Rethinking my "80% / 50%" reimbursement rule of thumb

When it comes to discussing changes in healthcare policy, one of the most important--and most frustrating--topics which have to be tackled is how much healthcare services actually cost. I'm not necessarily talking about how much the patient pays, although that's obviously important as well...I'm referring to how much the healthcare providers charge and get paid.

Doctors, hospitals, clinics, pharmaceutical companies, medical device makers and so forth all get paid different amounts for different services from different payors, depending on whether it's a private insurance carrier, Medicare or Medicaid...and those rates generally range widely from state to state and carrier to carrier. One partial exception to this is Maryland, where they've been experimenting fairly successfully with a concept called "all-payer" rate setting:

Since the late 1970s, Maryland has operated an all-payer system for hospital services. An independent commission establishes the rate structure for each hospital. That eliminated hospital cost shifting across payers and spread more equitably the costs of uncompensated care and medical education and limited cost growth, but per capita Medicare hospital costs are among the country's highest. It appears that the system eliminated price competition between hospitals and led them to divert high-cost patients to alternative settings, where prices remained unregulated.

...On January 10, 2014, the Centers for Medicare and Medicaid Services(CMS) and the State announced a new model that will focus on overall per capita expenditures for hospital services as well as on improvements in the quality of care and population health outcomes. For 5 years beginning in 2014, Maryland will limit the growth of per capita hospital costs to the lesser of 3.58% or 0.5% less than the actual national growth rate for 2015 through 2018. The change is forecast to save Medicare at least $330 million. 3.58% is Maryland's historical 10-year growth rate of per capita gross state product.

However, for the rest of the country, there's still an insane array of pricing for everything under the sun healthcare-wise.

One of the key requirements for any sort of universal, government-paid for healthcare system is to have strict controls on how much is actually paid to healthcare providers. Otherwise there'd be almost no limits to how much they could charge, since they'd know that the government would be legally required to pay the bill. This is why Medicare and Medicaid have restrictions on how much they're willing to reimburse providers.

The general rule of thumb is that Medicare pays providers less than private insurance carriers do, and Medicaid pays them even less yet...but just as the amount carriers pay can be all over the map, how much less is paid by Medicare and Medicaid also varies widely across a variety of factors.

For years now, when talking about this subject (either via blog posts, twitter threads, in-person slideshows or my occasional video explainers), I've generally used 80% and 50% as my rough, ballpark estimates when it comes to how much Medicare and Medicaid reimburse healthcare providers. That is, I've assumed that Medicare pays providers, on average, roughly 80% as much as private insurance does, while Medicaid generally pays only around half as much.

I'm not sure precisely where I got those estimates, though I think the 80% Medicare number came from this article in Vox by Matthew Yglesias:

Single-payer skeptics tend to be simply incredulous that government-run systems, both in the United States and abroad, are more cost-effective. Isn't the government a legendary cesspool of waste and inefficiency? Why would a government-run system be more efficient?

Well, here's the answer: Foreign single-payer systems pay doctors less. They also pay pharmaceutical companies less. They pay less for medical devices, too.

It turns out that Medicare uses this trick, too, offering doctors only about 80 percent of what private insurance plans pay them.

The downside to Medicare paying just $426 on average for a colonoscopy when private plans offer $639 is that as a result, some doctors refuse to see Medicare patients. This is particularly something you see in large, dense, rich cities like New York or Boston where medical practices that can manage to get themselves written up on magazine "Best Doctors" lists can afford to be choosy about their patients.

But to the average health care provider, the Medicare patient market is just too big to ditch. Doctors — and hospitals and everyone else — take what they get and are glad for it.

Yglesias' 80% figure came from this CNN/Money article. However, that article is from 2014, and it's a single source, so I decided to do a bit more looking around today to see whether the situation has changed (or whether that was simply an inaccurate estimate). When I did, I received a lot of feedback...much of it confusing and sometimes contradictory. Here's some key Tweets from a Twitter thread/discussion I had with various healthcare wonks this morning (I've reformatted them into simpler bullets to save space):

- Me: HEALTHCARE TWITTER: For years I've been ballparking that Medicare reimburses providers roughly 80% as much as private insurance on average, and that Medicaid averages around 50% as much. I realize there are wide variations by state/procedure/etc, but does this seem accurate?

- Colin Baillio: Not sure of the exact answer, but if you’re just considering the base rates Medicaid may be right. But if you factor in supplemental payments, Medicaid reimburses close to Medicare.

- Michael Goodwin: I know that a lot of private insurers negotiate a straight “Medicare plus 20%” price...so 80% seems spot on. 100/120 is technically 83% but close enough.

- Kimberly Leonard: It's not 80 percent as much as private but 80 percent of what it costs to deliver the care, is my understanding.

Me: Hmmm ok, that makes sense, but that would suggest only around 60-65% as much as private reimbursement rates.

Leonard: Well...private pays MORE than what a service costs. Not 100 percent of costs. Again just kind of talking broadly here I'd have to pull exact numbers.Seth Trueger: numbers I generally hear:

-medicare reimburses about 85% of costs

-private insurers reimburse about 128% of medicare but huge variation even within same insurers (up to 7-800% and not covering other things)

-variation is across insurers, within insurers, across specialties

Me: So using your 85% / $128% example, for a $1,000 procedure —Medicare would reimburse $850 —Private would reimburse $1,088

Trueger: yeah sounds about right. except: very hard to define that $1000...Sam Clemens: For our psychiatry practice. That seems pretty accurate. Medicaid pays the least by far and requires the most paperwork/computerwork.

Katie Taylor: In my experience the relationship between commercial payment levels and Medicare is driven more by Specialty than Geography with primary care being on the bottom of the scale. The amount of competition in the specific market is also a big factor.

...and so on. I also found a couple of other reliable sources (reports from the Congressional Budget Office and the Kaiser Family Foundation):

- Me: According to this analysis from the CBO, I'm way off--it sounds like private insurance averages more like 85 - 100% higher on average, meaning Medicare only averages around 55% of private reimbursement rates, not 80%.

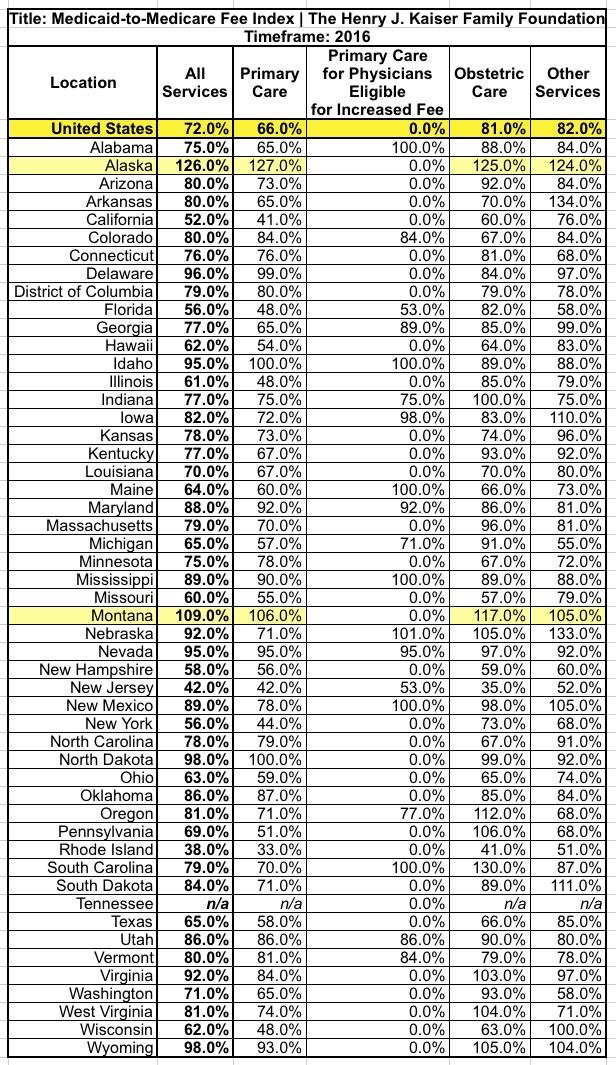

As for *Medicaid*, according to KFF, it sounds like Medicaid reimbursement averages roughly 72% as much as Medicare (again, wide range by state/service/etc)

If you assume Medicare averages 80% of private reimbursement, that'd be: Private: 100% Medicare: 80% of private Medicaid: 62% of private However, it looks like Medicare averages more like 60% of private, so: Private: 100% Medicare: 60% of private Medicaid: 43% of privateLarry Levitt (KFF): Those are pretty close for a comparison of Medicare, private, and Medicaid prices for inpatient hospital care. Prices for physicians are quite different.

Arlene Schumaker: Your revised figures sound closer to correct from what I remember. I’ve been out of billing for almost 3 years though...and so on.

Larry Levitt is about as trustworthy a source as I can think of for this sort of thing. Here's the key points from the 2017 CBO article:

In the physicians report, CBO analyzed three private payers — Aetna, Humana and UnitedHealthcare — which cover 39 million people across all 50 states. The three payers make up 25% of Americans with employer-based insurance and 50% of Medicare Advantage beneficiaries.

CBO reviewed 21 frequent and costly services. CBO found private insurance pays physicians much more than Medicare, particularly for brain MRIs, intensity-modulated radiation therapy, abdominal MRIs and knee arthroscopy. The highest physician payments for those services were at least 350% higher than Medicare payments. The average for those procedures was more than 200% higher for private payers compared to Medicare.

The report also said private insurers’ physician pay varies greatly and can be “based on physician competition” and "physician-hospital vertical integration.”

CBO also said Medicare Advantage plans don’t charge much more for out-of-network care compared to in-network care. Private payers charge much more for out-of-network care.

In the hospitals report, CBO examined the payment rates for hospital inpatient services for private insurers and Medicare Advantage plans and compared them to Medicare FFS rates. CBO used the same payers in the hospital report.

CBO found the average commercial payment rate for hospital admission was $21,400 in 2013, compared to $11,400 for a Medicare FFS patient, which was slightly more than for a Medicare Advantage patient ($10,700). Private insurance rates were 89% higher on average than Medicare FFS rates, according to CBO.

Medicare Advantage and Medicare FFS payments to hospitals were nearly identical and they were much lower than private payers. Private insurers’ payments to hospitals varied greatly, while Medicare FFS and Medicare Advantage varied much less.

Private insurers prices were about 150% higher than Medicare FFS at the 90th percentile and about 45% higher than FFS at the 10th percentile. Meanwhile, Medicare Advantage was only 6% higher than the average FFS rate at the 90th percentile and only 2% above the 10th percentile.

Yeesh. That's a pretty wide array, but as I noted on Twitter, it sounds to me like the average hovers around perhaps 80-85% more for private insurance than Medicare, give or take...which translates into Medicare paying somewhere in the 55-60% of private insurance range.

Meanwhile, the Kaiser link I mentioned includes this table, comparing the relative reimbursement rates of different types of Medicaid services to Medicare on a state-by-state basis. Overall, Kaiser pegs the nationwide average at around 72% as of 2016...which, assuming Medicare averages around 55-60% of private insurance, translates into around 40-45% as much as private insurance for Medicaid.

The other noteworthy thing is that there are two states (Alaska and Montana) where Medicaid actually reimburses providers at a higher rate then Medicare does. Huh.

Also worth noting is Colin Baillio's point regarding supplemental Medicaid payments. He provided further detail a little later:

It’s important to keep in mind that, on average, private insurance pays 144% of what it costs to provide care in hospitals, according to the American Hospital Association. https://t.co/mEWjKbtqxx https://t.co/UGGyFqcGa3

— Colin Baillio (@colinb1123) March 19, 2019

That same analysis shows that Medicare pays 89% of the cost of care and Medicaid pays 90% of the cost of care. At least for hospitals, we should change our priors about Medicaid reimbursement. Supplemental payments go a long way. https://t.co/mEWjKbtqxx

— Colin Baillio (@colinb1123) March 19, 2019

Using Baillio's figures, if a given procedure's official cost is $1,000, private insurance actually pays around $1,440 on average, versus around $890 for Medicare and $900 for Medicaid after supplemental payments are added in. So Medicaid may officially only pay the hospital around, say, $650 initially (~45% as much as private insurance), but the hospital will eventually be paid another $250 or so, bringing it up to around the same level as Medicare.

I admit to being somewhat confused about why this is the case...it seems like it'd be easier all around to simply increase Medicaid rates to match Medicare in the first place, which would cost exactly the same overall but would eliminate the need for any "supplemental payments"...but there are two reasons I can see for not doing that:

- First, I presume this gets into a territorial/budget dispute area between the federal and state governments--increasing Medicaid rates across the board would mean more federal and state dollars, whereas the current arrangement has a different formula.

- Second, I believe the supplemental payments to cover uncompensated care only apply to hospitals, not individual doctors/clinics. If so, that means that increasing Medicaid rates would cost more money still, since both hospitals and doctor's offices would be receiving higher final payments.

Here's a segment from the report Baillio linked to (also from the Kaiser Family Foundation, I should note):

Medicaid payments to hospitals and other providers play an important role in these providers’ finances, which can affect beneficiaries’ access to care. Medicaid hospital payments include base payments set by states or health plans and supplemental payments. Estimates of overall Medicaid payment to hospitals as a share of costs vary but range from 90% to 107%. While base Medicaid payments are typically below cost, the use of supplemental payments can increase payments above costs. Changes related to expanded coverage under the Affordable Care Act (ACA) as well as other changes related to Medicaid supplemental payments could have important implications for Medicaid payments to hospitals. This brief provides an overview of Medicaid payments for hospitals and explores the implications of the ACA Medicaid expansion as well as payment policy changes on hospital finances. Key findings include the following:

- Overall, hospitals have benefitted financially from the ACA coverage expansions and the increase in Medicaid payments, especially in states that expanded Medicaid coverage. Analysis of the Medicare Cost Report data for 2013 and 2014 shows overall declines in uncompensated care from $34.9 billion to $28.9 billion in 2014 nationwide. Nearly all of this decline occurred in expansion states, where uncompensated care costs were $10.8 billion in 2014, $5.7 billion or 35% less than in 2013.

- While hospitals expect to benefit financially from the Medicaid expansion, they expect some gains from the reduction in uncompensated care to be offset by volume-generated increases in Medicaid payments that may be lower than cost. The data is not reliable enough to support nationwide analysis of the extent to which this has occurred, and the effect would vary across hospitals.

- Despite the decrease in uncompensated care, other changes to Medicaid payment policy (such as required reductions to disproportionate share hospital (DSH) payments and policy changes to limit the use of other supplemental payments) are likely to have a more substantial effect on Medicaid hospital payment and overall hospital financial performance in the future. Ultimately the impact of reductions in supplemental payments will depend on decisions by state governments to offset reductions with increases to Medicaid base rates paid to hospitals.

...Like other public payers, Medicaid payments have historically been (on average) below costs, resulting in payment shortfalls. 1 However, hospital payment rates are often bolstered by additional supplemental payments in the form of Disproportionate Share Hospital Payments (DSH) and other supplemental payments. After accounting for these payments, many hospitals receive Medicaid payments that may be in excess of cost. Understanding how much Medicaid pays hospitals is difficult because there is no publicly available data source that provides reliable information to measure this nationally across all hospitals. Different data sources use different definitions of what counts as payments and costs, so estimates are sensitive to these data limitations.

In any event, it sounds like I'm going to have to modify my prior "80% Medicare, 50% Medicaid" rule of thumb into something a bit more complex:

- Medicare reimburses providers roughly 60% as much as private insurance

- Medicaid reimburses hospitals roughly 60% as much as private insurance (45% + 15% supplemental)

- Medicaid reimburses doctors roughly 45% as much as private insurance

I may modify this a bit, but it sounds reasonable for use to make general points about reimbursement rates and sweeping healthcare policy change impact, anyway.