UPDATE: Idaho: Datapalooza! OE5 Enrollment Data Breakout!

Idaho is one of only 2 state-based exchanges which stuck with the "official" December 15th deadline for the 2018 Open Enrollment Period (the other was Vermont). Unfortunately, they haven't released an official, detailed demographic breakout report yet, but they did discuss some relevant stats in their December board meeting...which, as it happens, took place on December 15th, which means it's still missing a bit of final data. For now this is the best I can do:

d) Enrollment Update

Mr. Kelly said YHI’s goal in enrollments is to be flat year-over-year, and it is within reach. When we look at average enrollments for 2017 of around 90,000 Idahoan’s, we appear to be ahead of that for 2018. As of this morning, we have almost 96,000 enrollments. This week alone, we have gained over 6,000 enrollments, way ahead of our growth for the same time last year. We also had well over 2,100 calls into the support center yesterday.

Note: YHI ended up with 101,793 enrollments, but 7,300 of those proved to be standalone dental plans; actual medical QHPs ended up totalling 94,507 people.

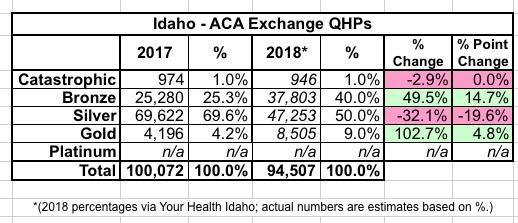

We have seen a lot of customer behavior around shopping and, of course, the usual rush at the end of open enrollment which is tonight. The lack of federal Cost Sharing Reductions, or CSR’s, has caused some shifts in the silver plans and the other metal tiers. We have seen a 14-point movement from silver to gold and bronze. As of this morning, that increased 18 points, meaning about 18 percent of our customers from last year have moved from silver to bronze or gold. Bronze is up 13 points and gold is up 5 points. That is a high indication that increased tax credits made gold more affordable and resulted in some zero-cost premiums for bronze plans.

The Chair asked why the catastrophic plans don’t really move at all.

Mr. Kelly said we did see an increase this year, but the total numbers are so small relative to the overall enrollment. As of November, we had 600 people on catastrophic plans and in January we anticipate over 1,000.

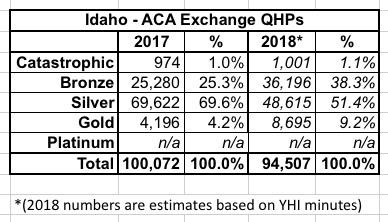

OK, this is imprecise, but based on the 2017 OEP Public Use File from CMS, the breakout should be something like this:

UPDATE 2/6/18: OK, I've received some more data directly from Your Health Idaho...not precise numbers but hard percentages...

...which I can backload to make the metal level table look like this:

Sure enough, Gold plans more than doubled, while Bronze plans increased by 50%, while Silver enrollment dropped by about 1/3. Silver Switcharoo in action!

Mr. Trexler added that once you hit 30 years old, you are rolled off catastrophic plans unless you can show hardship conditions.

Dr. Rusche said his concern is about the national message about the repeal and replace rhetoric in DC. He asked if there has been any confusion by customers. Mr. Kelly said the level of questions about whether or not the ACA is still in place has died down. It tends to be very reactive to news out of DC. We do think that the mandate is a smaller and smaller driver of the purchase decision here in Idaho. People purchasing insurance now understand the value proposition of having insurance via a monthly premium versus paying the penalty. We don’t believe it to have zero impact, but we do believe it to be in the single-digit percentage points here in Idaho.

This is an important point and could reduce the negative impact of the individual mandate being repealed to some degree...if it proves to be the case. It's possible that there's been a general education nationally over the past few years about how important having coverage on an ongoing basis is which will reduce the number of people who skip it due to there no longer being a mandate penalty. If so, great...but it's a hell of a bet.

Mr. Erstad asked if we could provide some demographic breakouts for age and metal tiers. Mr. Kelly said yes. Mr. Erstad said with the mandate likely to go away, it would be good to see those numbers now.

Dr. Livingston said looking at these numbers, it appears there is little churn of patients going off and on plans. Do we know what that number might be? And do we have any idea how many people had insurance last year through their employers and this year are purchasing insurance through the Exchange? Mr. Kelly said in terms of those that are auto renewed, we are in the high 80’s and last year we ended up with about 72 percent retention. In terms of those that are actively renewed and then actively reselect, we see that at about a quarter of our population that switch to another plan. Regarding the second question, we do not have the ability to track the impact of consumers moving between the Exchange and employer coverage.

Mr. Kelly said there has been some movement between carriers, but it is primarily in the space of the one carrier moving off the exchange and another moving out of specific geographic areas. BridgeSpan left the Exchange and has no enrollments for 2018, Blue Cross and Mountain Health Co-Op have increased, and SelectHealth is down slightly due to exiting some markets in southeast Idaho. We expect that to shift even more over the next few weeks, but feel it is more driven by the market decisions than any specific individual behavior.

There's also an interesting section about the impact of the insane federal policy debate last year locally:

Federal Policy

Mr. Kelly said it is clear the federal policy bouncing ball continues to be an area we need to focus on, and it does change hourly or daily. There are two current concerns. The first is the repeal of the individual mandate and the second is the Cost Share Reduction funding (CSR’s). It is worth noting, the repeal of the individual mandate may not have a significant impact on Idaho. Our estimates are around 5 to 7 percent of customers have a purchase decision that is heavily influenced by the mandate.

The Chair asked the carriers if their assessment of the repeal of the individual mandate is in line with our assessment.

Mr. Edgington said yes, and possibly lower. The penalty was low enough that people were more motivated by the carrot, or the value of the plans, than the stick, or the penalty. And the discussion of the mandate penalty being enforced for the past several months has cemented the notion that the mandate became less relevant.

Mr. Jeppesen concurred with Mr. Edgington. He thinks 5-7 percent is pretty high and that people are more motivated by the APTC and value of the plans.

The part about CSR reimbursements being reinstated is particularly interesting to me...I've written many times about how doing so now that the carriers have already gone the Silver Loading route would actually hurt more people than it helps...but it turns out there'd be other negative impacts as well:

Mr. Kelly said the second item is the funding of the Cost Share Reductions. If CSR’s are funded or reinstated for 2018, there are a number of technology changes that would need to be implemented. And these could take up to 60 to 90 days to resolve and implement for our subsidized customers and it would pose many challenges to YHI and our customers. These things would include design, development, testing and deployment. If funding is reinstated between now and January 1, implementation would be as late as April 1. At the forefront of our mind is the consumer experience, but changes would also affect our agents and brokers, enrollment counselors, and carrier partners. There are also costs associated with these changes. They would include the costs of training of consumer connectors, noticing, as well as the temporary and seasonal workforce numbers. While we don’t think the technology costs would result in a direct cost to YHI, there will certainly be significant opportunity costs as the team that would work on this development could not work on other planned technology improvements.

YHI will continue to work with our partners on plans for whatever comes next, and we do recognize that the Department of Insurance has to balance on and off exchange, subsidized and non-subsidized customers, and the impacts to each, and we will continue to work together to find an optimal solution. YHI believes that the optimal solution is reinstating CSR funding effective January 1, 2019.

Dr. Rusche said as he understands it, the CSR is a payment from the federal government to the carriers, and then the carriers are expected to offset deductibles, co-insurance, and any other out of pocket costs the insured might have. If they do decide to fund CSR’s in say July 1, 2018, do we end up doing a special enrollment? Mr. Kelly said these are all the questions we have been working on since September with DHW and DOI. It is extremely difficult to scenario plan when there are so many potential scenarios. We do know that if we need to recalculate APTC’s, it will take 60-90 days and have a significant negative impact on our customer experience.

Mr. Trexler said it is difficult to say as there are so many potential scenarios. This isn’t something we created and many states are feeling the same unknown. Once we have some language to look at, we can move forward.

Mr. Erstad asked if when the carriers provided their rates for 2018 to the Department of Insurance, they were asked to submit rates that assumed no CSR in the funding of those rates. Mr. Trexler said yes, that’s correct. And that is what we planned for. Even though there are no CSR’s being funded, the customer is still receiving the benefit of the cost share reduction from the carrier. The premium rates would then need to be looked at and recalculated if they decide to fund CSR’s.

Mr. Kelly said the latest on this is that for the continuing resolution that is to be voted on, CSR funding won’t be included, but that changes daily.

In other words, aside from however much people would be helped or hurt by the CSR reimbursements either being reinstated or not being reinstated, the worse possible scenario would be for them to be reinstated in the middle of the year.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.