2018 Rate Hikes: Vermont (early look)

Vermont is the 4th state to post their initial 2018 rate filings. Vermont has a couple of unusual policies re. their healthcare market: First, while they do technically have an off-exchange individual market, those policies are all fully ACA-compliant QHPs and are tracked exactly the same as on-exchange QHPs, meaning this dashboard report from February includes just about all of their individual market enrollees: 28,775 on exchange + 5,662 off-exchange, for a total of 34,437 ACA-compliant enrollees. Vermont didn't allow transitional plans, so aside from an unknown number still enrolled in grandfathered plans, that should represent their entire individual market.

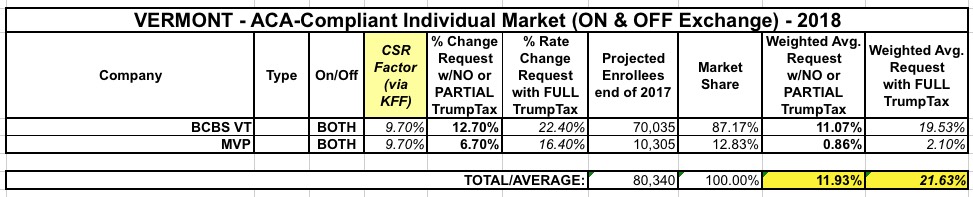

In addition, like DC and Massachusetts, Vermont's individual and small group risk pools are merged, meaning that increases to one are also reflected in the other. That's why the VermontBiz article lists considerably higher enrollment number (over 70,000 for Blue Cross Blue Shield and 10,000 for MVP Healthcare); they're all part of the same risk pool. It doesn't break the numbers out between individual and sm. group, but it doesn't need to; what's relevant is the overall market share and rate hike percentages:

BCBSVT proposes an average annual increase of 12.7% over 2017 premiums offered on Vermont Health Connect. Proposed increases per plan range from 5.8%-14.6%.

There are 42,357 contracts (70,035 members) currently enrolled in a BCBSVT QHP.

...MVP: The proposed rates reflect an average rate adjustment to prior rates of 6.7%, ranging from 2.3% to 10.5%. There are 4,889 policyholders, 6,847 subscribers and 10,305 members impacted by this rate filing.

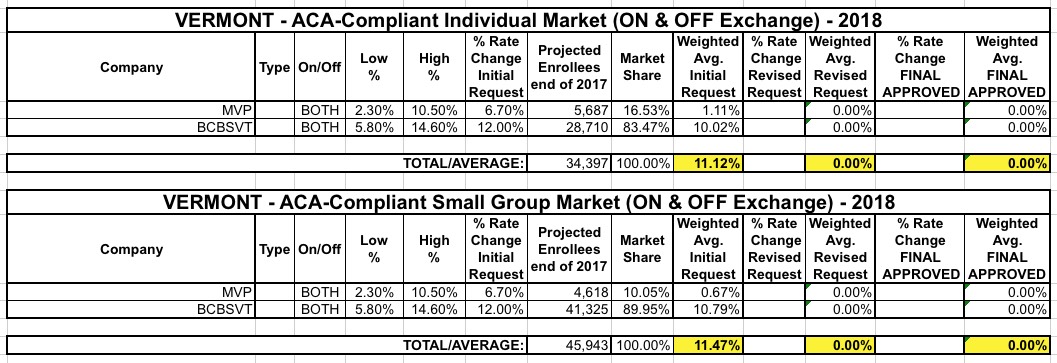

According to the actual rate filings, the small group/individual market breakout is:

- MVP: 5,687 individual market, 4,618 small group

- BCBSVT: 28,710 individual market, 41,325 small group

Vermont only has 2 insurance carriers operating in either market, so the spreadsheet is pretty easy to fill in. Overall, the weighted, unsubsidized average rate increase being requested by carriers is around 11.1% for the individual market and 11.5% for the small group market.

UPDATE 8/14/17: I've gone back and reviewed the updated/revised rate filings for Vermont; in addition to the requests being slightly higher, it appears that the average requested increases assume CSR payments will be made, meaning I have to add 9.7% (via Kaiser's estimates) to the totals to account for the CSR sabotage factor. This bumps the averages up significantly, to 11.9% or 21.6%: