By the Numbers: 2015 State by State Comparisons (UPDATED!!)

UPDATED 2/19/15 11:55pm: New data from Colorado, DC and Vermont added!

UPDATED 2/20/15 10:10PM: New data from Massachusetts, Connecticut & Kentucky

OK, hopefully there will be at least another 400K+ to plug into these tables, but with the official deadline out of the way, we have a pretty solid picture of where the states stand now.

Again, it's important to remember that the 2014 numbers included the 2-week "overtime" period, when 900K additional people selected a plan, while the 2015 numbers only include the official enrollment period.

In fact, there's still up to a solid month of data missing from several states for this year!!

- Connecticut: No updates since 2/13 (6 days missing, including surge weekend)

- Idaho: No updates since 1/17 (33 days missing, including surge weekend, obviously)

On the flip side, it's also important to remember that next week, some 200,000 people will be stripped away from this list...we just don't know how many from each state as of yet. I'm assuming that since this is due to legal residency issues, most of those culled will come from states like Florida, Texas and Arizona...but I don't know that for sure.

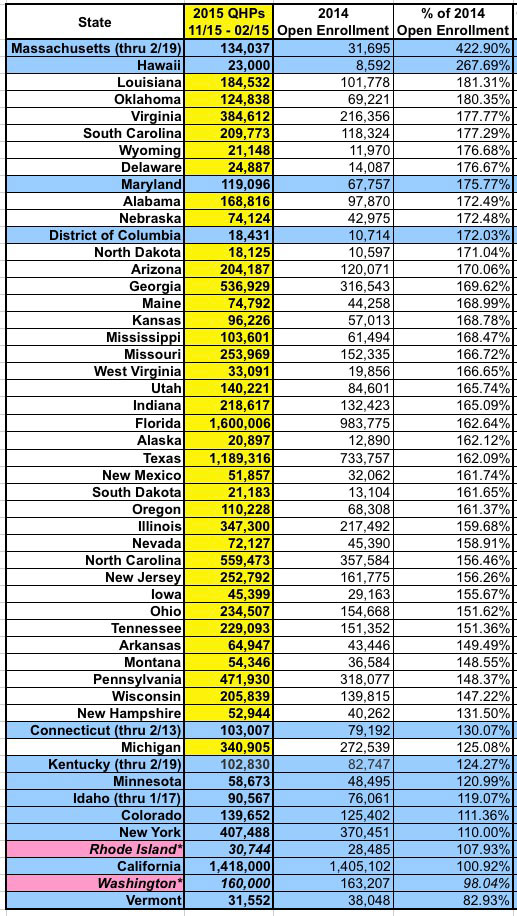

2015 QHP Enrollment Period vs. 2014 QHP Enrollment Period Having said that, aside from Massachusetts (which had/has a special situation), Hawaii, Maryland and DC blew away their 2014 enrollment totals. Of course, both have small populations, so perhaps it isn't that surprising...but it's still nice to see 4 of the state-based exchanges (3 of which had so many problems last year) take the top spots in this table. Maryland in particular had a stunning turnaround from their crappy 2014 exchange by racking up 76% more enrollments this time around. Blue Delaware and purple Virginia also are found high in the rankings. Aside from that, 4 beet-red states (Louisiana, Oklahoma, South Carolina and Wyoming) make up the top 10 Most Improved list. The opposite end of the spectrum is solid blue, although there's some mitigating circumstances here. CT, KY, NY, CA, CO & WA outperformed HC.gov significantly last year, so they had a higher bar to rise above this time around. Secondly, both Rhode Island and Washington State are handicapped due to only reporting paid enrollments (WA) or stripping out unpaid enrollments if past due (RI). Finally, as noted above, 2 of the states down here (CT and ID) are still missing significant enrollment data from the final weekend. |

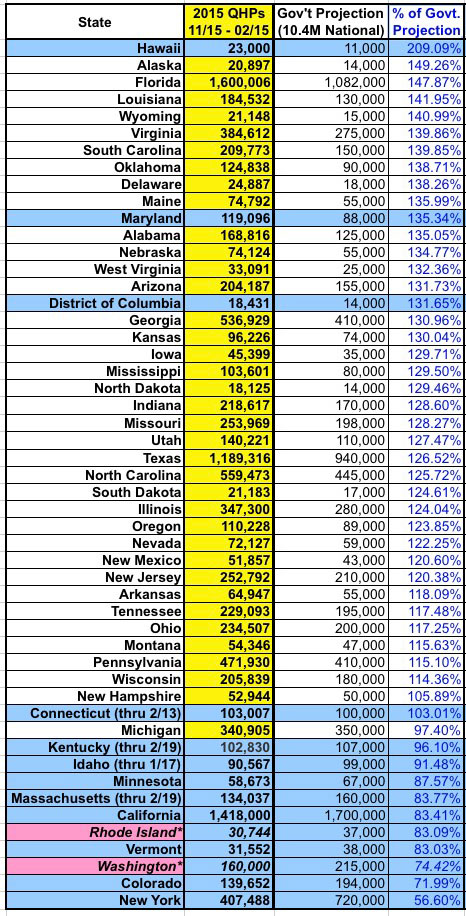

2015 QHP Enrollment Period vs. "Official" HHS Dept./State Exchange Projections: Hawaii is the biggest surprise here. They performed pathetically last year, even considering their small population and smaller uninsured rate...but unlike Maryland or Massachusetts, their technical woes didn't lead to a wholesale overhaul (or abandoning ship for HC.gov like Oregon and Nevada did). I don't know what anyone else was expecting out of the Aloha state, but I don't think anyone expected them to more than double the official target. Similarly, Alaska wasn't expected to do well since they're one of the few states where exchange policy premium rates really did skyrocket, due to the nature of their market. However, for sheer numbers, Florida is a jaw-dropper: Over 1.6 million enrollments...11% more than 2014 king California, even though CA has nearly double the population. And remember, with an extra week of potential "In Line by Midnight" additions, Florida could potentially break 1.7 million in the end. The bottom of the list is again composed of the same batch of state-based exchanges. Again, the missing data and other caveats apply, with one exception: New York. For whatever reason, the NY State of Health really thought they could nearly double last year's haul with 720K QHPs this time around; obviously that didn't happen. California is also looking to miss their target of 1.7 million, badly, even though that's only 21% higher than last year's tally. Hopefully the extra week of "In Line" additions will reduce the gap. On the up side, while Minnesota also missed their target, they came much closer than expected, and might even squeak by during the overtime period.

|

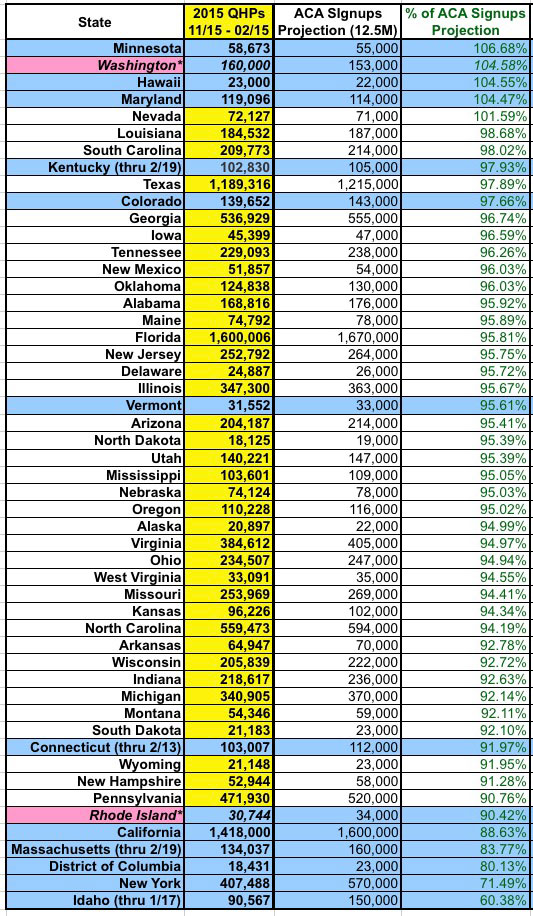

2015 QHP Enrollment Period vs. MY (REVISED) Projections:

UPDATE: OK, I changed my mind and went with the revised state-level projections that I made about a week ago. I just doesn't seem right to have poor Massachusetts sitting at the bottom of the pile due to my utterly misreading their situation. Florida is in a more reasonable spot in the middle of the pack, and I nailed most of the states pretty closely (of course, that was a lot easier to do when a good 90% of the data was already in...I fared much worse with my original state-level estimates). However, even with that advantage, I still seriously overestimated a few states. Those below 90% include:

|

|

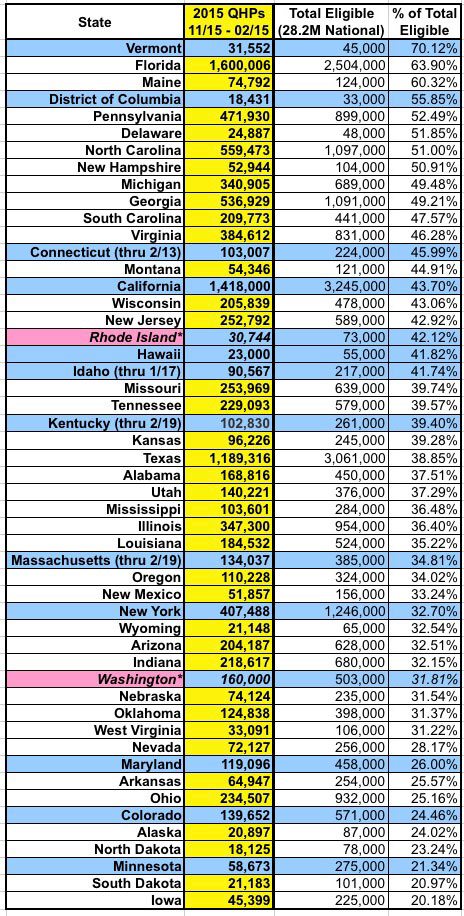

This is probably the most important table long-term: Out of the appx. 28 million or so people who could potentially enroll via the ACA exchanges, how many have actually been scratched off the list? Seeing Vermont at the top of the list isn't particularly surprising...but holy cow, look who's right behind them! Florida has enrolled an astounding 64% of their potential enrollees...in a completely GOP-controlled state whose governor was embroiled in the worst Medicare scam in U.S. history before being elected. (Gah!!!!) Note that 8 states have now enrolled at least 50% of their potential market, while 20 have enrolled at least 40%. Thirty-two states have enrolled at least 1/3. Colorado and Minnesota are disturbingly low this year, especially for states which are so supportive of the ACA. Minnesota was hurt, badly, by PreferredOne pulling out of their exchange over the summer, and it shows here. At the bottom of the list are Iowa and South Dakota, which just doesn't seem to like the ACA exchanges one little bit. What's especially noteworthy, however, is that unlike the other 3 tables, which have the state-based exchanges mostly lumped together at the bottom, this one shows a fairly even spread between state exchanges and HC.gov...in terms of the overall potential enrollments, all of the exchanges, federal or state, seem to have finally hit their stride, and are showing smooth proportional impact. |

2015 QHP Enrollment Period vs. TOTAL Eligible Potential Enrollees

2015 QHP Enrollment Period vs. TOTAL Eligible Potential Enrollees