled in ACA exchange policies in 2019.

These, again, are the exact same problems HRPs had before the ACA: Enrollment caps, waiting lists and so forth. It's also a major problem for anyone earning more than 400% FPL who has a pre-existing condition which isn't covered by the non-ACA plans, since they'd have to pay outrageous premiums in order to get an ACA-compliant policy. To be fair, this is already a major problem with the ACA's 400% FPL subsidy cliff...but Georgia's proposal would make this situation much, much worse.

FORTUNATELY, all of this is now moot anyway:

GA 1332 news: Yesterday the state asked the federal gov't to "pause" review. Today CMS declared the problematic parts of the waiver incomplete. Good to see state and feds recognize this waiver is unapprovable. They must reach the same conclusion if it reaches their desk again.

— Christen Linke Young (@clinkeyoung) February 6, 2020

Well, then. Apparently even Georgia realized what a disaster this would have been.

As for the part which was approved, the 1332 Reinsurance proposal, that looks fairly standard...tame, even:

The Reinsurance Program is estimated to lower average premiums by 10.0% statewide for PY 2021, resulting in savings for thousands of Georgians buying in the individual market today and making insurance more affordable for those currently uninsured who are not eligible for subsidies. The actuarial analysis estimates that the Reinsurance Program will increase enrollment in the individual market by 0.4% in PY 2021. The premium reduction will bring the most cost relief to individuals over 400% of the FPL who are not eligible for federal subsidies and therefore pay the full out-of-pocket cost for premiums; the estimated increase in enrollment is expected to be concentrated among residents above 400% of the FPL residing in the highest-cost regions of the State.

The Reinsurance Program will reimburse carriers a percentage of an enrollee’s claims between an attachment point and a cap. In PY 2021, the program is projected to reimburse claims at an average 27% coinsurance rate for claims between the attachment point of $20,000 and an estimated $500,000 cap. The program will reimburse at different percentages based upon a three-tiered geographic structure designed to provide greater premium relief in regions with the highest premiums and encourage more carriers to participate in parts of the State where there is less carrier participation.

What this means in plain English is that the reinsurance program will, on average, cover 27% of the cost of any ACA-compliant market enrollees who rack up medical claims running between $20K - $500K. Most of the other states with reinsurance waivers have a much higher reimbursement level...but they also tend to have a smaller attachment point range, so it probably amounts to around the same effect either way.

The only problem I have with the reinsurance waiver is the same one which comes with any reinsurance program: It pits unsubsidized vs. subsidized enrollees. Reducing the unsubsidized premium by 10% also means the benchmark Silver plan used to calculate subsidies is reduced by 10%...and that can actually result in many subsidized enrollees having to pay more for their premiums. Here's why:

Let's say that the price of Bronze, benchmark Silver, and Gold plans for a given enrollee are $300/mo, $600/mo and $700/mo respectively (the Silver plan would have been $500, but the carrier Silver Loaded the CSR costs by bumping it up another $100).

Let's say that due to Silver Loading, an enrollee earning, say, $37,000 (just under 300% FPL) is receiving $298/mo in subsidies (limiting his benchmark Silver premium to $302/mo). He used that $294 to buy a Bronze plan instead, so he only has to pay $2/month.

Let's say that due to the reinsurance program, the cost of all three plans drops exactly 10%, to $270, $540 and $630/month.

The good news is that the enrollee's unsubsidized premium just dropped by $30. The bad news is that his subsidy, which is based on the Silver plan, just dropped by $60/month, to $238.

That means the net cost for his Bronze plan just jumped from $2/mo to $32/mo...a 16x increase.

Don't get me wrong: $32/month actually isn't bad at all for a single adult earning $37,000/year...but if you're used to only paying $2, it sure doesn't feel that way.

This is the great irony and paradox of the APTC subsidy formula and how it interacts with Silver Loading, which I'll be addressing in more detail in a co-authored post tomorrow.