CBO confirms it: Trump's Obamacare sabotage cancelled out Trump's OTHER Obamacare sabotage!

Well, Keith Hall, Director of the Congressional Budget Office, just confirmed pretty much everything that we've been saying for a year or more now:

The Affordable Care Act (ACA), in section 1402, requires insurers who participate in the marketplaces established under that act to offer CSRs to eligible people who purchase silver plans through the marketplaces. CBO views that requirement as establishing an entitlement for thoseeligible.

To qualify for CSRs, people must purchase a plan through a marketplace and generally have income between 100 percent and 250 percent of the federal poverty guidelines (also known as the federal poverty level, or FPL). The size of the subsidy varies with income.

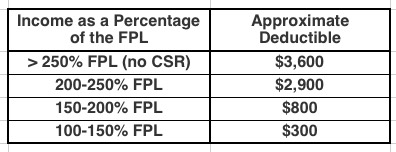

CSRs reduce deductibles and other out-of-pocket expenses like copayments. For example, in 2017, by CBOs estimates, the average deductible for a single policyholder (for medical and drug expenses combined) with a silver plan varied according to income in the followingway:

As an aside, it's very helpful to finally have this table available. Until now I had no idea what the dollar amount breakout/averages forCSR assistance were...I just knew the Actuarial Values for the different income brackets (94%, 87%, 73%). If I cross match this table with the average metal level chosen in each group I can figure out roughly how much CSR assistance was actually spent on each one.

...Before October 12, 2017, the federal government reimbursed insurers for the cost of CSRs through a direct payment. However, on that date, the Administration announced that, without an appropriation for that purpose, it would no longer make such payments to insurers.

Yup, October 12th was the day that Donald Trump finally threw the temper tantrum he'd be threatening to all year. He thought that doing so would "blow up" the ACA exchanges, causing them to "explode" yadda yadda yadda.

However, because he didn't (and still doesn't) have the slightest idea how the CSR system actually works (admittedly, it's a bit nonintuitive to most people), and because most of the insurance carriers, state insurance commissioners and state-based exchange chairs do understand how it works, they were able to come up with a very clever workaround:

Because insurers are still required to offer CSRs and to bear their costs even without a direct payment from the government, most have covered those costs by increasing premiums for silver plans offered through the marketplaces for the 2018 plan year. (For the most part, insurers did not increase premiums for other plans to cover the cost of CSRs because the CSR entitlement is not available for thoseplans.)

Voila! That, my friends, is the heart of CSR Silver Loading (and by extension the Silver Switcharoo)!

...On the basis of an analysis of insurers rate filings, CBO and JCT estimate that gross premiums for silver plans offered through the marketplaces are, on average, about 10 percent higher in 2018 than they would have been if CSRs were funded through a direct payment. The agencies project that the amount will grow to roughly 20 percent by 2021.

Hmmm...that 10% is actually lower than the 14% that I (as well as other analyses) estimate it at, but whatever. The point is that cutting off CSR reimbursement payments resulted inhigher premiums...but in turn also resulted in higher APTC subsidies to fill the gap, which also meant that...

...For plans besides silver ones, insurers in most states have not increased gross premiums much, if at all, to cover the costs of CSRs. Because the premium tax credits are primarily based on the income levels of enrollees and not the nature of the plan they choose, enrollees could use those credits to cover a greater share of premiums for plans other than silver ones in those states. For example, more people are able to use their higher premium tax credits to obtain bronze plans, which cover a smaller share of benefits than silver plans, for free or for very low out-of-pocket premiums. Also, some people with income between 200 percent and 400 percent of the FPL can purchase gold plans, which cover a greater share of benefits than do silver plans, with similar or lower premiums after tax credits. As a result of those changes, in most years, between 2 million and 3 million more people are estimated to purchase subsidized plans in the marketplaces than would have if the federal government had directly reimbursed insurers for the costs ofCSRs.

BOOM. The CBO has just put a hard number (well, a range, anyway) of just how many 2018 ACA exchange enrollees they estimate enrolled in subsidied policies specifically due to Silver Loading/Switching: Between 2-3 million.

In other words, the CBO is basically saying that one of Donald Trump's attempts to sabotage the ACA exchanges basically blew up in his face: Subsidized enrollment (9.8 million people) would have only been 6.8 - 7.8 million, give or take, if he hadn't done so.

Assuming the number of unsubsidized enrollees remained exactly the same, that would've theoretically meant total ACA exchange enrollment of between 8.8 - 9.8 million instead of the 11.8 million actual tally.

This was exactly my point when I wrote an entry titled "Will Trump's Obamacare Sabotage Cancel Out Trump's Obamacare Sabotage?" last November:

While the half-length period is confusing things (along with everything else), the biggest question for me is this:

- The massive average premium hikes (caused mostly by Trump's CSR sabotage) will likely cause up to ~1.3 million unsubsidized enrollees to drop off the exchange (or at the very least to downgrade their policies severely), but, at the same time...

- That very same CSR sabotage, combined with the clever Silver Load/Silver Switcharoo strategy utilized by most states, also means that millions of subsidized enrollees will qualify for bargain Gold plans or dirt-cheap/FREE Bronze plans.

So really, the question is whether the latter cancels out the former...Who knows...maybe it'll be a wash?

...In any event, this is why, while my official projection remains at a gloomy 10.0 million, I also wouldn't be shocked if it ended up breaking 13.0 million instead. All bets are off this year.

In the end, of course, the grand total came in at around 11.8 million.

On the surface this may sound like those people owe Trump a "thank you" for cutting off CSR payments...but it's not that simple. Remember, while millions of people benefitted from his inept sabotage attempt, millions of others (around 6.5 million by my estimates) were hurt by his CSR cut-off stunt..because the CSR money had to come from somewhere, and it was the unsubsidized population who got stuck with the bill.

Beyond this, cutting off CSRs also caused many of the insurance carriers to just throw their hands up and pull a full Eric Cartman by dropping out of the ACA exchanges (and usually the off-exchange market as well) altogether, causing massive confusion and panic for hundreds of thousands of enrollees.

Put another way, he tried shooting at poor people on 5th Avenue but missed...and shot middle-class people instead. Not exactly praiseworthy behavior.

Finally, there was still a bunch of other types of sabotage efforts by Trump and the GOP last year which was "successful" in damaging the individual market and dampening enrollment (half-length enrollment period, 90% cut in advertising/marketing, 40% cut in outreach, etc etc).

Fortunately, about 20 states or so went one step further than simple Silver Loading and did the full Silver Switcharoo instead:

In CBOs projections, higher gross premiums for silver plans affect premiums for people who are not eligible for premium tax credits (most of whom have income above 400 percent of the FPL). However, many of those enrollees have options for purchasing other plans to avoid paying the premium increases resulting from the Administrations policy change in October 2017. Just as insurers in most states have not increased premiums for plans other than silver ones much to cover the costs of CSRs, insurers in many states have not increased the premiums of silver plans sold outside the marketplaces to cover the costs of CSRs either. Therefore, many people who are not eligible for subsidies are able to select a plan besides a silver one or a silver plan sold outside the marketplaces and avoid paying the premium increases related to the lack of a direct appropriation forCSRs.

The blog post then gets to the heart of the matter: How would the CBOhave to change their projections if CSR funding was officially appropriated after all?

...if legislation was enacted that appropriated funds for direct payments for CSRs, the agency would update its baseline projections to incorporate those appropriations and to reflect lower premium tax credits and other effects because insurers would no longer increase gross premiums for silver plans offered through the marketplaces to cover the costs of providingCSRs.

On the surface, this may not seem that noteworthy. However, there's a danger here. As I've noted several times before, CMS Administrator Seema Verma seems to be mulling over the idea of trying to prohibit Silver Loading altogether for 2019 and beyond. There's a big question as to whether she can do this legally (since insurance premium regulation isvery much in the jurisdiction of the states, not the federal government), but that doesn't mean she won't try to do so. Today's CBO blog post basically just gave her the official budgetary cover she's likely been looking for to do so.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.