Washington State: APPROVED 2019 #ACA rate hikes: 13.6% (all 11 carriers)

OK, this is a pretty minor update, but in the interest of completeness I should post it.

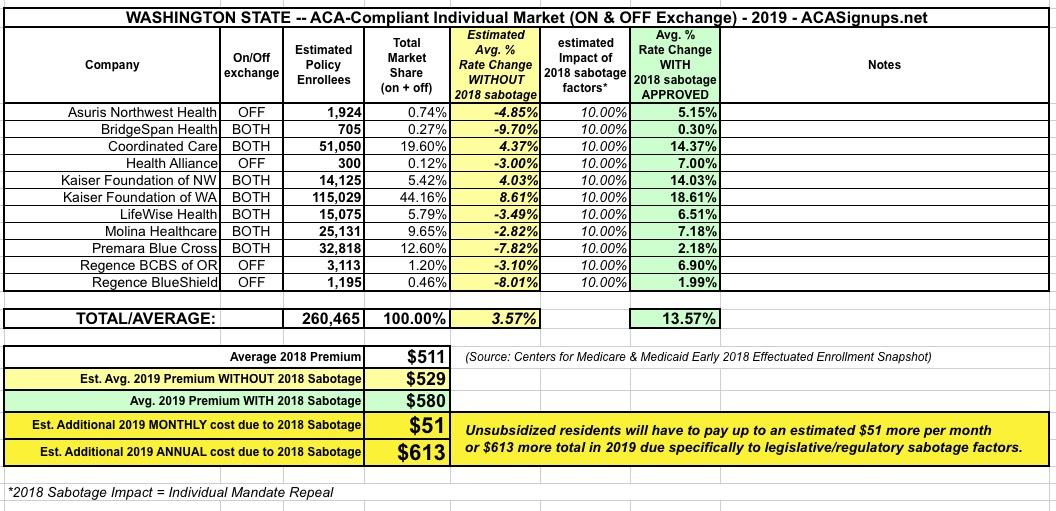

In mid-September, the Washington State insurance commissioner posted the approved 2019 average ACA individual market premium changes for carriers statewide, coming in at 13.8% overall.

The only problem is that the report only included the seven on-exchange ACA market carriers. The four carriers which offer off-exchange policies (which are pretty much identical and are part of the same risk pool, but don't qualify for tax credits) weren't included. They make up roughly 23% of Washington State's total individual market.

Today, just a few days before Open Enrollment begins, the WA Insurance Commissioner posted the complete approved rate change information. The overall average has dropped slightly, to 13.6%:

Eleven insurers approved to sell 74 plans in Washington's 2019 individual market

13.57 percent average rate increase approvedOctober 29, 2018

OLYMPIA, Wash. — Washington state Insurance Commissioner Mike Kreidler has approved 11 health insurers to sell 74 plans in Washington's 2019 individual health insurance market. Health insurers requested a 19.44 percent average increase, but Kreidler’s office determined that only 13.57 percent was justified. All 39 counties in the state will have at least one Exchange insurer.

“I’m grateful increases are down from last year and that we’re seeing some moderation of rate changes, but I know these costs may be hard for many to afford — especially if they don’t qualify for subsidies," said Kreidler. “Unfortunately, the Trump administration is focused on sowing uncertainty in the insurance markets and insurers are reacting. In addition, his administration and Congress have failed to address the underlying costs of health care in this country and until they do, individuals and businesses buying health insurance will be impacted.”

See individual market health insurers and plans available by county (PDF, 114.38 KB)

Search approved 2019 premiums by insurer and find decision memos and the complete filings for each insurer.

About 266,000 Washingtonians — about 4 percent of our state population — do not get employer or government-sponsored health insurance and must buy their own coverage. Individual health plans are available through the state Exchange, Washington Healthplanfinder, or directly from an insurer. However, financial subsidies are only available through the Exchange.

Last year, 207,000 people enrolled through the Exchange, and approximately 60 percent of them received a subsidy. Open enrollment — for coverage beginning Jan. 1, 2019 — starts Nov. 1 and ends Dec. 15, 2018.

The final, approved rate change table is below.

I should also note that while I had originally estimated the impact of 2018 sabotage by the Trump Administration at around 14% for Washington State due to the combination of the ACA mandate being repealed and the expansion of #ShortAssPlans, I've knocked my estimate of the impact on 2019 premiums down to a flat 10 percentage points thanks to Insurance Commissioner Kreidler's new rule regarding so-called "short-term, limited duration" plans:

Under the proposed rule:

- Short-term limited duration (STLD) medical plans can last no more than three months and are not renewable.

- A consumer can have STLD coverage for no more than three months in a 12-month period.

- Insurers selling STLD medical plans must provide consumers with the disclosure form included in the proposed rule that clearly states the limitations of the coverage and prompts consumers to check to see if they are eligible to purchase coverage through Washington’s Health Benefit Exchange before they buy an STLD medical plan.

- STLD medical coverage must offer major medical coverage, with a maximum total payment of at least $1 million. Any pre-existing condition look-back period cannot exceed 24 months. Consumer coinsurance cannot exceed 50 percent, and any insurer offering an STLD medical plan must offer at least one plan with a deductible of $2,000 or less.

- STLD application forms, policies and rates must be approved by OIC prior to being offered or sold.

- STLD medical plan rescission and cancellation is limited to defined circumstances with requirements for adequate consumer notice.

With that in mind, here's my final estimate of the impact of #ACASabotage on 2019 premiums: Roughly $51 per unsubsidized enrollee, or around $613 for the year apiece:

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.