UPDATE: LET'S DIVE IN: CAP's "Medicare Extra for All"

Yesterday, the Center for American Progress announced their own proposal for a new, comprehensive, national, universal healthcare coverage system. I'm giving my initial thoughts annotation-style.

Medicare Extra for All: A Plan to Guarantee Universal Health Coverage in the United States

By the CAP Health Policy Team Posted on February 22, 2018, 6:00 amOVERVIEW: This proposal guarantees the right of all Americans to enroll in the same high-quality plan modeled after the Medicare program.

OK, first up, something which seems almost trivial but has a deeper meaning to it. Some Bernie Sanders supporters may claim that CAP has "co-opted" the title "Medicare for All"...except that a) Sanders actually took the name "Medicare for All" from the H.R. 676 bill which was introduced for years by former Congressman John Conyers long before Bernie became a national figure, and b) Neither Conyers' nor Sanders' bills were "Medicare" by the definition it has today anyway. CAP's "Medicare Extra for All" bill isn't defined the same as today's Medicare either...which is precisely why they added "Extra" to the name.

I know this seems like an incredibly petty, tiny thing, but it's actually important for several reasons, including definitions of comprehensiveness, provider reimbursement rates and so forth. Including the word "Medicare" in the title helps with the branding and gives people a general sense of ease, while the "Extra" clarifies that it's not quite the same program. Good.

Introduction and summary

Health care is a right: No American should be left to suffer without the health care they need. The United States is alone among developed countries in not guaranteeing universal health coverage.

Much of CAP's preamble seems to be designed to nip a few of the die-hard "SINGLE PAYER NOW!!" crowd's complaints in the bud: CAP states right off the bat that YES, THEY FULLY SUPPORT UNIVERSAL, COMPREHENSIVE COVERAGE FOR ALL, bold-faced and highlighted.

Of course, I'm pretty sure that's been the stance of most of the CAP folks for a long time anyway, but it's been called into question for the past couple of years since there are disagreements on how to achieve that end goal, so they want to make that clear up front.

Over the past half century, there have been several expansions of health coverage in the United States; today, it is past time to ensure that all Americans have coverage they can rely on at all times.

The most recent coverage expansion, the Affordable Care Act (ACA), was an historic accomplishment, expanding coverage to 20 million Americans—the largest expansion in 50 years. The law has also proved to be remarkably resilient: Despite repeated acts of overt sabotage by the Trump administration—and repeated attempts to repeal the law—enrollment has remained steady.

In the near term, there is an urgent need to resist sabotage and efforts to undermine Medicaid, to push for stabilization to mitigate coverage losses and premium increases, and to expand coverage through Medicaid expansion in all states that have not already done so. At the same time, it is imperative to chart a path forward for the long-term future of the nation’s health care system.

I actually wish they had broken this out into bullet points, because it helps clarify the TIMING of the situation for supporters of universal coverage:

- 1. Resist sabotage of the ACA/Medicaid: Protect the progress we've made to date. This is what Democrats have been fighting like hell to do for the past year (well, the past 8 years, really).

- 2a. Stabilize the individual market: This has always been the biggest trouble spot of the ACA, with problems made far worse by Trump/Congressional GOP...and it's only expected to get worse next year due to the individual mandate being repealed and Trump opening up the floodgates for Short-Term and Association (ShortAss) plans.

- 2b. Expand Medicaid across all states: This is related/connected to 2a in terms of risk pool stability/etc, but is separate in other ways. Again, we're in a situation where red states are trying to weaken Medicaid by imposing work requirements, lifetime limits and so forth.

- 3. Chart the path forward for long-term future: This is the main debate going on between now and 2020 within and across the breadth of the universal coverage movement, whether you call them Democrats, "progressives", "Single Payer advocates" or what have you.

The core question, to me, is whether #3 should be achieved via ONE major bill or TWO.

Many within the SPNOW! crowd, of course, want to go directly from where things stand today to full-scale, 100% Single Payer "Medicare for All", Bernie Sanders-style. They may accept a time window of a few years for the process to complete, but they want that specific final goal to be baked into whatever the master bill itself is.

Others, including myself, may prefer a similar eventual end goal, but believe that mandating a single, 100% publicly funded, 100% mandatory participation single payer system will simply never fly even with a few years to ramp it up.

Part of the problem is that it's been my experience that some within the SPNOW! crowd seem to be under the mistaken impression that those who fall into the second category want to stop with 2a/2b, when in fact I can't think of anyone with that view. To a one, every "moderate left" or "incrementalist Democrat" healthcare wonk I know of agrees that #3 is the next step...they just have different views about how to go about it.

Anyway, let's move on...

Costs and deductibles remain much too high: 28 percent of nonelderly adults, or 41 million Americans, remain underinsured, which means that out-of-pocket costs exceed 10 percent of income. In the wealthiest nation on earth, 28.8 million individuals remain uninsured.

This is actually an interesting and welcome. I've never been quite sure whether there's an "official" definition of "underinsured" or not. 10% of income seems like a fair rule of thumb, at least above a certain income level.

To address these challenges, the Center for American Progress proposes a new system—“Medicare Extra for All.” Medicare Extra would include important enhancements to the current Medicare program: an out-of-pocket limit, coverage of dental care and hearing aids, and integrated drug benefits. Medicare Extra would be available to all Americans, regardless of income, health status, age, or insurance status.

There's the "extra" part: Out of pocket limits, dental/hearing coverage, integrated drug coverage, and anyone can buy in if they want to.

Employers would have the option to sponsor Medicare Extra and employees would have the option to choose Medicare Extra over their employer coverage. Medicare Extra would strengthen, streamline, and integrate Medicaid coverage with guaranteed quality into a national program.

This is actually the most surprising part of the plan to me: It would replace Medicaid a few years in. I'm surprised because with the employer market covering ~48% of the population, (current) Medicare covering ~17% and Medicaid covering ~23% (for a combined ~37% without double-counting dual-eligibles), I figured that any proposal of this nature would mainly focus on covering the remaining ~15% or so at first. That is, I figured those three programs would be mostly left in place, for a total of four major types of coverage. Instead, Medicaid Extra would apparently merge itself with Medicaid as well. I'm guessing the reasoning for this has to do with both reimbursement rates for providers as well as moving primary control over the system from the states to the federal government.

The cost of coverage would be offset significantly by reducing health care costs. The payment rates for medical providers would reference current Medicare rates—and importantly, employer plans would be able to take advantage of these savings. Medicare Extra would negotiate prescription drug prices by giving preference to drugs whose prices reflect value and innovation. Medicare Extra would also implement long overdue reforms to the payment and delivery system and take advantage of Medicare’s administrative efficiencies. In this report, CAP also outlines a package of tax revenue options to finance the remaining cost.

Bingo. If the entire payment system is based on the existing Medicare rates and infrastructure, you can't have 51 different rate settings which keep changing based on who controls the state government that year.

Medicare Extra for All would guarantee universal coverage and eliminate underinsurance. It would guarantee that all Americans can enroll in the same high-quality plan, modeled after the highly popular Medicare program. At the same time, it would preserve employer-based coverage as an option for millions of Americans who are satisfied with their coverage.

THIS is probably the single biggest issue that SPNOW! folks are likely to get outraged about: It would "preserve employer-based coverage", which of course means it would not put the insurance companies out of business by any means. Initially, at least, nearly half the country would still be on private, profit-based policies.

I have...no problem with this, for several reasons:

First, because if it's successful, over time companies would likely increasingly drop their contracts with private carriers and move towards the Medicare Extra program. Even if they didn't, again, if successful, employees would increasingly drop their private coverage and move towards Medicare Extra.

Secondly, private insurance companies already administer about 70% of Medicaid and 30% of Medicare now, so it's not like they'd be hurting for business. If anything (I haven't gotten to this part yet), it's possible they'll actually do better via Medicare Extra, although that's obviously not a guaranteed thing. Alternately, they may be eventually phased out...but again, that would happen as a natural shift occurs, so no one's gonna get the rug yanked out from under them.

In short, this is the mystical "Public Option" which Democrats have been dreaming about for a decade: Not "single payer" in and of itself, but a solid, dependable, rational, logical path towards a potential eventual "single payer" plan...at a pace most of the population would be comfortable and totally OK with, because it would happen organically.

Health systems in developed countries

In developed countries, health systems that guarantee universal coverage have many variations—no two countries take the exact same approach. In England, the National Health Service owns and runs hospitals and employs or contracts with physicians. In Denmark, regions own and run hospitals, but reimburse private physicians and charge substantial coinsurance for dental care and outpatient drugs. In Canada, each province and territory runs a public insurance plan, which most Canadians supplement with private insurance for benefits that are not covered, such as prescription drugs or vision and dental care. In Germany, more than 100 nonprofit insurers, known as “sickness funds,” are payers regulated by a global budget, and about 10 percent of Germans buy private insurance, including from for-profit insurers. Across all of these systems, the share of health spending paid for by individuals out of pocket ranges from 7 percent in France to 12 percent to 15 percent in Canada, Denmark, England, Germany, Norway, and Sweden. In short, health systems in developed countries use a mix of public and private payers and are financed by a mix of tax revenue and out-of-pocket spending.

This, again, is directed specifically at those who claim that "EVERY OTHER COUNTRY HAS SINGLE PAYER!" even though only a handful actually do; they keep mistaking "universal coverage" for "single payer" when the two don't necessarily mean the same thing.

In the United States, Medicare is a model of these systems for the elderly population and provides a choice of a government plan or strictly regulated plans through Medicare Advantage. Medical providers are private and are reimbursed by the government either directly or indirectly.

These various systems share two defining features. First, payment of premiums through the tax system—rather than through insurance companies—guarantees universal coverage. The reason is that eligibility is automatic because individuals have already paid their premiums. Second, these systems use their leverage to constrain provider payment rates for all payers and ensure that prices for prescription drugs reflect value and innovation. This is the main reason why per capita health care spending in the United States remains double that of other developed countries.

Bingo: While insurance companies do tack on their own administrative costs and profit margin, that's only part of the reason healthcare is so expensive in America. At the end of the day, the carriers are just a middle man...it's healthcare provider, hospitals, medical device companies and drug companies which are the final destination for premiums, deductibles and co-pays.

Medicare Extra: Legislative specifications: Medicare Extra adopts the U.S. Medicare model and incorporates both of the common features of systems in developed countries. The following are detailed legislative specifications for the plan.

Eligibility

All individuals in the United States would be automatically eligible for Medicare Extra. Individuals who are currently covered by other insurance—original Medicare, Medicare Advantage, employer coverage, TRICARE (for active military), Veterans Affairs medical care, or the Federal Employees Health Benefits Program (FEHBP), all of which would remain—would have the option to enroll in Medicare Extra instead. Individuals who are eligible for the Indian Health Service could supplement those services with Medicare Extra.

Newborns and individuals turning age 65 would be automatically enrolled in Medicare Extra. This auto-enrollment ensures that Medicare Extra would continue to increase in enrollment over time.

YES, THANK YOU!

One of the main reasons people got so hot & bothered about the ACA was the infamous "If you like your plan you can keep it" brouhaha. As you may recall, the insurance carriers were given nearly four years to bring their non-compliant policies up to ACA requirements, with the deadline for doing so being 12/31/13. Very few did so, and as a result, in late October 2013, about 5-6 million people enrolled in non-compliant plans started receiving cancellation notices, advising them to replace it with a new, ACA-compliant plan. Many of them freaked the hell out, driven in large part by President Obama's infamous quip.

The backlash was so fierce that the Obama Administration had to backtrack somewhat, telling the individual states that if they wanted to, they could in turn allow the carriers in their state to extend the cut-off deadline by several years. Some states did, some didn't; some carriers did, some didn't.

The lesson, of course, is that people get very cranky about having their current healthcare coverage torn away even if it kind of sucks. Medicare is already the default transition for people who turn 65 anyway, so there's no "take it away!" fear there. That means having people go onto Medicare Extra when they hit 65 shouldn't be a big deal...they'd simply be transitioning over to Medicare Extra instead of Medicare Traditional. And for newborns...well, obviously they wouldn't care since, you know, they're newborns.

Let me put it this way: If Medicare Extra stopped right here, without anyone else signing up, we'd still achieve 100% "Medicare Extra for All" eventually...it would just take 65 years to accomplish.

Individuals who are not enrolled in other coverage would be automatically enrolled in Medicare Extra. Participating medical providers would facilitate this enrollment at the point of care. Premiums for individuals who are not enrolled in other coverage would be automatically collected through tax withholding and on tax returns. Individuals who are not required to file taxes would not pay any premiums.

THAT'S the biggest chunk of the public likely to be directly impacted: My guess is that it would eventually replace the entire current Individual Market, along with covering most of the remaining uninsured...with one major caveat:

In concert with comprehensive immigration reform, people who are lawfully residing in the United States would be eligible for Medicare Extra.

The individual market is currently somewhere around 16 million people total (I'm assuming it's dropped by a million or so over the past year due to the various sabotage factors I've written about so often). Another several million are in BHP plans, Health Sharing Ministries, Student Plans and so forth. Plus, of course, most of the ~28 million currently uninsured. Depending on how the immigration situation shakes out, you'd potentially be looking at anywhere between 25-30 million enrolled by the end of the fourth year (the timeline is described below), and it would grow from there.

Benefits

Medicare Extra would provide comprehensive benefits, including free preventive care, free treatment for chronic disease, and free generic drugs. The plan would guarantee the following benefits:

- Primary and preventive services

- Hospital services, including emergency services

- Ambulatory services

- Prescription drugs and medical devices

- Laboratory services

- Maternity, newborn, and reproductive health care

- Mental health and substance use disorder services

- Habilitative and rehabilitative services

- Dental, vision, and hearing services

- Early and periodic screening, diagnostic, and treatment services for children

Over time, these benefits would be updated, just as benefits are updated under Medicare, through its National Coverage Determination (NCD) process.

OK, so pretty much everything would be covered except non-medically necessary cosmetic surgery and the like. Good.

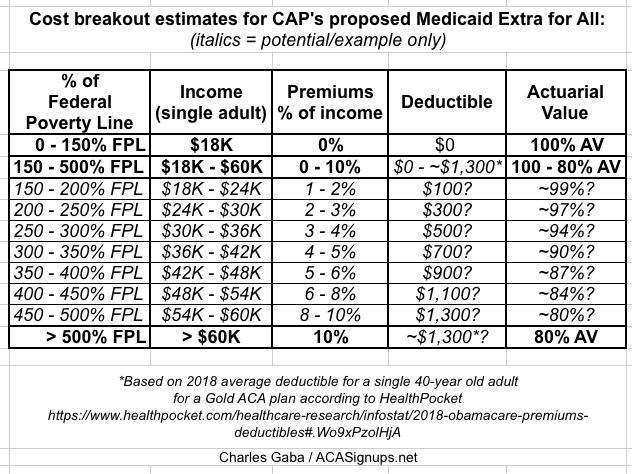

The Center for Medicare Extra (described below) would determine base premiums that reflect the cost of coverage only. These premiums would vary by income based on the following caps:

- For families with income up to 150 percent of the federal poverty level (FPL), premiums would be zero.

- For families with income between 150 percent and 500 percent of FPL, caps on premiums would range from 0 percent to 10 percent of income.

- For families with income above 500 percent of FPL, premiums would be capped at 10 percent of income.

The average share of costs covered by the plan, or “actuarial value,” would also vary by income. For individuals with income below 150 percent of FPL, the actuarial value would be 100 percent—meaning these individuals would face zero out-of-pocket costs. The actuarial value would range from 100 percent to 80 percent for families with middle incomes or higher.

Consistent with these actuarial values, the Center for Medicare Extra would set deductibles, copayments, and out-of-pocket limits that would vary by income. For individuals with income below 150 percent of FPL and lower-income families with incomes above that threshold, the deductible would be set at zero. Preventive care, recommended treatment for chronic disease, and generic drugs would be free.

If I'm understanding this correctly, this is roughly what things would look like at various income levels (I'm estimating the deductible based on the average 2018 deductible for an 80% AV Gold ACA plan, according to HealthPocket):

This is...extremely reasonable. To put it in ACA terms, it's effectively the rough equivalent of:

- Bumping ACA Medicaid expansion up to 150% FPL, across all 50 states

- Substantially beefing up the ACA's Advance Premium Tax Credit formula...

- ...while also moving the benchmark plan baseline up from a Silver to a Gold plan, and...

- ...removing the 400% FPL cap on subsidies, while simultaneously...

- ...making the ACA's "Family Glitch" and "Skinny Plan" glitch moot, since all employees would be able to jump on board regardless of their family coverage situation or how generous/skimpy their employer plan was.

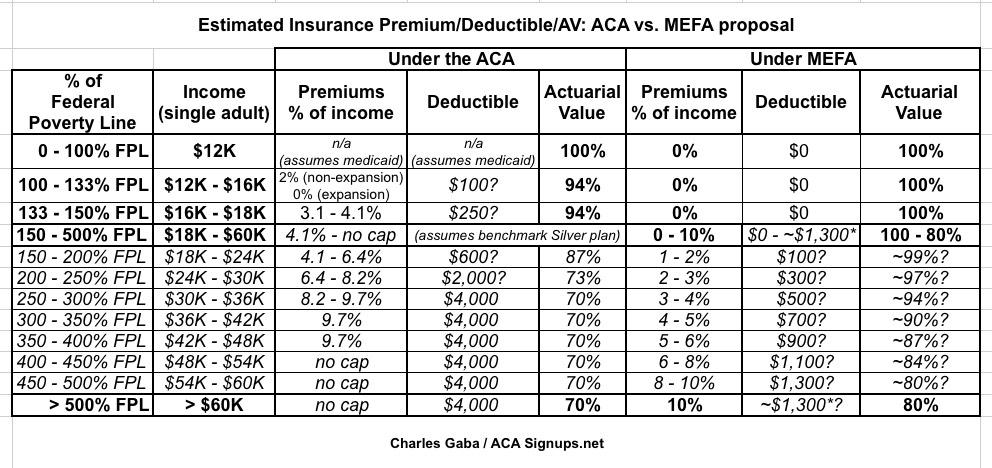

UPDATE: OK, by request, I've expanded the table above in an attempt to provide a side-by-side comparison of how Medicare Extra for All (MEFA) enrollee expenses would look compared to current ACA exchange enrollees. It's not a perfect comparison for a couple of reason, of course; in addition to the caveats already noted above, the way deductibles and AV ratings work is somewhat different between the two plans, so for the ACA I assumed a single 40-year old adult choosing a benchmark Silver plan. Also, under 133% it gets confusing because of the Medicaid expansion split and the 100% - 133% overlap (I didn't even bother trying to explain the 133% / 138% question for Medicaid expansion). The 94% / 87% / 73% AV ratings between 100 - 250% FPL come straight from the Cost Sharing Reduction program. The deductibles listed under the ACA benchmark plan are estimates based on average Silver deductibles from HealthPocket and some educated guesses on my part for the CSR levels.

All that being said, if you line the two up next to each other, here's roughly what it looks like. Needless to say, MEFA coverage would be is much more generous/robust at pretty much every level:

Enrollees would have a free choice of medical providers, which would include any provider that participates in the current Medicare program. Copayments would be lower for patients who choose centers of excellence that deliver high-quality care, as determined by such measures as the rate of hospital readmissions.

With the exception of employer-sponsored insurance, private insurance companies would be prohibited from duplicating Medicare Extra benefits, but they could offer complementary benefits during an open enrollment period. Complementary insurance would be subject to a limitation on profits and banned from denying applicants, varying premiums based on age or health status, excluding pre-existing conditions, or paying fees to brokers.

OK, I admit I'm not 100% sure what this means--does "no duplicating but complementary is ok" mean "no more private individual market at all"? I take it that's not what it refers to. Will update this when I find out.

UPDATE: Louise Norris thinks that it does mean exactly this: The private individual market would eventually be phased out altogether, except for supplemental insurance, along the lines of MediGap plans for Medicare enrollees today. Again, I'd be fine with that. The individual market is a royal pain in the ass for everyone including the carriers anyway, which is why the "3-legged stool" was necessary in the first place. I can't fathom too many people crying over this provision.

Long-term services and supports

Millions of Americans rely on long-term services and supports (LTSS) to support their daily living needs, making expansion and improvement of LTSS coverage an important part of health care reform, especially for Americans with disabilities.

Currently, individuals with disabilities who receive Social Security Disability Insurance are subject to a two-year waiting period before they are eligible for Medicare. Medicare Extra would eliminate this waiting period. In addition, individuals with disabilities can be disqualified from Medicaid coverage if their assets exceed a limit. Medicare Extra would eliminate this asset test and allow individuals with disabilities to earn and keep their savings.

Under the current Medicaid program, there is a wide variation in the benefits offered for LTSS. Medicare Extra would establish a benefit standard based on the benefits of high-quality states, as rated by access and affordability. The Medicare Extra benefit would include coverage of home and community-based services, which make it possible for seniors and people with disabilities to live independently instead of in institutions.

As discussed below, states would make maintenance-of-effort payments to Medicare Extra. States that currently provide more benefits than the Medicare Extra standard would be required to maintain those benefits, sharing the cost with the federal government as they do now. States would continue to administer the benefits that would be financed by Medicare Extra.

The Center for American Progress is developing additional LTSS policy options to supplement this new Medicare Extra benefit.

I don't know much about, or write much about, Long-Term Services/Supports, but I do know that my stepfather, who passed away last fall at the age of 99, required 24/7 care for the last 10 years of his life, and that Medicare didn't cover a lot of that. It cost a fortune. This is a huge and growing problem as medical science improves and the country ages.

Medicare Choice

Within the current Medicare program, Medicare Advantage provides a choice of plans that deliver Medicare benefits to seniors. Currently, an estimated 20.4 million seniors are enrolled in Medicare Advantage, or 34 percent of total Medicare enrollment. There is evidence that these plans can provide care that is high quality. However, Medicare often overpays these plans compared with the traditional Medicare program.

Medicare Extra would reform Medicare Advantage and reconstitute the program as Medicare Choice. Medicare Choice would be available as an option to all Medicare Extra enrollees. Medicare Choice would offer the same benefits as Medicare Extra and could also integrate complementary benefits for an extra premium.

To eliminate overpayments to plans, Medicare Extra would use its bargaining power to solicit bids from plans. Medicare Extra would make payments to plans that are equal to the average bid, but subject to a ceiling: Payments could be no more than 95 percent of the Medicare Extra premium. This competitive bidding structure would guarantee that plans are offering value that is comparable with Medicare Extra. If consumers choose a plan that costs less than the average bid, they would receive a rebate. If consumers choose a plan that costs more than the average bid, they would pay the difference.

Medicare and Medicare Advantage have never been my area of expertise, so I'll avoid commenting too much on this idea. It sounds like a good thing, but again, not in my wheelhouse.

Employer choice

U.S. employers currently provide coverage to 152 million Americans and contribute $485 billion toward premiums each year. Surveys indicate that the majority of employees are satisfied with their employer coverage. Medicare Extra would account for this satisfaction and preserve employer financing so that the federal government does not unnecessarily absorb this enormous cost.

THIS has been and remains one of the biggest stumbling blocks for "Universal Single Payer" proposals: While the individual insurance market sucks for millions of unsubsidized people, more than half of employer-sponsored insurance enrollees have no beef with their plan. They may not love it, they may have gripes here and there...but they aren't unhappy either, certainly not unhappy enough to demand something different. Again, think about the "you can keep it!" backlash in October 2013...but multiply that by 10x, and you see why it's so tricky to try and rip away employer coverage from nearly half the country.

CAP's Medicare Extra avoids this problem entirely by making the shift voluntary for both the employers and employees. If they're happy with their current setup, fine. If it sucks, they switch.

The reason the "you can keep it" backlash happened is because the ACA originally only allowed those with non-ACA individual market plans from before 2010 to keep them; plans enrolled in between 2010 - 2014 were supposed to be cut off on 12/31/13. One of the reasons for that is simple: If you're going to invoke guaranteed issue and community rating provisions, that means you have to have a broad, stable risk pool of enrollees...and the individual market has always been pretty small (it rose from around 10.6 million people in 2013 (just before ACA regulations kicked in) to an all-time high of around 18-19 million before dropping off again last year...and again, some of those are part of a different risk pool), so it's tricky to get a broad risk pool, so you have to do what you can to nudge people into it. This is the exact opposite of what the Trump Administration and Congressional GOP have been doing the past year, of course.

Under Medicare Extra, there should be a solid 25-30 million right off the bat...and since it's mostly publicly funded, there's less pressure to Keep It In The Black anyway. Thus, the pool should be plenty large enough to allow anyone else the leisure of deciding whether to jump in or not.

At the same time, employer coverage is becoming increasingly unaffordable for many employees. Among employees with a deductible for single coverage, the average deductible has increased by 158 percent—faster than wages—from 2006 to 2017. The Health Care Cost Institute recently found that price growth accounts for nearly all of the growth in health care costs for employer-sponsored insurance.

Yup. Most employer-sponsored insurance enrollees are "satisfied" with their plans now, but that's gradually slipping. Employers are seeing their healthcare costs increase year over year, which they're passing onto their employees in the form of skimpier coverage. The "Skinny Plan" glitch of the ACA means that while the Employer Mandate does require companies to provide coverage, the coverage provided doesn't have to necessarly be awesomesauce.

Medicare Extra balances the desire of most employees to keep their coverage with the need of many employees for a more affordable option. Employers would have four options designed to ensure that they pay no more than they currently do for coverage.

First, employers may choose to continue to sponsor their own coverage. Their coverage would need to provide an actuarial value of at least 80 percent and they would need to contribute at least 70 percent of the premium; the vast majority of employers already exceed these minimums. The current tax benefit for premiums for employer-sponsored insurance—which excludes premiums from income that is subject to income and payroll taxes—would continue to apply (as modified below).

In other words, they can keep providing coverage themselves, but the coverage has to be solid (ACA Gold or better), closing the Skinny Plan glitch, and they have to keep covering the lion's share of premiums.

Second, employers may choose to sponsor Medicare Extra for all employees as a form of employer-sponsored insurance. Employers would need to contribute at least 70 percent of the Medicare Extra premium. Under this option, employers would automatically enroll all employees into Medicare Extra. The Medicare Extra cost-sharing structure would apply and employees would pay the Medicare Extra income-based premium for their share of the premium. The tax benefit for employer-sponsored insurance would not apply to premium contributions under this option.

That's the catch here--the plans would be less expensive...but they also wouldn't get the tax break.

Third, employers may choose to make maintenance-of-effort payments, with their employees enrolling in Medicare Extra. These payments would be equal to their health spending in the year before enactment inflated by consumer medical inflation. To adjust for changes in the number of employees, health spending per full-time equivalent worker (FTE) would be multiplied by the number of current FTEs in any given year. The tax benefit for employer-sponsored insurance would not apply to employer payments under this option.

In other words, the employees would still move to Medicare Extra, but the employer would have to pony up about the same amount of money to the government either way. This effectively means paying the government to handle the administrative headaches for them, which I suspect most companies would be more than happy to do anyway.

Fourth, employers may choose to make simpler aggregated payments in lieu of premium contributions. These payments would range from 0 percent to 8 percent of payroll depending on employer size—about what large employers currently spend on health insurance on average. The tax benefit for employer-sponsored insurance would not apply to employer payments under this option.

This is about the same as the third option but it keeps the calculations simpler: If you have X number of employees, you pay Y% of it to the government to help pay for your employees getting Medicare Extra coverage on their own.

Small employers—71 percent of which do not currently offer coverage—would not need to make any payments at all. They may choose to offer no coverage, their own coverage subject to ACA rules in effect before enactment, or Medicare Extra. Small employers are defined as employers that employ fewer than 100 FTEs for purposes of the options described above.

Interesting. Under the ACA, "small employer" is defined as 50 full time employees or more; under Medicare Extra, that would be bumped up to 100.

Employee choice

When employers choose to offer their own coverage, employees may choose to enroll in Medicare Extra instead. At the beginning of open enrollment, employers would notify employees of the availability of Medicare Extra and provide informational resources. If employees do not make a plan selection, employers would automatically enroll them into their own coverage.

When employees enroll in Medicare Extra, their employers would contribute the same amount to Medicare Extra that they contribute to their own coverage. The Medicare Extra income-based premium caps would apply to the employee share of the premium. Because employees would be subsidized by Medicare Extra, the tax benefit for employer-sponsored insurance would not apply to employer premium contributions under this option.

I'm honestly not sure whether the ACA's Open Enrollment Period would still be in place here--it sounds like "open enrollment" refers to the employer's OEP, not the one currently in place under the ACA. I could be misunderstanding this, however.

State maintenance of effort

Medicaid and the Children’s Health Insurance Program (CHIP) would be integrated into Medicare Extra with the federal government paying the costs. Given the continued refusal of many states to expand Medicaid and attempts to use federal waivers to undermine access to health care, this integration would strengthen the guarantee of health coverage for low-income individuals across the country. It would also ensure continuity of care for lower-income individuals, even when their income changes.

In other words, CAP has decided to fix the problem of Kentucky, Indiana and other red states screwing around with Medicaid by saying "screw this!" and federalizing the whole damned thing. Works for me.

States would be required to make maintenance-of-effort payments to Medicare Extra equal to the amounts that they currently spend on Medicaid and CHIP. For states that did not expand Medicaid, these amounts would be inflated by the growth in gross domestic product (GDP) per person plus 0.7 percentage points. For states that did expand Medicaid, these amounts would be inflated by the growth in GDP per person plus 0.2 percentage points. After 10 years of payments, they would then increase by the growth in GDP per person plus 0.7 percentage points for all states. This structure would ensure that no state spends more than they currently spend, while giving a temporary discount to states that expanded their Medicaid programs.

Good. The blue states get a little bonus for ponying up their share of the Medicaid bill the past few years while the red states were dragging their heels.

States that currently provide benefits that are not offered by Medicare Extra would be required to maintain those benefits, sharing the cost with the federal government as they do now. They would provide “wraparound” coverage that would supplement Medicare Extra coverage.

Administration

Medicare Extra would be administered by a new, independent Center for Medicare Extra within the current Centers for Medicare and Medicaid Services, which would be renamed the Center for Medicare. To ensure that the Center for Medicare Extra is immune from partisan political influence within the administration, the legislative statute would leave little to no discretion to the administration on policy matters. In this respect, the administration of Medicare Extra would resemble the administration of the current Medicare program and not of the Medicaid program.

Good. No farting around by toadies like Tom Price or Seema Verma (I haven't concluded anything about Alex Azar yet).

Transitioning to Medicare Extra

The transition to Medicare Extra would be staggered to ensure a smooth implementation. The steps would be sequenced based on need, fairness, and ease of implementation. Before Medicare Extra is launched, a public option would fill immediate gaps and provide immediate relief.

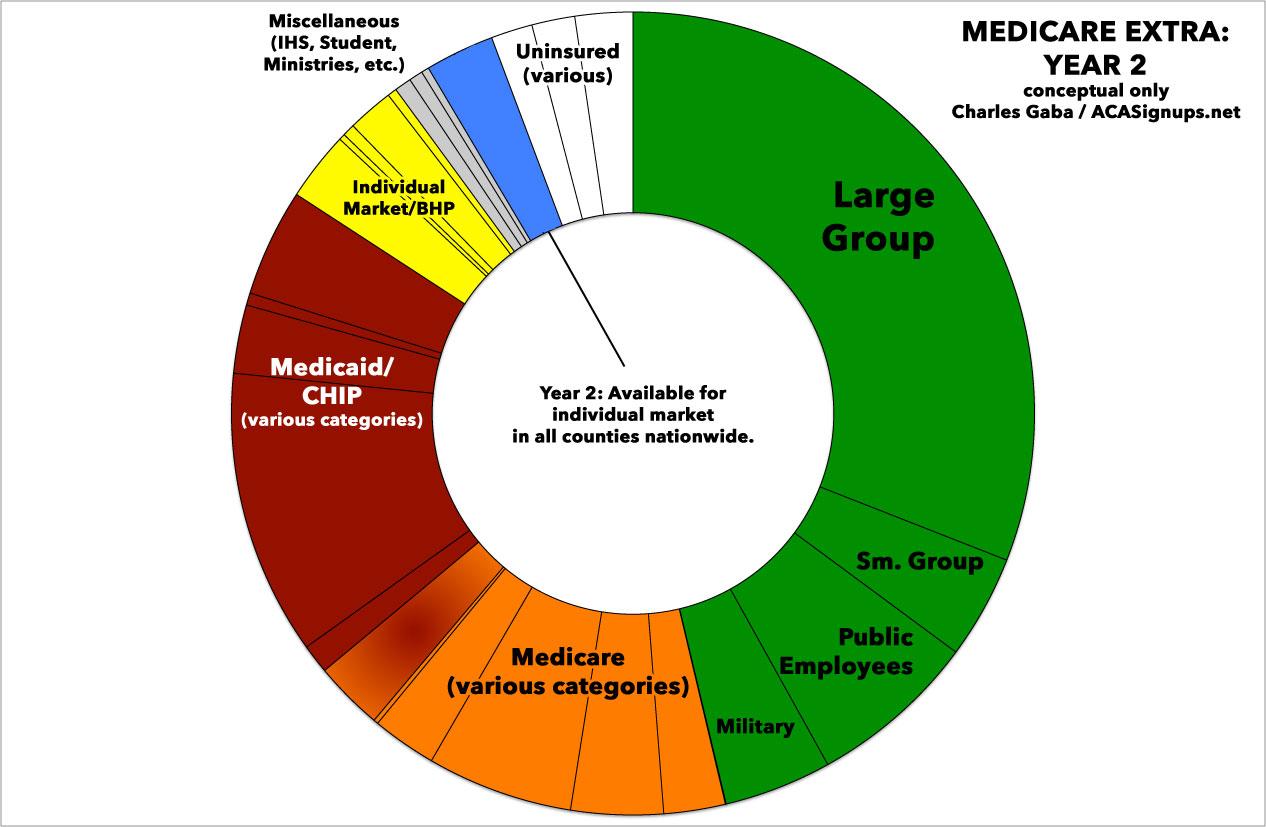

In the first year after enactment (Year 1), the Center for Medicare Extra would be established and would offer a public option in any counties that are not served by any insurer in the individual market. The provider payment rates of the plan would be 150 percent of Medicare rates. In Year 2, this plan could be extended to other counties in the individual market.

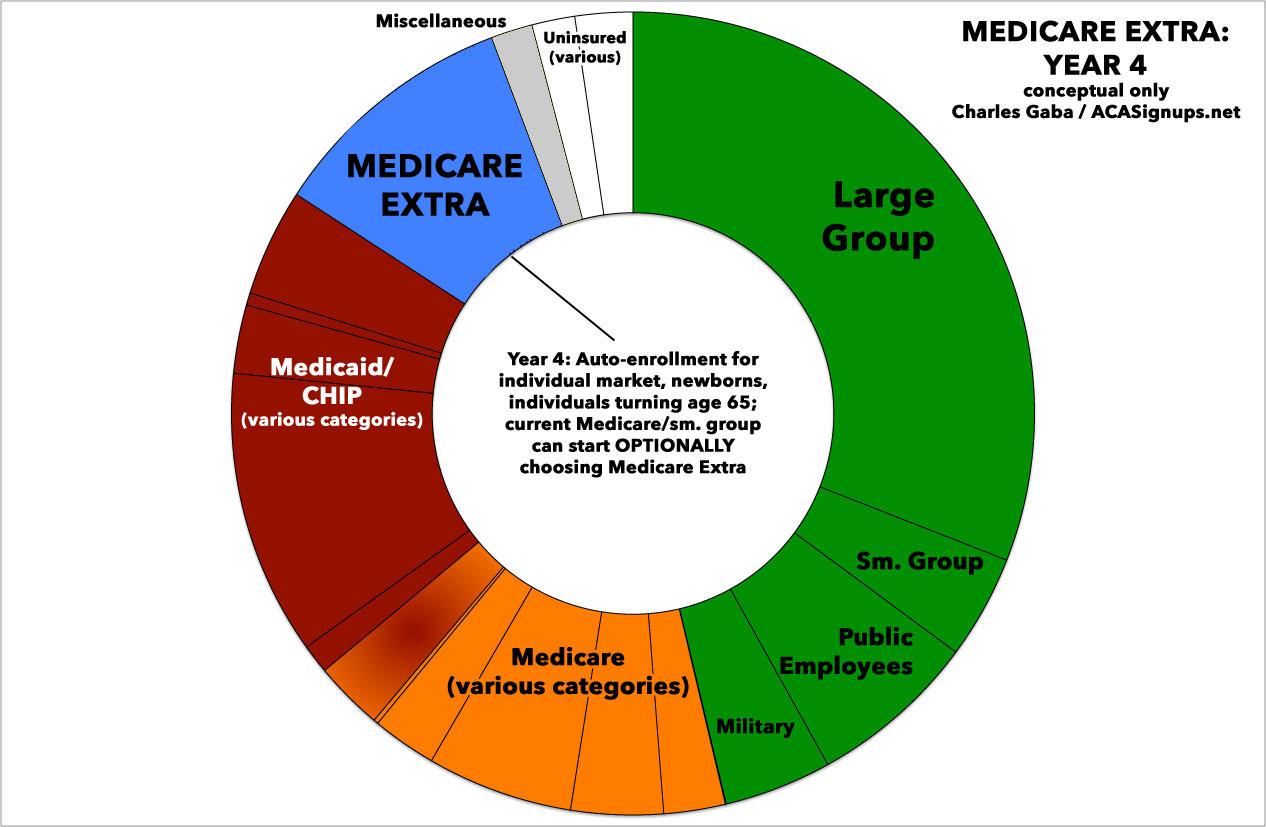

In Year 4, the Center would launch Medicare Extra. Auto-enrollment would begin for current enrollees in the individual market, the uninsured, newborns, and individuals turning age 65. Enrollees in the current Medicare program and employees with employer coverage would have the option to enroll in Medicare Extra instead. Small employers would have the option to sponsor Medicare Extra for all employees.

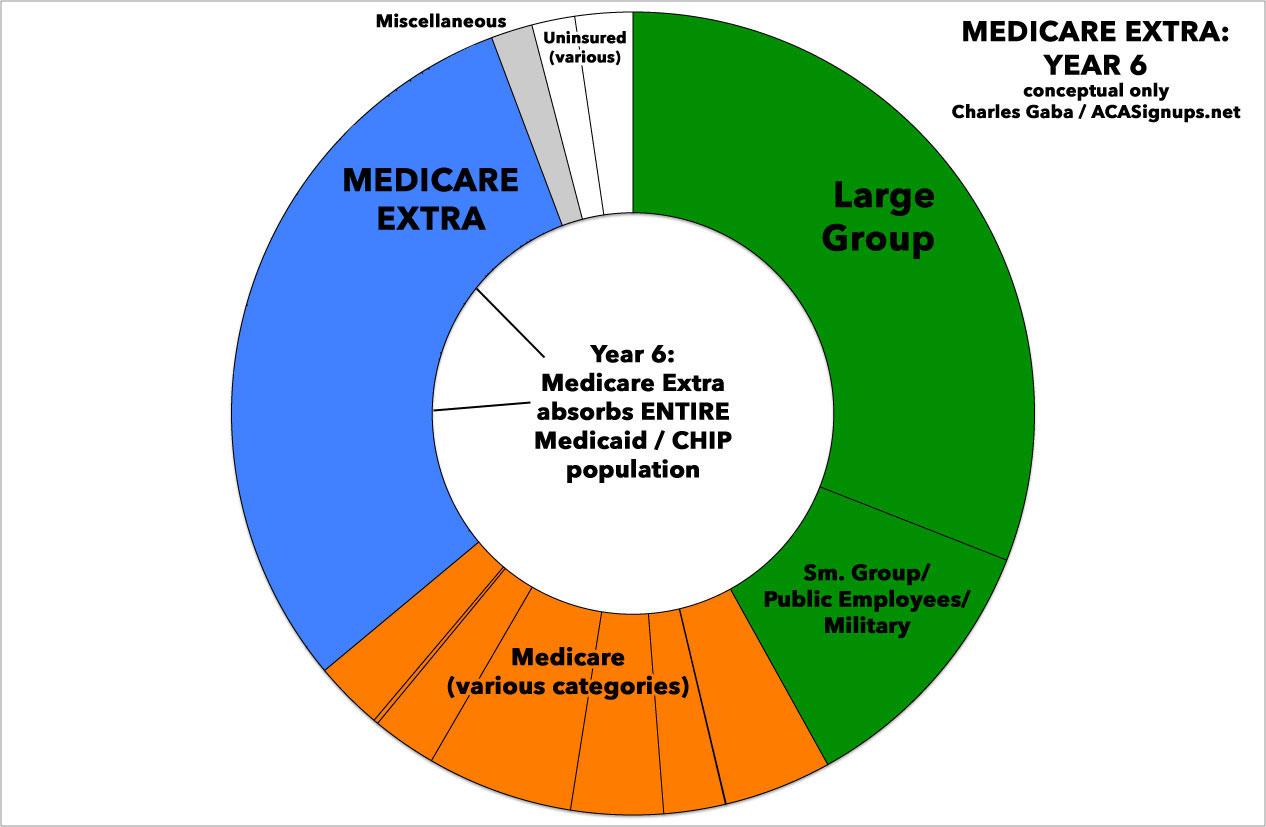

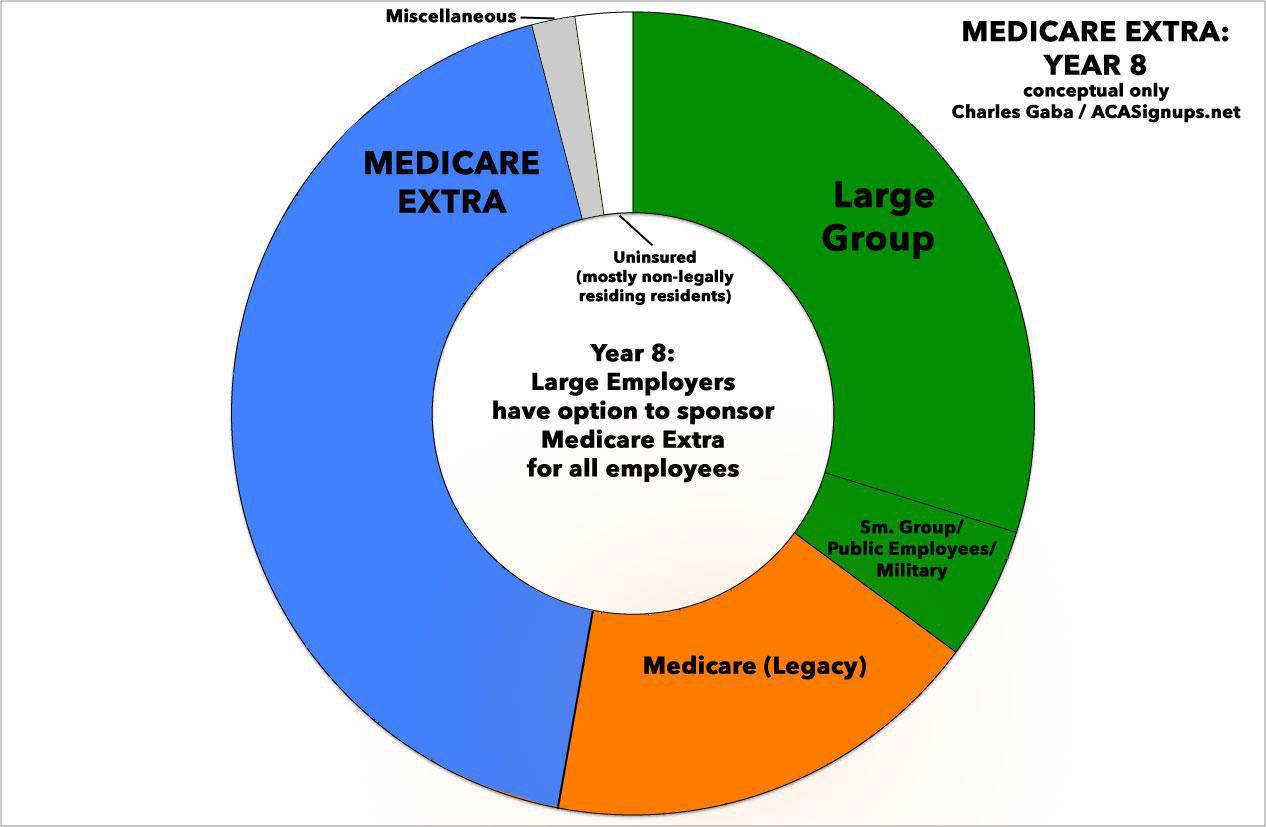

In Year 6, enrollees in Medicaid and CHIP would be auto-enrolled into Medicare Extra. In Year 8, large employers would have the option to sponsor Medicare Extra for all employees, and the tax benefit for employer-sponsored insurance would be limited for high-income employees.

Excellent. I've said before that it would likely take 5-10 years to fully ramp up a program of this scope (vs. 10 - 20 to go full-blown Single Payer, even assuming it was politically or logistically feasible).

NOTE: I'm skipping over the ENTIRE "how to pay for it" section, not because this isn't a vitally important topic but because a) a lot of it goes over my head and b) this post is getting too damned long. Suffice it to say that there are plenty of other think pieces which I'm sure go into far more depths about the potential costs, savings, and tax implications of Medicare Extra.

Whew!

OK. So...what do I think?

Well, obviously the end result is likely to differ somewhat from what they posted today in quite a few ways, but assuming the plan were to be enacted pretty much as described above...I like it. A lot.

Read my post over at Cracked from last year in which I describe about a half-dozen major headaches/barriers which need to be overcome in order to make any large-scale changes to the U.S. healthcare system. The Center for American Progress Medicare Extra for All proposal tackles most of them, and does so in a way which will piss off the fewest number of people while also being scaled up gradually enough to cause minimal disruption but quickly enough to achieve universal coverage within 8 years of being passed...which is about as quickly as anyone could reasonably expect it to happen in my view.

By an amazing coincidence, 8 years also happens to be the exact length of 2 Presidential terms of office. Even if it were to pass and be signed into law, I don't think CAP expects that to happen any earlier than January 20, 2021, of course...even with a massive Blue Wave in November, you'd still have Donald Trump in the White House (er...Mar a Lago, that is). But assuming we elect a Democratic President in 2020, 8 years is just about the right timeframe.

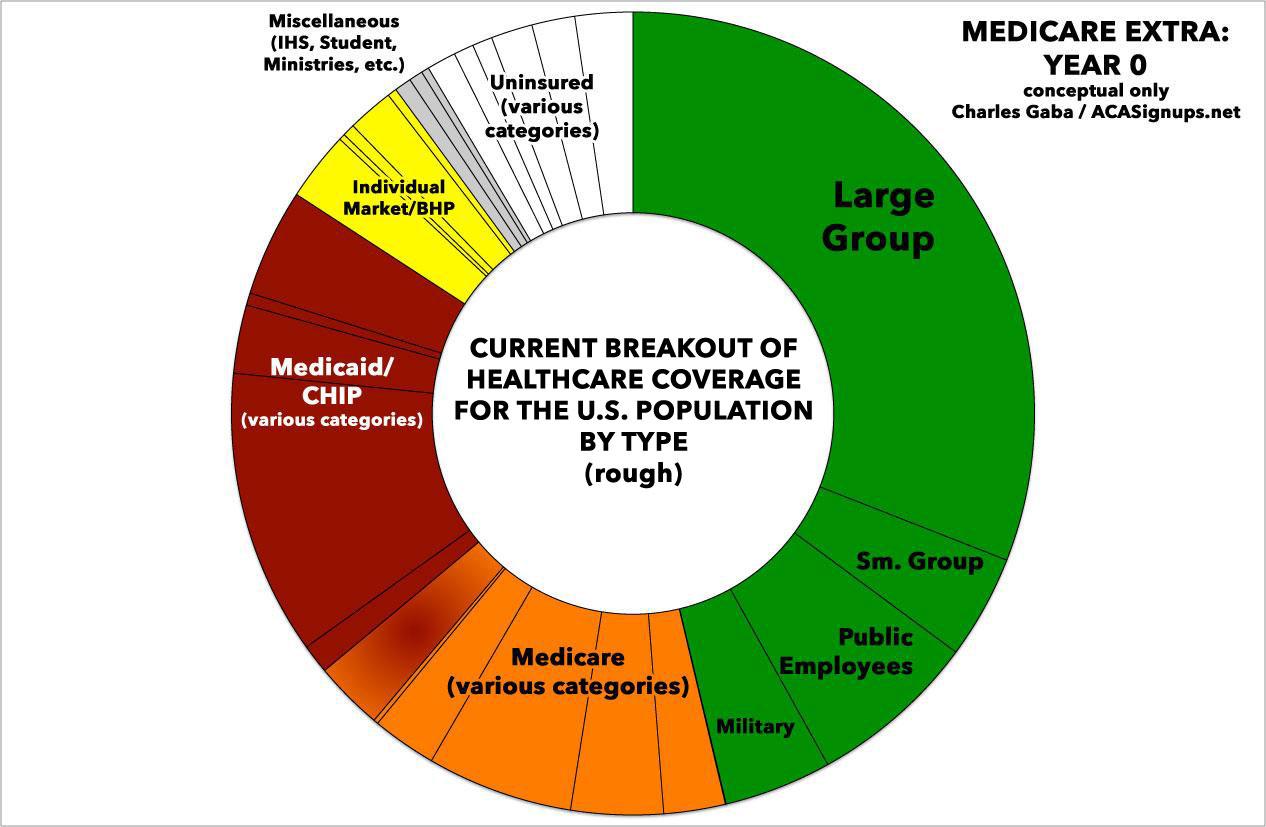

Assuming ideal circumstances (hah!), here's how I the 8-year phased-in process would theoretically play out (the exact ratios below are very rough, of course, and are for illustrative purposes only). The first "psychedelic donut" is taken from about a year ago; obviously some of these slices have shifted around a bit since then, with the uninsured section widening by a few million people due to various factors, including Trump/GOP sabotage of the individual market and so forth:

By the end of Year 8, practically the entire U.S. population would theoretically be covered by one of three types of healthcare programs:

- About 40% would still be enrolled in employer-based insurance (including public employees and the military).

- About 15% would still be enrolled in "legacy" Medicare programs of some sort.

- About 40% would have transitioned over to Medicare Extra.

- I'd imagine perhaps 1-2% would be enrolled in other various programs such as the Indian Health Service and so forth.

- Finally, a small percent of the population, perhaps 2-3%, would still be uninsured, mainly consisting of undocumented immigrants.

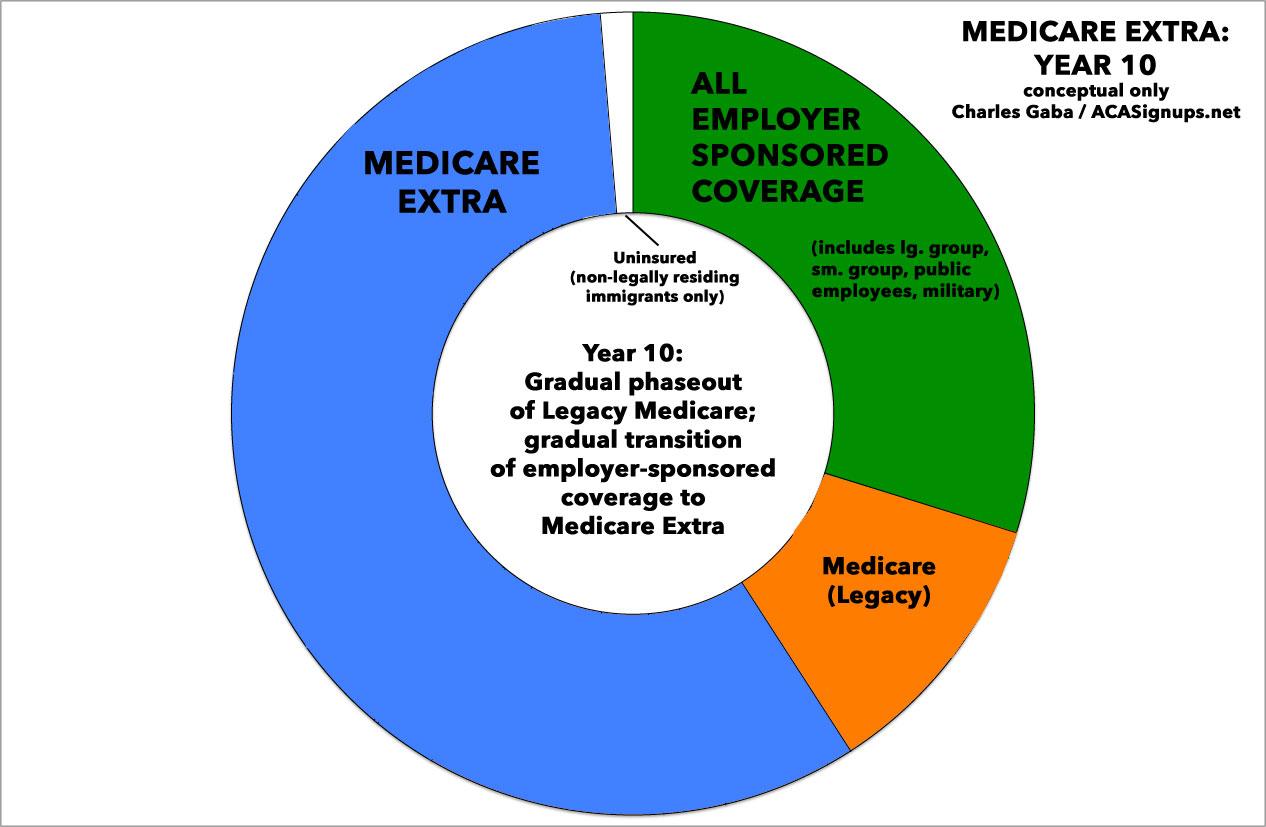

Assuming the entire process went smoothly (hah!) and there were no other major disruptions or policy changes along the way (double hah!), from this point forward it would likely just be a gradual phasing out of legacy Medicare enrollees as they pass away (or choose to move to Extra). It's possible that every employer would eventually switch over as well, which would result in a 100% Single Payer-based system down the road...or, perhaps you'd end up with 2/3 of the country in Medicare Extra while 1/3 sticks with employer-based coverage. Ideally, I could see it looking something like this by around Year 10:

The thing is, either of these routes would have achieved the goal: near-100% universal, comprehensive, publicly-funded healthcare coverage, done in a way which is rational, responsible, feasible and practical.

Overall, "Medicare Extra for All" is very similar to a couple of other proposed plans, including former Congressman Pete Stark's AmeriCare Health Care Act:

You can think of the AmeriCare approach as a public option on steroids. It would create a new single-payer program called AmeriCare that would take on everyone ensured by Medicaid and SCHIP, and would automatically enroll all children at birth. It would pay the same rates to providers as Medicare, meaning it'd be considerably less generous to doctors and hospitals than private insurers.

AmeriCare involves cost sharing very similar to what you'd find in a private plan, but more affordable. There are deductibles ($350 for individuals, $500 for families), co-insurance (20 percent of spending above the deductible), an out-of-pocket spending cap ($2,500 for individuals, $4,000 for families), and premiums.

However, cost sharing would be sharply limited for low-income families. Individuals and families living on less than twice the poverty line ($48,500 for a family of four in 2015) wouldn't have to pay premiums, deductibles, or co-insurance, and there would be premium subsidies and lower deductibles for people between two and three times the poverty line.

Here's the kicker: Employers could buy into the plan. They'd have to pay 80 percent of the premium, leaving 20 percent to employees, but it'd be an alternative every company got to their existing private plan.

...as well as other proposals by Jacob Hacker...

It should be resurrected. Under the proposal I’m describing, employers would either provide insurance that was at least as generous as Medicare Part E’s or they would contribute to the cost of Medicare Part E, which would automatically enroll their workers. Because the contribution requirement is central to signing people up, it should cover the entire workforce—including independent contractors and other self-employed workers (who would pay the contribution directly, as they do Medicare and Social Security taxes). But the level of contribution should vary with wages. That’s how the House bill worked: The contribution would have risen from nothing for the lowest-wage firms up to 8 percent of payroll for the highest-wage firms.

...and this one by Jon Walker of ShadowProof:

Automatic enrollment in MICA is limited to citizens and legal residents. The challenges undocumented people face in obtaining health care may be best addressed through immigration reform. Enrolling undocumented people in the federal system comes with substantial risk, as immigration officials could use their enrollment to locate them and initiate deportation proceedings. An immigration bill is needed to resolve their documentation status so they can obtain health care without fear of reprisals.

...Employer-provided insurance is one of the top sources of funding in our health care system, but most people don’t realize what their benefits truly cost them. Instead of trying to fully educate everyone about this and how a whole large new tax would on net leave them better off, it is politically easier to just build on top of this funding source. It also technically puts the responsibility of moving people from private insurance onto MICA on the employers instead of the government. The hope is most companies will accept this change because signing up with MICA would dramatically reduce their health care costs.

Credit aside, I'm extremely impressed with CAP's "Medicare Extra for All" proposal. If something along these lines was to become the Next Big Healthcare Policy to succeed the Affordable Care Act, I'm on board.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.