Rhode Island: Insurance Commissioner *approves* avg. indy market rate hike of 1.3%

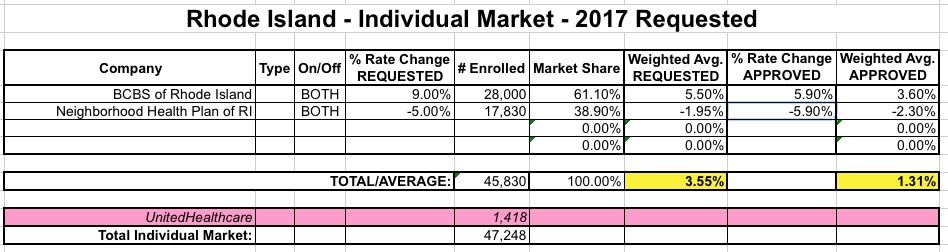

Rhode Island, in addition to being one of the smallest states, is also one of the first states I crunched the rate hike numbers for back in late May. It was actually pretty easy to run a weighted average hike request since there are only 2 carriers even operating on the individual market next year: Blue Cross Blue Shield of RI and Neighborhood Health Plan (UnitedHealthcare is dropping out of the RI indy market entirely, but only has about 1,400 people enrolled to begin with).

Anyway, BCBS was asking for a 9% increase, while Neighborhood is among the very few carriers to actually request a rate decrease...of around 5%. As a result, Rhode Island has the honor of having the lowest average rate hike request of all 50 states (+DC) next year...a mere 3.6% overall, which is awesome.

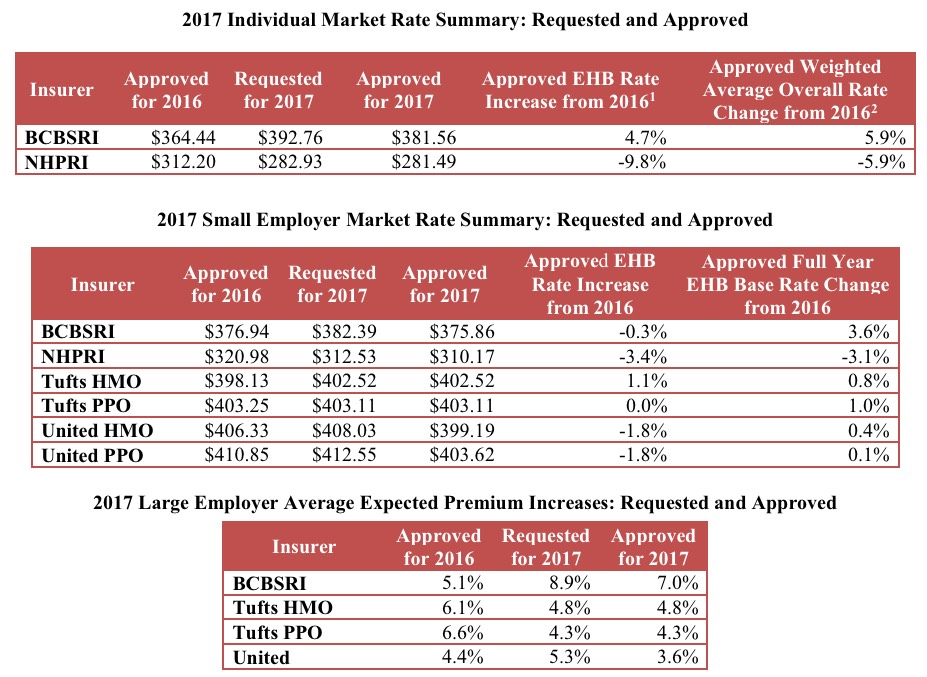

Well, nearly 3 months later, the RI Insurance Commissioner has weighed in with even more good news: Rates will be going up even less than that in 2017:

Health Insurance Commissioner Kathleen C Hittner, MD today announced her final decision on commercial health insurance premiums for 2017. She approved lower rates than those requested for most health insurers, resulting in approximately $18 million dollars in savings for individuals and employees. The rising cost of medical care – the prices insurers pay to providers for particular services and the number of services members use – continues to be the main driver of health insurance premium growth.

As a bonus, not only does the memo lsit the approved rate hikes for the individual and small group markets (which I have a scattershot history of tracking), but they even include the large group market, which I almost never write about or try to analyze:

Yup, the BCBS increase is several points below what they had asked for, and the Neighborhood rates will be even lower than the carrier had requested. Here's what it looks like when you plug in the enrollment figures:

That's a nominal 1.3% average rate hike across the statewide individual market.

As for the small and large group markets, I haven't run their requested rate changes at all and I don't know the relative market share of the carriers, but an unweighted average of each comes in at just a 0.5% increase for the former and 4.9% for the latter...both of which are about as stable as you could ask for.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.