And now for something completely different...

A woman named Monica Gomez of Carrington College requested that I post the following here at ACA Signups. I was impressed with both the content and graphic design, so here it is:

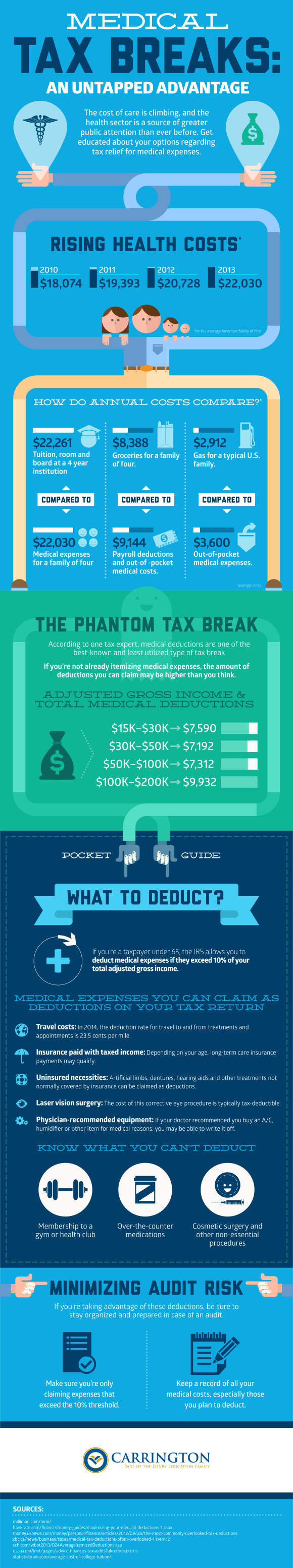

The Silver Lining: Medical Tax Breaks Can Offset Health Care Costs

Everyone needs medical services at some point in their lives. Yet, annual expenses rise every year: health care costs increased 22% from 2010 to 2013 alone. Now that health insurance has become mandatory, many fear that their health expenses will increase even more. Luckily, Americans may be able to offset some of their health care costs by by deducting applicable medical expenses.

Who Qualifies?

The infographic lays out how much money can be saved by taking advantage of medical tax deductions: The annual health care cost for a family of four is $22,030, which translates into an average year of college tuition, including room and board. A substantial portion of this figure can be redeemed through medical deductions – one of the most overlooked tax breaks. If adjusted gross income is between $15K and $100k, for example, it is possible to write off a little over $7k as a medical deduction.

According to the IRS, medical deductions are possible for those who paid in excess of 10% of their adjusted gross income. If over 65, the percentage to be met is 7.5. The temporary limitation for seniors is in effect until December 31, 2016.

What Qualifies?

Many items qualify as medical deductions: out-of-pockets expenses to doctors, in-patient hospital care, treatments for medically suggested addiction and weight-loss programs, transportation to and from appointments/treatments, and a portion of health insurance premiums. Furthermore, specialty items that are normally covered by health insurance, like orthodontics and hearing aids, are also eligible. Dental expenses can be deducted as well.

Consolidate all the medical expenses you and your dependents received to meet the 10% threshold. The Arthritis Foundation points out that if you are over 65, you and your family can already deduct medical expenses at 7.5% of your gross adjusted income. It is important to note that deductions must be taken for the calendar year in which they are paid, which is not necessarily the same year the medical service is received.

What Doesn’t Qualify?

Some items don’t count. Except for insulin, over the counter medications will not be accepted. Medical and hospitalization premiums paid by the employer are a wash. Most cosmetic surgeries are not applicable unless to correct a deformity or treat an injury from an accident.

So, for the upcoming tax season, make sure to gather all your evidence, including scripts and orders from physicians, documents showing mileage to and from treatments/appointments, as well as receipts for any forms of transportation other than your own car. Organizing and itemizing your medical expenses could save you thousands of dollars this tax season.