CAP analysis confirms: ACA Sabotage jacked rates $1,000 this year and will jack them ANOTHER $1,000 next year

Back in mid-April, I crunched a bunch of numbers and concluded that around 6.5 million people enrolled in unsubsidized ACA-compliant individual market policies are, on average, paying an additional $960/year ($80/month) for their policies this year due specifically to last year's sabotage efforts by Donald Trump and Congressional Republicans. This is separate from other factors such as medical trend and the reinstatement of the ACA carrier tax. The actual 2018 "Trump Tax" ranges from as little as almost nothing at all in Vermont and North Dakota to as high as $1,500 per enrollee in Mississippi and Pennsylvania.

The 2018 sabotage impact was mainly due to 1) CSR reimbursement funding being cut off; 2) uncertainty over individual mandate enforcement; and 3) a mish-mash of Open Enrollment changes including cutting the time window in half, slashing marketing/assistance budgets by 90% and 40% respectively and so forth.

As it happens, that ~$960/person Trump Tax was exactly the same as one of the most likely scenarios projected by the Center for American Progress a year earlier:

But even the mere possibility that the Administration fails to implement these ACA provisions could spur a rate hike. Assuming a 25 percent chance that both these changes occur would suggest an 8.5 percent rate hike, or $480 annually on top of normal premium growth, as shown in Table 1. If insurers priced in a 50 percent likelihood of both these changes, that would lead to a 17 percent increase or $960.

Early data show that 2018 rates may be coming in higher than expected in many places. In a recent survey of insurers, the consulting firm Oliver Wyman found that the median rate increase for 2018 will be somewhere between 10 and 20 percent, an increase above what medical trend alone would justify.

The ~$1,000 figure is also very close to similar projections by both myself and the Urban Institute:

In other words, at the moment, carriers across those 21 states are asking for an average premium increase of (($467 x 1.19) - $467) = $89/month x 12 months = $1,068 specifically to cover their anticipated cost sharing reduction losses.

As it happens, this is also almost exactly the same amount that the Urban Institute projected would be the case nearly a year and a half ago:

We find that premiums for silver Marketplace plans would increase $1,040 per person on average. This premium increase would, on average, make silver plan premiums higher than those of gold plans(plans with 80 percent actuarial value). The higher premiums would in turn lead to higher federal payments for Marketplace tax credits because such payments are tied to the second-lowest-cost silver plan premium. All tax credit–eligible Marketplace enrollees with incomes up to 400 percent of FPL would receive larger tax credits, not just those eligible for CSRs.

Note that at the time I was assuming around 19% due to sabotage out of 34% total rate hikes; I later revised both of these downwards to 17.8% out of 29.7% total, which would amount to $83/month or $996/year.

In other words, no matter how you slice it, Urban Institute had it right, I had it right and the Center for American Progress had it right at the national level.

OK, so that's 2018. What about 2019? In addition to everything listed above (CSR cut-off, shortened enrollment period, etc), there's three new types of sabotage being implemented by Trump and Congressional Republicans: Actual repeal of the individual mandate; expansion of non-ACA compliant Short-Term Plans (STPs); and expansion of non-ACA compliant Association Health Plans (AHPs). Keep in mind that there's a big difference between raising premiums slightly just in case the IRS doesn't enforce the mandate penalty and raising them significantly once the penalty is actually repealed altogether.

OK, so what impact is this new suite of sabotage policies going to have next year?

Well, once again, there's the Urban Institute, which projects that...

- The elimination of the individual-mandate penalties and the other policy changes, such as the withdrawal of cost-sharing reduction payments and the diminution of federal investments in advertising and enrollment assistance during 2017 that affected the 2018 open enrollment period, will lead to an additional 6.4 million people uninsured in 2019 compared with prior law (12.5 percent of the nonelderly population uninsured compared with 10.2 percent).

- The introduction of expanded short-term, limited-duration policies, consistent with proposed regulations, would increase the number of people without minimum essential coverage by 2.5 million in 2019. Of the 36.9 million people without minimum essential coverage, 32.6 million would have no coverage at all (completely uninsured), and 4.2 million would enroll in expanded short-term limited-duration plans.

- The combined effect of eliminating the individual-mandate penalties and expanding short-term limited-duration policies would increase 2019 ACA-compliant nongroup insurance premiums 18.2 percent on average in the 43 states that do not prohibit or limit short-term plans.

It's important to note that when all 50 states + DC are included, the Urban analysis projects the average sabotage-specific premium impact to be more like 16.6% nationally.

There's also this very rough, blurry, early projection from a presentation at the National Health Policy Conference, which suggests around a 20% overall average rate increase, with 2/3 of that (around 14%?) being sabotage-specific.

For mandate penalty repeal specifically, the Congressional Budget Office officially projects a one-time 10% premium increase.

For expansion of short-term plans, the HHS Dept's. official chief actuary projects federal spending on increased subsidies to cover the increase premiums will amount to $1.2 billion next year alone. How much would $1.2 billion represent in terms of premium increases? Well, that's a bit tricky since it also relies on knowing how many healthy people would be dropping their ACA-compliant coverage to move to junk plans, but I can take a shot:

- In 2017, according to a new report from the Milliman actuarial firm, around 9.8 million people were enrolled in effectuated on-exchange policies each month on average.

- Around 83% of those folks were subsidized, or roughly 8.1 million each month.

- This year, exchange enrollment dropped about 3.8%, while the subsidized portion remained at 83%, so that should mean roughly 7.8 million subsidized enrollees each month in 2018.

- Subsidized enrollment will likely remain nearly the same next year, since just about all of the enrollment drop due to both mandate repeal and #ShortAssPlans will likely come from the unsubsidized ACA market, which means...

- That $1.2 billion would likely be spread out across around 7.8 million people...

- ...which means the HHS actuary is projecting a subsidy increase of around $154 per person ($13/month) specifically due to short-term plan expansion.

- Since the average exchange-based premium this year is around $600/month, that means HHS is projecting about a 2% premium increase due to STP expansion.

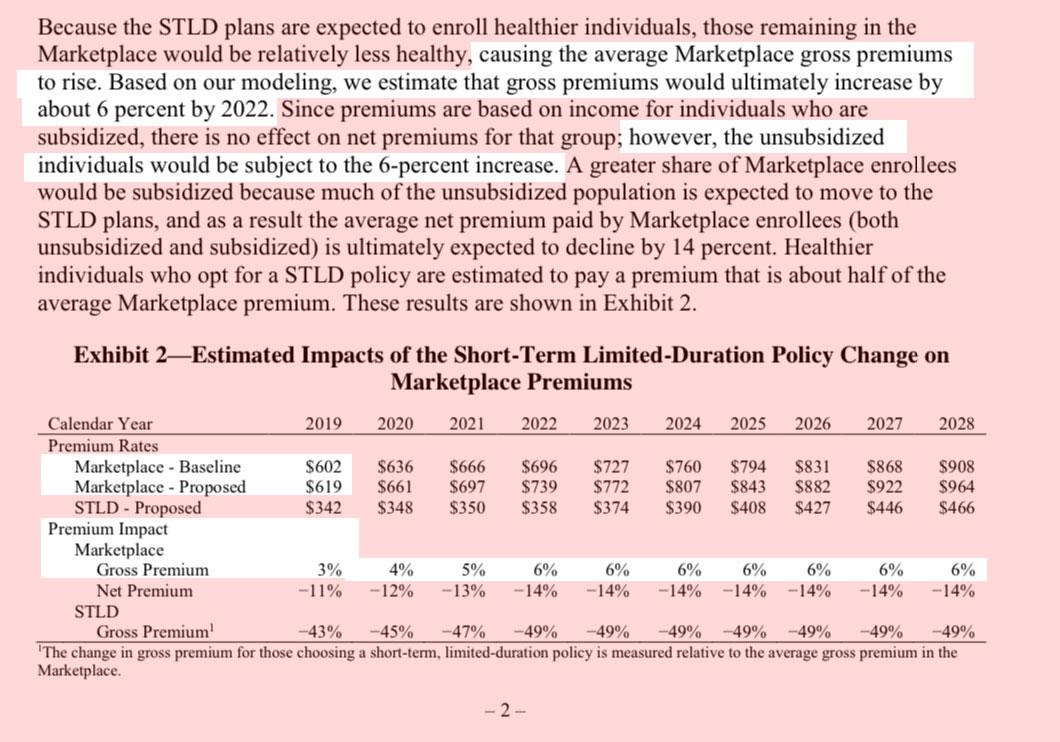

UPDATE: D'OH!! It turns out I didn't even need to do all that back-of-the-envelope math; I found the link to the HHS Chief Actuary Report itself!

That's a 3% increase in unsubsidized premiums in 2019 specifically due to expansion of short-term plans alone, rising to 6% by 2022.

Of course this still doesn't account for association plan expansion. For that, I turn to a new analysis from The Actuary magazine, which suggests 1.4% - 4.4% increase in claims on the individual market due to cannibalization by AHPs...which, in turn, means at least somewhere around a 3% premium increase.

Add up all 3 (10% mandate repeal, 3% short-term plans, 3% association plans) and you're talking about around a 16% average premium spike in 2019 due to this year's ACA sabotage.

...which, as it happens, is almost identical to what the Urban Institute is projection as well (16.6% nationally on average).

All of which brings me to the actual headline of this entry:

State-by-State Estimated Premium Increases due to Individual Mandate Repeal and Short-Term Plan Rule

Using estimates from the Urban Institute, this column projects average state-by-state premium increases for 2019, in dollars. Estimated premium increases due to these acts of marketplace sabotage average $1,013 nationally for benchmark premiums for a 40-year-old individual.

...Combined, the recent tax law’s repeal of the individual mandate and the administration’s short-term plan rule will undermine the individual insurance market and increase premiums for ACA-compliant coverage.

Using the Urban Institute’s projections of the average percent premium increase due to these two actions, CAP estimated the potential premium increase in dollars for each state in 2019. For example, in Tennessee, the 2019 annual premium for a benchmark plan for a 40-year-old would be $1,727 higher due to the two Trump administration policies. While premium tax credits may cushion the blow of rate increases for lower-income enrollees, unsubsidized consumers will pay for the premium hikes out of their own pockets. Results for all states are displayed in Table 1.

UPDATE: I just realized that the CAP state projections are based on the older version of the Urban Institute analysis; they posted a revised version of the report which corrects/updates the status of both Vermont and Washington, which also slightly changed their national impact projections. I've whipped up a corrected version of the table above (which is also a bit easier to read, I should note!):