(sigh) That's not how it works. That's not how any of this works.*

Over at Bloomberg News, Katherine Doherty has a story about the outgoing Obama administration's Hail Mary attempt to get more millenials to enroll in ACA exchange policies for 2017 in order to help stabilize the risk pool:

Two months before President-elect Donald Trump begins his attempt to repeal the Affordable Care Act, the Obama administration and its allies are making an aggressive final push to sign-up some of the program’s most reluctant customers -- young people.

Healthy and new to the workforce, the “young invincibles” -- people aged 25 to 34 -- represent the highest uninsured rate of Americans, according to a survey released in November by the Centers for Disease Control and Prevention. While coverage of people in that range has grown under Obamacare, the group has for the last five years had the highest rates of uninsurance compared to other age bands.

It's a good story, but there's one section in particular with a line which will make anyone with the slightest idea about how insurance works wince:

Megan Tice-Royea, 29, didn’t sign up for health insurance last year. “I’ve always been a healthy person,” Tice-Royea said in a phone interview. She works 40 hours a week as a manager at a family grocery store in Newport, Vermont, a job that pays $14 an hour. In September, she was admitted to the hospital with a gallbladder infection. The surgery left her $32,000 in debt.

“I knew I couldn’t afford it,” she said. “It was a life-or-death situation.” Now she’s considering signing up for an insurance plan through Obamacare, but only if it will help pay off her earlier medical bills. “I feel like this is the only way to go. I just wish we had better options.”

(sigh) Aside from Ms. Tyce-Royea's cringe-inducing lack of understanding about how insurance works, out of curiosity, I decided to take a look at her situation by plugging her info into the Vermont Health Connect ACA exchange website.

- 29 years old (presumably she was 28 at this point last year)

- Lives in Newport, Vermont

- Earns $14/hour; at 40-hours per week, that's around 2,000 hours per year or $28,000/year

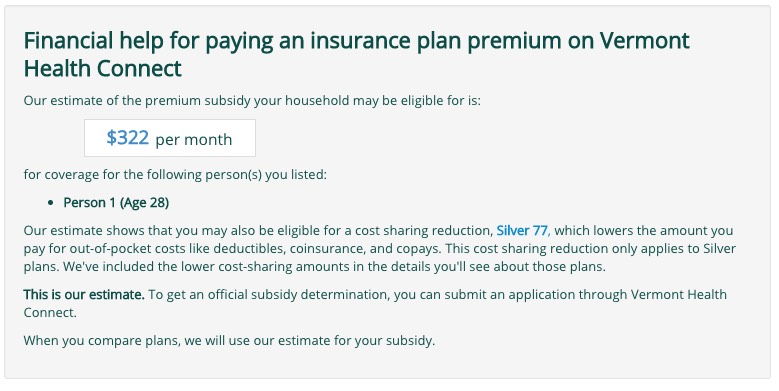

Assuming she's single, this would have qualified her for $322/month in financial assistance, along with CSR (cost sharing reduction) assistance for 2016 if she'd chosen a Silver plan.

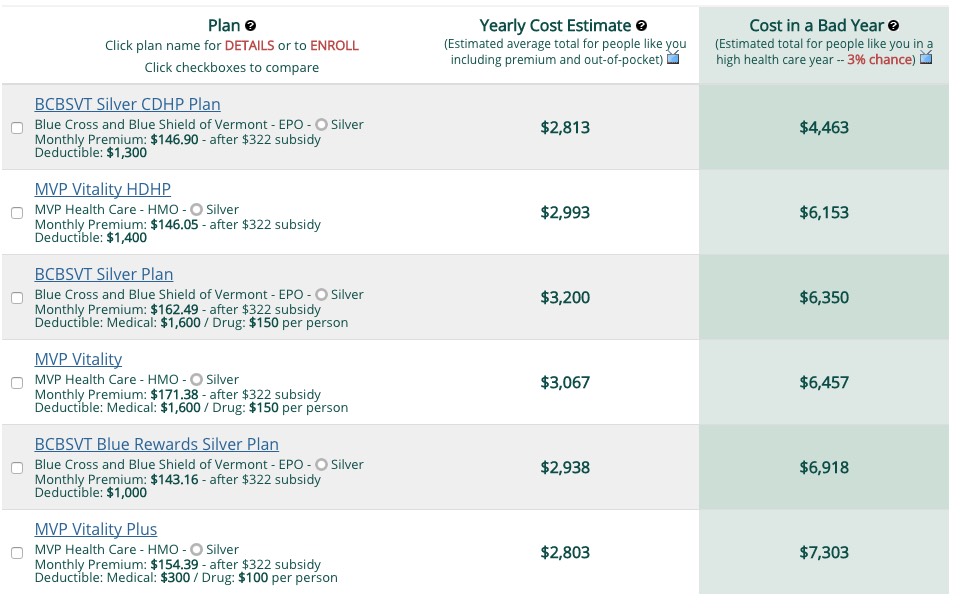

This brought up 6 Silver plans, ranging from $143 to $171/month after the subsidy, with a deductible ranging from $300 - $1,400 (the footnotes above note that the deductible is after CSR has been applied). Assuming she didn't have any medical expenses at all this year, her cost would've been as little as $1,716 for the entire year (6.1% of her income). Her worst-case scenario, had she chosen the BCBSVT Silver CDHP plan, would have been less than $4,500 for the year including the full deductible, co-pays and coinsurance (16% of her income).

Of course, she could be married, have kids, etc. in which case her situation would be different, but I think you get my point.

Instead, she's $32,000 in debt.

*Hat tip to Adrianna McIntyre for the heads up. Aside: it turns out this saying originally came from...an insurance commercial.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.