UPDATE: Yes, the ACA mandate penalty costs less than the premiums for some people, but...

Abby Goodnough had an interesting story in the NY Times yesterday about the fact that for some people, simply paying the Affordable Care Act's "Shared Responsibility" tax (otherwise known as the Individual Mandate penalty) may actually be more affordable than actually signing up for an ACA-compliant healthcare policy.

I've written about this before, of course. It is absolutely true that for some people (the Kaiser Family Foundation estimates roughly 7.1 million people), their mandate tax (whether a flat $695/person or 2.5% of their household income, whichever is greater) is indeed less than the annual premiums for the lowest-cost policy available in their area (even after taking federal tax credits (APTC) into account). By KFF's estimates, the mandate tax would cost more than the least-expensive policy for only around 3.9 million currently-uninsured Americans (although the actual number of uninsured who could potentially enroll in exchange policies, whether with APTC or at full price, seems to be closer to 15 million according to the very same KFF study from which they stated the 11 million figure...I'm not sure what accounts for the 4 million difference, but that's actually besides the point here).

Now, as I noted in my own analysis of the potential impact of the mandate tax on "Young Invincibles", I noted that given a choice between paying $X for nothing and $X + (some variable amount) for a ACA-compliant healthcare policy, my guess is that most people are likely to still go ahead and sign up as long as the cost is less than perhaps twice as much, even if the plan itself seems somewhat skimpy.

In other words, if the choice is between a $700 penalty for bupkis and, say, $1,000 for a Bronze plan (43% more), most people will probably go ahead and spring the extra $300...but they if the least-expensive plan is more than twice the penalty (say, $1,500) they're much more likely to say "screw that!" and just pay the tax. Again, I'm not basing this on any hard analysis, it's just my gut instinct; I could be wrong about this.

Here's the first example from the NY Times story:

Mr. Murphy, an engineer in Sulphur Springs, Tex., estimates that under the Affordable Care Act, he will face a penalty of $1,800 for going uninsured in 2016. But in his view, paying that penalty is worth it if he can avoid buying an insurance policy that costs $2,900 or more. All he has to do is stay healthy.

“I don’t see the logic behind that, and I’m just not going to do it,” said Mr. Murphy, 45, who became uninsured in April after leaving a job with health benefits to pursue contract work. “The fine is still going to be cheaper.”

In Mr. Murphy's case, my theory obviously doesn't hold: $2,900 is only 61% more than his $1,800 penalty. He states flat-out that he'd rather shell out $1,800 for literally nothing than spend an additional $92/month (about the cost of a smartphone service plan) to have healthcare coverage. He literally states that his plan is to simply "not get seriously sick or injured".

The article goes on to clarify that Mr. Murphy "earns too much to qualify for federal subsidies that defray the cost of coverage". I don't know if Mr. Murphy is married/has kids, but I'm assuming not since neither is mentioned in the article and $2,900 breaks down to $242/month, which, at full price, is unlikely to cover more than one person. I plugged in a 45-year old man living in Sulfur Springs, Texas into HealthCare.Gov, earning more than $47,080/year (400% of the Federal Poverty Level for an individual), and sure enough, the least-expensive plan for him is a BCBSTX HMO for $243/month with a $6,750 deductible.

Of course, if Mr. Murphy does become seriously sick or injured over the course of 2016, that extra $1,100 is gonna seem like chump change, even including the $6,750 deductible.

But, whatever; he's decided to play the odds, which is his right. That's one example.

In any event, it's the next case study where I have a bit of a gripe:

Susan Reardon, 61, of Kalamazoo, Mich., said she was leaning toward going uninsured this year. She calculated that she would have to spend more than $12,000, including premiums of nearly $500 a month and a $6,850 deductible, to get anything beyond preventive benefits from the cheapest exchange plan available to her.

Ms. Reardon, whose husband is old enough to be covered by Medicare, said she would rather pay out of pocket for the drugs she takes for fibromyalgia and the handful of doctor appointments she tends to need each year.

If something catastrophic happens, she said, “I feel like it’s better just to die.”

As for the tax penalty, which could approach $1,500 for her?

“Come and get me,” Ms. Reardon said.

Setting aside Ms. Reardon's rather curious declaration that she feels her own life is worth less than $12,000 per year, I looked up her specs at HC.gov and it's true: $497/month ($5,964 for the year), plus a $6,850 deductible.

It's important to note that neither Mr. Murphy nor Ms. Reardon are hardship cases; both of them earn more than 400% of the federal poverty line (which is why neither one qualifies for federal tax credits).

Of course, it's also worth noting that Ms. Reardon's Out of Pocket Maximum is also $6,850 for the plan in question, which means that once the deductible is paid off, there'd be no further co-pays or other cost sharing on her part as long as she stays in network and doesn't require non-essential services.

The point is this: Ms. Reardon is comparing her $1,500 penalty against a supposed cost of $12,814 when she should be comparing it against just the $5,984 for the premiums themselves.

Why? Because if she doesn't get covered, the $6,850 deductible is utterly irrelevant, since she'll have to pay 100% of all costs she incurs no matter what (and without the out-of-pocket ceiling, I should add). On the other hand, assuming she doesn't become sick/injured beyond her existing fibromyalgia drugs, her out of pocket costs would be pretty much the same either way (except that having the policy would mean no cost for regular checkups, mammograms and other preventative services).

Don't get me wrong: $5,984 is a lot more than $1,500 (4 times as much, in fact), but 4x is still a hell of a lot less than the 8.5x implied by Ms. Reardon's calculations.

My point is this: If you're going to compare "how much it would cost" to get covered vs. not getting covered, you should at least do so in an apples-to-apples fashion. You can't assume that you'll be healthy without the policy but simultaneously assume that you'll need all sorts of services with the policy. Calculate each with the same assumption.

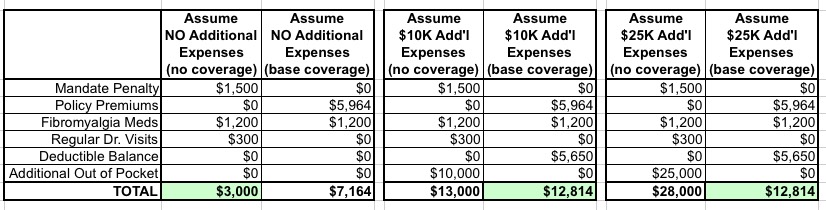

In Ms. Reardon's case, it works out this way:

- IF she has no additional healthcare needs, without coverage, her cost will be $1,500, plus her fibromyalgia drugs at full price (I haven't a clue what it costs her...let's say $100/month?), plus, say, $300 for 3 $100 "regular" doctor's appointments = $3,000 total for the year.

- IF she has no additional healthcare needs, with coverage, her cost will be $5,964, plus her fibromyalgia drugs at full price (long before the deductible is maxed). Her regular checkups would presumably be free as covered preventative care under the ACA. Let's call it $7,200 total for the year.

In this scenario, she would end up paying $4,200 more for the policy than she would if she paid the penalty, so it would indeed make sense to go without.

However, what if she has $10,000 in additional healthcare needs this year (above and beyond her expected expenses)?

- IF she has $10K in additional healthcare needs, without the coverage, her cost will be $3,000 + $10,000 = $13,000

- IF she has $10K in additional healthcare needs, with coverage, her cost will be the $5,964, plus the first $6,850 in expenses ($1,200 for the drugs, plus the next $5,650 in expenses),

plus 40% of the remaining $4,350 ($1,740).That comes out to around $14,200 or so.

UPDATE: D'OH!! I can't believe I forgot about this; thanks to Seth Trueger for reminding me that the ACA's Out of Pocket Maximum means that once it's reached, in-network covered services are covered at 100% for the rest of the year! That doesn't just mean co-pays, it also includes the 40% for services which she'd otherwise have to pay...as long as she stays in network.

So, lemme try this again: In the $10K scenario, with the policy in question, Ms. Reardon would be looking at around $12,800 for the full year...or $200 less than going without coverage. Of course, she might have to go out of network for some of it and thus end up still paying more, but it'd be a much tougher judgment call.

Finally, what if she ends up with something more serious? Say, $25,000 in additional expenses?

- Without coverage: $3,000 + $25K = $28,000

- With coverage: $12,814 = again, around $12,800 for the full year.

In the $25K scenario, Ms. Reardon would save $15,200 by getting covered, all else being equal (and again, assuming she stays in network).

Here's a simple table demonstrating the three scenarios:

Again, I'm not saying that Ms. Reardon or Mr. Murphy are wrong to opt out; it may very well be the better course of action for each of them. I'm just saying that you have to compare like vs. like when making these judgment calls.

The problem with health (or any type of) insurance, of course, is that you never know ahead of time what the coming year holds for you.

If everyone knew with 100% certainty that they aren't going to become seriously sick or have a major injury for the next calendar year, of course it would make more fiscal sense not to sign up for a healthcare policy. Unfortunately, no one has any way of knowing that. It's all about risk management...something which most people are terribly bad at calculating properly.

UPDATE x2: On a related note, Phil Galewitz of Kaiser Health News has a story today about how many insurance carriers are starting to offer additional types of primary care visits free of charge (no deductible, no co-pay) beyond those already required to be covered at no charge under the ACA:

Health insurers in several big cities will take some pain out of doctor visits this year — the financial kind.

They’ll offer free visits to primary care doctors in their networks.

You read that right. Doctor visits without copays. Or coinsurance. And no expensive deductible to pay off first. Free.

In Atlanta, Chicago, Dallas, Miami and more than a dozen other markets, individuals seeking coverage from the insurance exchanges can choose health plans providing free doctor visits, an insurance benefit once considered unthinkable. The improvements are rolling out in a limited number of plans following reports that high copays and deductibles have discouraged many Americans who signed up for private coverage the past two years from using their new insurance under the Affordable Care Act.

...The no-fee visits go beyond the many preventive services, such as immunizations and screenings that all insurers must provide under Obamacare without charging a copay, even when a deductible hasn’t been met.

Only some carriers are mentioned, and the additional types of free coverage vary from carrier to carrier, but this is an very positive development which further weakens the argument of "going bare".

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.