WARNING: A great deal in 2018 doesn't necessarily mean a great deal in 2019. SHOP AROUND!

Last year I wrote a LOT about Silver Loading and Silver Switching for 2018...basically, the way which ACA individual market enrollees can save hundreds or even thousands of dollars on their 2018 insurance policies by taking advantage--perfectly legally and ethically--of the unusual pricing of different metal level policies this year.

The short version is this: Due to the way the ACA's tax credit formula works, Donald Trump's attempt at sabotaging the ACA exchanges by cutting off Cost Sharing Reduction (CSR) reimbursement payments to insurance carriers actually (partly) backfired on him, resulting in an unusual situation in which several million subsidized enrollees ended up benefitting from the pricing fallout, while millions of unsubsidized enrollees ended up being hurt by it...but other unsubsidized enrollees ended up being able to avoid being hurt by switching to a special off-exchange Silver plan (thus, the "Silver Switch").

The key to subsidized enrollees benefitting is that the price increase of the benchmark Silver plan (that is, the 2nd lowest-priced Silver policy available on the ACA exchange) has to be higher than the price increase of Bronze or Gold plans. If The benchmark plan increases by $50/month, ACA subsidies also increase around $50/month...but if Bronze or Gold plans only increase by $25/mo, subsidized enrollees can use their extra $50 to enroll in a Bronze or Gold plan, thus saving the $25/mo difference. That's a $300/year savings!

Many people took advantage of this for 2018, often to the tune of thousands of dollars in savings--people snapped up Bronze plans for NO net premium cost at all, while others enrolled in Gold plans which cost them less than a Silver plan would. Awesome!

The problem for 2019 is that this quirk in the tax credit formula works both ways.

If the cost of the benchmark Silver plan drops by $50/month while Bronze or Gold plans only drop by $25, guess what happens next year? That's right: Those same enrollees could lose $300, because their subsidies will drop by $600 while their premiums only drop by $300. The same holds true if Silver plans only go up a little while Bronze/Gold go up a lot, actually...the key is the relative change between the benchmark premium and other types of policies.

Of course, there are other reasons why subsidized enrollees can lose out next year as well which have nothing to do with Silver Loading. If a new entrant into the local ACA exchange market decides to aggressively undercut the competition on pricing of Silver plans, subsidized enrollees could see their tax credits dwindle even if (or perhaps because of) their current carrier doesn't change the price of any of their policies. Remember, "benchmark plan" doesn't necessarily refer to the 2nd lowest-cost Silver plan your carrier is offering...it's the 2nd lowest-cost plan any exchange carrier is offering.

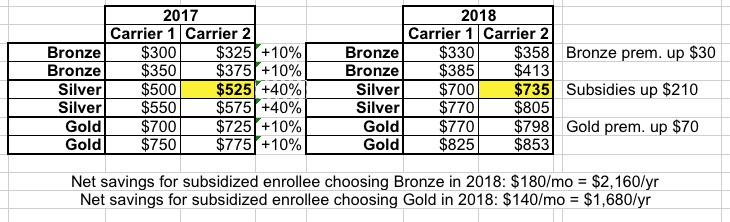

Let's say that these were the prices of policies in 2018 vs. 2017:

This is a simplified example, but it illustrates how several million subsidized enrollees saved big by choosing dirt-cheap Bronze or bargain-priced Gold policies. Carrier 2 has the 2nd lowest-priced Silver plan, which ACA tax credits are based on regardless of which policy the person actually enrolls in. Bronze and Gold premiums for both carriers only increased 10%, while SIlver premiums increased 40% to make up for the lost CSR revenue...but that also means tax credits increased around 40% as well.

Since the credits increased $210/month while the price of Bronze and Gold plans only increased around $30 or $70 respectively, the subsidized enrollee saves $140 - $180 by "downgrading" or "upgrading" to Bronze or Gold.

But what about 2019? Well, if all of the policy premiums stay about the same for all of the carriers, or if they all drop at roughly the same amount across the board for every metal level...not much changes, really. Those benefitting today continue to save money by sticking with Bronze or Gold plans, although they might not be quite as good of a deal as they were this year.

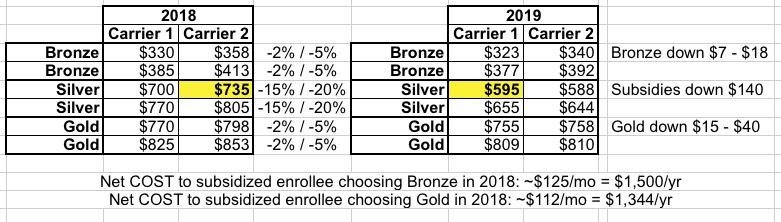

For instance, let's say that both carriers drop their rates by a flat 2% across the board:

As you can see, if the subsidized enrollee chose a Gold plan in 2018, they'll likely pay almost exactly the same in 2019 as well...their net premium may even drop a buck or two more per month. However, if they chose a Bronze plan, they'll pay around $8 more per month, since their subsidies dropped by more than their premium did. Annoying, but not devastating.

HOWEVER...what happens if the benchmark Silver plan drops relative to the other plans?

The exact opposite effect. Let's look at two scenarios. In the first, the same two carriers are in the market. Both lower their premiums for every plan, but they drop their Silver plans by substantially more than the Bronze or Gold...basically, they both overestimated how much they lost in CSR funding, so have to correct for that by easing up on the Silver plans:

Ouch. This is a reversal of what happened in 2018...instead of saving a couple thousand dollars, they're suddenly losing a thousand or more, since the benchmark plan dropped far more relative to their Bronze or Gold plan. In this scenario, they may be better off moving back to the Silver plan.

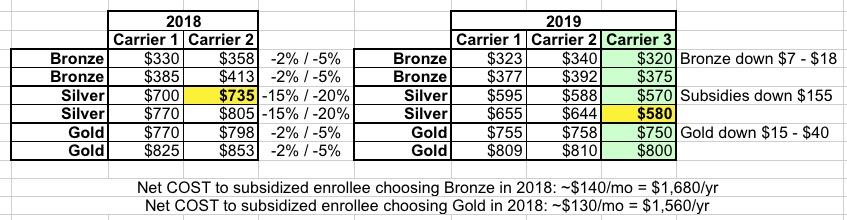

Finally, what happens in the secnario above but in addition, a third player enters the market in 2019 and decides to aggressively undercut the others?

Double ouch. The newcomer has just swooped in and "stolen" the Benchmark Silver status from both of the other two carriers. The benchmark plan has dropped from $735/month to $580, meaning $155 less in monthly subsidies for some enrollees, while Bronze and Gold have only dropped slightly, costing them over $1,500 apiece next year.

Subsidized buyers in Philadelphia are going to be significantly worse off this year...In 2018, a 40 year old non-smoker earning $27,000 a year would qualify for a $0 premium CSR plan because of a large Silver Gap between the least expensive Silver plan and the Benchmark Silver Plan. In 2019, the least expensive Silver plan will cost that same subsidized individual about $160 a month. I expect significant subsidized enrollment drops as the Silver Gap got crushed.

Conversely, non-subsidized buyers in Philadelphia will see cheaper Bronze and Silver plans so they will be better off.

As always, the ACA is an individual and county level story with very different incentives and saliencies for subsidized and unsubsidized folks. Low premiums levels are enrollment enhancing for non-subsidized buyers while low Silver spreads are enrollment depressors for subsidized buyers.

Now, it's important to keep in mind that unsubsidized enrollees benefit from all of these scenarios...they have to pay full price, so any price reduction is a Good Thing as far as they're concerned, whether it's 2% or 20%. It's also important for subsidized enrollees to remember that they aren't necessarily getting a bad deal in 2019...they may just be losing out on the great deal that they're getting this year. It's all a matter of perspective, and it's all relative to whatever you're paying now.

It's also important to keep in mind that there are many parts of the country where enrollees will still be better off with a Bronze or Gold plan. This is especially true in states which are newly Silver Switching next year, including Alaska, Arkansas, Colorado, Delaware, Kentucky, New Mexico, North Dakota, Tennessee and Vermont. I'm not saying that everyone will benefit from doing so in these states--the pricing and plans available are all over the place, and there are other variables at play in some of them, and there are multiple rating areas in some states whcih can effect things as well--I'm just saying that, as always, SHOP AROUND EVERY YEAR TO FIND THE BEST VALUE.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.