UPDATE: Indiana chooses the worst possible way of spreading their CSR load

Protect Our Care is a healthcare advocacy coalition created last December to help fight back against the GOP's attempts to repeal, sabotage and otherwise undermine the Affordable Care Act. This morning they released a report which compiled the approved 2018 individual market rate increases across over two dozen states.

Needless to say, they found that the vast majority of the state insurance regulators and/or carriers themselves are pinning a large chunk (and in some cases, nearly all) of the rate hikes for next year specifically on Trump administration sabotage efforts...primarily uncertainty over CSR payment reimbursements and, to a lesser extent, uncertainty over enforcement of the individual mandate penalty.

Anyone who follows this site knows that this is hardly shocking news; I've been laser-focused on this issue for the past five months or so. I've already compiled and broken out the average rate increases for 22 of the 28 states covered by the Protect Our Care report. The average increases in my spreadsheets differ from some of the numbers in the POC report because I also include the off-exchange ACA-compliant market (which isn't always included in the sources cited by POC's report), and because I make sure to weight the averages by relative carrier enrollment share of the market. For these reasons, the Protect Our Care report normally wouldn't have caught my eye, though obviously it's a good thing for the sabotage issue to get more exposure.

However, POC has also tracked down the approved rate increases for six additional states which I hadn't yet compiled...which makes this exciting to a healthcare data nerd like myself! They've helped me fill in the blanks for Illinois, Indiana, Nevada, Ohio, South Dakota and Utah. So without further ado, here's Indiana:

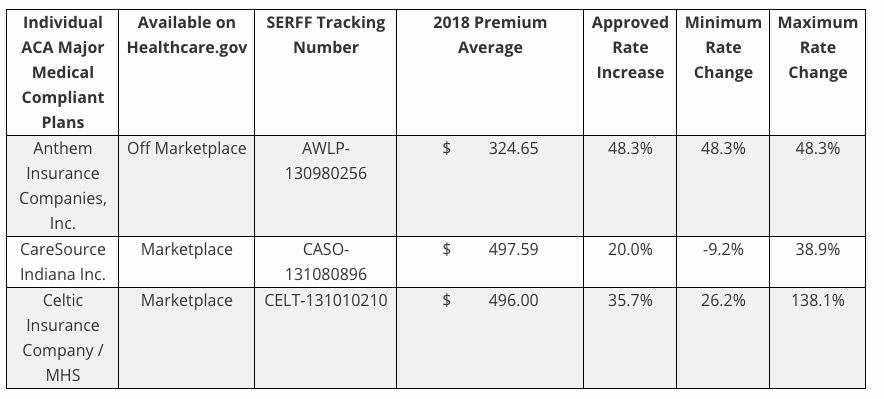

The Indiana Dept. of Insurance has posted the approved rate hikes for the three carriers participating in the ACA-compliant 2018 individual market:

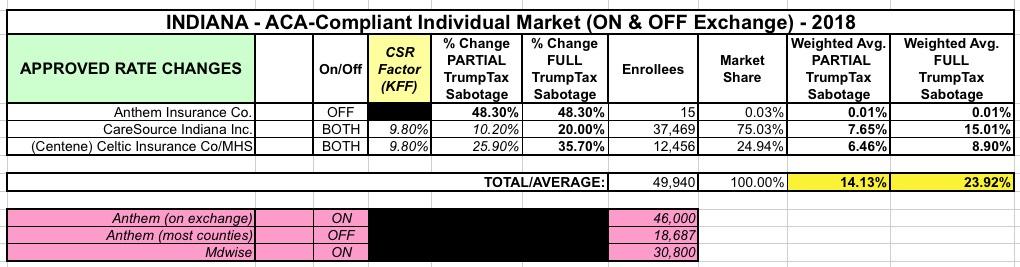

Note that there's only three carriers total, and Anthem (which has the highest average increase) is only offering off-exchange policies, so they aren't impacted by the CSR issue. In addition, according to their rate filing earlier this summer, Anthem only has 15 people enrolled in those policies anyway, so that huge 48% rate hike is a virtual non-factor when weighted by market share. When I plug in CareSource and Centene/Celtic, I get a 14.1% average if CSRs are paid vs. a 23.9% hike if they aren't.

UPDATE: Ah, crap...according to this article from IndyStar.com, Indiana is spreading the CSR load in the worst way possible: Across all plans, on & off exchange:

But because the state instructed insurers to spread the rate impact across all types of plans, not just the mid-level plans used to calculate the premium subsidies, people who don’t get federal help for their premiums will feel the full effect of the rate hike.

That’s a different approach than many other states have taken, said Gary Claxton, an expert on the private health insurance market at the nonpartisan Kaiser Family Foundation.

“Basically, in Indiana, they’re making people pay what, at least in the other states I’m aware of, mostly the (federal) government will pay,” Claxton said.

Jenifer Groth, spokeswoman for the Indiana Department of Insurance, said the insurers wanted to spread the costs across all levels of plans to keep the price variation reasonable. Unlike in many other states, Groth said, insurers are discontinuing non-subsidized plans sold separately from Healthcare.gov. For the estimated 40,000 to 50,000 policyholders who will have to change carriers next year, the state wanted prices to be consistent across the different levels of plans, she said.

It’s possible customers who pay the higher rates will get a rebate if the federal government continues the payments to insurers next year.

...Groth said there are several ways insurers could respond if the payments continue next year. Those including seeking permission for either a mid-year rate reduction or permission to pay refunds.

(sigh) OK, they're throwing in a couple of minor mitigating factors here, but maybe, possibly getting some of it back in 2019 is gonna be small comfort to those who have to pay an extra 10 point increase in 2018.