Used car salesman Alex Azar hawks "golf cart on blocks" as a "good option" for your driving needs

Dear Secretary Azar:

I read with great interest your Op-Ed piece in yesterday's Washington Post extolling the virtues of "Short-Term, Limited Duration" plans and how awesome it is that the Trump Administration is hoping to flood the individual health insurance market with them. I figured you might appreciate a bit of fact-checking.

Obamacare forgot about you. But Trump didn’t.

For all the discussion of Obamacare since its passage, it is too rarely known that the law effectively split the United States’ individual insurance market in two.

Yes and no. What split the market in two was the fact that premiums have increased faster than expected. Those earning more than 400% of the Federal Poverty Level (FPL)--around $48,000/year for a single adult or $98,000/year for a family of four--don't qualify for financial assistance and have to pay full price.

The obvious solution to this is to remove the 400% FPL subsidy threshold cut-off so that no one has to pay more than 9.6% of their household income for their individual market policy premium subsidies. This can be done via a simple bill which was already introduced last summer by six U.S. Senators. The entire text is only around 200 words.

One group of Americans — about 8 million enrollees in 2017 — now pay, on average, less than a quarter of the cost of their health insurance, receiving ever-growing taxpayer subsidies to insulate them from Obamacare’s high premiums. But there is a second group of Americans who have faced the full premium increases driven by the law’s broken regulations. Roughly 5 million Americans, as of 2017, have chosen to pay those premiums without any subsidies, while 28 million other Americans remain uninsured, many priced out of coverage entirely.

The actual number of subsidized exchange enrollees was 9.2 million as of February 2018, according to your own data. The monthly average for the full year will no doubt be lower, I agree. And the 5 million unsubsidized enrollee figure (around 1.5 million on exchange, 3.5 million off-exchange) is about right.

However, your "...driven by the law's broken regulations" jab is the definition of chutzpah, seeing how it was Congressional Republicans and Donald Trump who caused those premiums to increase by 17% this year and another 8% or so in 2019 by "breaking" two of the biggest provisions of the ACA: Cost Sharing Reduction reimbursements to insurance carriers and the individual mandate penalty.

Don't get me wrong--premiums for unsubsidized enrollees on individual market policies had already increased substantially between 2013 and 2017, before the major Trump/GOP sabotage efforts went into effect...around 84% on average nationally (not 105%, as your misleading ASPE report suggested).

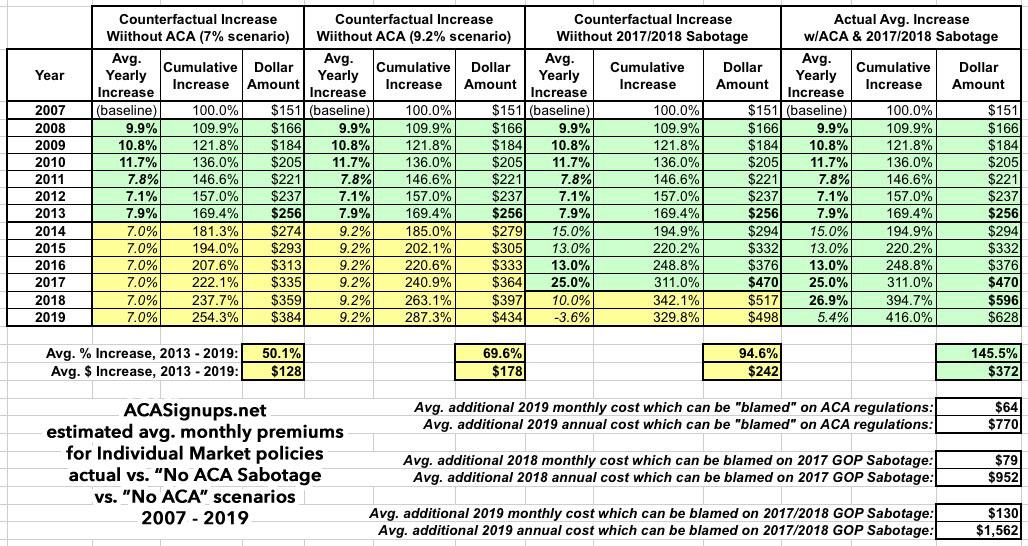

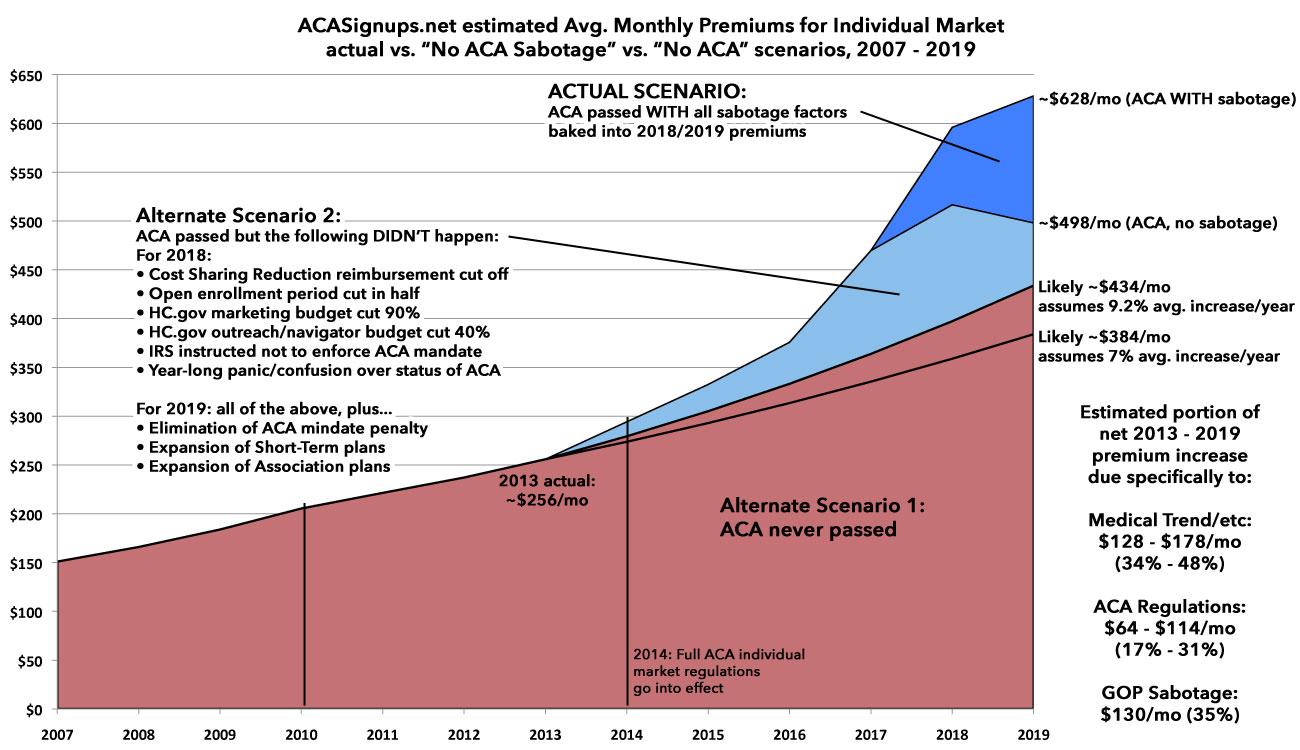

However, let's consider how much premiums would have increased over that time period had the ACA not become law in the first place. That is, what would they look like if the individual market premium trend from the pre-ACA years had continued on for the next 9 years?

- According to this report from your own department, average individual market premiums increased by 9.9% in 2008, 10.8% in 2009 and 11.7% in 2010. In 2011 it dropped to 8.6%...which happens to be the first year the initial ACA provisions went into effect, especially the 80/20 Medical Loss Ratio rule.

- Then there's this article in Health Affairs which concluded that average indy market premiums rose by 11.7% in 2010, 7% in 2011, 7.1% in 2012 and 7.9% in 2013. Your own department's reports confirms the average premium increases in 2012 at 7.1%.

The annual increases from 2008 - 2013 average out to around 9.2%. In the absence of any other significant healthcare policy changes, let's assume that in a no-ACA universe, average premiums continued to climb at roughly 9.2% per year up through 2019. Alternately, I've looked at a scenario in which the average increase ran just 7.0% per year.

If you plug these numbers into a spreadsheet (averaging the 2011 estimates), you get something which looks very close to this:

In a non-ACA universe, to the best of my reckoning, individual market policy premiums would have increased anywhere from50% - 70% from 2013 to 2019, to around $384 - $434/month per person on average.

Now, it's true that in the actual world, with the ACA in place, the average 2019 premium will likely be around $628/month, a difference of roughly $194/month or $2,300/year.

HOWEVER...a significant chunk of that was actually caused by specific actions taken by the Trump Administration in 2017 (cutting off Cost Sharing Reduction reimbursement payments to insurance carriers, slashing the marketing budget for HealthCare.Gov by 90%, slashing the outreach/navigator budget by 40%, deliberately causing confusion about whether or not the individual mandate would be enforced, etc.) and, in 2018, by both Congressional Republicans (repealing the individual mandate penalty outright) and the Trump Administration (expansion of Short-Term Plans, which aren't remotely ACA-compliant, and of Association Health Plans which are technically compliant but only via an extraordinary bending of the rules).

2018 premiums increased by an average of around 27%. By my best estimates, roughly 17 percentage points of that was due specifically to the CSR cut-off (~14%) and other sabotage measures taken by the Trump Administration last year (~3%), leaving just 10 points due to actual medical trend and other non-sabotage factors.

2019 premiums appear to be set to only go up an average of around 5.4%...but they would have dropped by around 3.6% on average without the GOP's #MandateRepeal and Trump expanding #ShortAssPlans.

This isn't something I'm making up...your own predecessor, former HHS Secretary Tom Price admitted this point:

Price says that he's not a big fan of the GOP tax bill's 2019 individual mandate repeal-- says it will harm the pool in the exchange markets & drive up costs

— Ariel Cohen (@ArielCohen37) May 1, 2018

Heck, even Trump-appointed CMS Administrator Seema Verma basically admitted as much just the other day:

Bravo to New Jerseyans, who will see their premiums in the individual market drop by about 15% from the expected premiums because @NJGov took action to address the failures of Obamacare. Today, @CMSgov approved NJ’s 1332 State Innovation Waiver. https://t.co/xvX4kcVZLW

— Administrator Seema Verma (@SeemaCMS) August 16, 2018

The specific "action" which the Democratic Governor of New Jersey took which Verma is referring to included...drumroll please...reinstatement of the ACA's individual mandate penalty, which the insurance carriers and state insurance commissioner themselves stated knocked rate increases down by 6.8 points...and the fact that New Jersey already didn't allow Short-Term plans anyway. The "15% drop" referred to above, of course, refers specifically to the reinsurance waiver which she signed off on...which itself was allowed for by the ACA itself, making her "failures of Obamacare" dig even more insulting and nonsensical.

As far as I can tell, while it's true that unsubsidized enrollees will be paying around $770 more apiece in premiums than they would without the ACA...it's also true that they'll be paying twice as much as that...around $1,500 more apiece...due specifically to Republican sabotage of the ACA.

And, of course, without the ACA in place, millions of those people wouldn't be able to be insured at all, in many cases at any price, since the carriers would be allowed to deny them coverage for having...you guessed it...pre-existing conditions.

Anyway...you were saying?

Americans will once again be able to buy what is known as short-term, limited-duration insurance for up to a year, assuming their state allows it. These plans are free from most Obamacare regulations, allowing them to cost between 50 and 80 percent less.

Yes, you're right...these unregulated plans (which I've renamed #ShortAssPlans, since they'll no longer be either short-term nor of limited duration) do cost a lot less...for the same reason that golf carts costs less than street legal automobiles.

Guess what golf carts don't typically include?

- Doors or any protections from the elements (sometimes they have a windshield!)

- Heat/Air Conditioning

- A trunk or storage space

- The ability to seat more than 2 people (sometimes 4)

- The ability to go more than 15 miles per hour

- The ability to drive more than 40 miles on a single charge

- Seat belts, air bags or any safety features whatsoever

...and so on.

"But what about deductibles and out of pocket costs? Haven't those gone up dramatically 'due to' the ACA?

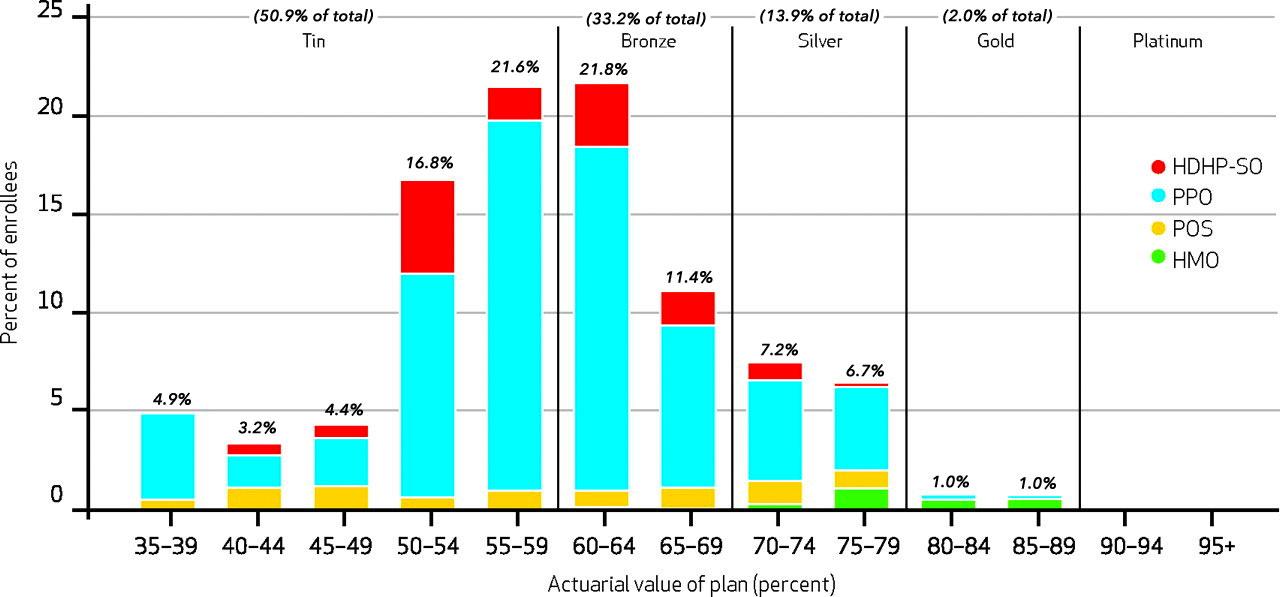

Well, again...let's take a look at the Actuarial Value of policies sold on the individual market before the ACA and today.

Here's a HealthAffairs study from June 2012 which did an in-depth analysis of Group and Individual Market policies as of 2010...the last year before initial ACA provisions went into effect:

The average actuarial value for a group health insurance plan in 2010 was 83 percent ( Exhibit 1 ). As patients incurred higher medical expenses, their insurance paid a higher percentage of the cost. Thus, for families that incurred medical expenses that placed them in the top 1 percent of the population, plans paid 96 percent of allowed charges. For the bottom 50 percent of spenders, insurance paid only 64 percent of the charges.

...The average actuarial value for an individual plan was 60 percent ( Exhibit 2)—more than twenty percentage points less than that for group insurance (Exhibit 1 ). For families incurring the highest 1 percent of medical expenses, individual insurance covered 87 percent of the bill, compared to 33 percent for families in the lowest half of spending. There were no platinum plans in our sample of individual plans, and the majority of enrollees were in a tin plan.

Average out-of-pocket spending per family was $4,127 ( Exhibit 2 ). Out-of-pocket spending for the top 1 percent of spenders ranged from $27,435 for tin plans to $6,383 for gold plans. For families in the bottom half of spending, the figures were $1,544 and $571, respectively. Ninety-six percent of families faced a deductible, which averaged $2,858 for single-person coverage.

It should be noted that $2,858/person would be around $3,300 today, not that much lower than the $4,033/person average deductible faced by individual market enrollees on 2018 ACA policies.

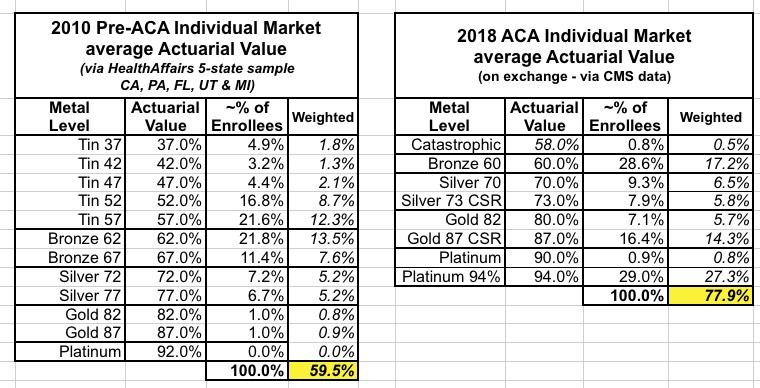

So how does the 60% average Actuarial Value compare to 2018 ACA individual market coverage?

Well, here's the graph showing the AV breakout from the 2010 Health Affairs individual market enrollment data:

I compare this side by side with CMS's own 2018 Open Enrollment Period data from the 2018 Public Use File, which breaks out metal level enrollment and even helpfully provides data on the 73%, 87% and 94% AV Cost Sharing Reduction enrollment:

As you can see, in 2010, the average Actuarial Value of Individual Market enrollees was right around 60%...effectively an ACA-era Bronze Plan, although over half of pre-ACA indy market enrollees were in what amounted to junk plans...and again, those policies could deny coverage for those with pre-existing conditions.

In 2018, the average Actuarial Value of Individual Market enrollees is around 78%...and, once again, they can't deny coverage or charge more to people with pre-existing conditions, nor can they cut off benefits for an infant in the neonatal unit or for someone halfway through their chemotherapy session, for example.

Unsurprisingly, experts believe there will be healthy demand for these affordable options. Up to 2 million Americans, and possibly more, are expected to enroll within the next few years.

...a large chunk of which will be healthy people dropping their ACA policies, which in turn will cause the remaining ACA enrollment risk pool to become dramatically sicker on average, driving up costs and therefore premiums significantly, exascerbating the problem further.

Such plans were offered for terms of up to 12 months for decades until, in an effort to push Americans into Obamacare, the previous administration restricted the plans to 90 days and prohibited insurers from renewing them beyond that time period. This eliminated them as an option except for the shortest transitions between other sources of coverage.

Actually, several states already restricted them to 3 months (or in some cases 6 months) and didn't allow them to be renewed even before the ACA...with very good reason. And yes, they are intended only for "the shortest transitions between other sources of coverage"...that's precisely why they're called "Short Term, Limited Duration" policies: They're supposed to be short-term, for a limited duration.

But these short-term plans can be a good option for many Americans priced out of Obamacare’s regulations — especially small-business owners, independent contractors in today’s “gig economy” and younger Americans transitioning between school and employment.

Again, 2/3 of the reason they've been "priced out" of the ACA's regulations is specifically due to Trump/GOP sabotage of ACA regulations.

The Trump administration has gone to significant lengths to ensure customers know that these plans are not subject to the same regulations as Obamacare plans and that they are not the right choice for everyone. In fact, we require more robust warnings about the limits of these plans than President Barack Obama’s administration did.

That's great...but those "robust warnings" wouldn't be as necessary if you hadn't yanked the limits off of them and repealed the mandate penalty in the first place. Plutonium comes with warnings as well, but I don't think "don't leave lying around your living room for a year" is on the warning list because it isn't available for any Joe Schmoe to purchase in the first place.

Some have raised concerns about the possibility that short-term plans will pull healthy consumers out of the Obamacare exchanges, driving up premiums. But estimates from the Centers for Medicare & Medicaid Services actuary suggest any such premium increases would be minimal and would not affect subsidized consumers.

Um...yes, that's true, the CMS report you linked to does claim that only 100,000 - 200,000 healthy enrollees would do this. You know how they came to that conclusion? By completely ignoring the entire off-exchange individual market, which makes up around 70% of unsubsidized ACA enrollment (around 3.5 million out of 5 million total)....as you just stated yourself in the second paragraph of your Op-Ed above.

In other words, instead of 100-200K, it's likely to be more like 600K people...and of course, that would be the healthiest 600K, driving up unsubsidized rates dramatically for the remaining enrollees.

This is, in part, because those without subsidies who were previously enrolled in Obamacare plans have already left those plans in droves because of premium hikes under the law. For these consumers, short-term plans can offer an affordable option. Our decision to allow renewability and separate premium protections could also allow consumers to hold on to their short-term coverage if they get sick, rather than going to the exchanges, which improves the exchange risk pools.

Except, of course, that those short-term plans won't have to cover anyone with pre-existing conditions in the first place, which means those who are denied coverage from #ShortAssPlans but earn too much to receive ACA subsidies are utterly SOL.

The president signed legislation that will end the individual mandate penalty starting in 2019. Repealing the mandate and expanding short-term plans mean that millions of middle-class Americans who couldn’t afford health insurance will now be able to do so.

Um...except your own CMS Administrator and your own Trump-appointed predecessor (along with every actuary, insurance expert and healthcare think tank under the sun) have both openly admitted that repealing the individual mandate increases premiums substantially, thus making actual health insurance less affordable.

What you're referring to as "affordable" "health insurance" are, for the most part, junk plans. At best, they're golf carts. There's nothing wrong with a well-made golf cart, but it isn't a car. Furthermore, you won't even be allowed to buy the golf cart if the dealer doesn't want to sell it to you...and not only won't the golf cart have doors, seat belts, air conditioning or the ability to go more than 15 MPH, they don't even have to include a steering wheel or tires if they don't want to do so.

Oh, but they do have to include a big sign saying this, so I guess that's something.