Michigan: A deep dive into Abdul El-Sayed's "Michicare" Proposal

NOTE: The original post was getting to long/unwieldy so I've separated out my initial analysis of the proposal into this separate post.

Yesterday, Michigan Democratic Gubernatorial candidate Abdul El-Sayed publicly rolled out his vision for a state-based Single Payer healthcare system. I wrote up an overview yesterday. Below are my initial thoughts, based on reading both the summary and full version of the proposal as presented on El-Sayed's website.

For the record: I've been openly supporting one of the other Democratic candidates, former state Senate Minority Leader Gretchen Whitmer, for Governor for quite some time now for a variety of reasons. However, I've also said that I'd be fine supporting El-Sayed in November if he manages to win the nomination in August.

With the caveat that I'm supporting her, it should be noted that Whitmer was the one who, as Senate Minority Leader, championed and helped push ACA Medicaid expansion for 680,000 Michiganders through a completely Republican-controlled state government, which was one hell of an impressive accomplishment (granted, GOP Gov. Rick Snyder supported Medicaid expansion at the time as well, but the Michigan GOP has become one of the most extreme in the country over the past couple of decades).

I should further note that 5 years later, even as El-Sayed was announcing his new plan, those very same Republicans just sabotaged that very Medicaid expansion program by adding pointless, onerous work requirements to the program which will likely result in tens of thousands of those people being kicked off their healthcare coverage...and Whitmer isn’t in office anymore to fight back against it. There's still hope that Gov. Snyder will veto the bill.

THE NAME: Michicare. I would've gone with MittenCare, but perhaps that sounds a bit too fuzzy. WolverineCare might work as well (after all, Wisconsin calls their Medicaid program "BadgerCare"). Anyway, Michicare it is. I guarantee that reporters and politicians are going to get confused and use "Medicare", "Medicaid" and "Michicare" interchangeably, but perhaps that's the point.

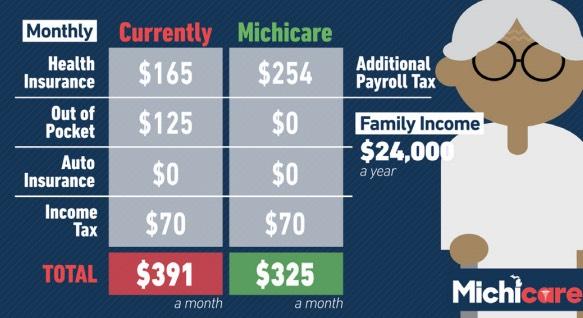

"The average Michigan family (two parents and their child, making Michigan’s average salary of $48,432 a year) will save almost $5,000 a year between insurance, out-of-pocket health costs, and auto insurance under Michicare. Under Michicare, a patient’s health insurance will also be comprehensive, portable, and permanent. That means Michiganders will have continuous coverage even when they change jobs. "

The example shown up front claims that a typical 3-person household in Michigan (2 adults, one kid) earns $48K/year (just for reference, that's about 233% of the Federal Poverty Line). The example shown claims that this family is currently paying an average of $3,700/year in premiums, $600/year in co-pays/deductibles, $2,600/year for auto insurance and $1,500/year in income tax, or $8,500/year total. It then claims that under Michicare, these would total just $3,400 or so.

I have no idea whether any of these numbers are accurate. Assuming they are, it's important to note that while they show the "income tax" as staying the same in their examples, it would actually be higher, with the additional amount being paid as a new payroll tax, which is often confused with an income tax. Also noteworthy: A chunk of the theoretical savings would come from lower-priced auto insurance, which is interesting--I presume this is because it takes over most of the medical areas of auto insurance coverage.

Michicare is a plan for Medicare for All for the state of Michigan, providing publicly financed health insurance to all Michigan residents under age 65. Michicare would cover a comprehensive set of benefits based on the essential health benefits outlined by the Affordable Care Act, and every Michigander would choose a primary care provider to help direct their care. Michicare would eliminate co-pays and deductibles for medically necessary services, so you would not pay out-of-pocket fees when you are seeking needed care.

Important to note: Michicare would not take over Medicare, which of course makes sense since Medicare is run federally, not by the state. However, it would cover the bulk of the types of supplemental coverage not provided by Medicare. I don't see any mention of what would happen to Medicare enrollees under 65 (there's around 9.1 million of them nationally, which should translate into roughly 280,000 or so in Michigan).

Also noteworthy: You would still have to choose a PHP, which suggests that this would be more of an HMO set-up than a PPO, although I'm not sure about that.

Michicare would decrease overall healthcare costs in Michigan by moving to a streamlined system with lower administrative costs and fairer prices. Instead of deductibles, out-of-pocket costs, and premiums paid to private insurers, Michicare would be publicly financed through a combination of a payroll tax and a business tax. Private insurance companies would still be permitted to offer supplemental health insurance, but Michicare would provide comprehensive benefits to all Michiganders, diminishing the need for private coverage. Michicare is an ambitious and realistic plan to secure truly universal healthcare in Michigan.

Most of the die-hard single payer advocates I talk to seem convinced that lower administrative costs (and removing the profit motive) alone will manage to cut costs in half or less, but the truth is that the biggest reason universal healthcare systems in other countries costs so much less is because of tight cost controls, which is where "fairer prices" come into play. This means some sort of "All Payer Rate Setting" along the lines of what Maryland has started doing.

Funding? Payroll tax and business tax...along with repurposing of existing federal dollars for Medicaid, CHIP and ACA subsidies, I presume, as well as repurposing of state Medicaid dollars.

One of the biggest questions is whether or not Michicare would be made mandatory or not. If so, it helps keep costs down via a single, extremely broad and stable risk pool...but it's gonna scare the hell out of/piss off a lot of people who will freak out about losing their current policies (remember the "If You Like Your Plan You Can Keep It!" debacle over the ACA a few years back? And that was only about 2% of the population!).

On the other hand, if you don't make it mandatory for everyone and still have a significant private healthcare market (presumably mostly employer-based)...well, then it simply wouldn't be an universal "single payer" healthcare system. Nothing wrong with that in my book, of course...which is exactly why I'm a big advocate of a system along the lines of CAP's Medicare Extra for All...but you really shouldn't sell it as "universal single payer" if it doesn't make single payer universal.

Still, that may be moot, as the paragraph above suggests that it would be mandatory.

— Reduce auto insurance rates. Michiganders pay almost twice as much for car insurance than the national average. That’s because right now we’re asking auto insurance to double as health insurance, covering unlimited medical care after accidents. By guaranteeing health coverage for all Michiganders, Michicare would significantly decrease the need for auto insurance companies to cover medical expenses, allowing auto insurance rates to fall.

Yup, exactly as I figured. This is an interesting point which I hadn't really considered before: If you have a comprehensive, universal healthcare system that covers everyone for pretty much everything, then injuries due to car crashes would be taken care of by that system as well.

— Alleviate healthcare costs for businesses. Right now, employers with more than 50 employees are required to provide healthcare coverage to their employees, which drives up the costs of doing business. Providing every Michigander with healthcare coverage under Michicare reduces the burden on employers, helping spur our economy.

This is one of the biggest points in favor of a taxpayer-funded healthcare system, of course, and is one of the reasons why the very last item on my "If I Ran the Zoo" ACA wish list is to actually repeal the ACA's employer mandate (but only after most of the other items have been taken care of first, like removing the 400% FPL income cap for subsidies, beefing up the subsidy formula and so forth). Half the population is currently covered by Employer Sponsored Insurance, and eliminating it is critical to any true Single Payer system.

— Empower healthcare providers. It’s becoming more and more difficult for individual providers to compete with big hospitals who use their power to negotiate higher reimbursements from insurers. By paying all providers at rates comparable to Medicare, Michicare would even the playing field among providers, from solo practitioners to large hospital groups. Furthermore, a streamlined billing system will replace the convoluted billing and coding systems that doctors deal with today, in which every health insurance plan has different requirements to pay out claims.

Voila: There's your All-Payer rating system (aka price controls). Of course, Medicare generally pays providers around 20% less than private insurance does (which will save lots of money but also upset lots of hospitals/doctors)...but it also pays about 50% more than Medicaid generally does (which will make hospitals/doctors happy but would cancel out some of that savings). The main point is that right now pricing is all over the map (figuratively and literally), so this would vastly simplify things.

All Michigan residents would be enrolled automatically in Michicare at birth. Michiganders who are transitioning from private insurance to Michicare will submit a simple application to enroll. Currently uninsured Michiganders would enroll using this same process. All Medicaid and CHIP recipients would be automatically transitioned to the Michicare plan.

Hmmm...I'm still confused about whether it would be mandatory for everyone under 65 or not. This paragraph suggests that it would be optional for anyone with Employer or Individual Market coverage, but mandatory for Medicaid/CHIP enrollees. Furthermore, there's this later on which also suggests that it won't be mandatory for those with employer-based coverage (I'm talking about major medical coverage, not supplemental):

WILL MICHICARE BE MY ONLY OPTION FOR HEALTH INSURANCE?

No. You will still be allowed to purchase a health insurance plan that is supplemental to Michicare (as people often do for their Medicare coverage) out of your own income, or through your employer or union. Michicare by design will be comprehensive, but we understand that sometimes people may choose to seek something they feel is more than comprehensive.

Furthermore, Michicare will not prohibit the sale of other insurance plans (even if they are redundant with the services covered by Michicare), so employers who want to offer something completely separate from Michicare will still be allowed to do so.

This isn't a minor quibble; it's a critical question: Would it be mandatory or not, and for which populations under 65?

The list of services covered is important:

- Outpatient care

- Emergency services

- Hospitalizations

- Maternity and newborn care

- Comprehensive Reproductive services and family planning

- Outpatient and inpatient mental healthcare

- Substance abuse treatment and services

- Prescription drugs

- Rehabilitative services

- Laboratory services

- Preventive/wellness services

- Chronic disease management

- Pediatric services

- Vision care

- Dental care

- Michicare will cover both primary care and specialist visits.

Most of these are already part of the ACA's 10 Essential Health Benefits, of course, along with vision and dental. There's one in particular which is sure to cause a lot of headaches, however:

- Comprehensive Reproductive services and family planning

The detailed view says that this "Includes birth control pills and IUDs", which is great to hear...but there's one word I didn't see anywhere in either the overview or the detailed version of the plan: Abortion.

Unless I've missed it, El-Sayed doesn't specifically state whether or not abortions would be covered. If so, fantastic...but I guarantee the GOP and MI Right to Life are gonna (literally) cry bloody murder. If it doesn't...well, that's gonna cause most women and plenty of men to cry foul, especially if this plan is indeed mandatory for just about every woman under 65 years old.

This is no small thing. The Hyde Amendment (which prohibits federal dollars from being used to fund abortion) caused no end of headaches and convoluted workarounds for the Affordable Care act...and at the state level, NARAL, which you would normally think would be all on board a single payer healthcare system, actually opposed the ColoradoCare ballot initiative a couple of years ago specifically because Colorado has their own state-level version of the Hyde Amendment: State funds can't be used to pay for abortion (i.e., via Medicaid/etc).

Michigan doesn't have such a law to my knowledge...but the GOP legislature did pass the Godawful "Rape Insurance" bill back in 2014 which forced many Michigan women to buy abortion coverage as a separate rider, even in cases of rape or incest.

This is...a Big Deal. Again, if Michicare covers abortion, everything's Kool and the Gang with me...but if it doesn't, that means that all women would have to pay for it privately as "supplemental coverage", which I'm guessing they won't be too keen on. I hope the El-Sayed campaign clearly answers this question.

UPDATE: I've received confirmation from El-Sayed's campaign that abortion services "will certainly be covered by Michicare", including a link to this Rewire.News article:

The plan did not mention abortion services. However, in a statement to Rewire.News about whether abortion care would be included in the policy and if he would seek to overturn state restrictions banning insurance from covering abortion services, El-Sayed said that “as a doctor, I know that there is no such thing as comprehensive health care without comprehensive family planning services, which means access to abortion services without the state getting in the way. Therefore, we will seek to amend any state policy that stands between a woman and her doctor.”

OK, good...except that according to the Kaiser Family Foundation, Medicaid currently only covers abortion in cases of rape, incest or the life of the pregnant woman in Michigan, so I presume that would have to be "amended" either separately or as part of the actual Michicare legislative text itself.

What happens if I get sick when I am out of Michigan?

Michicare will cover emergency services anywhere in the country. Planned medical care, such as primary care visits or scheduled surgeries, will be covered only within Michigan.

What if I move out of state for college?

Michicare will cover basic medical services, such as primary care visits and mental healthcare, for Michigan residents who attend college out of state.

Hmmm...I have no idea what sort of interstate agreements/regulations would be required to make these happen, but glad to hear they've thought about it.

FUNDING:

Critics say that single-payer plans are unrealistic. As a doctor, former public health professor, and former health commissioner, I can assure you that they’re wrong. Every single high-income society in the world except for ours has been able to secure the benefits of universal healthcare for their communities, and now a majority of Americans are in favor of a single-payer health system. Critics who say single-payer healthcare is politically impossible are usually beholden to corporate lobbies or lack the political will to achieve such transformative change. Our campaign cannot be bought and sold, and we know that a people-powered campaign allows us to stand up to the special interests who tell us universal healthcare is just a lofty dream. Together, we will make Michicare a reality.

Note the wording here: He correctly states that most other high-income countries have universal healthcare coverage, being careful not to state that "most countries have single payer!", since that's simply not true, as "universal coverage" and "single payer" are very different things. The then notes that recent polling shows that most of the country favors single payer (likely true, although that approval drops dramatically once you start pointing out the tax hikes/etc which would be involved).

I'm rather irritated by the next section, however, where he makes a blanket strawman opinion statement as fact (which is impossible to disprove): "Critics who say single-payer healthcare is politically impossible are usually beholden to corporate lobbies or lack political will." He then does what he was pretty good about avoiding by conflating "single payer" with "universal healthcare". I know plenty of people who think "single payer" is extremely unlikely (and no, not all of them are "beholden to corporate lobbies")...but I know of almost no one who claims that "universal coverage" is impossible.

Will Michicare mean that the state controls healthcare?

No. Under Michicare, hospitals, doctors, nurses, and healthcare providers would stay private. In fact, you would have more choice; under Michicare you would have access to an extensive network of providers, and you wouldn’t have to fight with your insurance company about whether or not it will cover services from the doctor of your choice. You control your healthcare; Michicare makes sure you can pay for it.

I'm glad he threw this in here, since a lot of people don't understand the difference between a Single Payer system like Canada (where the hospitals and doctors are private) and a Socialized Medicine system like the UK (where the hospitals are owned by the government and the doctors/nurses/etc. all work for the government, along the lines of the Veteran's Administration here in the U.S.).

What will Michicare mean for undocumented immigrants?

Under the Dr. El-Sayed administration, the State of Michigan will not consider federal documentation status. All residents who pay Michigan state taxes will be eligible for Michicare.

Hoo-boy. This would be another hot-button issue similar to abortion coverage. Some states (California in particular) already provide coverage to undocumented immigrants via one program or another, but blanket statewide taxpayer-funded coverage for them will be sure to set off lots of attacks and heartburn. Unlike the abortion issue, however, at least El-Sayed states this flat out, good to hear it.

The proposal then goes into several different case study examples: A low-income single Detroit mother of two on an ACA exchange plan; a fixed-income elderly woman currently on Medicare; a young middle-class couple expecting their first kid. It also gives a couple of examples from the employer side: A small business owner and a large corporation.

I checked out the "single mother on the ACA" specs at HealthCare.Gov and the scenario looks legit.

The elderly Medicare enrollee example is interesting: To his credit, El-Sayed openly admits that yes, this woman would see her taxes increase to a point higher than her current Medicare premium; her savings (a nominal $700 compared to the single mother's theoretical $4,800 savings) would come from her out of pocket costs disappearing altogether.

Politically, this would be one of the trickiest minefields to navigate: Explaining to senior citizens how you're gonna save them money even as you're raising what they pay for Medicare. Again, I give him credit for being up front about this.

The "middle class family" example is a bit puzzling, because the description talks about the problems faced by unsubsidized individual market enrollees (which is where the biggest problems of the ACA can be found today)...but the example itself uses a couple with employer coverage (they're both teachers).

Here's the weird thing, though: The exact same couple earning the same amount ($60,000) on the individual market would currently have to pay full price for an ACA exchange policy...which would average around $480/month for the two of them after subsidies, or $450/month once their baby is born. That would be an even more dramatic hypothetical savings under Michicare...which is why I'm really surprised they didn't make this a separate example.

It's getting very late, so I'll leave it at that for now, (I'm about 2/3 of the way through the plan). More tomorrow.

UPDATE Thursday Morning: OK, I'm back...let's pick up where we left off...

The small and large business examples make the point that while corporations would have a new tax added, it would supposedly pale in comparison to their savings from unloading their healthcare costs.

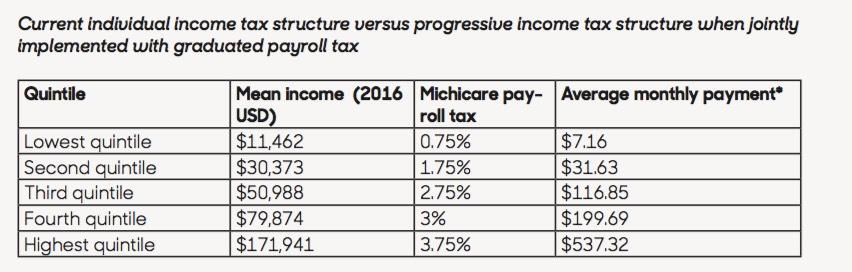

I have to turn from the employer tax to the payroll tax for a moment, however. Here's the actual payroll tax chart from El-Sayed's campaign:

I suspect another major "sales pitch" headache for El-Sayed will be for people with generous employer-sponsored policies today. As the Michicare proposal notes:

Employees will submit a simple application to obtain insurance through Michicare. Changes from current coverage will depend on what insurance plan an employee currently buys through their employer, but all Michicare enrollees will be guaranteed a comprehensive set of benefits. Employers may also choose to offer supplemental health insurance to employees who are Michigan residents.

Here's the problem: Let's say you're a single adult, no kids, and currently earn $60,000/year. According to the chart above, you'd fall into either the third or fourth quintile, so you'd be paying around $1,800/year in additional taxes, right? That's around $150/month.

Now, if you're on an individual market policy today, at that income level, you don't qualify for ACA subsidies and have to pay $500/month for a plan which only covers 70% of your healthcare expenses. Everyone in this category (including myself) would be thrilled to see our premiums drop by 70% for a policy which covers everything under the sun.

If you're on a typical employer policy, the total cost for your policy in Michigan is likely around the same $500/month (although it's also likely to be quite a bit more comprehensive (I'm not sure what's typical, but let's say an 80-85% actuarial value?). However...your employer is covering about 70% of that, meaning you're only paying about $150/month in premiums as it is.

Now, when you add in the other 15-20% of out-of-pocket costs, you'd probably still come out ahead...but it's gonna be much closer, and a lot tougher to sell you on.

In Michigan in particular, this gets even tougher in the case of a union worker with an extremely generous "Cadillac plan" which covers even more and costs you almost nothing in premiums. In that scenario, you could conceivably go from paying almost nothing now to paying the same $150/month.

Of course, the obvious solution to this would be for the employer to take the massive cost savings they're getting from unloading their healthcare costs and use part of it to increase the employee's salary by at least the amount of the additional payroll tax...but I'm guessing that's not likely to happen. Even if they do so, that wouldn't start until after the new law went into effect, making it an even tougher sell up front.

OK, moving on to the impact on healthcare providers (doctors, nurses, hospitals, clinics, etc.):

Physicians and other health professionals want to spend more time serving patients, but they are burdened by the onerous administrative requirements of private insurers. Right now, doctors and nurses spend twenty or more hours every week negotiating with insurance companies about which treatments will be covered and dealing with other administrative issues that distract from patient care. Dedicated clerical staff spend over thirty hours per week doing similar work related to billing and claims processing.

By simplifying the billing process into one stream, Michicare will allow doctors to focus less on administration and more on patient care. It will also empower providers who care for vulnerable Michiganders. Doctors face a financial penalty for taking care of the most vulnerable in our current reimbursement system where Medicaid and Medicare reimbursements have not been competitive with private insurers. In Michigan, Medicaid reimburses only 65 cents for every dollar that Medicare reimburses on average for all services and only 57 cents for every dollar Medicare spends on primary care.

Side note: I appreciate the handy Medicaid-to-Medicare Index reference.

Side note 2: Getting rid of all that overhead/paperwork/red tape/etc. is an inherently good thing for the doctors/nurses...but it's also important to keep in mind that if you eliminate those 30 hours/week that clerical staff currently spend dealing with it, that means you're going to be eliminating a bunch of clerical staff jobs in the process. "Saving money through increased efficiency" unfortunately amounts to "firing a bunch of paper shufflers"...and while that's a good thing overall, those staffers aren't gonna see it that way. Something to keep in mind.

Under Michicare, providers will be paid the same amount for taking care of any patient, rich or poor. Michicare reimbursement rates will be set relative to Medicare rates with competitive reimbursements. Further, reimbursements will not differ by provider type, allowing all providers, whether they are private practitioners or work for a large hospital system, to compete on a level playing field. Over time, changes in Michicare reimbursements will be designed with provider input and will focus on minimizing unnecessary care and maximizing health. A focus on maximizing outcomes that matter to patients while minimizing costs will empower allied health professionals in Michigan. Michicare will ensure that providers like dentists, optometrists, nurse practitioners, physicians’ assistants, pharmacists, and podiatrists are reimbursed fairly for their services.

"Reimbursed fairly" is, of course, kind of a subjective term. Paying an actor $5 million to star in a movie may seem more than fair to most people...but if you're Robert Downey Jr., you're probably gonna feel differently. Similarly, a dentist currently earning $200,000/year isn't gonna be happy if their pay ends up dropping to, say, $150K, even if that's the average income for dentists nationally and thus seems like "fair" reimbursement to most people. Again, this is a sales/political problem more than anything, but one which needs to be taken into consideration.

The proposal also goes into several interesting programs which El-Sayed clearly has personal experience with: Community Health Workers, free vision screening & eyeglasses for children, etc.

There's another section which I welcome...but also has inherent dangers:

Harnessing the power of Big Data

Right now Michigan is missing a tremendous opportunity to improve clinical care because patient data is dispersed across different billing systems and electronic medical records. Anybody who receives care at different institutions may undergo redundant, wasteful testing because key records are difficult to transfer.

This system prevents us from understanding exactly where we are succeeding and failing on key quality measures, from appropriate prescribing of opioids to effective control of diabetes. By consolidating patient data from across the state, Michicare would create powerful opportunities to better understand public health and to improve our collective health, from investing in additional services to monitoring for emerging infections and other threats to public health. As always, patient privacy is of utmost importance, and patient data will always be secure and protected.

At the core of my being, I'm a data guy; that's the main focus of everything I do here at ACA Signups. However, there is some element of security risk from having all of your medical information controlled through a single, centralized database. On the other hand, it's not like the private insurance industry has a stellar track record of protecting sensitive enrollee/patient medical data secure today...

There are additional sections on the opioid crisis, mental healthcare, prescription drugs, long-term care and so on which I'm not getting into today. Suffice to say I'm impressed by these issues being discussed individually.

One important (and controversial, among healthcare wonks) item: Like Bernie Sanders' national Medicare for All proposal, under Michicare there would be no cost-sharing of any sort:

Michicare will eliminate out-of-pocket costs like co-pays and deductibles for medically necessary care. Many essential drugs will be free, while others will be subsidized by the state.

I find the fixation among many hard-core Single Payer advocates with not requiring any cost sharing on the enrollee's part of any type to be rather fascinating, seeing how most other countries--even most with universal coverage--include at least nominal co-pays for some services.

There's another paragraph which yet again makes it sound like participation in Michicare would not be optional for anyone under 65:

Role of Private Insurance

A unified, publicly financed system is the most effective way to increase negotiating power and reduce excessive administrative costs that currently exist with multiple private insurers. Private insurers may still retain a limited role under Michicare, mainly through offering supplemental coverage to Michiganders for services that Michicare does not cover, like add-on services not deemed medically necessary, expedited access to elective services, or increased long-term care coverage.

The next section goes into non-reimbursement-related savings, pointing out that private insurance carriers currently eat up between 11-20% of premium dollars in administrative overhead, profit margin, marketing and so on...and then claiming that Medicare only spends around 2% on these things (not including profit, of course). To play Devil's Advocate on this for a moment, I'm actually going to quote someone whose very name being mentioned usually causes me to roll my eyes: Avik Roy. Roy notes several reasons why the "Medicare costs 2% to administer!" claim may be fudging the numbers a bit. Some of them are specious or questionable, but he does have one valid point: The vast majority of Medicare enrollees are elderly, therefore they tend to have much higher medical costs than the population at large, which in turn means that the same administrative cost divided into a higher medical cost is going to naturally come out as a smaller percentage.

For instance, in Michigan, Medicare spent an average of around $11,300/enrollee in Michigan in 2014, while the average for total healthcare spending per Michigander overall (including everything Medicare doesn't cover, remember) was only around $8,100 apiece. Furrthermore, that includes the Medicare population.

According to the Agency for Healthcare Research & Quality:

The elderly (age 65 and over) made up around 13 percent of the U.S. population in 2002, but they consumed 36 percent of total U.S. personal health care expenses. The average health care expense in 2002 was $11,089 per year for elderly people but only $3,352 per year for working-age people (ages 19-64).

Of course this was back in 2002; things have no doubt changed dramatically since then, but assuming the ratios are similar, elderly folks cost 3.3x as much apiece as those 19-64. When you throw children into the mix, I'd imagine the ratio is more like 4:1 or even 5:1.

In other words, if you extrapolated that 2% of $11,100 ($222/person) out to the rest of the population, it would be more like 6.6% ($222 / $3352). Throw kids in the mix and it might be closer to 8%. This is back-of-the-envelope math, of course, but you get my point. Granted, 6.6% or even 8% would still be much better than 11-20%. And of course there could be other economy-of-scale savings since you'd have the entire non-elderly population of Michigan under a single system instead of a patchwork. Some administrative expenses would be the same whether serving 1 person or all 8.3 million nonelderly Michiganders; I'd imagine that if it was properly managed, they might be able to bring it in at perhaps 5% administrative cost overall.

The next section talks about Accountable Care Organizations:

Michigan needs to move away from a fee-for-service system, which rewards providers for delivering expensive and unnecessary services rather than focusing on what patients and communities actually need. Michigan is already a leader in health system innovation with some of the strongest alternative payment systems in the country, including Accountable Care Organizations and Patient-Centered Medical Homes.

The El-Sayed Administration will explore a range of innovative payment models during the transition to Michicare, including building on current alternative payment models. Any reforms will always be tested on a limited basis, and system-wide change will focus on patient outcomes and satisfaction and on provider satisfaction.

I just want to give a quick shout-out to the Affordable Care Act, which vastly expanded the use of ACOs and other alternative payment experiments. The ACA doesn't get nearly enough credit for a lot of the less-sexy stuff like this.

All-Payer Rate Setting

As an intermediate step to full implementation of a state single-payer program, the El-Sayed Administration will immediately take steps to move Michigan to an all-payer rate setting system. Instead of the current system of charging widely disparate rates for patients on Medicaid, Medicare, and different private plans, under all-payer rate setting, providers are paid the same amount for the same service by any payer (public or private). This system is fair, and it has been used in Maryland to save substantial costs. It offers a natural approach to prepare providers for a single-payer system where reimbursement will be streamlined through Michicare.

Maryland's All-Payer Rating system is much beloved by many of my fellow healthcare wonks. Glad to see El-Sayed is being pretty good about giving credit where due for so many of these ideas.

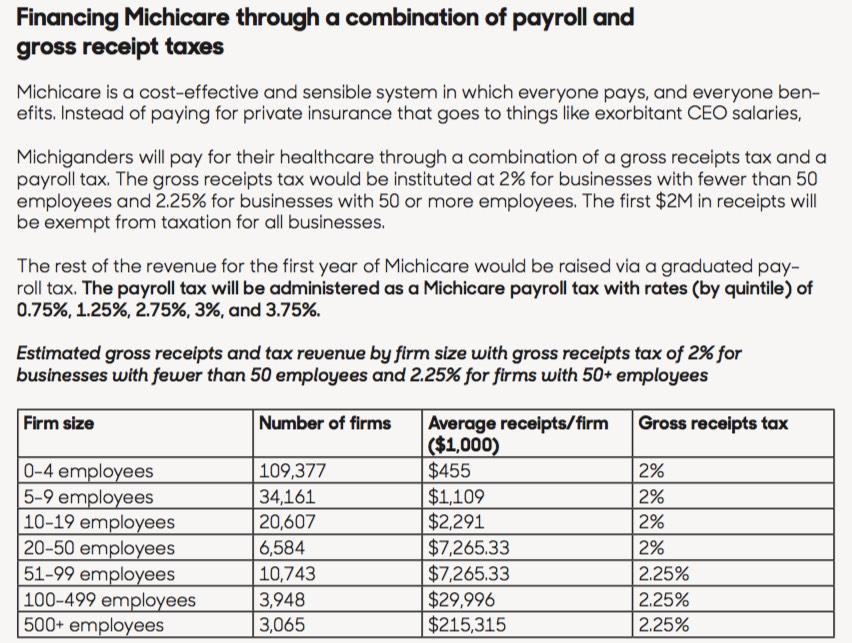

PAYMENT: Here's the chart showing the proposed business tax and (again) payroll tax structures:

It's a very good idea to exempt the first $2 million in gross receipts for the business side, and I personally wouldn't have a problem with the proposed progressive payroll tax...except for one problem, as noted in this Detroit News article from yesterday:

The Shelby Township Democrat also wants to move to a graduated income tax. His plan calls for raising the state's 4.25 percent personal income tax to 5 percent for the lowest earners and up to 8 percent for the state’s wealthiest residents. The increase would be administered through a payroll tax deducted from employee wages.

(Again: That's the current 4.25% income tax + 0.75%, 1.75%, 2.75%, 3.0% or 3.75%)

Moving to a graduated income tax would require voter approval for an amendment to the Michigan Constitution.

Whoops. Yeah, that's a real problem: Michigan's income tax is currently flat under the state Constitution. As I understand it, the legislature can change the rate (and did so most recently in 2012, to 4.25%), but it can't make it progressive...it has to be the same regardless of income.

As for the federal funding side of the equation, that's the other "outside of the legislature/governor's control" shoe dropping:

Other elements of the plan could require sign off by the state Legislature, currently controlled by Republicans, or GOP President Donald Trump’s administration.

Yup, remember, under this proposal, federal Medicaid, CHIP and ACA exchange subsidy funding would have to be repurposed towards the new Michicare system:

Lastly, Michicare will also be financed by maximizing federal healthcare dollars flowing into the state. The El-Sayed Administration will apply for waivers that will allow federal Medicaid and ACA dollars to be used for Michicare financing. This should vastly reduce the out-of-pocket expenses that Michiganders now pay and finance a better healthcare system for us.

Fantastic, except that, again, that waiver would have to be approved by...Donald Trump's CMS Administrator, Seema Verma (at least until 2021, anyway). For instance, while the ACA's individual mandate has been effectively repealed, the employer mandate is still in place; since Michicare would replace just about all employer-based insurance, that rule would have to be waived, and so on, along with the ACA exchange/subsidies and so forth.

In other words, for this to work as presented, not only would both the Michigan state House and state Senate have to pass the bill, we would also have to amend the state Constitution and get authorization from the Trump Administration.

A tall order, to say the least.

This brings me to the final section, which discusses the process El-Sayed has in mind for actually putting together the specific legislative text to try and get his proposal passed...as well as the measures which he'd take in the interim:

Protecting Medicaid and Healthy Michigan

Until we pass Michicare, it is critical to protect Medicaid and Healthy Michigan, our Medicaid expansion program. In April 2018, the GOP-controlled Michigan Senate voted 26-11 to pass a bill that would take away health insurance from Medicaid recipients unless they document that they work at least 29 hours a week. That would disproportionately affect cities that are predominantly black. Our state must stop being known for public health scandals that threaten the health of minority groups and instead become known for ensuring universal access to health. Under an El-Sayed administration, a bill with Medicaid work requirements in any form would be struck down.

Additionally, Dr. El-Sayed would take immediate steps to increase Medicaid enrollment among Michiganders who are eligible for Medicaid. The El-Sayed administration would increase outreach to minority groups and Michiganders without stable housing; work to design a simplified sign-up process; and develop an automatic enrollment mechanism tied to an existing process such as tax returns or birth or school records. The El-Sayed administration would also process Medicaid claims through a government agency, rather than contracting the claims out to private insurance companies.

I agree with doing all of that. HOWEVER...there's an extremely important hole in his "Until we pass Michicare" section: What about protecting the individual market NOW?

The only way El-Sayed has a chance of implementing Michicare is with progressive Democratic majorities in both the state House and Senate (or at the very least, a majority in one and an even split in the other, with the Lt. Governor acting as a tie-breaker. Even then, it could take well over a year to actually put together the legislation and get it passed...and even then, there would presumably be some sort of a ramping up implementation period, which I have to imagine would take at least another year. In other words, the absolute earliest I can conceive Michicare being fully implemented would be January 1, 2021.

That means at least two more Open Enrollment Periods, with unsubsidized individual market premiums likely to jump another 15% or so next year (rough guess on my part) and likely another 5-8% in 2020. If so, that would bring the average unsubsidized individual market premium in Michigan up to around $620/month per person (for a 70% AV Silver plan) for over 100,000 middle-class Michiganders by 2020.

Obviously there's not a damned thing El-Sayed (or Whitmer) will be able to do for 2019 (except possibly retroactively), but for 2020 (and likely 2021, at least) this theoretical Democratic majority will have to also pass some sort of "ACA 2.0" legislation along the lines of what other states like California, Maryland, New Jersey and Vermont are already doing right now.

This is a glaring oversight in a proposal which is otherwise pretty detailed...and it's not just addressed to El-Sayed, I should note; neither his campaign website nor Gretchen Whitmer's mentions anything specific about repairing/strengthening the ACA itself (whether in the short- or long-term). This is something which needs to be rectified by both candidates ASAP.

CONCLUDING THOUGHTS:

Two and a half years ago, when Bernie Sanders introduced his so-called "Medicare for All" plan, I caught a tremendous amount of crap for pointing out how poorly detailed it was: Just 1,700 words long (roughly 6-7 printed pages)...and of that, nearly the first half was just back story. The so-called "FULL Plan" itself was perhaps 3-4 pages at most, absurdly simplistic and lacking in detail.

By contrast, Dr. El-Sayed's "Michicare" proposal is very well detailed in most areas, and even covers a few areas which I hadn't thought of (especially the auto insurance overlap factor). This is clearly an area where he has a lot of experience and knowledge. If Sanders had introduced this bill in January 2016...well, I still wouldn't have voted for him in the primary for other reasons, but at the very least I would have taken him a lot more seriously as a candidate.

Having said that, there are still a lot of important unanswered questions, including (but not limited to):

- A definitive answer as to whether or not Michicare would be mandatory or optional for all Michigan residents under the age of 65?

- What happens to people currently enrolled in Medicare who are under 65 years old?

- Would the Primary Care Provider act as a gateway to specialists (ala an HMO) or would they act as more of a "homeroom teacher" (ala a PPO)?

- Abortion would be covered...but how would it be funded given both state and federal regulations regarding use of public tax dollars?

- What's the timeline for implementation? Would it be phased in over several years or all go into effect at once?

- What, if any, provision would you make for those who would lose their jobs in the health insurance and related industries? For instance, BCBSM alone employs about 8,100 people...I gotta figure when you include other carriers, billing companies and so forth, you're probably looking at 40,000 or so people who'd be out of a job?

- Where did you come up with the math for the Michigan side of the proposed funding mechanisms (business tax + payroll taxes)? Are you reasonably sure the 0.75 - 3.75% payroll tax and the 2.0 - 2.25% business tax would actually generate enough funding to pay for it all?

- Assuming the bill were to become law, the Constitutional amendment was enacted and the HHS Dept. were to sign off on the proposed federal waivers, what happens if there's a significant federal funding shortfall in the future (for instance, what if $7 billion is rescinded from CHIP funding, or if the Medicare Hospital Insurance Trust Fund comes up short due to last winter's GOP tax cut bill, or if ACA subsidy/Medicaid expansion funds are decimated* and turned into block grants via a revived Graham-Cassidy bill from Congress)?

- What happens to active duty and/or veterans of the military? They're currently covered by the VA or TriCare; would they still have to pay into the system?

- What about Indian Health Service enrollees?

- Are you absolutely dead set on no cost-sharing of any sort, or is that negotiable?

- As noted above, if elected, what do you have in mind to do about Michigan's ACA-compliant Individual Market until Michicare is passed?

There's a thousand other questions which I'm sure I'll think of later, of course.

Having said all that, I applaud El-Sayed for, at the very least, being honest and up front about both the disruptive nature of his proposal as well as acknowledging that yes, even most lower-income people would indeed have to pay 1-2% of their income into the system.

Does this proposal, in a form close to how it's laid out at El-Sayed's website, have a serious chance of actually happening? Color me still extremely skeptical...but it's a lot better thought-out and covers a lot more bases than most other single payer proposals I've seen so far.

*UPDATE Midnight Thursday: Welp. Given the bombshell announcement regarding Trump's Department of Justice a few hours ago, El-Sayed's math might end up having to be slightly recalibrated. Here's why:

- Michigan has around 242,000 ACA exchange enrollees this year averaging around $3,800/year in APTC subsidies via the ACA. That adds up to $930 million per year, although it's probably actually closer to $800 million after monthly attrition/etc.

- Michigan has around 120,000 people receiving CSR assistance this year. I estimate that totals around $270 million. Of course, Trump eliminated CSR reimbursement payments last year, which was instead loaded as part of the $800 million in APTC assistance.

- Michigan received around $3.2 billion in federal ACA Medicaid expansion funding in 2015. That's probably closer to $3.5 billion/year today.

That's a total of around $4.3 billion per year in funding which is at risk. Divided among 8.4 million Michiganders, that's roughly $510 more per person which he could potentially have to come up with to make his proposal work.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.