UPDATED: Maine: Gov. Mills announces merged indy/sm. biz risk pools, standardized plans, state-based exchange & more!

Maine Governor Janet Mills had already announced her intentions regarding moving Maine to a state-based ACA exchange last fall, but now she and state legislative leaders are making it official with the rollout of a new bill...but they're including several other important improvements as well, and I'm mostly cheering all of these, although the logic is a bit confusing on a couple of points:

Mills, Jackson & Gideon Announce Bill to Improve Health Insurance for Maine People and Small Businesses

Augusta, MAINE – Governor Janet Mills, Senate President Troy Jackson, and Speaker of the House Sara Gideon today announced legislation to improve private health insurance for Maine people and small businesses. LD 2007, The Made for Maine Health Coverage Act, would make some of the most common medical visits free or less costly, simplify shopping for a plan, leverage federal funds to help make premiums more affordable for small businesses, and put Maine in the driver’s seat to ensure that all Maine people have clear choices for their coverage.

The bill takes a targeted approach to improving private health insurance without the need for any appropriation of state dollars. The legislation was introduced by House Speaker Sara Gideon and Senate President Troy Jackson on the Governor’s behalf.

“Over the past year, more than 57,000 Maine people have been able to access life-saving health care through Medicaid expansion, and, with the Legislature, my Administration has strengthened critical health protections for Maine people through LD 1. Both are significant steps forward. Now, my Administration, with the help of Senate President Jackson and Speaker Gideon, is taking the next step to improve health insurance for Maine people and small businesses,” said Governor Janet Mills. “The Made for Maine Health Coverage Act sets Maine-specific deductibles and copays, offers a Maine solution for small businesses, and creates a Marketplace designed to best meet the needs of Maine people. I look forward to working with the Legislature to continue to tackle health care, a critical issue for our state and our people.”

“Access to health care is about freedom. It’s something I’ve said over and over again because it’s true, and I know what that means for working people. It means the difference between going to the doctor when you’re sick and putting your health – potentially your life – at risk,” said President Jackson. “Last year, we passed a number of important bills to make health care more affordable and accessible. But our work isn’t over; too many barriers still remain. When we said that we would do everything in our power to make health care more affordable and accessible, we meant it. With this bill, we begin to take the marketplace out of the hands of folks in Washington D.C. and put Maine people in charge. I’m proud to be a co-sponsor and will fight to see it become law.”

“Not a single Mainer should be rationing their medication or avoiding a trip to the doctor because they aren’t sure what it will end up costing – every single one of us deserves access to quality, affordable health care. With ongoing uncertainty at the federal level, it’s critical that we craft lasting state policies that ensure stability and predictability for consumers here in Maine,” said Speaker Sara Gideon. “This legislation will help control out-of-pocket costs, bring stability to the volatile small business marketplace, and make shopping for health insurance simpler and easier. This session we must address these urgent matters, and I look forward to continuing our partnership with Governor Mills to ensure prescription drugs are affordable, healthcare – including reproductive care – is accessible, and opioid recovery services are available throughout the state.”

“Health insurance too often remains unaffordable and confusing, with premiums, out-of-pocket costs and deductibles still out of reach for many. This bill keeps the momentum going to drive down Maine’s uninsured rate and improve coverage for our state,” said Maine Department of Health and Human Services (DHHS) Commissioner Jeanne Lambrew.

“LD 2007 will apply the same successful reinsurance model to the small group market that has been used to stabilize Maine’s individual market since January 2019,” said Maine Insurance Superintendent Eric Cioppa. “Thanks to the existing reinsurance program, individuals are paying less on health insurance premiums than they would have otherwise; we anticipate the same will be true for small businesses, if the Governor’s proposed bill is enacted.”

The bill uses a three-pronged approach to improve private health insurance in two markets: the individual market, which serves people who buy their own insurance instead of getting coverage through work or publicly funded programs, and the small group market, which serves small businesses.

This proposal would help by:

- Providing consumers in the individual and small group markets with relief from high out-of-pocket costs and making it easier to compare plans:

- This bill requires health plans to cover the first primary care visit and behavioral health visit each year for free – with no deductible and no out-of-pocket costs, making some of the most common health care visits less costly. Additionally, under the bill, the second and third primary care and behavioral health visits could have a co-pay but the deductibles would not apply.

- With high deductibles and confusing and hidden costs too often causing Mainers to forgo health care and coverage, this bill makes it easier for consumers to understand their options by having health plans offer the same deductible, copays, and out-of-pocket limits for a set of commonly-used services. By standardizing upfront costs into “clear choice designs”, the bill makes it easier for Maine people to understand and compare plans and encourages insurance companies to compete on premiums and quality. These simplified, standardized designs would be developed in consultation with patients and providers among others, and insurers could offer a different design if it better helps patients.

OK, I'm very happy about this one...with one exception. It beefs up the minimum standards of healthcare policies while also standardizing plan design so that you can have a true apples-to-apples comparison instead of a confusing array of inscrutible variances on obscure things most people don't understand. Call this the Steve Jobs model:

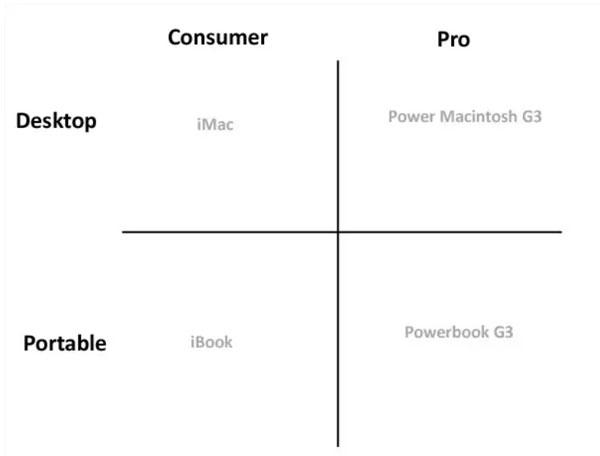

When Steve Jobs came back to Apple in 1997, the most important thing he did was simplify the product line.

At the time Apple was making a bunch of different products for a bunch of different people, and none of it made any sense.

After weeks of meeting with product people he had heard enough, writes Walter Isaacson in Steve Jobs. He shouted "Stop!" in the middle of a product meeting and said, "This is crazy."

He went to a whiteboard and drew up the chart below which was a simple cross. At the top it had consumer and pro. On the sides it had desktop and portable.

By focusing on just four products Apple was able to start its comeback.

Obviously Maine's policy options won't be that simplified, but too much choice can be just as cripping and harmful as too little choice.

The only problem I have with this is the final bit: "...and insurers could offer a different design if it better helps patients."

If the "standard" plans are optional instead of mandatory, that defeats most of the point of having them. This really isn't any different from what HealthCare.Gov tried with their "Simple Choice" offerings...until scrapping the option this year. Yes, it still helps some people since they can choose to only view the simplfied options, but it still allows for a confusing array of total options. Ah well.

- Pooling insurance plans and premiums for individuals and small businesses and improving stability and affordability:

- Maine’s small group market has faced increasing monthly premiums and decreasing enrollment, making it difficult for many small businesses to offer coverage to their employees. Meanwhile, Maine people are spending less on premiums in the individual market than they otherwise would have as a result of Maine’s reinsurance program (Maine Guaranteed Access Reinsurance Association or MGARA). The program pays for part of the cost of the most expensive bills, lowering and stabilizing health insurance premiums.

- The bill merges the small group and individual markets in Maine, creating a combined, larger and, as a result, more stable pool of enrollees to help prevent unpredictable premium increases. Insurers will then be able to determine premiums based on this larger pool and offer the same plans to both individuals and small businesses, thereby helping small businesses to get a handle on health care costs.

- The bill extends reinsurance for the first time to small businesses to lower their premiums, funded by the federal government and current fees in MGARA. To ensure taxpayer dollars are well spent and give insurance companies leverage to negotiate prices with health providers, the proposal would by limit the amount the program pays for reinsurance for certain high-priced services to no more than twice what Medicare pays for certain high-priced services.

These two elements (a merged market and changes to reinsurance) would require approval from the Federal government through a State Innovation Waiver (also known as a 1332 Waiver). Maine would be the first in the nation to apply to the Federal government for a 1332 Waiver of this kind to improve small business insurance coverage. This provision would go into effect only if Maine and the federal government agree that the proposal will stabilize and reduce small businesses’ monthly premiums.

I've long been a strong advocate of merging as many risk pools together as possible for the very reasons noted in the second bullet above. Taken to its extreme, you'd have a single national risk pool with all 327 million Americans in it, which is about as "large and stable" as you can possibly get. Until then, however, I still support at least merging them at the smaller levels...in this case the Individual and Small Group markets. There's nothing unique here--the District of Columbia, Massachusetts and Vermont already do this, and other states have considered doing so.

So why haven't more done so? Well, here's the problem: Individual market risk pools tend to be sicker/more expensive than small group market pools by their vary nature, because they're usually smaller and more volatile. In fact, this is one of the main reasons to merge them with the small group market, to make it larger and more stable. The problem is that this means that average individual market premiums will go down...by making average small group market premiums go up.

Since small business associations tend to be very well organized and effective politically, this makes it very difficult to pull such a merger off, even if the grumbling dies down after a few years (that's a big assumption...for all I know, the sm. biz groups in MA, VT & DC are still fuming after all this time?).

In Maine's case, they seem to be suggesting that extending their existing ACA individual market reinsurance program to also include the (newly merged) small group market will cancel out this problem for small businesses, but I admit to being confused as to just how effective that would be. Remember, Maine's reinsurance program isn't terribly robust to begin with, so I'm not sure how much more money there would be left to spare.

In addition, there's also the curious ass-backwards fallout of "reverse silver loading". Due to a long, stupid series of events, unsubsidized premiums dropping on the individual market can actually cause subsidized (net) premiums to go up. That's exactly what's happening in Colorado this year after their much more robust reinsurance program went into effect. I still support reinsurance overall, but it's definitely causing some unintended consequences.

Another odd aspect is the "limit the amount to 2x Medicare" clause.

Standard reinsurance waiver programs will have the government pay for, say, 80% of all medical claims for a given enrollee between $40,000 - $250,000/year. That means that if a patient racks up, say, $200,000 in claims, the government will foot the bill for 80% of $160,000 of it, or $128,000. By lopping that amount off of the insurance carrier's costs, they then reduce overall premiums by some amount for all of their enrollees.

In this case, the "2x Medicare" clause makes it sound like instead of paying $128,000, the government would only cover 2x what Medicare would normally reimburse the medical provider for. So if Medicare would normally only reimburse the hospital, say, $80,000 for that $200,000 claim, that means the government will only pay $32,000 (80% of $40,000). This obviously saves the taxpayers money but it also makes the reinsurance program a lot weaker.

I don't know what any of the actual numbers or dollar amounts involved here are, however, so I'll reserve judgment on this aspect until I hear more details.

Note the final line above: "This provision would go into effect only if Maine and the federal government agree that the proposal will stabilize and reduce small businesses’ monthly premiums." Hmmmmmm...

- Tailoring coverage education and enrollment efforts to Maine:

Following up on her commitment to pursue a State-based Marketplace, this third approach will move Maine towards a State-based Marketplace, allowing Maine to capture funding currently going to Washington, D.C. and use those dollars to promote enrollment and customize outreach to fit Maine’s needs. It also can improve the consumer experience by extending the annual open enrollment period so people have more time to sign up for coverage.

- Starting in the fall of 2020, Maine would run a State-based Marketplace using the federal website, HealthCare.gov, and related services. Maine would conduct its own education, in-person consumer assistance, and outreach on coverage.

- Maine would transition from HealthCare.gov to a fully state-run system – operating our own website and call center – if an evaluation of benefits and feasibility of doing so show that this is the best path forward for Maine people.

- Funding for the Marketplace would come from existing user fees on insurance companies, no higher than what the insurance companies pay now.

I already wrote a lengthy entry on this provision, and readers already know I'm a big fan of states breaking off of HC.gov anyway, so I won't rehash my strong support of this move.

This new legislative action by Governor Mills, Senate President Troy Jackson, and House Speaker Sara Gideon comes after the three teamed up last year to spearhead into law LD 1, which codified into State law critical Affordable Care Act protections in the state’s regulated markets, such as guaranteed coverage for pre-existing conditions, a ban on lifetime and annual caps on coverage and allowing young adults up to age 26 to remain on their parents’ insurance, as well as coverage for essential health services such as ambulance services, prescription drugs, and pediatric care. These protections – and more – are at risk in the courts where the Trump Administration refuses to defend the law in the case of Texas versus U.S.

It also builds on their work last year to enact the peoples’ will and expand Medicaid, which has enabled more than 57,000 Maine people to access life-saving health care.

Anyway, I'm sure more details will be forthcoming, but my general takeaway is:

- Requiring the extra free/low-cost office visits on all plans: GOOD!

- Standardized Plan Design: GOOD!

- Not making Standardized Plan Design mandatory: BAD!

- Merging the Individual & Small Group market risk pools: GOOD!...if they can pull it off without facing a poltical backlash from small businesses.

- Extending reinsurance program to include the newly-merged Small Group market: GOOD!...maybe, if they can somehow make the numbers work out.

- Splitting Maine off onto a state-based exchange: GOOD!

UPDATE: OK, I'm looking at the text of the bill itself...here's some details on the reinsurance provision:

1. Reinsurance amount. A member insurer offering an individual health plan under section 2736-C must be reinsured by the association to the level of coverage provided in this subsection and is liable to the association for any applicable reinsurance premium at the rate established in accordance with subsection 2. For calendar year 2022 and subsequent calendar years, the association shall also reinsure member insurers for small group health plans issued under section 2808-B, unless otherwise provided in rules adopted by the superintendent pursuant to section 2791, subsection 5.

A. Beginning July 1, 2012, except as otherwise provided in paragraph A-1, the association shall reimburse a member insurer for claims incurred with respect to a person designated for reinsurance by the member insurer pursuant to section 3959 after the insurer has incurred an initial level of claims for that person of $7,500 for covered benefits in a calendar year. In addition, the insurer is responsible for 10% of the next $25,000 of claims paid during a calendar year. The amount of reimbursement is 90% of the amount incurred between $7,500 and $32,500 and 100% of the amount incurred in excess of $32,500 for claims incurred in that calendar year with respect to that person. For calendar year 2012, only claims incurred on or after July 1st are considered in determining the member insurer's reimbursement. With the approval of the superintendent, the association may annually adjust the initial level of claims and the maximum limit to be retained by the insurer to reflect changes in costs, utilization, available funding and any other factors affecting the sustainable operation of the association.

On the surface, this makes it sound like an extremely generous reinsurance program. HOWEVER, as David Anderson clarified for me, not only have the amounts above been superceded by the more recent ACA 1332 reinsurance waiver, the reinsurance only goes into effect for enrollees with specific conditions:

MGARA will be funded by multiple sources, including reinsurance premiums paid by insurers and an assessment on all health coverage sold in Maine. Maine requests about $33 million per year in federal pass-through payments. Overall 2019 revenue is expected to be $93 million, meaning the federal government would provide about 35 percent of MGARA’s funding. MGARA will use a hybrid reinsurance model with components of both an attachment point model and a conditions-based model.

MGARA will reimburse insurers for 90 percent of claims between $47,000 and $77,000 and 100 percent of claims paid in excess of $77,000 up to $1 million. In addition, when an insurer enrolls a high-risk individual, the insurer cedes that policy to MGARA. This means that the insurer pays 90 percent of the individual’s underlying insurance premium to MGARA itself. In return, MGARA pays a part of the insurer’s claims if they exceed a certain amount. Insurers can also voluntarily cede coverage to MGARA.

Good grief. Apparently it works like this:

- You (the enrollee) pay, say, $700/month in premiums

- Assuming you're diagnosed with one of the qualifying conditions (see below), your insurance company turns control of your policy over to the state

- Your insurance carrier pays the state $7,560 for the year (90% of your premium...$630 x 12) to help fund the program

- If you rack up, say, $200,000 in claims for that particular condition, the state covers $123,000 + $27,000 = $150,000 of it

- Your insurance carrier pays most of the other $50,000, plus whatever portion of your other claims they'd normally pay

- Thus, your insurance carrier effectively comes out $150,000 - $7,560 = $142,440 ahead.

At least I think that's how it works. Sheesh. As for why the program only costs the state $60 million/year given how generous the terms appear, that's because it's limited to certain conditions:

MGARA has identified eight designated medical conditions that require insurers to cede coverage. These conditions include various types of cancer, congestive heart failure, HIV, and rheumatoid arthritis. To collect this information in the past, insurers were allowed to require that consumers complete health questionnaires when they applied for coverage. Because most individual market enrollment is now done through HealthCare.gov in Maine, collection of these health statements is no longer possible. Instead, MGARA will require mandatory ceding of any policy with ICD 10 claims codes that are related to the eight designated medical conditions.

UPDATE: This article provides some additional details and context on the bill, and also quotes a friend of mine, Mitchell Stein:

...The bill would affect more than 120,000 Mainers who have individual or small group insurance through the ACA.

The small-group and individual markets both have about 60,000 enrollees, so merging the two would effectively double the insurance pool, and potentially reduce health care costs by spreading them out among more people.

That's actually kind of convenient...apparently each risk pool is roughly the same size; in theory this should mean splitting the difference between the two, causing premiums to increase for one by the same amount they decrease for the other, though that's a bit simplistic.

Small-group insurance for small businesses is ACA insurance sold outside the online marketplace and, unlike individual ACA plans, is not subsidized by the federal government. That makes the insurance more costly for enrollees and businesses, and as health care costs have increased, usage of the small-group market has declined from 83,590 in 2013 to 59,980 in 2018.

Interesting. It's worth noting that the Maine small group market shrinking by 28% could be due to any number of other factors (has the number of people employed by small businesses vs. large businesses or freelancers changed significantly over the years?), but this also helps explain this move. If it continues to shrink, at some point it'll have to be merged, after all.

David Clough, Maine state director of the National Federation of Independent Business, which represents small businesses, said he appreciates the focus on the cost of health insurance for small-business owners, but won’t take a position on the bill until the NFIB can study it more.

“The legislation the governor is advocating represents a pragmatic approach instead of radical reforms contained in some state legislation being considered this year,” Clough said.

A reasonable response, and an interesting example of the Overton window in effect. As I noted above, small businesses would normally protest merging with the individual market...but if the alternative is something they hate even more...

A reinsurance program – the Maine guaranteed Access Reinsurance Association – that has been credited with reducing costs in Maine would cover the merged market. Fees for the reinsurance program, which currently generates $22.6 million from Maine health care plans and $62.3 million from the federal government, would remain the same.

Eric Cioppa, Maine insurance superintendent, said the larger patient pool should reduce costs for enrollees even though fees would be the same because a larger pool is better at spreading out the risk.

Stein, the policy analyst, said he questions whether that will turn out to be true, especially without raising fees. Other states have decided it’s not worth doing because even though the size of the insurance pool grows, those with individual insurance on average tend to be older and sicker than those with small-group insurance. So it’s questionable whether that’s a benefit to the small-group market, Stein said.

Again, this is where the math gets a bit difficult to follow. Pooling risk doesn't do anything to reduce the total cost of treating all of those people, it simply spreads the cost out across more of them, so unless you're also taking steps to reduce the provider cost, the total amount of money needed is exactly the same.

Right now there's around $85 million in reinsurance funding available, being spread across 60,000 people, or around $1,400 apiece. This makes it sound like the same $85 million would be spread across twice as many people, cutting the per-enrollee funding in half. The state seems to think that the pooling of the markets will somehow reduce total costs by another $85 million...I think.

The reinsurance changes would need a federal waiver to go into effect, even if the bill is signed into law. The mandatory free primary care and therapy visits do not need a waiver and could go into effect immediately.

If the bill is approved, the state would move to a state-run ACA marketplace. Enrollees would still use www.healthcare.gov to sign up, but outreach and marketing would be run by the state instead of the federal government.

Honestly, this is the part I'm rooting for the most.