New Jersey: State-level Individual Mandate penalty appears to be working after all...partly

Last year, I noted several times that regardless of what your opinion may be of the ACA's Individual Mandate Penalty (which was, until this year, either $695 per adult/$348 per child or 2.5% of your household income, unless you received an exemption), one of the key things to keep in mind about the penalty is that any impact it has on encouraging people to go ahead and enroll in ACA-compliant healthcare coverage is entirely dependent on two things:

- Second, they then have to decide that it makes more sense for them to go ahead and pay whatever the premiums for compliant coverage are rather than going not doing so and risking getting hit with the financial penalty (along with risking bankruptcy via catastrophic medical bills)

In addition to these points, there's also another factor: Confusion about the timing of the penalty. Remember, Open Enrollment begins on November 1st and ends on December 15th in most states...for coverage effective starting in January...but the penalty isn't actually charged until the following spring. That is, people deciding whether to enroll for 2017 were mostly doing so in 2016, but they weren't charged any penalty until 2018.

As if this wasn't confusing enough already, in December 2017 congressional Republicans and Donald Trump repealed the ACA mandate tax penalty itself (technically they just set the fee to $0 or 0.0% of income)...but didn't make the "repeal" effective until January 1, 2019. As a result, people who weren't covered in 2018 were still charged the penalty when they filed their federal taxes a few months ago in spring 2019 (although Trump's IRS Dept. made it easy-peasy to avoid doing so by simply lying on your 1040).

Adding to the confusion: Under Trump's instructions, the IRS originally announced that they were pretty much blowing off enforcing the penalty in early 2017...but then reversed themselves and said that they would be doing so later on that year. Between this and the ongoing "repeal/replace" saga, which included several different GOP "replacement" bills which each had their own version of a "mandate penalty", most consumers had no clue what the heck the situation was with it.

In response to the federal penalty being repealed, a few states took action to replicate the penalty at the state level. Massachusetts simply dusted off their own pre-ACA penalty, which uses a different tax formula, while the District of Columbia and New Jersey quickly passed laws duplicating the federal formula of $695/2.5% of income).

While I applauded this move (and wish more states would follow their lead...California is the only other state to do so to date), starting in 2020), I also realized that there'd be even more confusion about the mandate penalty in DC and NJ than the rest of the country (Massachusetts wasn't nearly as big of an issue since their population had already been aware of their state penalty for years before the ACA's anyway). Was the penalty repealed? Was it reinstated? At the federal or state level? How much was it? And what year did it apply to?

When the dust settled on the 2019 Open Enrollment Period, the initial results out of New Jersey looked disappointing: While unsubsidized premiums dropped by 9.3% in large part thanks to the mandate penalty being replicated, ACA exchange enrollment also dropped by 7.1%...higher than the 3.8% average for HealthCare.Gov states as a whole.

CMS Administrator Seema Verma gleefully pounced on this data point:

.@coveredca blames subpar enrollment on no federal mandate penalty, but NJ kept penalty and saw much, much bigger drop. Forcing Americans to buy insurance they can’t afford isn’t the answer.

— Administrator Seema Verma (@SeemaCMS) January 31, 2019

However, I pointed out that there was a lot of missing information which made this premature, including this key point:

- First, this doesn't include off-exchange enrollment. In Q1 2018, they had around 89,000 effectuated off-exchange QHP enrollees. If the Q1 2019 off-exchange number also drops significantly, then the odds are that the reinstated mandate penalty went either unknown or unheeded. If it holds close to 89K, on the other hand, that suggests that a decent number of unsubsidized enrollees did enroll (grudgingly, perhaps) due to the mandate still being around. You'd really have to compare this with the off-exchange impact in other states as well, however.

Of course I wrote this in January; there was no way of knowing what the Q1 enrollment data would look like until that report was released.

Cut to moments ago (thanks to Andrew Sprung aka Xpostfactoid for the heads up):

NJ Department of Banking and Insurance Releases Health Insurance Enrollment Figures for First Quarter of 2019

Enrollment Demonstrates Need for State-Based Health Exchange; Will Allow NJ to Further Combat Trump Administration Policies that Harm Access to Coverage

TRENTON — The New Jersey Department of Banking and Insurance today released figures showing that more than 300,000 New Jerseyans were enrolled in health insurance in the individual market as of the first quarter of 2019, down slightly from last year. A total of 315,359 New Jerseyans were enrolled in coverage, a four percent reduction in health insurance enrollment in the individual market for the first quarter of 2019 compared with the same period in 2018.

Wait, what's that? I thought exchange enrollment dropped by 7.1%! Well, it did...but read on:

Commissioner Marlene Caride said actions taken by the Murphy Administration and the Legislature are critical to the stabilization of the health insurance market and to improving access to coverage, but the reduction in enrollment over last year further demonstrates the need for New Jersey to have greater control over its health insurance market through the establishment of a State-Based Exchange. The administration, along with Legislative partners, has proposed creation of a State-Based Exchange for 2021.

“New Jersey has worked vigorously to combat the federal government’s actions to undermine the Affordable Care Act and our work has resulted in meaningful changes in our state, including the reduction of health insurance premiums in the individual market by 9.3 percent this year,” said Commissioner Caride. “Yet, the Trump Administration’s sabotage of the Affordable Care Act has created significant challenges for states, particularly those with a federally-facilitated exchange. It is clear that continuous federal attacks on the ACA, which have included severe federal funding cuts to outreach programs, advertising and navigators who assist consumers with obtaining coverage, affected health coverage enrollment. Moving to a State-Based Exchange will allow the state to establish policies to further protect our residents and improve access to coverage and care.”

The number of New Jerseyans enrolled in individual health plans in the first quarter of the calendar year, which includes consumers who newly enrolled and re-enrolled during the Nov. 1 to Dec. 15 open enrollment period, was 315,359 in 2019 compared to 328,761 in 2018 – a 4 percent decrease. In 2018, enrollment in Marketplace and off Marketplace plans for the first quarter was down 10.8 percent compared to the prior year.

For 2019, the department encouraged health insurance carriers selling plans in the individual market to offer a lower cost silver plan off the Marketplace (off the exchange), to provide lower cost options for those who do not qualify for federal tax subsidies. Two carriers offered the off marketplace only silver plan. Figures show that enrollment increased in the off the Marketplace plans compared to last year.

THERE you have it, folks...

“We will be analyzing enrollment to ensure that we are taking every step we can while utilizing the federally-facilitated exchange to improve residents’ access to coverage, but we know that having a State-Based Exchange is key to protecting New Jersey from the actions of the federal government and creating policies that best meet our state’s needs,” said Commissioner Caride. “This administration is committed to moving this initiative forward along with the Legislature for the benefit of families in our state.”

Governor Murphy last year signed two healthcare bills into law to continue a requirement to have coverage beginning in January of 2019 and to allow for the creation of a reinsurance program. The two laws resulted in an overall average 9.3 percent reduction in premium rates in the individual market for 2019.

The governor announced in March the state would move to a State-Based Health Exchange for 2021. Transitioning to a State-Based Exchange (SBE) will give the state more control over the open enrollment period; access to data that can be used to better regulate the market, conduct targeted outreach and inform policy decisions; and allow user fees to fund exchange operations, consumer assistance, outreach and advertising. By redirecting the assessment on premiums, currently paid to the federal government to utilize a Federally-Facilitated Exchange (FFE), New Jersey can operate an exchange that is tailored and efficient for New Jersey residents.

The first quarter 2019 report for the Individual Health Coverage Program may be found here.

The first quarter 2019 report for the Small Employer Health Benefits Program may be found here.

Historical enrollment information for both programs may be found here.

The Open Enrollment Period is over. Residents may still enroll in coverage, or change plans, if they have a major life change that qualifies for a Special Enrollment Period, or if they qualify for NJ FamilyCare. More information may be found at GetCovered.NJ.gov.

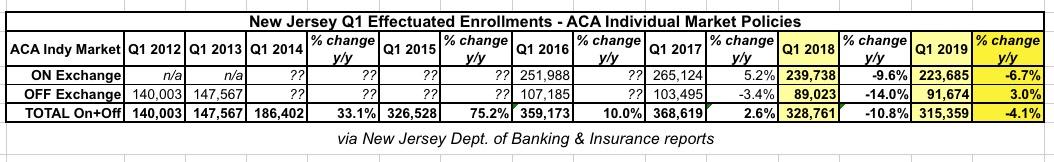

I took the liberty of plugging in the Individual Market effectuated enrollment numbers from all of the New Jersey charts into a simplified spreadsheet below:

And there it is: ON-exchange enrollment increased 5.2% in Q1 2017 before plummeting 9.6% in 2018 and another 6.7% in 2019 (remember, this is effectuated enrollments as of March of each year, so it won't necessarily match up with the open enrollment period selections).

OFF-exchange enrollment, on the other hand, dropped 3.4% in Q1 2017 and an ugly 14.0% in 2018...but increased by 3.0% in 2019.

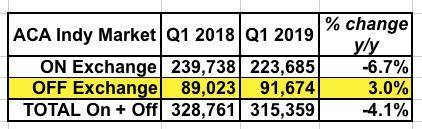

Here's an even simpler version with just 2018 and 2019:

I don't know how much of this is due to the mandate penalty vs. #SilverLoading (which is also something the state government can take credit for), but either way, this provides significant support for the state-level penalty being established.

Why the discrepancy between on & off-exchange numbers? Because 100% of off-exchange enrollees have to pay full price for their policies. This means they're naturally going to be far more reluctant to sign up in the absence of some sort of incentive to do so. If the penalty didn't have any enrollment impact, you would have expected off-exchange numbers to have also dropped by around 6.7%, or around 6,000 people. Instead they increased by over 2,600.

Of course total enrollment is still down 4.1% year over year, but that's a lot less than the 7.1% it initially looked like.

The only real way of being certain about this would be to compare New Jersey to other states which don't have their own mandate penalty this year...including their off-exchange numbers. Unfortunately, very few states keep track of that data as clearly as New Jersey, so that could prove tricky.

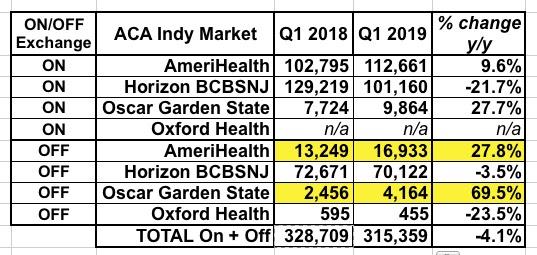

As an aside, here's a side by side comparison of the market share breakout for both years. Oxford is a non-entity (they're off-exchange only and only have a few hundred people enrolled in either year anyway). The noteworthy takeaway is that both AmeriHealth and Oscar saw substantial enrollment increases (both on and off-exchange) even as Horizon BCBSNJ saw a whopping 22% drop on exchange but only 3.5% off-exchange. Silver switching likely accounts for some of this as well.

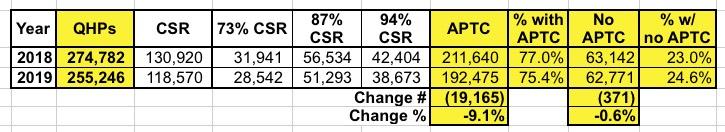

Also worth noting: Here's the side-by-side comparison of the raw QHP selection numbers from the 2018 and 2019 Open Enrollment Periods in New Jersey. Note that while subsidized enrollment dropped by 9.1%, unsubsidized enrollment only dropped by 0.6%.

Overall, I'd say this is a pretty good result given how much confusion there was over the issue. California is kicking off their own mandate penalty this fall, presumably with a widespread awareness campaign to go with it, so it'll be interesting to see how they fare, especially since they have their own exchange and a full marketing/education budget to go along with it. Stay tuned...

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.