2018 MLR Rebates: Lessons Learned, plus All 50 States (+DC) in One Table

If you've been reading the site recently, you know that I've been obsessed for the past 2-3 weeks with nothing but the 2018 Medical Loss Ratio rebate payments.

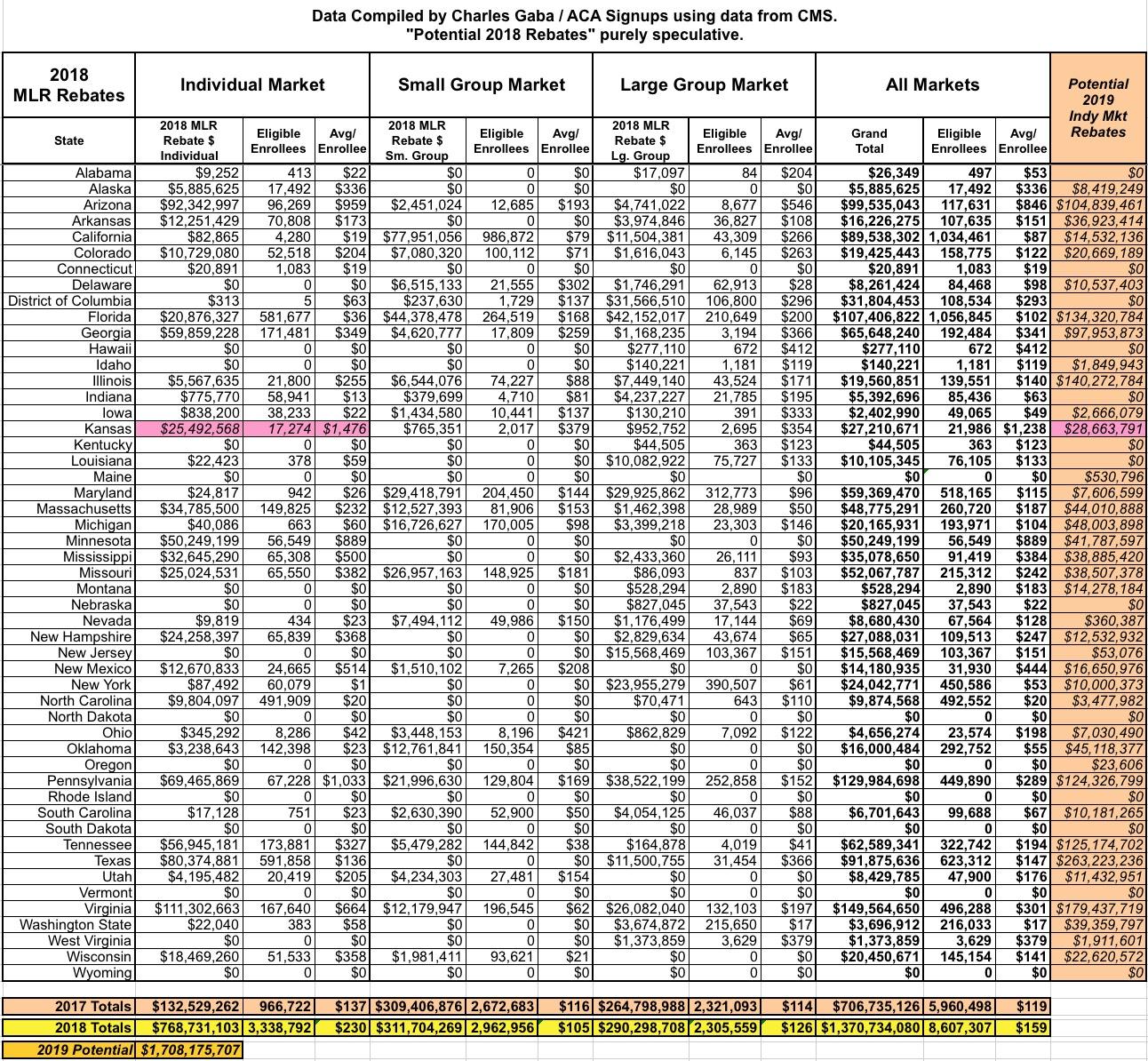

Now that I've completed posting my analyses of all 50 states (+DC), I'm wrapping it up with a table summarizing the the totals for the entire country, how it compares with the Kaiser Family Foundation's similar report posted a few days ago, and some additional thoughts and observations which have come to mind in doing this project.

First of all, as noted, the Kaiser Family Foundation published their own report analyzinng the 2018 MLR rebates when I was about halfway done posting my own state-by-state analyses. They made sure to give me a nice shout-out, anyway:

We at KFF put out an analysis today of how much insurers will be paying in rebates to consumers and employers later this month. @charles_gaba also has very good information on this, and we all benefit from his tireless tracking. https://t.co/uPX2SPklcY

— Larry Levitt (@larry_levitt) September 10, 2019

Kaiser includes a handy bar graph breaking out the Individual, Small Group and Large Group market rebates by year. For 2018 they have the grand total for all three markets add up to $1.278 billion...nearly 20% higher than the previous all-time highest rebate year in 2012 (which was also the first year the MLR rule was in effect).

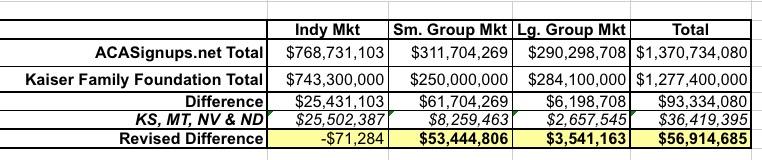

I actually get a grand total of $1.37 billion...around $93 million higher than Kaiser. A big chunk of this is because Kaiser chose to leave out four states: Kansas, Montana, Nevada and North Dakota, because these four states are apparently missing at least 10% of their enrollment data...whereas I've included all four of them:

At least 12 insurers did not file rebate data as of August 10. We suppress rebates in Kansas, Montana, Nevada, and North Dakota because insurers that make up more than 10% of enrollment in those states did not file MLR data.

I don't know if the missing carriers are included in my data (I started my projects a few weeks later than Kaiser did), but between this, Kaiser's rounding dollar amounts off to the nearest $100,000 and other reasons, there's some discrepancies between their numbers and mine:

Kaiser lists the number of policyholders or subscribers, whereas I list the total number of covered lives, so there's no way to compare those differences.

When you remove the 4 states in question, the Individual market totals are virtually identical. The large group market is off by about $3.5 million or 1.2%. It's the small group market where there's still a major discrepancy (over $53 million, or about 17%)...I'm not sure what accounts for that.

It's pretty remarkable how close Kaiser came last spring to the actual totals this year:

Our analysis also finds that insurers are expecting to pay a record total of about $800 million in rebates to individual market consumers for not meeting the ACA medical loss ratio threshold, which requires them to spend at least 80% of premium revenues on health care claims or quality improvement activities. This comes from initial estimates reported by insurers; actual rebates could end up being either higher or lower. In total, across the individual, small group, and large group markets, insurers expect to issue about $1.4 billion in rebates this year based on their 2018 performance. If insurer expectations hold true, these will be the largest consumer rebates issued since the MLR program began.

Sure enough, the actual totals ended up being $769 million, $312 million and $290 million, for a total of $1.37 billion. Impressive.

How about my own very crude, very spitball estimate of the potential rebates for next year? Well, here's what I said in early August:

If you use Anderson's 7% and assume the final, national weighted average for 2020 comes in at around 0.5%, that means roughly 6.5% of that $93.2 billion could end up having to be rebated to enrollees....or potentially 1/3 of up to $6 billion.

The three-year rolling average means that the actual amount paid out would be 1/3 of that...perhaps $2 billion in September 2020.

When I ran the numbers based on the actual data from 2017 and 2018 and project 2019's MLRs, I ended up with a somewhat smaller (but still massive) potential total for the Individual market: Perhaps $1.7 billion. Not bad, given that the $2 billion figure was complete spitballing. Of course, the $1.7 billion projection is still based on some major assumptions about the 2019 experience; it'll be interesting to see if I end up even remotely close to the actual amounts next August/September.

I also learned some interesting tidbits along the way, including:

- New York has a higher MLR threshold for the individual & small group markets (82%) than the ACA's 80% federal minimum.

- Massachusetts has a much higher MLR threshold for the individual & small group markets (88%) than the ACA's 80% federal minimum.

New York's 82% didn't make much difference this year, but in Massachusetts, all $47.3 million of the indy/sm. group rebates being paid out this year are thanks specifically to that 88% level (that is, all of the carriers making payments in those markets fell between 80-88%).

- Thanks to Kaiser, I learned that if a carrier had fewer than 1,000 "life years" over the 3-year MLR period (that is, fewer than 1,000 total covered lives enrolled), they aren't subject to the MLR provision. This explains why there are some carriers listed in the state tables which list small numbers of covered lives but don't list any MLR percentage at all, or where the MLR may be under 80% but there's still no rebate.

- I also learned that if a carrier has between 1,000 and 75,000 "life years", their MLR percentage is adjusted on a curve. That is, they're given a MLR boost ranging from 0% to 8.3%, which means if a carrier has, say, 400 enrollees per year (1,200 life years total), they only have to spend 71.7% of premiums on medical claims. This is likely a big part of the reason why carriers in some very small states (Wyoming, North Dakota, etc) don't have to pay out any rebates...they simply don't have enough enrollees in the state to hit the thresholds.

- There's another adjustment factor as well, based on the carriers' average deductble. The higher the average deductible, the higher the adjustment.

I guess the idea here is that a carrier which only sells Bronze plans with sky-high deductibles is naturally going to have a much lower claims-to-premium ratio, since a big chunk of the medical claims are instead paid by the enrollee as part of their deductible instead.

Kaiser also taught me a few other things:

- Expatriate Plans: Insurance policies sold to Americans working abroad may have higher administrative expenses than other policies and therefore receive an adjustment (by multiplying the numerator of the MLR by 2.0).

In other words, expatriate plans have an effective MLR threshold of just 40%.

- “Mini-Med” Plans: Insurance plans with annual benefit limits of $250,000 or less – which typically have lower MLRs because medical claims are low relative to administrative costs – will receive temporary MLR adjustments for the years leading up to the opening of insurance exchanges in 2014.

Not really an issue anymore, since mini-meds have been pretty much phased out by the ACA's no-annual caps provision.

- Newer Plans: As new insurance plans tend to have fewer claims in their first year, applying the MLR standard to these plans could create a barrier to entry into the insurance market. The ACA therefore allows a one-year deferral for insurers with a high proportion of new plans (representing at least half of their business in a given state).

In other words, carriers like Oscar and Bright Health, which are expanding into several new states in 2020, won't have their MLR data included in the formula until 2021.

The rules for university/student plans when it comes to MLR is more obscure. Kaiser doesn't mention them at all, but here's what CMS has to say about it:

To address the special circumstances of Student Health Plans, HHS will apply a methodological adjustment to the way the medical loss ratio is calculated for those plans. Similar to mini-med and expatriate plans, the adjustment will address the unusual expense and premium structures of student health plans. These changes to the methodology for reporting and rebates apply only in calendar year 2013, after which time no adjustment is provided.

In addition, we added to the MLR rule a provision that requires student coverage to be aggregated nationally as its own pool rather than on a State by State basis, and to report experience separate from other policies.

This makes it sound like student plans are subject to the same 80% threshold today, but they're reported as a single MLR percentage nationally by the carrier instead of state-by-state. I have no idea how many students are enrolled in plans which are eligible for MLR rebates...I presume the rebate is paid to the university, and then listed as a line-item adjustment in the student's tuition or board billing?

- I learned (thanks to Michael Capaldo) that if a carrier owes less than $5 in MLR rebates to an individual market policyholder or less than $20 to a small or large group policyholder (the employer + employees combined), the rebate is considered to be "de minimis" ("of no significance") and

they don't have to actually pay it out.According to Kaiser, de minimis amounts only account for around $900,000 of the total across all three markets, however, so this doesn't do much to address the discrepancies between my group totals and theirs.

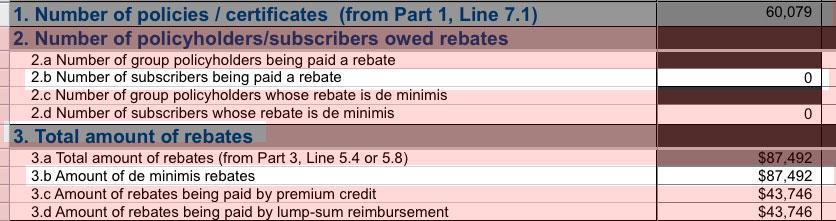

For instance, while I joked about "The United States Life Insurance Company in the City of New York" paying out a whopping $1.46 apiece to 60,000 enrollees, it turns out nope, they don't have to pay out any of this:

Whoops...looks like I misunderstood how the de minimis rule works:

One clarifying piece: the de minimis threshold doesn’t mean they don’t pay it, just that they spread the total of the de minimis rebates over the rest of the population who are receiving rebates.

— Wesley Sanders (@wcsanders) September 14, 2019

- Speaking of "The US Life Insurance Co. of NY", I learned that "travel insurance with medical coverage" plans are also subject to the ACA's MLR rule (including the higher 82% / 88% thresholds in New York and Massachusetts), although any rebates from those plans weren't analyzed by either Kaiser or myself. That sort of thing likely accounts for a lot of the more obscure carrier names listed in some of the state tables.

Unfortunately, guess what types of policies aren't subject to the MLR rebate provision? That's right: so-called "short-term, limited duration" plans, aka #ShortAssPlans, aka the exact types of junk policies which the Trump Administration has been pushing hard to expand.

By the way, in case anyone wonders whether the rebate checks are actually going out to people: Yes, they are. Here's a couple of responses I got from Texas residents:

...and here's one from Minnesota:

There's a bunch of other wonky stuff as well, but this post is getting pretty long already, and I'm getting a bit sick of writing about it, to be honest, so without further ado, here's the table aggregating all fifty states (+DC) and all three markets into a single table. I've also included a column listing my crude projection for potential 2019 MLR rebates on the right side.

Note: Kansas' $25.5 million is highlighted in red because I'm not certain about whether it's legit or not.