One more noteworthy 2017 RA report tidbit: On-exchange vs. off-exchange premiums

The big story in the 2017 Risk Adjustment report from CMS over the weekend is, of course, the fact that CMS has decided to freeze $10.4 billion in revenue transfers (or $5.2 billion, depending on your POV) in response to a judgicial ruling in a New Mexico lawsuit.

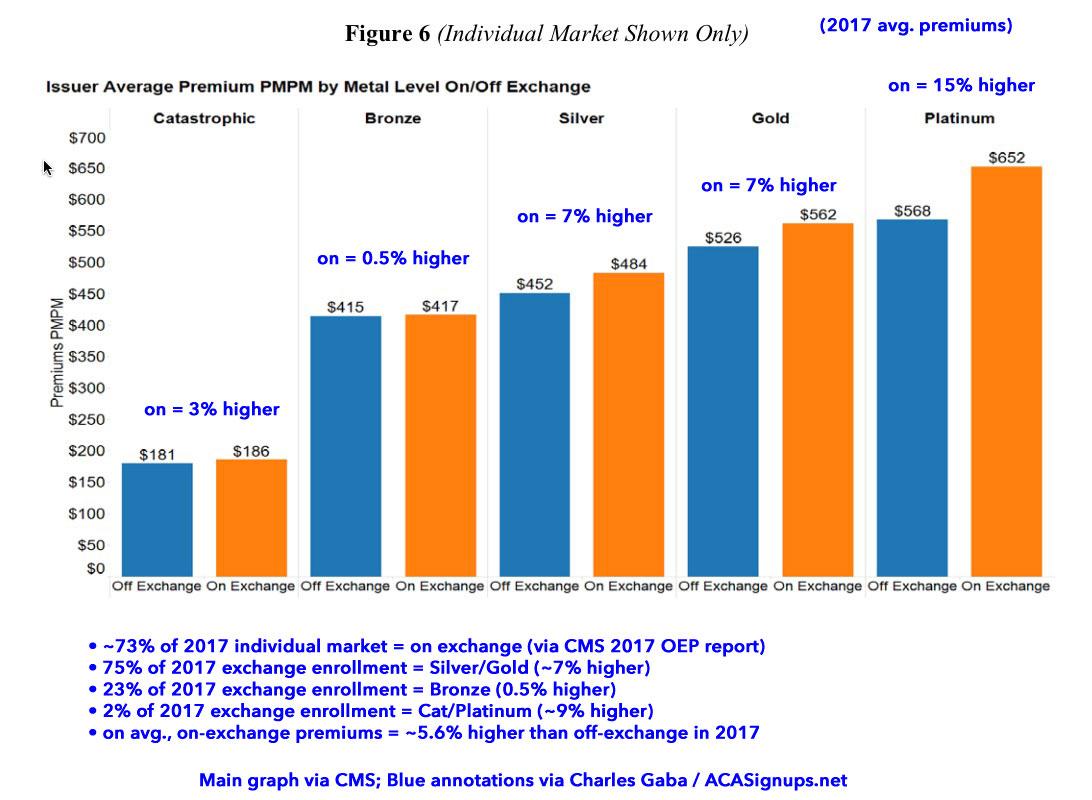

However, before the actual table breaking out all the carriers by state and how much each owes/is owed, the report includes some other interesting wonky data stuff about 2017 enrollment. Most of it wasn't of much interest to me, but one bar graph caught my eye:

This chart compares the average monthly premium for 2017 individual market enrollees both on and off the ACA exchange. This is important because while there's all sorts of data points available for on-exchange enrollees, the off-exchange market has always been a lot more difficult to get info about.

I decided to take this one step further to see if I could figure out what the average premiums are overall for the off-exchange market. Here's what I came up with:

According to the 2017 Open Enrollment Period report from CMS, fully 75% of exchange-based enrollees chose either Silver or Gold plans in 2017. 23% chose Bronze plans, while just 2% signed up for either Catastrophic or Platinum plans. Based on this, the average gap between on and off-exchange premiiums is:

- Catastrophic: 1% x 2.7% higher = 0.0003

- Bronze: 23% x 0.5% higher = 0.0011

- Silver: 71% x 7.1% higher = 0.0503

- Gold: 4% x 6.8% higher = 0.0027

- Platinum: 1% x 14.8% higher = 0.0015

- TOTAL: Around 5.6% higher for on-exchange vs. off-exchange premiums

It's important to note that this does NOT mean on-exchange policies "cost more"...for the most part they're the exact same policies at the exact same prices. It just means that people enrolling in on-exchange plans tended to choose the slightly more expensive policies overall.

Of course, this was for 2017 premiums only; the situation has presumably changed somewhat for 2018 due in large part to the effects on both the on and off-exchange market of Silver Loading and the Silver Switcharoo...and due to Silver Switching, there are many states where unsubsidized premiums for the same Silver plans are less expensive going forward.

It's also worth noting that, also according to CMS, around 73% of the total Individual Market (not including grandfathered/transitional plans) was on-exchange by 2017:

- 2014: 65% on-exchange, 35% off

- 2015: 69% on-exchange, 31% off

- 2016: 68% on-exchange, 32% off (interesting!)

- 2017: 73% on-exchange, 27% off

We don't know the 2018 situation yet, of course, but I'd be willing to bet that the on-exchange market will end up being close to 80% of the total by the time the dust settles this year.