UPDATE: I have seen the future of health "don't-call-it-insurance!" under Donald Trump, and it is called "HomePort Health"

So Jay Norris, a health insurance broker in Colorado (and husband to the fantastic Louise Norris) tweeted this a few minutes ago:

Customer: What about community healthcare plans?

Me: Anything not ACA compliant won't provide protection for catastrophic expenses.

Customer: HomePort Healthcare says they move you to an ACA plan if you have a catastrophe because those can't deny you for pre-existing conditions

— Jay Norris (@lukkyjay) December 14, 2017

...to which Louise noted:

This is an astounding level of negligence on the part of that salesperson and/or company.

Please spread the word: YOU CANNOT SWITCH TO AN ACA-COMPLIANT PLAN OUTSIDE OF OPEN ENROLLMENT unless you have a qualifying event. A catastrophic health problem is NOT a qualifying event. https://t.co/BAPChCasOG— Louise Norris (@LouiseNorris) December 14, 2017

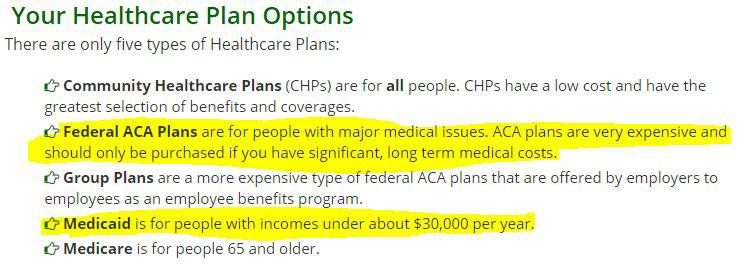

Jay decided to look into "HomePort Healthcare" and noted this pile of utter garbage:

So I googled Homeport Healthcare. Check out this page on their website: https://t.co/yoT6PijmCV pic.twitter.com/lujNSnffUR

— Jay Norris (@lukkyjay) December 14, 2017

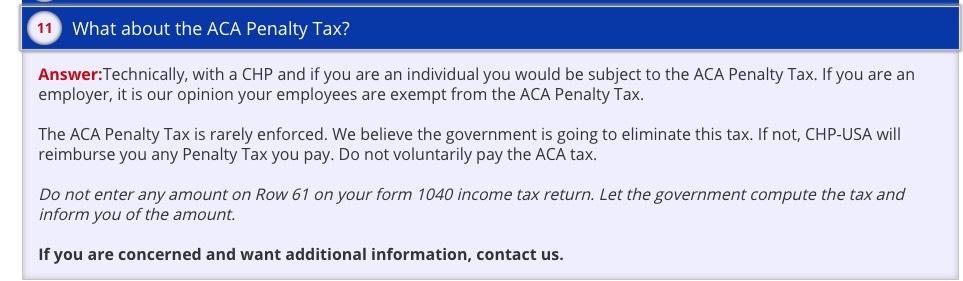

This is so jaw-droppingly full of nonsense I don't know where to begin. I decided to look further, and came up with even more garbage...including blatant instructions from an "insurance company" to not pay your taxes and flat-out lies about which people are exempt from the mandate penalty:

I'm not going to actually link to their website, but the shamelessness of these sleazy claims is breathtaking.

Oh, yeah: Here's what it says at the bottom of their site:

HomePort Healthcare Services is a financial management company specializing in the healthcare marketplace.

Yes, because I always trust a bank to guide my healthcare decisions.

Good God:

My doctor has not heard of HomePort or CHP. What should I do?

Answer: This is not uncommon especially if you don't show your CHP ID card or identify yourself as not having insurance. Most Medical Providers are only familiar with the larger insurance companies. If you are talking to the Medical Provider on the telephone before a visit, tell them you are "Self-Pay" and give the Medical Provider our telephone number and email. Ask them to contact us.

If you are at the Medical Provider's office, be sure to give them your CHP ID card. Directions and our contact information are on the back of the CHP ID card. Tell the Medical Provider to call us for certification and directions.

Remember, you need to tell the Medical Provider you do not have insurance, you are self-pay and want a cash-pay discount.

This is filling me with confidence:

What is a Medical Event?

Answer: A Medical Event is generally defined as any medical treatment with a Medical Provider for an Accident, Critical Illness or a Non-Critical Illness. A Medical Event generally costs more than $500. An office visit with your doctor for a routine medical treatment is not considered a Medical Event.

...What should I do when I have a Medical Event?

Answer: The answer depends on when the Medical Event occurs. If your Medical Event is to be scheduled at a later date, then you should send us a Medical Event Registration Form now. Your HomePort concierge will help you with your Medical Event check pricing and where you should consider receiving the treatment.

If your Medical Event has already occurred, then as soon as practical you need to register your Medical Event.

...If possible, receive treatment from your Primary Care Physician or at an Urgent Care facility. Not at an ER. Obviously, if it is an emergency, receive treatment at the nearest medical facility.

Please note, if there is a delay in registering your Medical Event, your Medical Event's bill processing may be delayed or even denied. Please be timely with your registering of any Medical Event.

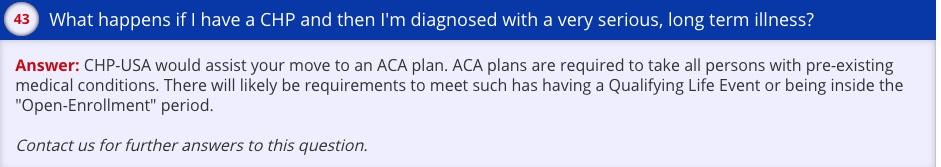

Oh, and in case you're wondering about the curious claim in Jay Norris' original Tweet, here's that mystery solved (I'm switching back to screen shots; it seems more effective that way):

In other words, if you're diagnosed with cancer at the same time that you happen to be getting married, divorced, giving birth, adopting a child, moving to a different state, etc. during the 10 month "off season", they'll "assist" you in enrolling in an ACA-compliant policy via a Special Enrollment Period.

If, however, you don't happen to be doing any of those things within 60 days of being diagnosed, you're basically screwed until the following January.

There have always been scammy, scummy companies trying to prey on people's ignorance and there always will be no matter how tightly regulated an industry is, but you can expect 100x as much crap like this as Donald Trump continues to gut insurance industry regulation...like every other industry he touches.

UPDATE:

Big thanks to all the folks who tagged the Colo. Div. of Insurance on this issue. We take these matters seriously and will look into this and alert any other relevant government agencies if needed. Again, thanks for bringing to our attention.

— DORA Colorado (@DORAColorado) December 14, 2017

Good thing, too:

Down the scam rabbit hole:

Homeport Healthcare tells a customer that they "set you up as an independent rep of the HomePort Healthcare company, so then they can maneuver that to qualify for the "loss of employer coverage" event."

— Jay Norris (@lukkyjay) December 14, 2017