Kaiser Family Foundation Mostly Confirms my ~29% average rate hike estimate (w/~15% CSR factor)

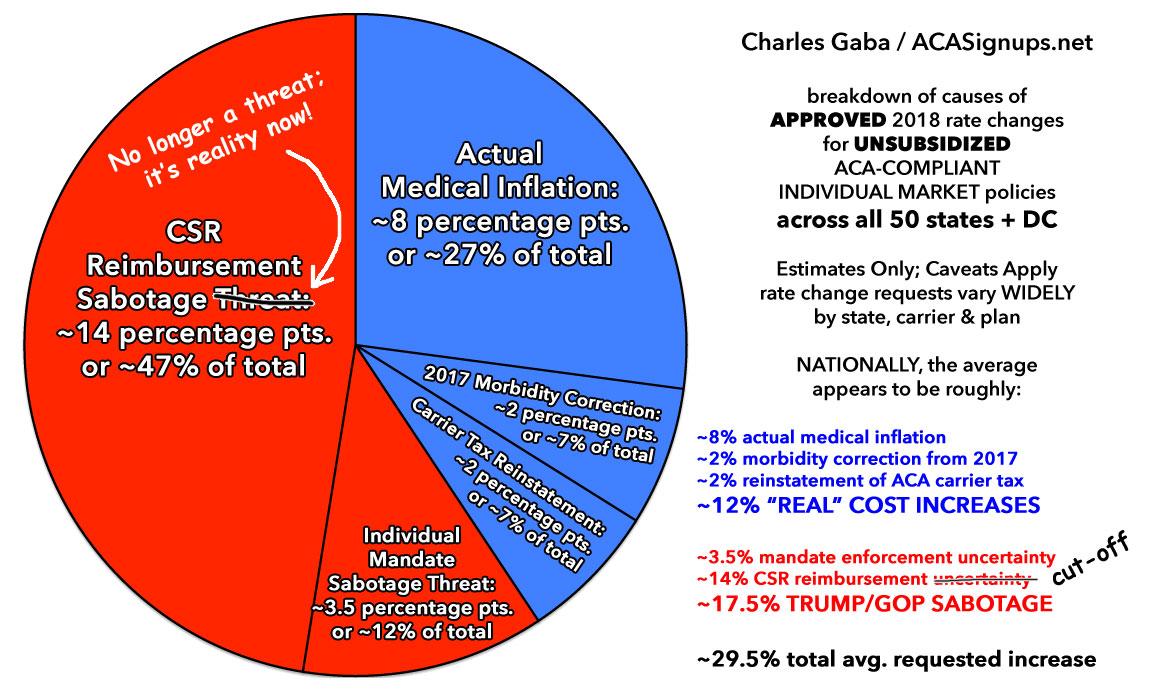

Just taking a moment to pat myself on the back. Here's my final estimate of the average unsubsidized 2018 premium increases nationally, along with a rough breakout of the reasons for the increase:

With the 2018 Open Enrollment Period coming up just 5 days from now, it's time to put this to bed: After 6 months of painstaking research and analysis, I've compiled a comprehensive analysis of the weighted average rate changes for unsubsidized ACA-compliant individual market policies in 2018, including both the on- and off-exchange markets. It's already been confirmed by a different analysis by healthcare consulting firm Avalere Health, which used a completely different methodology to arrive at the exact same conclusion: The national average increase is between 29-30%, ranging from as low as a 22% average premium drop in Alaska (thanks to their successful reinsurance program) to as high as a painful 58% increase in Virginia.

I've further confirmed that of that 29-30%, the deliberate Cost Sharing Reduction cut-off by Donald Trump is responsible for roughly 13-14 percentage points overall, or nearly half of the total. An additional 3-4 percentage points (12% of the total) has been tacked on in response to carriers' ongoing concerns about whether or not the Trump administration intends on enforcing the Individual Mandate penalty.

OK, so that's around 17% for Bronze, 33% for Silver (splitting the difference between lowest/second-lowest) and 18% for Gold. This doesn't include all plans on the exchange, of course, but it should cover the vast majority of them.

Well, according to the 2017 Open Enrollment Period Public Use File, here's the breakout of exchange enrollees by metal levels this year:

- Catastrophic: 0.91%

- Bronze: 22.94%

- Silver: 71.15%

- Gold: 4.05%

- Platinum: 0.97%

Kaiser doesn't include either Catastrophic or Platinum plans in their analysis, but they only add up to 1.9% of all exchange enrollments anyway, so they wouldn't be more than a rounding error.

So, some simple math:

- 22.94% x 17% = 0.038998

- 71.15% x 33% = 0.234795

- 4.05% x 18% = 0.00729

Add them up and you get 0.281083, or 28.1% on average.

OK, so Kaiser has things coming in slightly lower than me, but still pretty close.

In addition, by looking at the Bronze and Gold plans it should be fairly obvious that Silver plans would only be going up by perhaps ~17.5% if Trump hadn't cut off the CSR reimbursement payments. About 40 states loaded CSR costs onto Silver plans exclusively, which accounts for the additional ~15.5 percentage point increase on those plans.

This is actually slightly higher than my own estimate of 14 percentage points being tied to CSR costs.

Of course, there's one other important factor to consider: Kaiser is only including exchange-based policies. There's several million people enrolled in off-exchange only policies which could skew the averages up or down as well.

All in all, I'd say I hit pretty close to the mark.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.