IMPORTANT UPDATES: w/out details, Ohio woman's story blaming Obamacare for her rate increase makes little sense...

UPDATE: I made two major errors in my original calculations below: First, I thought that Ms. O'Donnell lived in Howell, Ohio; it turns out she lives in Powell, Ohio. Secondly, I didn't realize that her children likely qualify for the CHIP program, which is essentially the kid's version of Medicaid. I've updated all calculations to reflect both of these factors...and they actually make the point of the diary even more valid).

I didn't tune in to this evening's CNN Democratic Town Hall until right after a key question to/response from Hillary Clinton specifically about the premiums for individual policies on the Affordable Care Act exchanges. Fortunately, several people were uploading the entire things in chunks (of varying audio/video quality) even as it was being broadcast, so I was able to watch the clip in question:

Here's the transcript:

JAKE TAPPER, CNN: Secretary Clinton, I want you to meet Theresa O'Donnell; she's an office coordinator from

HowellPOWELL*, Ohio. She says she's leaning in your favor, but has not yet made the firm and complete decision.

*UPDATE 3/14/16: My mistake; she's from Powell, not Howell; see further updates below.

O'DONNELL: Hello, I voted for Obama, but then my health insurance skyrocketed, from $490 a month to $1,081 a month, for a family of 4. I know Obama told us that we'd be paying a little more, but doubling...more than doubling our health insurance costs has not been a "little" more. It has been difficult to come up with that kind of payment every month. I would like to vote Democratic, but it's cost me a lot of money, and I'm just wondering if Democrats really realize how difficult it's been on working-class Americans to finance Obamacare.

CLINTON: Well, thank you for asking me that, because...may I ask, before, were you buying your family health insurance in the individual family market...were you getting it through an employer...how were you insured before?

O'DONNELL: Purchasing it privately because we both had bouts of unemplolyment.

CLINTON: So you were going to a broker, and buying a health insurance policy.

O'DONNELL: Yes.

CLINTON: And, in effect, it nearly tripled after you went on the exchange, and bought a policy under the Affordable Care Act, is that right?

O'DONNELL: We could not; it was much more expensive than just purchasing private insurance from the insurance company.

CLINTON: So...you're still buying your private insurance directly?

O'DONNELL: Yes.

CLINTON: OK. Well, first of all, let me say, I want very much to get the costs down, and that is going to be my mission, because I do think that for many, many people...there are exceptions, like what you're telling me...having the Affordable Care Act has reduced costs, has created a real guarantee of insurance, because if you had a pre-existing condition under the old system you wouldn't have gotten affordable insurance.

So, it's done a lot of really good things, but it has become increasingly clear that we're going to have to get the costs down, and what I would like to see happen for you and your family is that if we can get the co-pays down, the deductibles down, get the prescription drug costs under control, that you would find an affordable plan on your exchange, and the one thing that I would like you to do--and I'm not saying that it's gonna make a difference--but I would like you to just go shopping on that exchange. As I understand it, Ohio has the federal exchange--is that right Joyce?--because they did not set up a state exchange. So, you have the federal exchange, and to go on and keep looking to see what the prices are, because we need to get more competition back into the insurance market.

One thing that I want to work on with my friends from Congress who are here, is we've got to get more non-profits that are capable of selling insurance back into the insurance market. Y'know, Blue Cross & Blue Shield used to be non-profits...and then they transformed themselves into for-profit companies. And there was some effort made under the Affordable Care Act to get some competition from non-profit institutions. Some of them work...and a lot of them didn't...and I want to know what we can do...because if you could get a range of insurers--some of whom were not-for-profit companies--that would lower costs.

So, there's a number of things I'm looking at...and what I want to assure you and your family of is that I will do everything I can as President, working with members of Congress, where necessary, to try to get the costs down. But I do want you to keep shopping, because what you're telling me is much higher than what I hear from other families. And, so, I want to be sure that if there's a better option out there for you, you're gonna be able to take advantage of it, and then I'll work as hard as I can to get the costs down for everybody, and that includes prescription drug costs, which are skyrocketing, and increasing costs for everyone else.

The problem here is that on the one hand, given the live, televised town hall format, you certainly can't expect Ms. O'Donnell to give a 20-minute, detailed explanation of how much her family earns, the exact carrier and type of policy that they had prior to the ACA exchange policies launching in 2014, which specific policy they chose for 2014, whether they kept the same policy in 2015 and/or 2016 and so on.

On the other hand, some of those details are pretty damned important to know in order to understand Ms. O'Donnell's situation. Clinton made sure to have her clarify one of the most important ones: She and her family were not previously covered via an employer-sponsored policy, and she also got her to clarify that their new policy was not purchased via the ACA exchange, but rather directly via their insurance carrier.

Both of these are crucially important to know, and the second one raises a really important question: Why on earth didn't this woman enroll via HealthCare.Gov? Her response is something about the exchange policies being "much more expensive" than purchasing it directly from the carrier...but that makes no sense at all since she had just gotten done saying that she and her husband "both had bouts of unemployment" and are a "working class" family of 4.

If that's the case, then she and her family presumably earn well under 400% of the Federal Poverty Line ($97,000/year for a family of 4), and therefore should have qualified for reasonably hefty federal tax credits (APTC) to cut the premiums down to size and possibly even cost sharing reduction (CSR) assistance for co-pays/deductibles, assuming their income was under 250% FPL ($61,000/year).

Without having any additional information to go on, I'd be willing to bet that Ms. O'Donnell probably did go to HealthCare.Gov and looked around, but likely didn't enter her family's income/etc. into the window shopping tool to see whether they qualified for financial assistance. If not, that could easily explain why she thought that they'd have to pay such high rates via exchange policies vs. going off-exchange.

The other major problem here is that we have no idea what sort of policy the O'Donnell family had before, nor do we know what type of policy they're currently enrolled in. That $490/month policy might have been a so-called "junk" policy which barely covered anything...or it might've been awesome. Their new $1,081/month policy might be fantastic...or it might be skimpy with a huge deductible. We really don't know in either case...and Sec. Clinton was obviously thinking the same thing I was, but couldn't ask too many nosey questions about her personal finances or specific details of either the old or new policies, either. Doing so would have bogged the town hall down and made her look too wonkish, while also making her look like she was badgering the voter, which is never a good look for a candidate.

However, let's assume that the woman did keep the same (or a very similar) policy (which is a huge assumption on my part). Let's further assume that it was a decent "Silver" plan in both cases (again, a huge assumption).

She's from Howell, Powell, Ohio, which is in Lawrence County Delaware County. I plugged what I know of Ms. O'Donnell's situation into the HC.gov shopping tool. I don't know her or her family's ages or income, but made a guess at the following: Let's say that she's 40 years old and her husband's 42, with two children ages, say, 10 and 13 (?). I'm also going to assume that since she and her husband both had "bouts of unemployment" that their household income was around $40,000 last year (??).

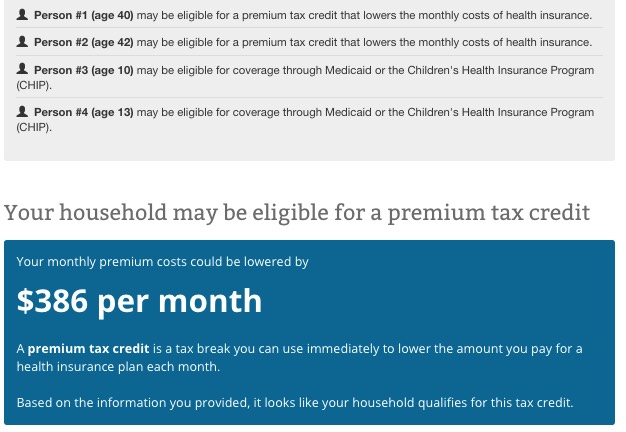

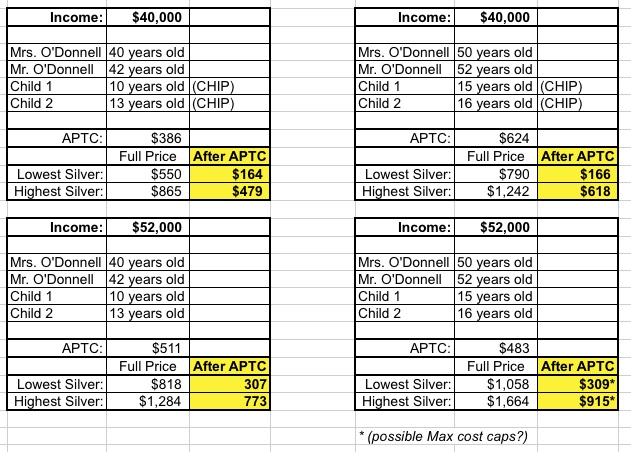

If so, the family would qualify for a $651/month $386/month advance premium tax credit towards their policy, as well as some amount of Cost Sharing Reductions:

In addition, note that in this situation, as Andrew Sprung brought to my attention, the children would qualify for Medicaid/SCHIP (Ohio did accept the ACA's Medicaid expansion provision, but even aside from that, Ohio already covered children up to 206% of the federal poverty line anyway). That just leaves the parents.

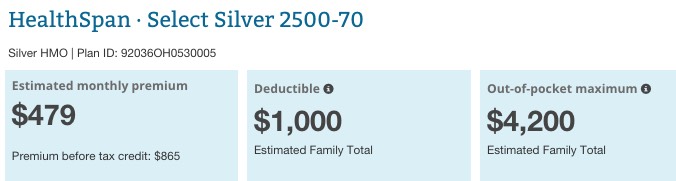

Now, what about the plan itself? Even the most-expensive Silver plan on the market for two non-smoking adults, aged 40 & 42 in Howell, Powell, Ohio is only $865 at full price, with a $1,000 deductible and a $4,200 out of pocket maxiumum...and with that $386 tax credit, the monthly premium would have actually been just $479/month...$11/month lower than the $490 they were paying before.

In fact, the most expensive policy I could find to her "$1,081/month" figure was a Gold plan from HealthSpan which would run $1,033/month full price ($646 after the tax credits).

But what about the children? Above, I assume a $40K/year income, which puts the family well under the 206% FPL cut-off for CHIP. What if they're above that threshold, however?

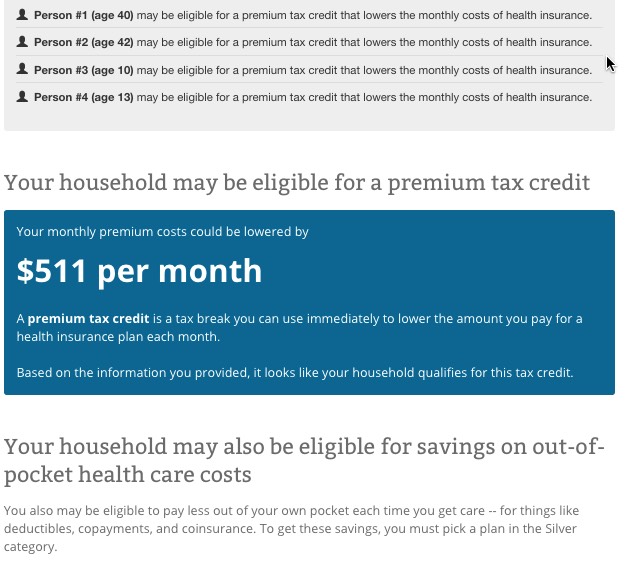

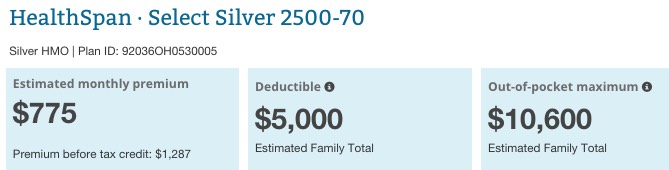

For a family of 4, the FPL is $24,300. 206% of that is $50,058. IF the O'Donnell family earns $52,000, the kids are no longer eligible for CHIP...but the tax credits increase to $511/month:

In this scenario, the most expensive Silver plan is indeed $1,287/month at full price, but again, after the tax credit this drops to $773/month for the O'Donnell's...$308 lower than the $1,081 she says they're paying now:

Again, the tax credit and CSR amounts could be much higher or lower depending on their actual ages/income, and I haven't a clue how comprehensive either their old or new policies were/are, but the odds of a "working class family of 4" in which both parents have had "bouts of unemployment" having to pay over $1,000/month for a decent policy on the ACA exchange are virtually zilch. Again, the above examples are the most-expensive Silver plans; there are a dozen or so other options available in either scenario in which a Silver plan is available for as little as $164 (at $40K income) or $307 (at $52K income).

FINALLY, age makes a big difference. To this end, I plugged in two additional scenarios, with Mr. & Mrs. O'Donnell being aged 52 and 50 respectively, with the kids aged 15 and 16, at both the $40K and $52K levels. Here's what all 4 look like:

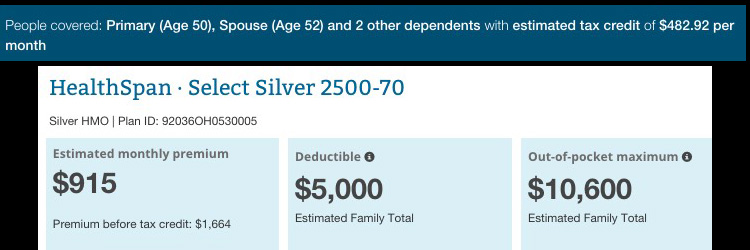

As you can see, the worst-case scenario ($52K income, so the kids don't qualify for CHIP) here has the family paying $915/month for the most-expensive Silver plan...but they would still have a wide range of options which start at $309/month.

The odd thing here is that according to HC.gov, the APTC amount is only $483, but the premium shown is $749 less than the full price amount; this may be due to the maximum cost caps of the ACA, but I'd have to look further to be sure:

The larger point is that I don't see any potential circumstances in which Ms. O'Donnell and her family should have to be paying $1,081/month for a half-decent policy in Powell, Ohio...and at the same time, that original $490/month figure sounds suspiciously low, even accounting for lower premiums in 2013. Remember, this is for a family of 4...what sort of coverage did they actually have at the time?

It's important to stress that none of this is to accuse Ms. O'Donnell of anything. After all, one of the appealing ideas behind moving to single payer insurance is that doing so would simplify the entire healthcare coverage system, getting rid of all sorts of confusing terms and complicated formulas.

Even so, the question as presented was lacking some crucially important details.

Update: One other big unknown: We have no idea when she was paying $490/month. I'm assuming that she meant that she paid $490 in 2013, and is paying $1,081/month for 2016, but that might not be the case. If so, then it's important to note that premium rates were increasing at around 11% per year on average BEFORE the ACA went into effect, or 37% more in 2016 than 2013. In other words, $180 of that increase was already probably baked in no matter what...and if the original policy sucked, it would suck just as badly today for $180/month more.

As for Clinton's response...

The good news is that she did try to gently emphasize the importance of shopping around on the ACA exchange, and made it clear that something about the "more than doubling" of the woman's premium didn't seem to add up. In addition, I actually applaud Clinton for pushing on the "bring more non-profits to the exchange for competition" front. Her reference to "some effort being made" to include non-profit carriers was obviously referring to the ACA-created Co-Ops, half of which have failed (while the other half are mostly on shaky ground), and she more recently came out strongly in favor of bringing back the much-ballyhooed "Public Option"...at the state level.

The obvious reason for pushing state-based public options is that she knows damned well that it's never gonna go through at the federal level with a GOP-held Congress. The thing is, though, state-based "public options" really amount to something very similar to what the Co-Ops are already...it's mainly a matter of whether they'd be left to sink or swim on their own, or if there'd be some sort of guaranteed funding to tide them over the rough patches. Interestingly, the example Hillary used about Blue Cross/Blue Shield originally being non-profits was the exact same point she made in this recently-released email from the height of the 2009-2010 battle over the ACA before it even passed:

...That expertise is clear in some of the email messages, in which, for example, Mrs. Clinton questioned a decision by Senator Max Baucus of Montana, a main drafter of the legislation, to use nonprofit health insurance cooperatives to compete with profit-making insurers, rather than a government-run health plan, known as the public option.

“But the ‘system’ let the Blues go public,” she wrote in a message to Ms. Tanden, referring to the health insurance giant Blue Cross/Blue Shield, after learning of the Baucus plan. “What’s to prevent the co-ops from incorporating down the road? The return of nonprofits would have to require no changes.”

Sec. Clinton was a clear proponent of a federal Public Option back in 2009-2010, and is calling for state-based versions of the PO today. As far as I can tell, the main reason for the change is, again, the fact that both the House and Senate are held by the GOP, neither of which would be willing to add a PO back at the federal level.

Unfortunately, Clinton's response came through as being kind of muddled to me. While I understand her not pestering O'Donnell with a whole bunch of personal questions, I probably would have opened with something like this:

"Before I begin, I just wanted to check to see if you tried out the window shopping tool on the exchange website; if your household income is under $97,000, you probably qualify for tax credits to help lower the cost, and if it's under $60,000, you can cut your co-pays and deductibles down quite a bit as well. Having said that...."

Not only would this address the "nosey question" issue quickly without embarrassing the lady by actually asking her income, it would also instantly explain to the woman why she should go back onto the exchange and not just shop around, but actually plug in her info.

UPDATE: Someone pointed out that Hillary was very unlikely to have the exact FPL dollar figures in her head at that moment. An even simpler, faster response would have been along the lines of:

“if your household income is below a certain level, you qualify for financial assistance...there’s a website tool you can use to find out!”

The problem with this, of course, is that Open Enrollment is over now. The O'Donnell family is stuck with their $1,081/month policy through the end of the year unless some major life change occurs that qualifies them for a Special Enrollment Period.

Anyway, Hillary's response may have seemed "meh" to most people, but given that she only had a couple of minutes to try and respond to a question which was nearly impossible to answer without additional details, I'm willing to cut her a bit of slack here.

UPDATE: Thanks to Jurisdog for pointing out that it's possible that she and her family are caught in the ACA's "Family Glitch", in which a family doesn't qualify for APTC assistance if one member of the family is eligible for employer-sponsored insurance. I doubt this is the case, but it's possible...but again, without knowing more details about their family employment situation, it'd be impossible for Hillary (or the audience) to speculate.

UPDATE 3/14/16, 11:45pm: Both Andrew Sprung and Michael Hiltzik have chimed in. Sprung strongly suspects that the "Family Glitch" scenario is the most likely explanation, while Hiltzik focuses more on my larger point, that health insurance has always been complicated, and that Clinton would have to know a lot more details in order to understand the O'Donnell's situation.

UDPATE 3/14/16, 4:00pm: According to Mike James via Twitter, Powell, Ohio is one of the wealthiest zip codes in Ohio. I looked it up and sure enough, 43065 is definitely up there, with a median household income of around $124,000 and median house/condo value of $324,000.

This proves nothing, of course; I live in a pretty affluent area myself, after all, and there are always some households well below the norm income-wise. It's certainly possible that the O'Donnell's fall into this category...but it does add to the puzzle.

3/15/16: SEE IMPORTANT FOLLOW-UP POST