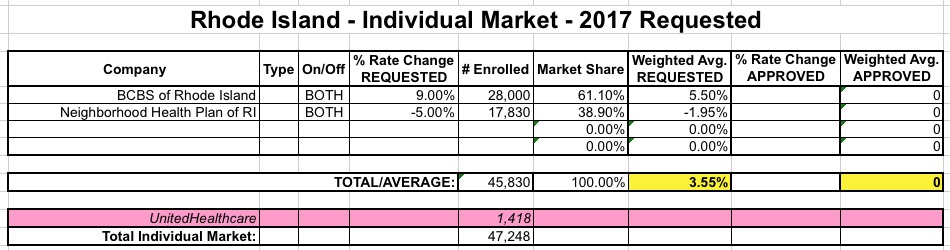

2017 Rate Request Early Look: Rhode Island

This year only 3 insurance carriers are offering policies on the individual market in Rhode Island: Blue Cross Blue Shield, Neighborhood Health Plan and UnitedHealthcare. The bad news is that United is pulling out of RI, although they only hold about 4% of the on-exchange market anyway. The rest of the on-exchange market is split almost evenly between BCBS and Neighborhood.

Both Neighborhood Health Plan and BCBS have submitted their filings, and there's some great (and surprising, for this year) news:

Carriers file two average rate increase amounts with OHIC: the EHB base rate increase and the weighted average rate increase. These two percentages reflect different calculations.

- Essential Health Benefits Base Rate Decrease: After considering all the pricing assumptions except for benefits and cost sharing, the average rate decrease for a theoretical plan that provides 100% coverage for all Essential Health Benefits would be 9.4%. Since this EHB decrease uses a theoretical plan, it allows for comparisons across health insurance carriers and across years.

- Weighted Average Rate Decrease: However, consumer plans have adjustments to reflect the benefits selected, including modifications to prior year benefits and pricing. The average premium decrease to consumers, before reflecting changes in age is expected to be 5.0%.

This is the first insurance carrier I've seen requesting a rate decrease for 2017. Unfortunately, I only know Neighborhood's on-exhange enrollee number (around 18,000 people), not their off-exchange number. I'll update the table accordingly if I'm able to find that.

As for Blue Cross Blue Shield, they're raising their rates about 9% for 28,000 people both on and off-exchange:

Carriers file two average rate increase amounts with the Office of the Health Insurance Commissioner (“OHIC”): the Essential Health Benefits Base Rate Increase and the Weighted Average Rate Increase. These two percentages reflect different calculations.

- Essential Health Benefits Base Rate Increase: After considering all the pricing assumptions except for benefits and cost sharing, the average rate increase for a theoretical BCBSRI plan that provides 100% coverage for all Essential Health Benefits (EHB) is 7.8%. Since this EHB increase uses a theoretical plan, it allows for comparisons across health insurance carriers and years.

- Weighted Average Rate Increase: Plan rates are adjusted to reflect the benefits selected, including modifications to benefits and cost sharing. The average premium increase to BCBSRI members, not reflecting changes due to age, is expected to be 9.0%.

- ...This filing impacts about 28,000 individuals now enrolled with BCBSRI and new customers joining after January 1, 2017. These individuals are enrolled either: directly with BCBSRI; or through Rhode Island’s health insurance marketplace (HealthSource RI).

Add them up and you get a weighted average increase of just 3.6%...and again, that's assuming that Neighborhood only has 17.8K enrollees. If their off-exchange enrollment is similar to BCBS (ie, around another 10,000 people), that would bring the overall average down even further, to around 2%, but I'll go with 3.6% for the moment.