UPDATE: Other Notes of Interest from today's CMS Effectuated Enrollment Report

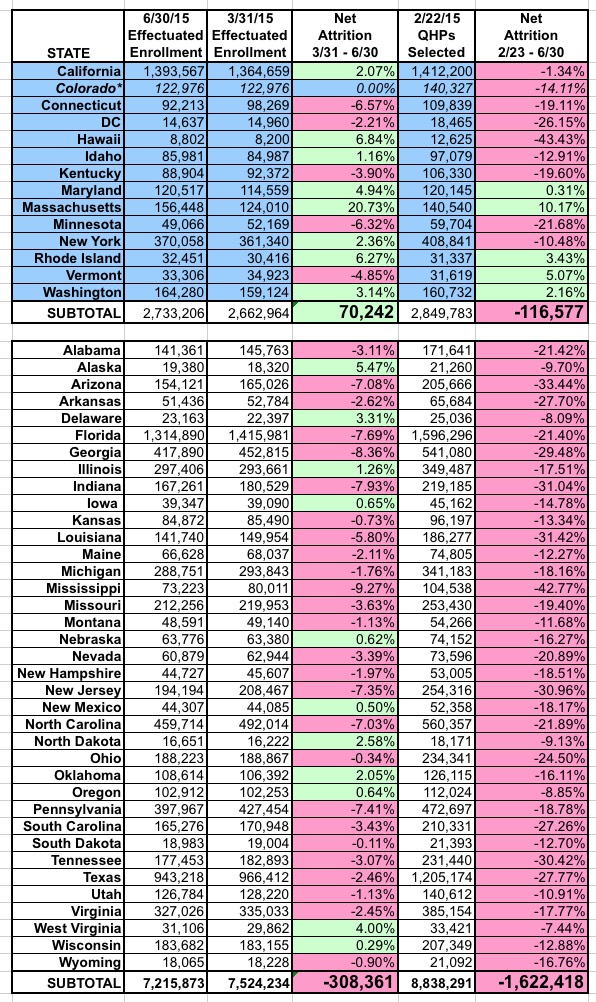

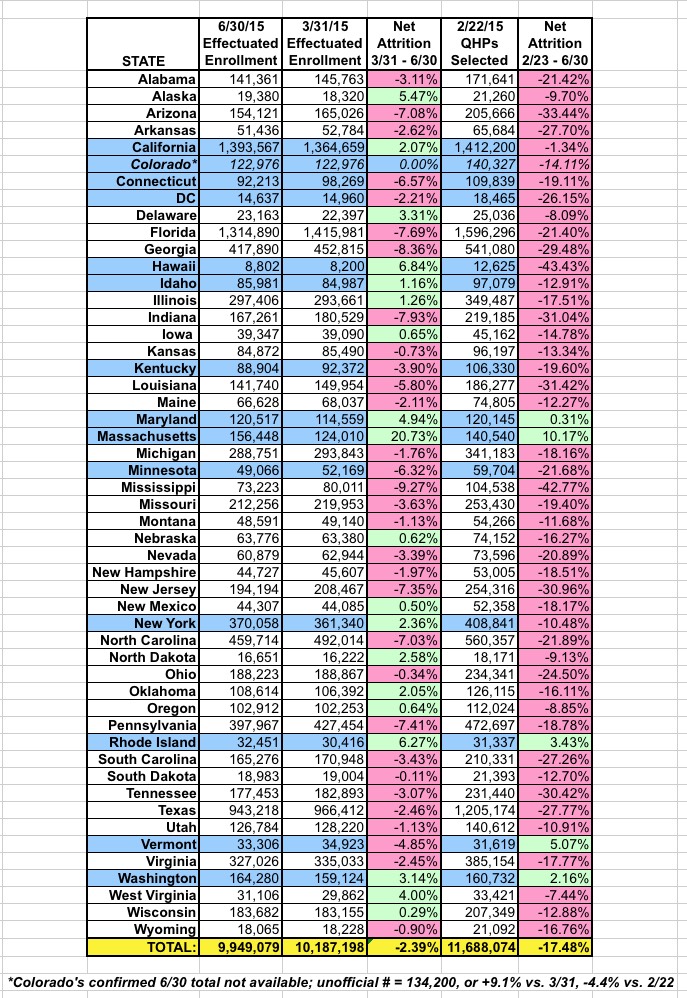

Comparing June 30 to March 31st:

- 9 of the 20 states which saw an increase in effectuated enrollees from 3/31 to 6/30 are state-based exchanges (remember, there's only 14 of these).

- 26 of the 30 states (+DC) which saw a decrease in enrollees are Healthcare.Gov states (mainly due to the 306,000 enrollees terminated due to legal residency issues).

- The highest off-season increase: Massachusetts, which saw a 20.7% increase in enrollees mainly due to their policy allowing year-round enrollment in "ConnectorCare" QHP policies.

- The worst off-season decrease: Mississippi, which lost 9.3% of their effectuated enrollees during the quarter.

- Colorado's June number is listed as being identical to their March number because CMS was unable to verify their June enrollment and simply copied the March number over. Their unofficial June 30 figure is 134,200, or about 9.1% higher than it was on 3/31.

- The percent of enrollees with APTC (Advanced Premium Tax Credits) has dropped slightly, from 85% in March to 83.7% in June.

- The percent of enrollees with CSR (Cost Saving Reduction) has also dropped a bit, from 57.4% to 56%

Both of these suggest that the bulk of those who have been kicked off for proof-of-legal-residency issues tend to be lower-income, which makes sense.

Update: Andrew Sprung notes that some people may have lost their tax credits or CSR assistance without losing their policies if they reported an income change or if their original income claims can't be verified, so perhaps not).- The average federal tax credit amount has also gone down very slightly ($272/month to $270).

- The Metal Level ratio, however, hasn't shifted at all; it remains 1% Catastrophic, 21% Bronze, 68% Silver, 7% Gold and 3% Platinum.

Comparing June 30 to the February 22nd QHP *Selection* totals:

- Since about 10% of those who select a QHP fail to actually pay their first monthly premium at all, the net attrition rate is much higher right off the bat.

- Consequently, 45 states (+DC) have seen decreases from 2/23 - 6/30, the worst of which are Hawaii and Mississippi (43% drops each)

- Hawaii's drop is partly due to their tiny enrollment number in the first place (only 12,000 or so) and partly due to their utterly screwed-up exchange and tracking system (depending on the source, they've claimed anywhere from as low as 8,000 to as many as 38,000 people enrolling in exchange policies this year)

- Even so, 5 states still had more people enrolled in effectuated policies at the end of June than had selected plans as of the end of Open Enrollment: Massachusetts (discussed above), Vermont, Rhode Island, Washington State and Maryland.

- NOTEWORTHY: All 5 of these states operate their own exchange, and only one of them allows year-round enrollment without requiring a qualifying life change to do so.

- Again, Colorado's June number is incorrect. At 134,200, this is about 4.4% lower than their 2/22 QHP selection tally.

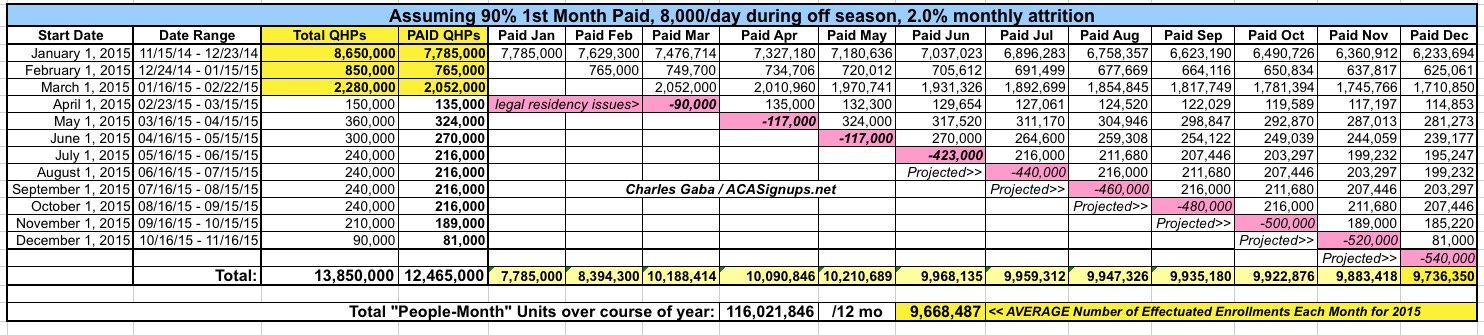

As for my full-year effectuated enrollment projection, here's what it looks like with the following corrections (click the image for a higher-resolution version):

- Off-season average enrollments increased from 7,500/day to 8,000/day

- The additional 306,000 legal residency terminations subtracted from the total

- Assumes 20,000 additional legal residency terminations each month for the rest of the year (this was the part I forgot to take into account)

As you can see, my existing estimate of roughly a 2.0% net monthly attrition rate (not including residency terminations) still seems to hold true: 10.19 million enrolled in March, 9.96 million enrolled at the end of June, both of which are extremely close to the actual numbers. Assuming no further significant residency terminations for the second half of the year, effectuated enrollments should end up around 9.7 million by December, and should also average around 9.7 million per month for the year (versus the CBO's projection of 13 million, which was eventually reduced to 11 million for the full 2015 calendar year).

UPDATE: As I noted earlier, state-based exchanges saw far less attrition on average than the Healthcare.Gov-based states due to HC.gov kicking several hundred thousand people off of their policies due to legal residency issues.

However, it's an even bigger difference than I thought; check this out...collectively, the state-based exchanges added over 70,000 people during the 2nd, off-season quarter (and that doesn't even include Colorado, which should have added around 11,000 more), while the 37 states run through Healthcare.Gov have lost 308,000.