Behold with Wonder as Ted Cruz & Mike Rounds use Magic Freedom Math to transform 18 into 3!

Last week, and then earlier today, I crunched some more numbers (with a big assist from the Kaiser Family Foundation) to figure out just what the impact of Ted Cruz's "Consumer Choice" #BCRAP amendment would be on the individual market, and the results weren't pretty. Here's what it boiled down to (rough estimates for all numbers):

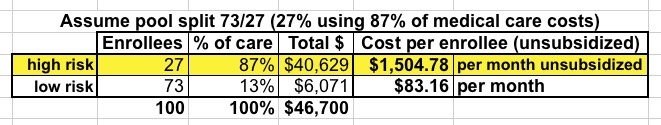

n other words, Kaiser estimates the breakout of the individual market as something like this:

- 73% "Cruz Plan" Enrollees (theoretically paying a nominal $83/mo)

- 17% Subsidized ACA Plan Enrollees (paying anywhere from $20/mo to $570/mo for a Bronze plandepending on age/income up to 350% FPL)*

- 10% Unsubsidized ACA Plan Enrollees (paying the full $1,505/month)

*It's important to remember that the BCRAP tax credits are based on a Bronze ACA plan, not Silver; the cost for a Silver ACA-compliant plan would be far higher than this).

How do those ratios work out in real numbers? Well, again, Kaiser estimates about 1.5 million people would fall into that third "doomsday" category...but that's based on a total individual market size of 15.3 million people. Again, I suspect that's too low (remember, that estimate is based on 2015 data), but let's assume it's correct; if so, the total breakout would be something like:

- 11.2 million "Cruz Plan" Enrollees (dirt-cheap rates...unless/until they actually get sick; then they're screwed)

- 2.6 million Subsidized ACA Plan enrollees (reasonable to ugly rates, depending on age/income)

- 1.5 million Unsubsidized ACA Plan enrollees (completely absurd rates, utterly unaffordable, out of the market)

...except, of course, that most of those 1.5 million would have no way of affording their $18,000, or more, per year, per person premiums, and would drop out entirely.

As you can see, in this scenario, unsubsidized pre-existing condition enrollees (i.e., those earning more than ~$42,000/year) would end up paying roughly 18 times as much as their "Cruz Plan" counterparts. Paying 43% of your annual income for your health insurance policy doesn't sit too well with most people. Enter fellow math-averse GOP Senator Mike Rounds:

The Cruz amendment, in short, sets up a classic adverse selection problem that could price those with pre-existing conditions out of the market.

But since this amendment is what Cruz and Lee have named as their price, Senate leaders have to find a way to let them have it—but with some adjustments to ensure that it doesn’t scare off moderates, vulnerables, and really any senators concerned about sustainable insurance markets. Resolving the conundrum Cruz’s amendment presents is now a central debate among Republican senators as they round up members for a vote next week.

One option that’s gaining steam, because it sounds like it could work in the abstract, is being pushed by South Dakota Sen. Mike Rounds. Though nothing’s been put to paper yet, the idea would be to link the prices of the compliant and noncompliant plans by a ratio to prevent the ACA plans from spiraling in cost while the “Cruz plans” remain nice and cheap.

“I talked to Sen. Cruz a couple of weeks ago about it and told him I would support it as long as there are provisions built into it so long as there is a ratio, a specific ratio, between the least expensive plan and the most expensive plan that any insurance company offers,” Rounds told reporters Monday afternoon. “And if [insurers cut the price on a cheaper] pool, they have to cut the price on the most expensive pool as well.” In other words, Rounds wants to keep the sicker pools tethered to the healthier pools, so insurance companies couldn’t keep premiums low for the plans healthy people want to buy while allowing premiums to skyrocket for the Obamacare plans sick people need.

OK. I'm guessing the idea here is to use a model similar to the current 3:1 "age band" on ACA policies. Granted, I don't know what the ratio would be...how much more "should" people with pre-existing conditions be forced to pay for the sin of being sick? 2:1? 4:1? I'll go with 3:1 for the moment.

Now, ACA critics often criticize the law for artifically keeping a 3:1 age band ratio when they claim that, actuarially speaking, older folks actually cost 5-6 times as much, which is why the BCRAP bill would change the age band from 3:1 to 5:1. That's a fair discussion to have...except that much of that gap (not all) is made up for by way of the ACA's tax credit structure, which provides additional subsidies to a large chunk of older enrollees anyway. In other words, it's a legitimate issue, but one which can be resolved.

However, if I'm understanding the "Cruz Roundkick" (or whatever they're gonna call it), it would attempt to bring an 18:1 actuarial ratio down to a 3:1 pricing ratio...but would try to do so without providing any additional tax credits in the process.

This...simply doesn't work. Remember, the ACA is already having problems "forcing" a 5:1 reality to work with 3:1 legislation, using tax credits available to people earning less than 400% FPL, based on a Silver plan.

The "Cruz Roundkick" amendment would create a worse version of this problem by trying to cram an 18:1 reality into 3:1 legislation, using tax credits only availalbe to people earning less than 350% FPL, based on a Bronze plan.

And don't forget, even if they somehow managed to make this nonsense math work, those people would still have to pay 3 times as much as their Cruz Plan counterparts.

So how could they make this work?

I called health care expert Larry Levitt, senior vice president of the Kaiser Family Foundation, to get his thoughts. He said the most glaring obstacle seems to be that that it would be difficult to link such unlike products operating under their own set of rules. Tethering highly regulated plans to wholly unregulated plans could be like tethering a hot-air balloon to Jell-O.

...Another approach to containing the costs of the regulated pools, Levitt said, would be to transfer money from low-risk pools to high-risk pools. This is similar to the “risk-adjustment” transfers that currently occur under Obamacare, but doing it between regulated and unregulated plans would be harder.

“The way risk adjustment works [under Obamacare] is that each insurer gets a score based on the risk of its population,” Levitt said, but they’re offering plans with the same benefits. So “how do you assign a score,” to use one hypothetical, “to one plan that covers prescription drugs and another plan that doesn’t?”

But Cruz, Lee and Rounds want their superrich tax cuts, dammit, so to hell with math and reality.