UPDATE: More Fun With Lawsuits: GOP win could result in millions of people screwed for $1,000 apiece, cost federal gov't up to $3.6B!

Just days after the Supreme Court ruled against the plaintiffs in the infamous King v. Burwell ACA case last June, I noted that there's another case quietly winding it's way through the federal court system: House v. Burwell. Here's some links to the earlier summaries:

- Coming Soon: The Return of the King... v. Burwell???

- Like the villian in horror movie sequels, King v. Burwell simply refuses to die.

The very, very short version is this:

- King v. Burwell threatened to kill APTC (Advance Premium Tax Credit) subsidies for around 85% of those enrolled in ACA exchange policies living in 3 dozen states run thorugh the federal exchange (roughly 6.4 million people last year; this year it would've been around 8.1 million, give or take).

- HOUSE v. Burwell, on the other hand, threatens to kill CSR (Cost Sharing Reduction) subsidies for around 57% of those enrolled in ACA exchange policies living in every state (likely around 7.3 million people this year). That's the number of people who a) have incomes below 250% of the Federal Poverty Line and b) chose Silver exchange policies.

OK, so 7.3 million low-income people are about to be screwed, right?

Well, due to the weird legal and logistical gymnastics of this particular case, not quite. As U of Michigan law professor Nicholas Bagley explained:

Health plans on the exchanges are required under the law to reduce cost-sharing levels for their enrollees who make less than 250% of the poverty level. The Treasury Secretary is then supposed to “make periodic and timely payments to the [health plans] equal to the value of the reductions.”

What if the Treasury Secretary can’t make those payments? Well, health plans would still have to adhere to the rules about reducing their customers’ cost-sharing. The 5.9 million* people who get cost-sharing reductions would thus get to keep them. Health plans just wouldn’t get reimbursed.

*(Note: 5.9 million refers to the number of people receiving CSR assistance as of last summer; as of today it's likely closer to 7.3 million, assuming a similar 58% rate)

OK, so it's the insurance companies which would be screwed instead, right?

Again, not quite: Bagley goes on to say...

Even without an appropriation, health plans still have a statutory entitlement to cost-sharing payments. What that means in non-legalese is that Congress has promised to pay them money—whether or not there’s an appropriation. And health plans can sue the government in the Court of Federal Claims to make good on that promise. (Congress has undeniably appropriated the money to pay court judgments.)

So the question isn’t whether the government will pay the cost-sharing reductions. It’s when. If the government is right, Treasury can make pay health plans on a “periodic and timely” basis. If the House is right, health plans have to file thousands upon thousands of duplicative lawsuits to get the money.

That’d be bonkers, of course. Forcing health plans to pursue expensive and time-consuming litigation to recover what they’re owed doesn’t help anyone. The plans will just pass on the costs of the litigation, delay, and uncertainty to their customers.

In other words, the end result of this mess is that instead of filing a mountain of paperwork to get reimbursed for the CSR payments, the insurance carriers would just say "to hell with it" and jack up their premium rates on everyone to make up the difference.

...In the meantime, the ACA will still require insurers to give a cost-sharing break to their low-income customers. The federal government won’t be able to pay insurers back, however, which will force insurers to raise premiums on all their customers to cover the shortfall. As premiums increase, the premium subsidies that people use to buy exchange plans receive from the federal government will also have to increase.

But that’s all very general. Can we put some numbers on it? The Urban Institute recently released a study by Linda Blumberg and Matthew Buettgens—highlighted prominently in the administration’s brief—that does just that. The study is carefully hedged; there’s loads of uncertainty here, and Urban doesn’t factor in the possibility of recovering the money through litigation.

Still, the top-line figures are pretty arresting. Under Urban’s model, premiums for a silver plan would increase, on average, by $1,040 per person. Cost-sharing subsidies would end, but premium subsidies would go up, yielding $3.6 billion in increased federal outlays each year. Yup, that’s right. If the House wins, it’ll increase federal spending by billions of dollars. How’s that for fiscal rectitude?

Read that again: If the Republican-held House of Representatives WINS their case, it will cost the federal government $3.6 billion more per year.

BUT WAIT, THERE'S MORE!

Remember, CSR payments only apply to people under 250% FPL (who chose Silver plans). APTC payments only apply to those under 400% FPL. What about those over 400% FPL who don't qualify for any financial assistance and are therefore paying full price for their policies?

Well, I'm afraid they're the ones who would be screwed in the end here. They'd be the ones who would see their premiums jacked up around $1,000 per year.

And how many people are we talking about here? Well, around 85% of ACA exchange enrollees receive APTC assistance, leaving around 1.9 million who don't this year (15% of 12.7 million), so it's 1.9 million people, right?

Wrong...because keep in mind that ACA-compliant OFF-EXCHANGE policies are part of the same risk pool as exchange policies. In other words, the full-price premium is the same for the same policy sold both on and off the exchange.

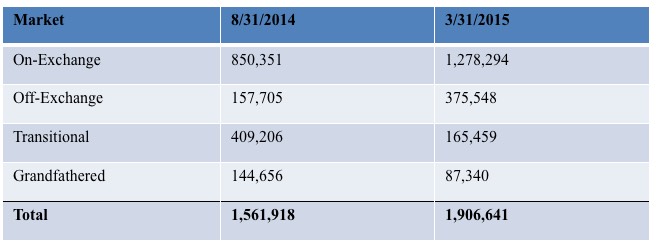

The total individual market should be roughly 20 million people this year, of which 12.7 million are exchange-based. Of the remaining 7.3 million off-exchange enrollees, if Florida's numbers are representative nationally, a minimum of 60% should be ACA-compliant, with the rest being either "grandfathered" or "transitional". It's actually likely much higher than that, because over 1/3 of the states didn't allow transitional plans at all, while grandfathered enrollees are dwindling rapidly. Again, take a look at how rapidly Florida's numbers shifted over just a 7 month period from August 2014 to March 2015:

The "transitional" enrollees dropped by 60% from 2014 to 2015. Grandfathered enrollees dropped by 40%. I think it's safe to say that with nearly another full year having passed since then, and Florida's 2016 exchange enrollment having increased to over 1.7 million, the odds are that the transitional and grandfathered numbers have plummeted even further, to perhaps 130,000 or so combined. ACA-compliant policies probably make up around 80% of the off-exchange market at this point.

Extrapolated nationally, that would mean that roughly 5.8 million off-exchange enrollees would be paying that same $1,000 extra, or around 7.7 million people nationally (1.9 million exchange-based + 5.8 million off-exchange).

My math here is a bit speculative; the actual number could be a bit higher or lower, but I'm pretty sure we're talking about roughly 7-8 million middle-class people who will end up stuck with an extra $1,000-per-year bill and the federal deficit increasing by several billion dollars...all because the House Republicans continue to insist on being complete jackasses.

UPDATE: OK, I have some "good" news and (definitely) bad news.

The good news is that it turns out that I misunderstood how the rate hikes would work in this scenario: As Josh Schultz informed me, due to how the risk pools work, only Silver plans would have their premiums increase, since those are the only ones which would be losing the Cost Sharing Reduction reimbursement. Bronze, Gold, Platinum and Catastrophic plans presumably wouldn't be impacted.

This is good because only around 67% of individual market enrollees actually choose Silver plans in the first place...and that's on the exchanges. For those over 400% FPL, my guess is that the majority of them tend to sign up for Gold or Platinum plans (remember, we're talking about individual earning over $47,000 or a family of 4 earning more than $97,000) .

OK, so let's assume that only 50% of those over 400% FPL choose Bronze plans, whether on or off the exchagnes; that cuts the number of people who are looking at $1,000+ premium hikes down to perhaps 3.5 - 4.0 million, hooray!! So, there's that.

HOWEVER, here's where things get really, really confusing and stupid when you consider the implications of this.

As noted in the actual Urban Institute study:

We find that premiums for silver Marketplace plans would increase $1,040 per person on average. This premium increase would, on average, make silver plan premiums higher than those of gold plans (plans with 80 percent actuarial value). The higher premiums would in turn lead to higher federal payments for Marketplace tax credits because such payments are tied to the second-lowest-cost silver plan premium. All tax credit–eligible Marketplace enrollees with incomes up to 400 percent of FPL would receive larger tax credits, not just those eligible for CSRs. On net, Marketplace enrollment would decrease by 1.0 million people because enrollees ineligible for tax credits could find less expensive coverage elsewhere, and federal government costs would increase $3.6 billion in 2016 ($47 billion over 10 years). We estimate that the change would also reduce the number of people uninsured by approximately 400,000.

So...

- Several million middle-class families would be hit for another $1,000 per year; while...

- The federal deficit would increase by $3.6 billion this year alone (increasing to $47 billion over the next decade).

However, in addition, silver plans would now cost more than gold plans...which in turn would mean that a bunch of people would upgrade from Silver to Gold, which would mess with the actuarial tables/risk pools something fierce. They figure that around 1 million higher-income exchange enrollees (which is to say, most of that 15%) would drop off the exchanges entirely, which would cause further disruption to the ACA-compliant risk pools, which in turn means more uncertainty, which in turn probably means more insurance carriers saying "to hell with this" and dropping off the exchanges, which in turn leads to more uncertainty and now we're once again into the exact "death spiral" which the GOP has been insisting would be caused by the ACA for years, but which only ever ends up having a real chance of happening due to their insistence on filing these endless lawsuits challenging the law's implementation.

The really bizarre outcome is the last point, though: Ironically, the Urban Institute thinks that one positive outcome of all this is that around 400,000 more low-income people jump on board to take advantage of the "Gold Loophole" as I'm designating it:

The number of uninsured individuals falls about 400,000 as some tax credit eligible–individuals with incomes over 200 percent of FPL take advantage of the new ability to purchase higher-tier (gold) policies with their federal assistance. This change is smaller than the 700,000 tax credit eligible– individuals who newly enroll in Marketplace coverage, because some of these new enrollees switched from employer coverage or had nongroup coverage but newly became eligible for tax credits.

So, the Silver lining (hah!) of all this is that around 400,000 more low-income people would gain coverage...at the (literal) expense of around 4 million medium-income people getting hosed.

Now, I personally don't mind ponying up a bit more to help more people receive healthcare, but this isn't quite what I had in mind. Besides, the other fallout (death spiral, etc) would likely make the whole system get ugly really fast anyway, negating any positive results.

UPDATE 5/12/16: Welp. Judge Collyer just gave her official ruling today, and as expected, it was in favor of Congressional Republicans:

A federal judge on Thursday ruled in favor of House Republicans in their lawsuit against the Obama administration over ObamaCare.

In a major ruling, Judge Rosemary Collyer, an appointee of President George W. Bush, said the administration does not have the power to spend money on "cost sharing reduction payments" to insurers without an appropriation from Congress.

Collyer's decision doesn't immediately go into effect, however, so that the administration can appeal it.

"This is not the first time that we've seen opponents of the Affordable Care Act go through the motions to try to win this political fight in the court system," said White House press secretary Josh Earnest.

Earnest said Republicans are trying to "refight a political fight that they keep losing. They've been losing this fight for six years, and they'll lose it again."

I assume the appeal process will take several more months (perhaps after the election?), and after that I presume it will move on to the Supreme Court regardless of which side wins the appeal, so next summer could indeed see the sequel to King v. Burwell play out at the SCOTUS.

It's also worth noting that in addition to everything below, the GOP winning House v. Burwell could also threaten the 500,000 or so people enrolled in the Basic Health Plan programs in New York and Minnesota, as well as an unknown number of Native Americans who receive CSR payments outside of the Silver plan level (thanks to Josh Schultz for that tidbit), and could even jeopardize potential developments such as Colorado's upcoming ColoradoCare Single Payer ballot initiative.

In short, while the Republican Party ultimately winning House v. Burwell wouldn't directly hurt as many people as them winning King v. Burwell would have, it would still be a major blow to several million people and could potentially gum up the individual insurance market in general even more than KvB would have.

UPDATE 5/13/16: Prof. Bagley has given his own "hot take" on yesterday's developments:

At bottom, the court’s reasoning is pretty straightforward. Although the ACA tells the administration to pay cost-sharing subsidies, the ACA doesn’t contain a specific appropriation to make those payments. And, under 31 U.S.C. §1301(d), “[a] law may be construed to make an appropriation out of the Treasury … only if the law specifically states that an appropriation is made.” As a result, the Appropriations Clause prohibits the administration from making cost-sharing payments. Q.E.D.

...For what it’s worth, I share the district court’s skepticism of the administration’s arguments. As I explain in some detail here, it’s hard to read §1324 as supplying an appropriation for cost-sharing reductions. What I don’t share, though, is the district court’s confidence that she could properly hear this case. Until now, no one has thought that one house of Congress could file a federal lawsuit to hash out an appropriations dispute with the executive branch. This shouldn’t be the first time, even if the administration broke the law.

What happens now? Even if the D.C. Circuit expedites the government’s appeal, the court is unlikely to resolve the case before the election. When it does, I suspect it will have very little patience for the district court’s conclusion that the House of Representatives has standing to sue. My hunch, too, is that the Supreme Court will either not intervene or uphold the D.C. Circuit’s eventual dismissal of the case. This opinion will attract a lot of attention—and it should—but it’s not an existential threat to the ACA.

In other words, Bagley agrees that the House GOP has a decent case, but disagrees that they have standing to sue. And yes, it's important to note that Bagley is a supporter of the ACA, so his concurrence with Collyer's skepticism is noteworthy.

Again, the worst-case scenario would be the hot mess I described above--jacked up rates for lots of full-price payers, confusing metal level pricing and continuing uncertainty/nervousness about the law itself among insurance carriers and the public alike, which is of course one of the primary goals of the GOP in the first place. As Bagley notes, however, it would not destroy the law, just gum it up.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.