Tennessee: *Approved* 2017 rate hikes: 59%, state exchange market "Very Near Collapse"

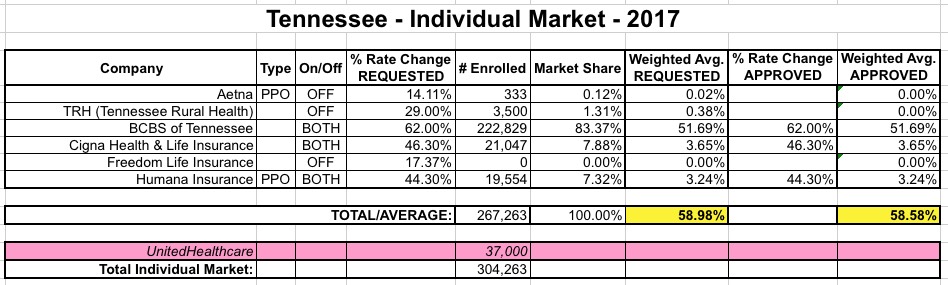

As noted a couple of weeks ago, all three of the major insurance carriers participating in Tennessee's individual market ACA exchange asked for massive rate hikes this year, ranging from 44-62%. Blue Cross Blue Shield asked for 62% in the first place; Cigna and Humana resubmitted their original requests for higher ones.

Today, they received what they asked for from the state insurance commissioner (h/t to "M E" for the tip):

Tennessee's insurance regulator approved hefty rate increases for the three carriers on the Obamacare exchange in an attempt to stabilize the already-limited number of insurers in the state.

...BlueCross BlueShield of Tennessee is the only insurer to sell statewide and there was the possibility that Cigna and Humana would reduce their footprints or leave the market altogether.

“I would characterize the exchange market in Tennessee as very near collapse ... and that all of our efforts are really focused on making sure we have as many writers in the areas as possible, knowing that might be one"...[state insurance commissioner] McPeak said to The Tennessean.

...“Beyond rates as we’ve discussed with the (TDCI) we continue to have concerns about uncertainty with the ACA at the federal level," Vaughn said to The Tennessean. "Due to these concerns we are keeping all of our options open at this point about participating in the 2017 marketplace. We anticipate making a final decision in mid-September.”

...Cigna asked for and received an average 46.3 percent increase. Humana asked for and received an average 44.3 percent increase. BlueCross BlueShield of Tennessee, which did not refile its request, asked for and received a 62 percent increase.

The article closes with a paragraph which encapsulates the debate over how much premiums are "really" increasing each year:

“Consumers in Tennessee will continue to have affordable coverage options in 2017. Last year, the average monthly premium for people with Marketplace coverage getting tax credits increased just $2, from $102 to $104 per month, despite headlines suggesting double digit increases,” said Marjorie Connolly, HHS spokeswoman, in a statement.

As always, there are two ways of looking at this. If you're only looking at the appx. 9.4 million people or so who are receiving APTC tax credits (of whom roughly 2/3 are also receiving CSR assistance as well), then the Scary Headlines aren't really that major of a concern. This is true.

The problem, as always, is that those 9.4 million people only make up around half of the total individual market. The other half (around 1.7 million on the exchanges and another 7-8 million off of the exchanges) have to pay full price for their individual policies; those folks are bearing the full brunt of the rate hikes, nor do any of them qualify for CSR assistance. That's the reason why I do my best to include all ACA-compliant policies (both on and off-exchange) when I estimate the annual rate hike averages, and I do so assuming the full, unsubsidized premium amounts.

Technically speaking there are 3 other indy market carriers in Tennessee, but the less said about "Freedom Life" the better, while Aetna and Tennessee Rural Health (TRH) only have about 3,800 enrollees between them, all off-exchange only. The article doesn't specify the approved hikes for those two, but unless it's absurdly higher or lower than what they requested, it wouldn't move the needle on the statewide average by more than a tenth of a point or so.

In many states like California, the ACA exchanges are doing just fine...but in some states like Tennessee and Arizona, it's not a pretty picture: