Reminder: If you didn't #GetCovered you may still have to pay ACA's Individual Mandate Penalty for 2018.

Lost amidst all the other overwhelming ACA-related news this week is one other important nugget: The Affordable Care Act's "individual mandate penalty", which was lowered to $0 in December 2017, was still the law of the land until December 31, 2018. It may have been changed at the time, but that change didn't become effective until January 1, 2019.

PART VIII--INDIVIDUAL MANDATE SEC. 11081.

ELIMINATION OF SHARED RESPONSIBILITY PAYMENT FOR INDIVIDUALS FAILING TO MAINTAIN MINIMUM ESSENTIAL COVERAGE.

(a) In General.--Section 5000A(c) <<NOTE: 26 USC 5000A.>> is amended--

(1) in paragraph (2)(B)(iii), by striking ``2.5 percent'' and inserting ``Zero percent'', and

(2) in paragraph (3)--(A) by striking ``$695'' in subparagraph (A) and inserting ``$0'', and

(B) by striking subparagraph (D).(b) <<NOTE: 26 USC 5000A note.>> Effective Date.--

The amendments made by this section shall apply to months beginning after December 31, 2018.

Remember, most people enroll (or choose not to enroll) for the upcoming year in November/December...but the ACA mandate penalty for those who didn't enroll in ACA-compliant coverage isn't actually charged until they file their taxes for that year, which isn't done until after the year has passed.

In other words, people who didn't #GetCovered in 2018 are just now being charged for that decision when they file their taxes in spring of 2019.

The irony of this is off the charts given that just days ago, the Trump Administration openly called for the entire ACA to be repealed specifically because the individual mandate was repealed...by Congressional Republicans and the Trump Administration.

Here's a reminder of what the tax for those who neither had ACA-compliant healthcare coverage in 2018 nor received an exemption waiver actually is:

The greater of either...

- 2.5% of your adjusted household income over the filing threshold, or

- $695.00 per adult and $347.50 per child,

- with a maximum of $2,085 per household.

Note that if you were covered for part of 2018, you only have to pay the penalty for the months you weren't covered.

Here's the details on the Individual Shared Responsibility Provision (that's what it's actually called) from the IRS website.

It's worth noting that part of the controversial Notice for Benefit and Payment Parameters (NBPP) released in January included this bit:

In response to President Trump’s first Executive Order, the proposed rule would also continue CMS’ work to eliminate overly burdensome regulations. For example, the rule proposes processes to allow individuals to more easily claim a hardship exemption from the individual mandate penalty directly on their tax return for the 2018 tax year.

Comparing the 2017 and 2018 exemption form instructions, I'm assuming these are the changes that this refers to:

What's New

Hardship coverage exemption. You can now claim a coverage exemption for certain types of hardships on your tax return. See the Types of Coverage Exemptions chart and General hardship (code G), for more information.

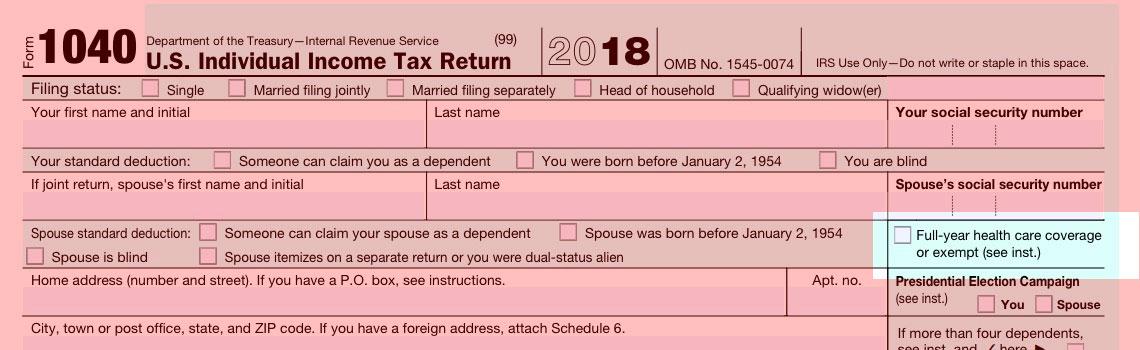

Checkbox on Form 1040. The “Full-year coverage” checkbox that was on line 61 of the 2017 Form 1040 has been moved to page 1 of the 2018 Form 1040 and retitled “Full-year health care coverage or exempt.” You will now check that box if you, your spouse (if filing jointly), and anyone you can or do claim as a dependent had qualifying health care coverage or a coverage exemption that covered all of 2018 or a combination of qualifying health care coverage and coverage exemptions for every month of 2018. If you can check the box on Form 1040, you don’t need to file Form 8965.

So what does that mean in practice? Well, for 2017, a "General Hardship" exemption had to be granted by HC.gov, and you needed an Exemption Certificate Number:

- General hardship—The Marketplace determined that you experienced a hardship that prevented you from obtaining coverage under a qualified health plan.

For 2018, the IRS will simply take you at your word...no ECN needed:

- General hardship—You experienced a hardship that prevented you from obtaining coverage under a qualified health plan

Yes, that's right...all anyone has to do this spring is claim that they "experienced a hardship" and they're off the hook.

This was predicted by David Anderson the very day Donald Trump was inaugurated in January 2017:

yes individual mandate exemptions will be passed out like pacifiers at a rave

— David Anderson (@bjdickmayhew) January 21, 2017

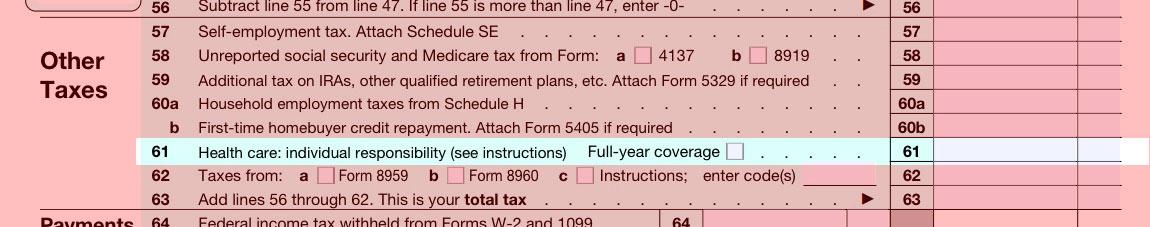

In any event, here's the second page of the 2017 Form 1040...

...and here's the first page of the 2018 Form 1040:

It's also important to note that Massachusetts still has their own Individual Mandate Penalty at the state level, while both New Jersey and the District of Columbia replicated the ACA's version at the local level. Those, however, won't actually be charged until next spring when people file their state/district 2019 taxes.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.