New Jersey: As expected, final 2019 ACA premiums to DROP 9.3% thanks to Dems cancelling out GOP sabotage

A few weeks ago, I posted about New Jersey's preliminary 2019 ACA-compliant individual market rate filings. At the time, the official New Jersey Dept. of Banking & Insurance specifically stated that:

- Because Congressional Republicans repealed the ACA's Individual Mandate Penalty, carriers were planning on increasing 2019 premiums by 12.6% on average, in part to account for the adverse selection which was expected to happen next year.

- However, thanks to the Democratically-controlled New Jersey state legislature and Governor swiftly reinstating the ACA individual mandate, actual 2019 rate filings are only expected to increase rates an average of 5.8%, saving the average unsubsidized indy market enrollee around $470 apiece next year.

- Finally, the NJ legislature also passed, and Governor Murphy signed into law, a robust reinsurance bill which, if approved by CMS, is expected to lower unsubsidized 2019 premiums by an additional 15 percentage points, for a final 2019 average premium reduction of around 9.2%.

...Well, sure enough, just moments ago, CMS Administrator Seema Verma announced that New Jersey's reinsurance waiver request has indeed been approved...the "1332 State Innovation Waiver" system itself is itself part of the Affordable Care Act. One of the best parts of the ACA is that it includes a framework for states to come up with improvements over it.

In other words, New Jersey Democrats are responsible for nearly every part of the 21.8 point relative rate reduction...all of which was either already part of the ACA or was allowed for by it.

...The result of this is that the four carriers offering ACA policies in New Jersey next year should be resubmitting their 2019 filings with the reinsurance program impact backed into them. This should mean overall net rate reductions of around 9.2%, give or take, although that will obviously vary from carrier to carrier and plan to plan.

...Between the mandate penalty reinstatement and the reinsurance program, that should mean an effective savings of around $124/month for unsubsidized enrollees...or nearly $1,500 for the year.

New Jersey Governor Phil Murphy, yesterday:

Governor Murphy Announces Impact of New Jersey’s Actions to Stabilize Health Insurance Market

Individual Market Health Insurance Rates to Decrease 9.3 Percent On Average for 2019TRENTON – Governor Phil Murphy today announced that aggressive actions taken by his administration to stabilize the health insurance market in New Jersey will result in an overall average rate decrease of 9.3 percent in the individual market for 2019.

So, it's slightly better than I thought--9.3% vs. 9.2%.

The reduction in health insurance rates is the direct result of New Jersey’s first-in-the-nation action to continue an individual mandate, after the elimination of the mandate by the Trump Administration at the federal level, and to implement a reinsurance program beginning in 2019. The two laws, signed by Governor Murphy in May, were cited by the Center for American Progress in its listing of New Jersey as the national leader among states for having taken action to protect consumers from federal sabotage of the Affordable Care Act.

“Our work is based on the core belief that health care is a right – not a privilege,” said Governor Phil Murphy. “Federal attacks on the Affordable Care Act and rising costs of health care have made premiums less affordable for residents buying plans on the individual market. We have taken deliberate actions to defend the gains made by the ACA and our work is demonstrating results. We will not back down from our work to protect New Jersey families and ensure they get the health care they deserve. My administration remains committed to doing everything it can to improve access to coverage and care.”

...Policies in Washington aimed at dismantling the Affordable Care Act have created enormous uncertainty in insurance markets nationwide. The repeal of the individual mandate led to requested rate increases in states across the country. If New Jersey had taken no action to stabilize its market, carriers indicated to the Department of Banking and Insurance that residents would have seen premium rates in the individual market rise by 12.6 percent over last year. Instead, as a result of the continuation of an individual mandate in New Jersey, carriers requested a 5.8 percent average increase in premium rates. Federal approval of the 1332 State Innovation Waiver in August, designed to lower anticipated premium rate increases, ultimately resulted in a combined or total average decrease of 9.3 percent in the 2019 rates compared to 2018.

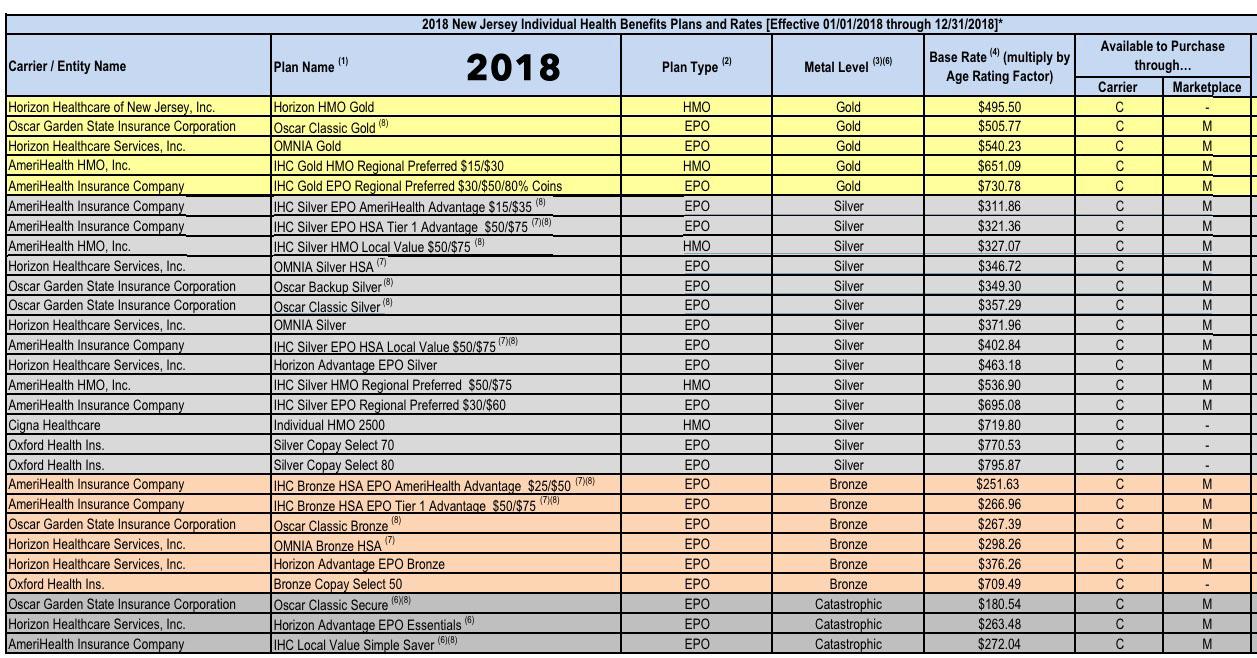

I haven't found the actual carrier-specific final rates yet, but here's the individual plan baseline premiums for 2018 and 2019: