Revenge of the #RiskCorridorMassacre: Feds may have to pay out $12B...and 2020 enrollees could get a chunk of that thanks to the ACA's MLR rule

Like Jack Twist in Brokeback Mountain, I can't seem to quit playing around with the jaw-dropping possibilities which could impact future Medical Loss Ratio rebate payments in response to the ghosts of Open Enrollment Periods past.

Back in June, I reported that the Supreme Court of the United States had agreed to take up the long-simmering (4 years!) Risk Corridor Massacre class action lawsuit:

On Monday, along with posting their decisions on several important federal cases, the U.S. Supreme Court announced that, much to the surprise of many healthcare wonks, they will take up the long-gestating (and presumed dead) Risk Corridor Massacre lawsuit:

Big news: SCOTUS is taking up the ACA risk corridors case. GOP's decision to stymie that program arguably did the most damage to the ACA marketplaces. https://t.co/VeMRcd5MYn

— Bob Herman (@bobjherman) June 24, 2019

As previously noted, the various Risk Corridor lawsuits had originally been assumed to be slam dunk cases: The United States Federal Government contractually and legally owed several hundred health insurance carriers billions of dollars via the ACA's "Risk Corridor" stabilization program, which was supposed to be active for the first 3 years of the ACA exchanges, from 2014 - 2016.

Again, here's the short version:

- For the first 3 years of the ACA, it included several "training wheel" programs designed to smooth out the rocky transition period.

- One of these was called "Risk Corridors", in which insurance carriers which did unusually better than expected were required to pay a portion of their profits into a central fund...

- ...while carriers which did unusually worse than expected were promised partial reimbursement via that same fund.

- If the amount put in was greater than the amount paid out, the government would keep the difference.

- If the amount owed was greater than the amount brought in, the federal goverment was supposed to pay the difference.

In the middle of the very first Open Enrollment Period, however, Congressional Republicans insisted that the rules of the Risk Corridor program be changed in such a way that if there was a shortfall in the fund, the "losing" insurance carriers would have to eat their losses no matter what...which is exactly what happened to the tune of over $12 billion over the course of 2014, 2015 & 2016.

Along with some other factors, led to financial ruin for nearly 20 smaller startup carriers, most of which didn't have the cash reserves to help them weather the Risk Corridor storm. I wrote obituary blog entries for yet another victim of the Risk Corridor Massacre weekly between August and November 2015...in a few cases, two of them went bankrupt the same day.

OK, so if SCOTUS rules in favor of the carriers (and they absolutely should...regardless of what you think of health insurance companies, the fact remains that they are contractually owed this money by the U.S. Government), most of the carriers will get paid what they were originally owed, and whatever firms now own the assets of the carriers which went belly-up will finally get a return on their investment. Big deal for the rest of us, right?

Well, yes...except that there's more to the story, and it involves, once again, the beauty which is the ACA's Medical Loss Ratio rule.

Again, under the Affordable Care ACt, insurance carriers on the individual market are required to spend at least 80 of their premium revenue on actual medical claims. If they spend less than 80% over a rolling three-year period average, they have to pay back the difference to the policyholders.

I wrote about this extensively in my big MLR Rebate Project a few months ago, which analyzed not only the record-breaking actual 2018 MLR payments ($770 million nationally) which went out in September, but also made projections as to the potential 2019 MLR rebates which will go out a year from now. My conclusion was that the 2019 payments (going out in 2020) could end up being double this years' due to the overpricing for the 2017 & 2018 plan years being fully baked in (potentially up to $2.0 billion total).

I then noted that due to the judgments in a different federal class action lawsuit regarding CSR reimbursement payments (not to be confused with the Risk Corridor payment case), 2020 MLR rebates could potentially be as much as quadruple this years...potentially hitting over $3 billion.

That brings me to today's update from Christen Linke Young regarding the Supreme Court taking up the Risk Corridor case:

Earlier this year, the Supreme Court agreed to hear Moda Health Plan, Inc. v U.S., a case about the Affordable Care Act’s risk corridors program. Dozens of insurance companies are arguing that they are owed $12 billion in risk corridor payments associated with their participation in the early years of Obamacare. The Court will hear arguments in the case on December 10 and likely make a decision this spring. The Court’s decision will have a one-time effect on the bottom line of many insurers. But how the Court resolves this backward-looking dispute about a now-expired program will not meaningfully change how the Affordable Care Act or health insurance markets operate in the future.

Aside from details on the timing of the SCOTUS arguments and decision, Young's article is mostly a more detailed overview of the history of Risk Corridors, how they were changed, how it impacted the carriers and how the lawsuit is playing out. She also, however, includes two important footnotes...especially the second one:

[1] Some insurers have sold the right to collect their risk corridors debt to other parties.

[2] It is worth considering how payment of risk corridors funds in 2020 would affect insurer revenue for purposes of the ACA’s medical loss ratio (MLR) requirements. The law requires individual market insurers to spend 80% of the revenue they receive on medical expenses and pay rebates to consumers if they do not. Under current regulations, risk corridors payments are considered revenue in the year in which they are received. If the risk corridors program had operated on the statutory schedule, those payments would have been received in the same time period in which insurers were incurring significant losses on high health care claims, so MLR rebates would generally not have been triggered. Today, however, insurers would receive a bolus of risk corridors payments at a time when they are already profitable, and some may be operating close to the 80% MLR threshold. This could incent some insurers with specific patterns of prior year revenue and costs to offer somewhat lower premiums to avoid having to pay MLR rebates.

In other words, having an "extra" $100 million (or whatever) counted as 2020 revenue would cause the carrier's 2020 MLR to drop several points, so they're more likely to lower their 2021 premiums to boost that years' MLR back up a few points to cancel it out for the 3-year rolling average formula.

However...that won't change anything for the payments going out in 2021, which would include the averages from 2018, 2019 and 2020.

I think you can see where I'm going with this: If the Supreme Court rules in favor of the plaintiffs, and if they order the federal government to pay out the years-past-due Risk Corridor funds, and if the money has to be counted as part of their 2020 revenue, that will likely mean a whopping $12 billion windfall being dumped into the laps of several hundred insurance carriers around the country all in one shot.

If all of that happens, then any carrier which is hovering around the 80% threshold (or already below it) would have to pay out a large chunk of it...or potentially even all of it...back to the policyholders.

Again, none of this is guaranteed. SCOTUS might shoot down the lawsuit, in which case nothing changes. They might rule for the plaintiffs but include some unusual rules about how the risk corridor payments are made or accounted for. Who knows?

CMS could change the rules regarding when/how it counts as revenue, so a lot of options.

— Christen Linke Young (@clinkeyoung) November 4, 2019

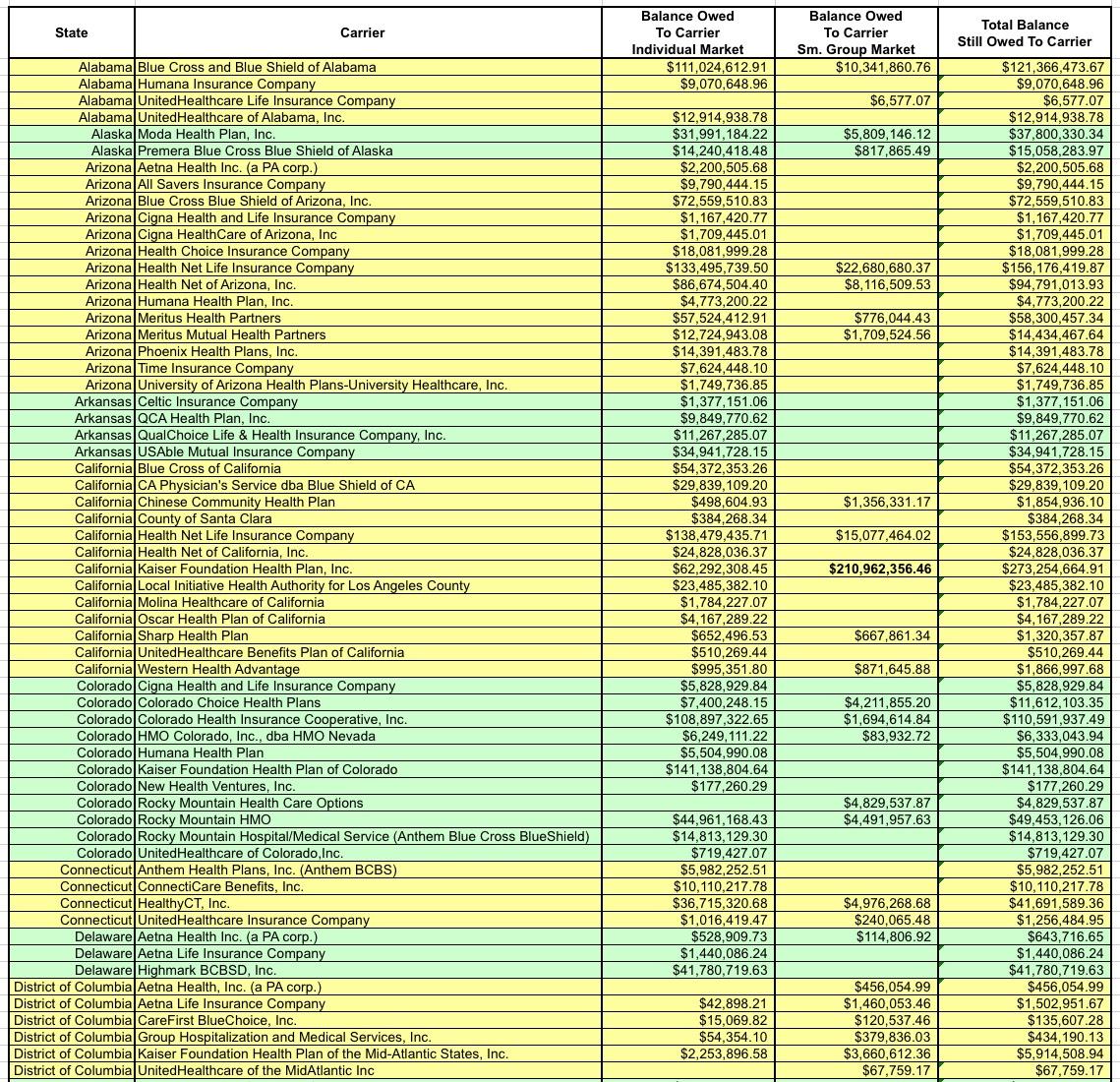

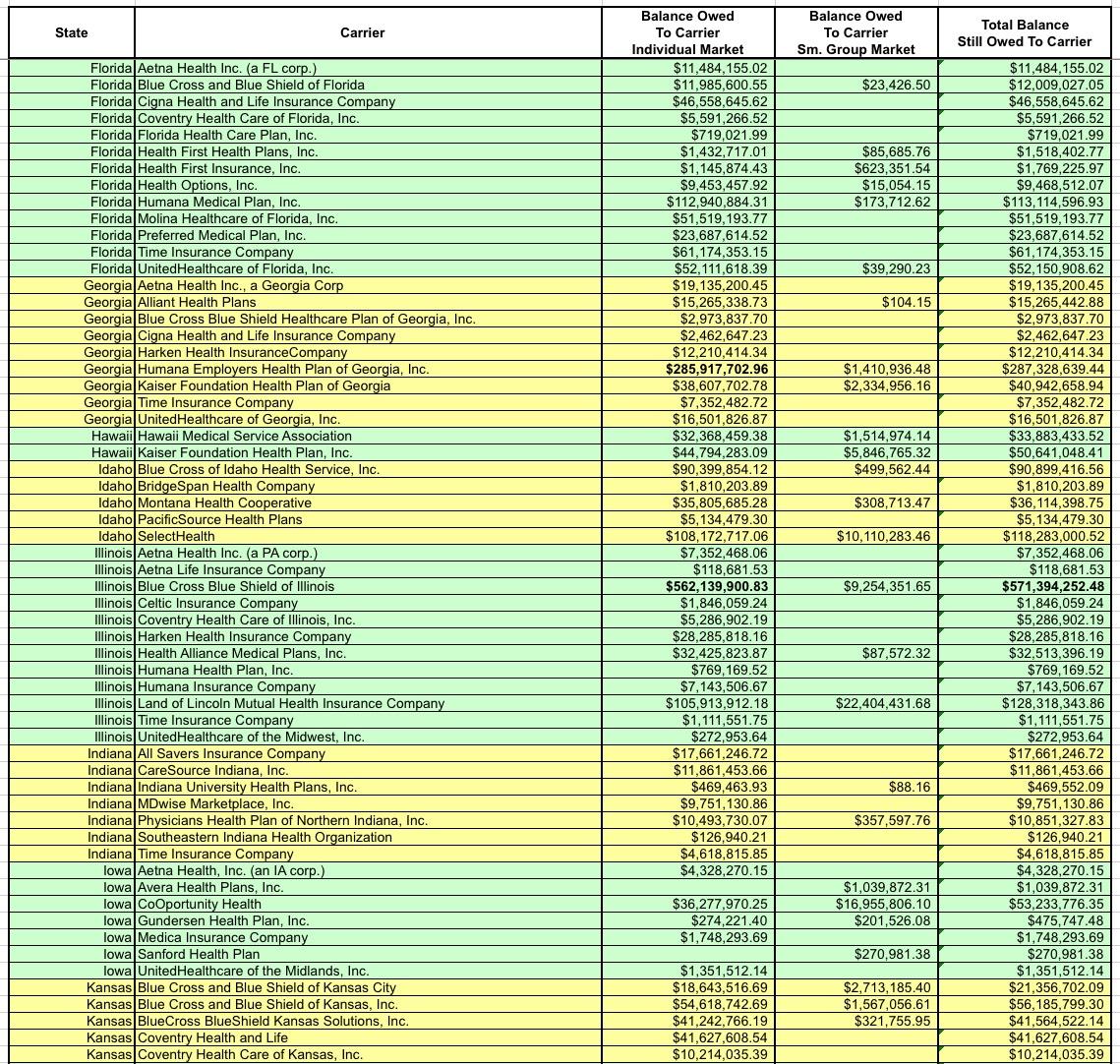

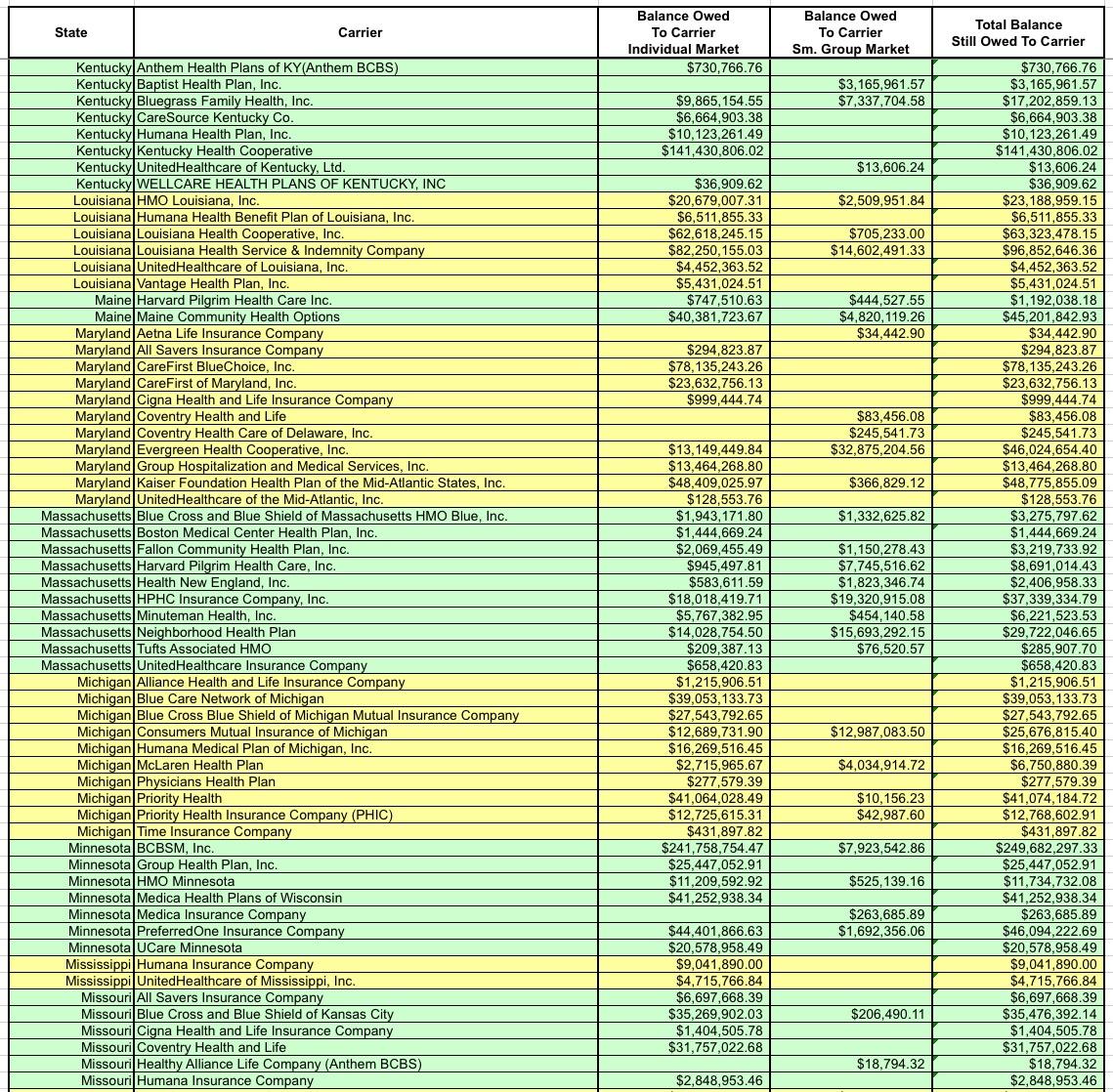

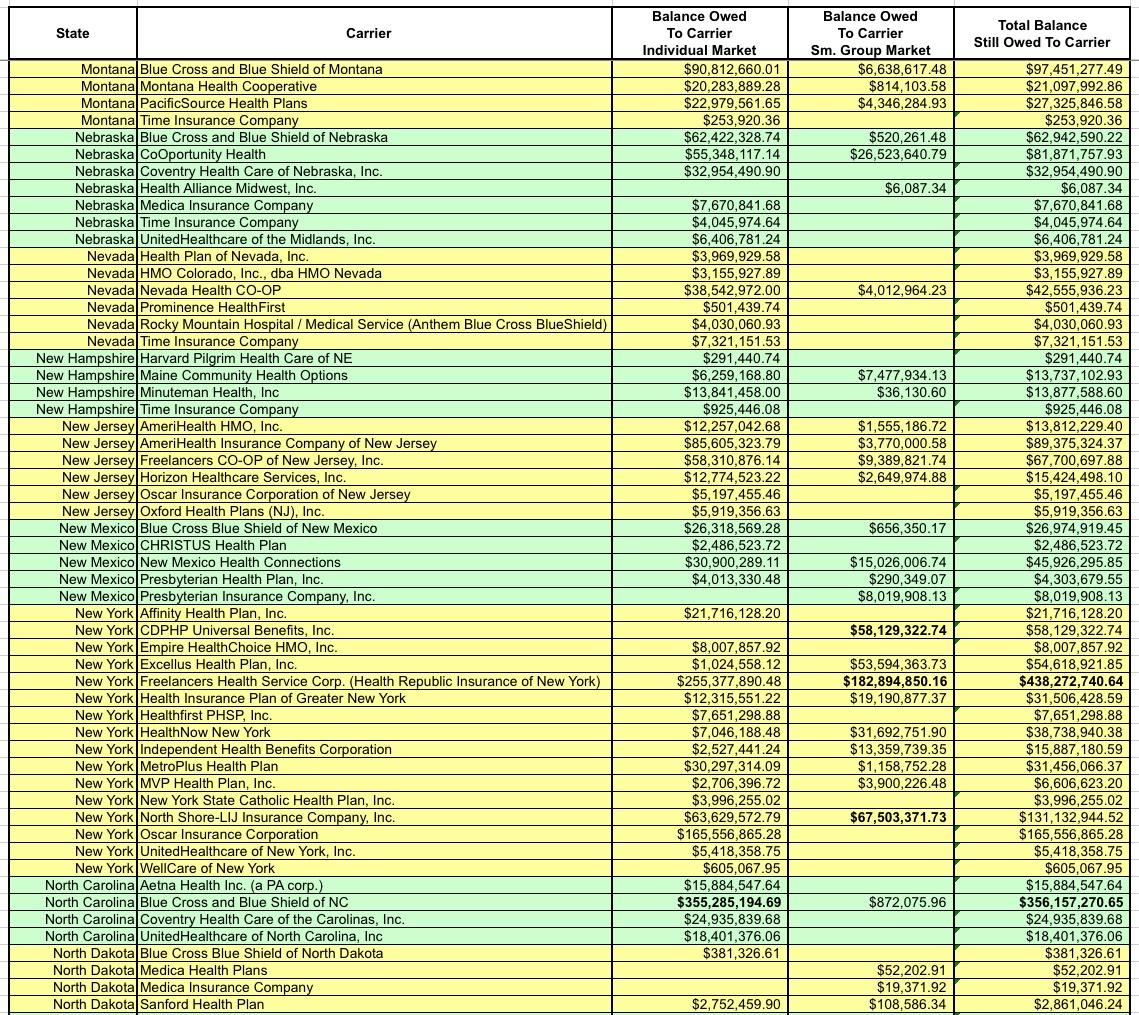

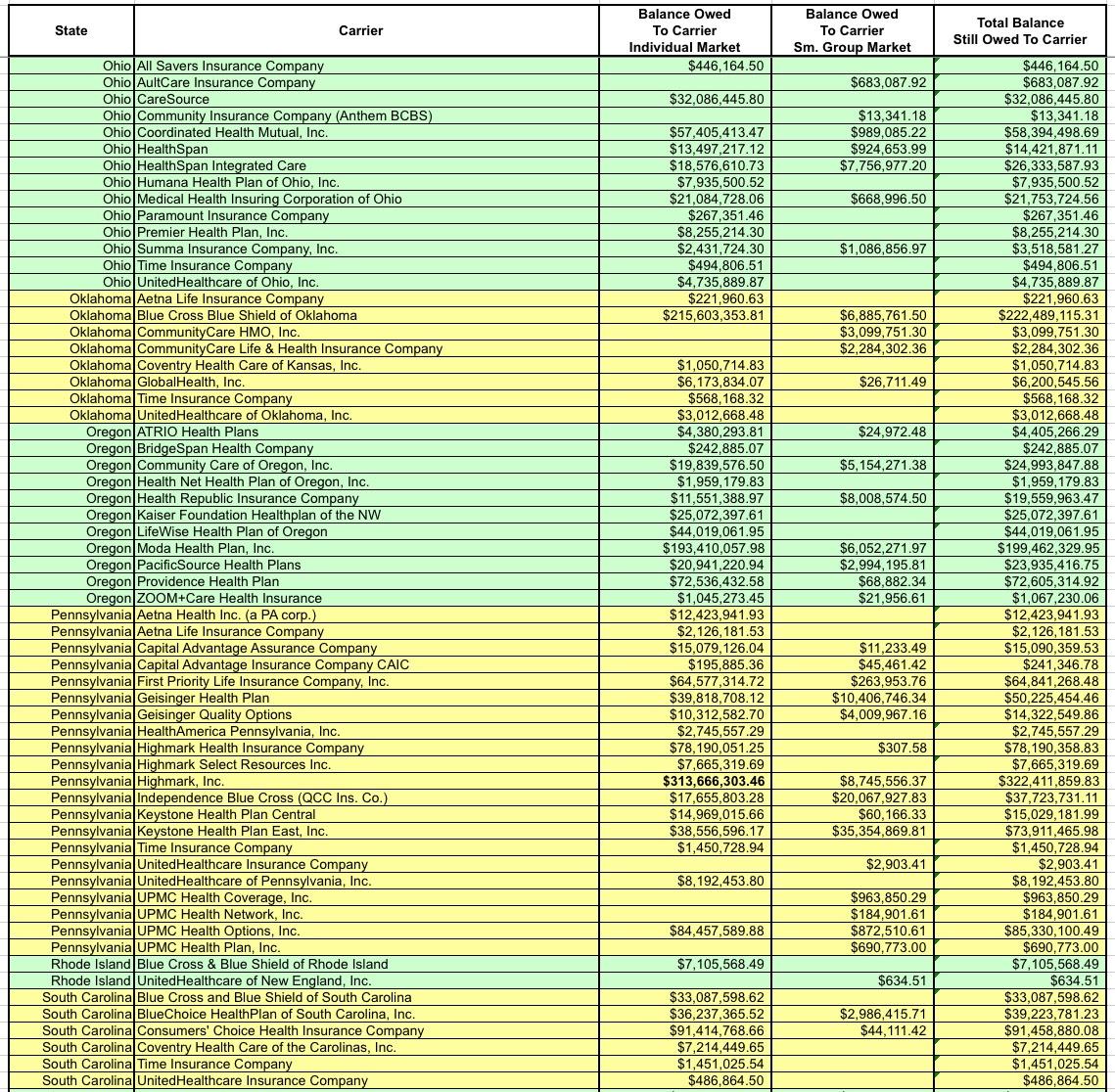

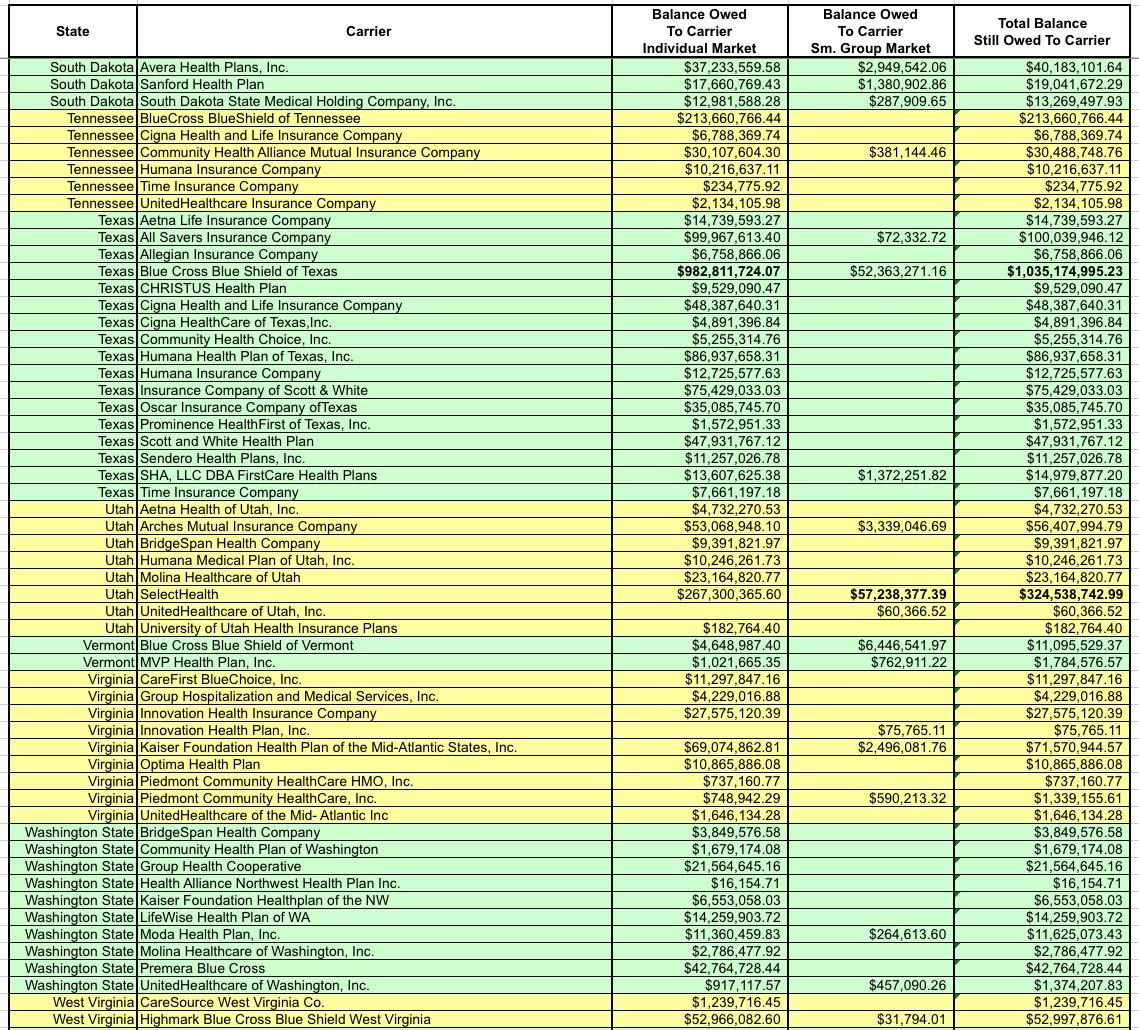

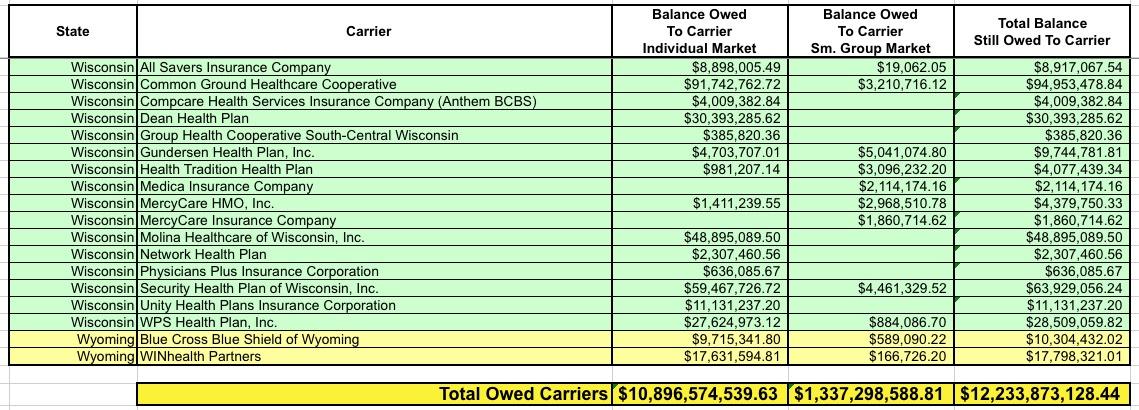

OK, let's take another look at the amounts actually owed to the carriers. Around $1.3 billion of it is owed to the small group market, which isn't really relevant here...I mean yes, it's a lot of money, and yes, this could mean some small bonuses to employees of small businesses, but the small group MLR rebates hasn't been nearly as volatile as the individual market over the past six years, so it's the individual market column you should be focusing on:

I've bold-faced the five highest dollar amounts. For the individual market it's BCBS Texas; BCBS Illinois; BCBS North Carolina; Highmark (Pennsylvania); and Humana (Georgia)

I noted earlier that a good twenty or so carriers have actually gone bankrupt...including Health Republic of NY. I assume their risk corridor payment would go to pay back the creditors. A few others have merged with or been acquired by other carriers; I have no idea how that will be handled.

Not only is Blue Cross Blue Shield of Texas owed more risk corridor money than any other carrier, it's not even close--they're owed over $1 billion, nearly twice as much as BCBS Illinois ($571 million). Nearly all of that consists of the $982 million BCBSTX is owed for their Individual Market business.

I don't know how many Indy market enrollees BCBSTX will have in 2020, but as of last year I have that number down as 390,000 Texans.

Let's take another look at BCBSTX (HCSC)'s actual MLR data:

- 2016: $2,28 billion in claims against $2.45 billion in revenue = 93.2% MLR

- 2017: $1.79 billion in claims against $2.47 billion in revenue = 72.3% MLR

- 2018: $1.79 billion in claims against $2.68 billion in revenue = 66.9% MLR

This resulted in a 3-year average of 77.2%. They had to pay out $75 million to 382,000 enrollees, averaging $196 apiece.

For 2019, BCBSTX reduced their average premiums by 6.5%. Assuming identical enrollment and a 5% medical trend for the year, I'm projecting (very roughly) perhaps $1.88 billion in claims against $2.50 billion in revenue. If so, that'd mean a 75.2% MLR for 2019...which in turn would mean a 71.4% 3-yr MLR. BCBSTX would have to pay back over $216 million to their policyholders, averaging $566 apiece.

For 2020, BCBSTX is reducing rates another 2.0%. Let's assume identical enrollment and a further 5% medical trend. If so, that would mean $1.97 billion in claims on $2.45 billion in revenue, pushing them back up to 80.6% MLR. The 3-year rolling average for 2020 would be around 73.9%...they'd have to pay back $149 million in 2021.

Now what happens if you drop an additional $983 million on top of their 2020 revenue?

Suddenly their 2020 MLR plummets to just 57.4%. The three-year average for 2020 is now just 65.5%...they'd have to pay back (wait for it)...$498 million in 2021 alone.

Divided among around 380,000 enrollees, that would average around $1,300 apiece. Furthermore, that's only one year...that 57.4% MLR will be factored into the equation for 2021 and 2022 as well.

But wait, there's more!

Guys, it gets even weirder! Some of the issuers who could get big RC receivables are barely even in there individual market anymore. So the enormous rebates could be getting paid out to a TINY number of residual enrollees.

— Christen Linke Young (@clinkeyoung) June 25, 2019

Wait…so that means if they had, say, 30,000 #ACA enrollees in 2014-2016 owed a total of $3 million, but only 300 are enrolled today, those 300 people get $10,000 apiece? Good grief.

It's important to note that even if everything plays out this way, it doesn't mean that all $12 billion will be paid out. For one thing, the individual market portion is only $10.9 billion of the total; the odds are a far smaller portion of the other $1.3 billion on the small group market would end up being paid out no matter what. For another, even this year (with record-breaking MLR rebates), of the 2,700 total carriers nationally, only 207 had to pay out any MLR rebates in any market, and only 67 owed MLR rebates on the individual market. That's still 3.7 million people who received rebates this year (even if some checks were only for $20 or so), however.

...or SCOTUS could shoot down the case entirely.

The possibilities are endless.