Yes, *NEW* QHP enrollments are *below* last year for the moment...but that may not mean anything.

Hmmmm...over at Investor's Business Daily, Jed Graham looks at HealthCare.Gov's 3rd Weekly Snapshot report from a different angle: If you set aside renewals of current enrollees, how are things looking in terms of new additions?

As I noted in my detailed 2016 OE3 projection breakdown, nationally the HHS Dept. is projecting around 8.1 million renewals, plus around 4.5 million new additions, for a total of roughly 12.6 million QHP selections (expected to then dwindle down to roughly 10.0 million still enrolled/paying by the end of next year. In contrast, I'm more optimistic: I projected around 9.0 million renewals, plus 5.7 million new additions.

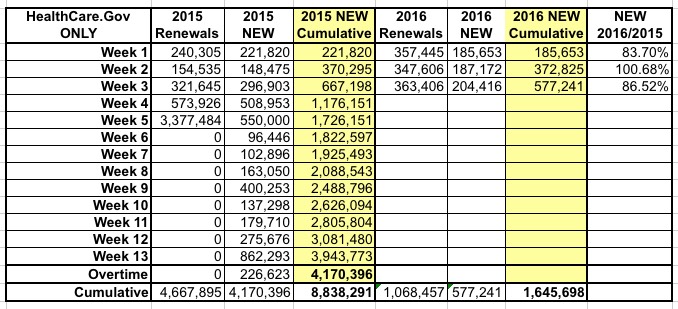

As Graham notes, however, while active renewals by current enrollees are up 49% so far (1,068,457 vs. 716,485), new additions are actually down about 13% (577,241 vs. 667,198). Graham's numbers are slightly different for both years because he rounded off using the cumulative percentages, while I used the week-by-week numbers:

Fewer new customers are signing up for ObamaCare exchange plans than at this point in last year's open-enrollment period.

In the first three weeks of enrollment for 2016 plans, 576,000 new customers selected plans via HealthCare.gov, down 13% from 664,000 a year ago, the Department of Health and Human Services said on Wednesday.

There's still plenty of time to sign up. Dec. 15 is the last day to enroll in time for coverage to start Jan. 1, and open enrollment lasts through Jan. 31. But the early data probably aren't being welcomed by insurers — and the Obama administration — hoping that the jump in the individual mandate penalty for lacking coverage would compel millions of young adults to enroll.

I decided to plug in the actual numbers based on both last year's and this year's Weekly Snapshots; here's what it looks like so far:

Graham is correct: While the 2nd week saw new enrollees slightly above 2015, for all 3 weeks combined it's down 13.5% year over year so far. There are a few factors which make this not a strict apples-to-apples comparison, of course; most notably, Open Enrollment started 2 weeks earlier this year, which means a) the Thanksgiving weeks don't match up (I expect a 30%+ drop in overall enrollment for the current week) and b) there are 2 additional weeks before the deadline for January coverage (12/15). In addition, these numbers are all for HealthCare.Gov only, which means they don't include roughly 25% of the total enrollments (via the State-based Exchanges)...and the renewal-vs-new ratios don't always match up.

Nationally last year, there were roughly 6.2 million renewals of existing enrollees and 5.5 million new additions. Let's assume that the new addition numbers this year continue to run around 13% below last year, both via HC.gov and nationally.

If so, we would end the Open Enrollment Period with roughly 4.8 million new enrollees on top of however many renewals there are. If HHS is correct about 8.1 million renewals, that would bring the grand total to 12.9 million QHP selections (around 300K higher than their mid-range projection); if I'm right about it being 9.0 million renewals, that's 13.8 million total, (roughly 900K lower than my total projection).

We won't know the renewal number until after the 12/15 numbers come in, which will be during Week 7 (12/13/15 - 12/19/15). That number probably won't be released until Wednesday, 12/23. However, even then, there's absolutely no way of knowing what will happen with the new enrollee number until after the dust settles at the end of January/ Once again, last year I nailed 12 out of 13 weeks pretty much dead-on target...but still fell way short for the final week, even with the "overtime" period tacked on. I thought there would be a massive 2.0 million surge the final week; instead it ended up being only around 1.2 million, coming in 800K short. Anything's possible.

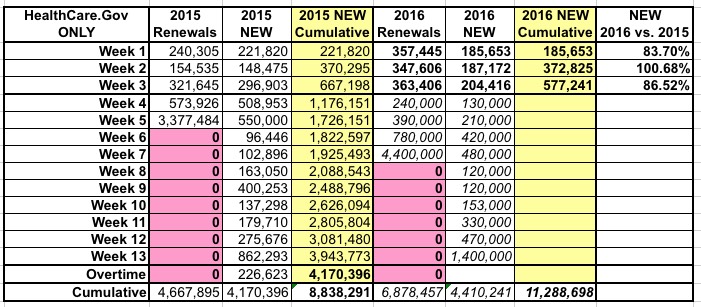

Assuming the national grand total does end up hitting my 14.7 million projection, here's roughly how I'd expect HealthCare.Gov to play out for the rest of the enrollment period (remember, this is for HC.gov only, so around 24% of total national QHP selections are missing from all of these numbers):

This assumes that the weekly ratio stays roughly 65 renewal/35 new for the next 3 weeks, then shifts dramatically to around a 90/10 ratio in Week Seven due to the bulk autorenewals being added in one shot. After that, all QHP selections should be new ones (aside from a few state-based exchanges which have their January deadline a week later (12/23) and some oddball "special circumstance" cases here and there).

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.