A Bump to 8.1M by 12/23...and where things go from here

When I made my original projection of 12.0 million QHP selections by 2/15/15, I assumed that roughly 6.1 million of the 6.7 million current 2014 enrollees would re-up via one of three methods:

- Actively logging into their existing account and renewing their current policy/switching to a different one

- Actively creating a new account (in states like MA, MD, OR & NV) and enrolling the same/a different policy for 2015

- Taking no action whatsoever and being automatically re-enrolled in their current account (or one nearly identical if the current one is no longer available).

In other words, I was operating on the assumption that roughly 6.1 million (91%) of current enrollees would stay on board one way or another, plus another 5.9 million new folks signing up for the first time.

Then, a week ago, I bumped up my estimates based on the early numbers showing a higher-than-expected ratio of new enrollees to current ones. A few days later I bumped up my estimate through 12/15 even further, to 4.7 million, and shortly after that, my 12/23 estimate from 7.7 million to 7.9 million. This number has gotten a bit messy due to the numerous deadline extensions and grace periods allowed for by various exchanges, but it effectively means that I've been expecting just shy of 8 million people to be enrolled in time for January 1st coverage.

Hell, Minnesota just joined Vermont in extending their January coverage deadline out (again) until New Year's Eve.

Still, the question remains, what will the breakout of renewals vs. new additions within that number be? It's an important question for several reasons, not least of which is that it could iimpact the total number in mid-February as well.

The data is still piecemeal, but there's enough available now to at least attempt to figure it out.

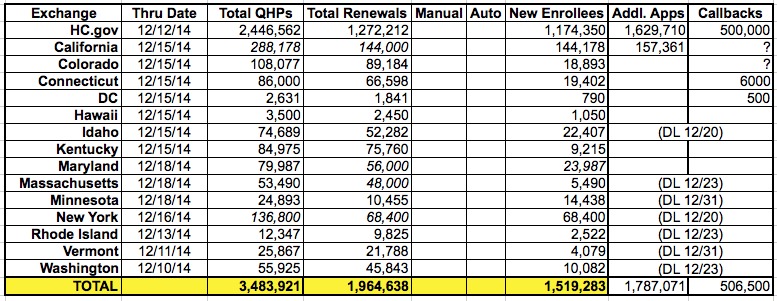

In cases where I have a total number but no breakout, I'm assuming a 70/30 renewal to new split (DC, HI, ID, MD, MA):

However, this is all I have to work with for the moment.I have to caution again that there are a LOT of variables here. The fact that the dates don't match up is a huge factor, since the "surge weekend" is included in some states but not others. Many of the above numbers are estimates. The New York & California totals are bare minimums, which is even more significant because they're the two largest states listed, and so on. Autorenewals are already mixed in for a few states (CO, CT & KY) but not others, and the deadline hasn't even passed (or has passed but isn't included in the numbers above) for many states.

All of that being said, it looks like the total as of 12/15 was, overall, roughly 56% renewals / 44% new additions.

Since I have the total through 12/15 estimated at roughly 4.7 million, that would mean roughly 2.6 million renewals + 2.1 million new enrollees through the 12/15 deadline for most states.

OK, so what does that tell us? Well, again, assuming around 6.7 million potential renewals/re-enrollments total, that leaves 4.1 million current enrollees. Not all of these are eligible for autorenewals (NV, OR, MD, MA in particular)...but most of those who aren't hadn't reached their deadlines yet as of the above dates, meaning there's still time for them to manually renew. Again, I'm also assuming that around 600K (9%) of current enrollees aren't renewing via the ACA exchanges at all--they're dropping out in favor of employer coverage, or moving over to an off-exchange plan, or moving to Medicare/Medicaid or whatever. Some may deliberately drop their coverage entirely even with the increased fine.

So, again, assuming that at least 6.1 million end up being renewed one way or another, you now have to add a minimum of 2.1 million more new enrollees, which brings you to...8.1 million.

Of course, that assumes that the number of new January enrollees stays at 2.1 million...when clearly it's going to be higher than that when you include all of the states which hadn't reached their deadlines yet, the hundreds of thousands of non-selected applications/determinations and/or "grace period" callbacks (see the last column) and so on. I'm assuming that most of the "callbacks" are for current enrollees (which I've already accounted for in the 6.1M figure), but I'm also assuming that the vast majority of "applications" are for new additions.

Still, there's enough uncertainty going on here that I don't want to push the point too much, so I'll leave it there: I'm bumping up my 12/23 total (aka "total enrolled for January 1st coverage") up by another 200K, to 8.1 million.

Now, here's the thing: That doesn't necessarily mean that I'm raising my total (2/15/15) projection. This may simply be a matter of people who I thought would enroll in February doing so in December instead. However, it certainly sets a higher floor for the eventual total.

Anyway, my revised projections are now:

- 8.1M in time for January 1st coverage (of which about 7.3 million will pay their first premium)

- 9.0M in time for February 1st coverage (of which about 8.0 million will pay their first premium)

- 12.5M in time for March 1st coverage (of which about 11.0 million will pay their first premium)

So...now what?

While, The Graph has always assumed that the estimated 3 million or so autorenewals (from around 45 states) would be reported all at once, bringing the estimated total up to over 7.6 million. Then, there should be a second "mini-surge" between now and Tuesday the 23rd as the rest of the states (except Vermont) reach their January coverage deadlines. I'm now expecting that when the dust settles on all of the renewals, autorenewals and "special case callbacks" from HC.gov, CA, CT etc, the total number of people who will be all set up for January coverage (pending payments, of course) should be around 8.1 million.

...which is a bit higher than what took 6 1/2 months to reach last year. Yes, the bulk of those are renewals, but even so, symbolically that's pretty cool.

After the 23rd, aside from a third "mini-surge" around January 10-15, things should be fairly quiet until around February 10th. At that point, there should be a final Massive Surge...and that's where the other Big Unknown comes into play. There will be a surge at the end, the only question is whether it'll be as impressive as the last few days of March were?

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.